PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842525

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842525

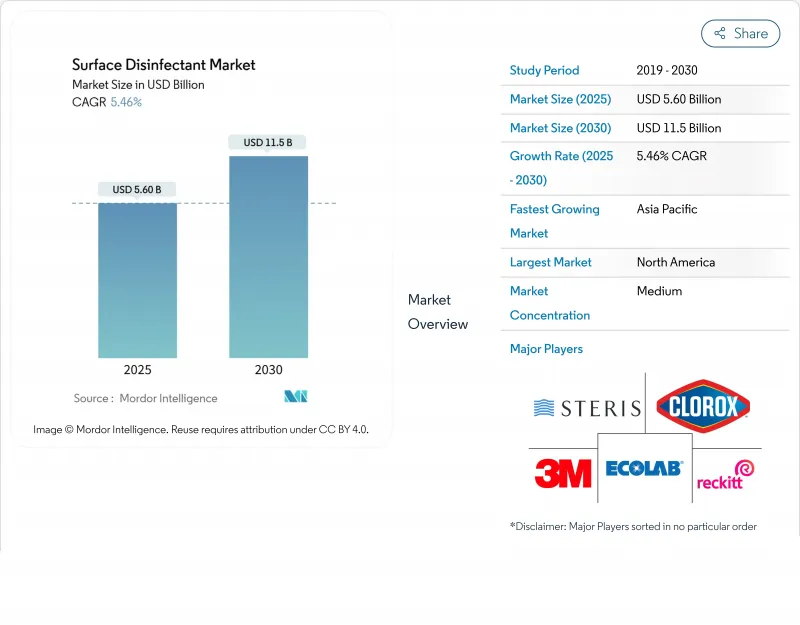

Surface Disinfectant - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Surface Disinfectants market size reached USD 5.6 billion in 2025 and is forecast to expand to USD 11.5 billion in 2030, reflecting a resilient 5.90 % CAGR as demand spreads across healthcare settings, workplaces, and households.

The surface disinfectants industry continues to widen its addressable base because infection-prevention standards are now written into building codes, insurance reimbursement policies, and corporate sustainability goals. A gradual shift from episodic purchasing during outbreaks to planned, budgeted procurement cycles is smoothing revenue seasonality, an outcome that helps producers optimise capacity planning. Regulatory agencies like the Centers for Disease Control and Prevention are tightening permissible exposure limits for legacy chemistries, which raises switching costs for end-users, yet concurrently stimulates innovation pipelines at suppliers. The combination of predictable demand and constant reformulation needs is subtly lowering entry barriers for niche innovators that target specific material compatibility or sustainability gaps.

Global Surface Disinfectant Market Trends and Insights

Escalating Global HAI Penalties Pushing Hospitals Toward Routine Surface Disinfection Audits

Hospitals now face reduced reimbursements when healthcare-associated infections are traced back to preventable lapses, and that financial penalty magnifies the value of rigorous surface-testing programs. German data showing hospital stays jump to 19 days for infected patients compared with 7 days for others offer administrators a straightforward savings narrative, reinforcing the business case for higher-spec disinfectants. Because audit findings are tied to reimbursement, infection control teams increasingly select products that integrate with digital logging tools, which in turn extends vendor influence beyond the chemistry itself. A direct consequence is that suppliers offering dashboard-ready usage metrics gain a competitive edge despite similar kill times on product labels.

Expansion of Healthcare Infrastructure Fuelling Institutional Purchases

Dozens of new tertiary hospitals scheduled to open across India, Indonesia, and the Gulf Cooperation Council nations have already embedded infection-control alcoves, automated dilution centres, and segregated storage bays into their architectural designs. These design choices tilt procurement toward bulk concentrates paired with closed-loop dispensing, thereby increasing contract sizes while cutting packaging waste. As architects specify fixture compatibility during the blueprint phase, disinfectant vendors are consulted months before a facility's commissioning, a timing shift that gives brand incumbents an early lock-in advantage. The pattern suggests that future greenfield hospitals may sign multi-year chemical supply agreements before patient admission begins, smoothing revenue visibility for the Surface Disinfectants industry.

Surface Damage Concerns on Sensitive Medical Equipment Limiting Chlorine & Aldehyde Use

Next-generation imaging suites feature polymer housings and touch-screen interfaces that degrade quickly under aggressive chlorinated agents, prompting biomedical engineers to designate chlorine-free zones. Every premature replacement of a USD 100,000 device strains capital budgets, so facilities increasingly accept slightly higher per-use disinfectant costs to avoid corrosion incidents. Suppliers have responded with quaternary ammonium blends fortified with corrosion inhibitors, a niche that maintains revenue even as regulatory debates surround those same quats. This tug-of-war shows how equipment preservation worries can temporarily outweigh ingredient safety controversies.

Other drivers and restraints analyzed in the detailed report include:

- Post-COVID Consumer Hygiene Sensitization Sustaining Household & Workplace Demand

- R&D Shift Toward Low-Residue, Rapid-Kill Formulations Enhancing Product Replacement Cycles

- Emergence of UV-C & Electrostatic Technologies Offering Chemical-Free Alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Alcohol-based solutions held a 39.1% Surface Disinfectants market share in 2024, underpinning a segment market size that remains the single largest revenue contributor. Their universal compatibility with hard surfaces and near-instant kill times reinforces institutional trust, ensuring stable baseline demand even as newer chemistries emerge. Healthcare buyers value alcohol's rapid evaporation because it minimises room-turnover delays, indirectly lifting bed utilisation rates and perceived service quality. The segment's loyalty allows suppliers to invest in scent-neutral or moisturising variants, creating micro-niches without cannibalising flagship SKUs.

Peroxide formulations are forecast to post a 7.8% CAGR from 2025-2030, more than one-third faster than overall Surface Disinfectants market size growth, confirming an industry pivot toward sustainability. FDA recognition of vaporised hydrogen peroxide has prompted competitive launches in ready-to-use wipes and aerosolised mists, shortening product-adoption cycles once seen as hindered by capital-equipment prerequisites. The broad-spectrum efficacy of peroxides against resilient spores offers hospitals a single-step protocol, an operational benefit that quietly lowers labour costs. This advantage explains why some facilities are replacing dual-product workflows-such as bleach plus alcohol-with a single peroxide wipe.

In 2024, liquid concentrates commanded a 43.2% Surface Disinfectants market share, translating into the largest formulation market size thanks to their cost-to-coverage efficiency. Facilities prefer liquids for floor-mopping systems and central dilution stations because dosing precision supports audit compliance. A side benefit is that large packs reduce packaging disposal volumes, aligning with healthcare sustainability pledges and indirectly limiting landfill surcharges. By retaining liquids as the baseline, vendors secure predictable raw-material purchasing, a factor that cushions margin volatility.

Sprays and aerosols are projected to record an 8.5% CAGR through 2030, making them the fastest-growing formulation slice within the Surface Disinfectants industry. Electrostatic variants add a performance halo that persuades facilities to allocate capital budgets rather than operating budgets, subtly altering approval workflows in suppliers' favour. Improved droplet adherence means fewer passes per surface, freeing housekeeping staff for other tasks and implicitly easing labour shortages. This labour-productivity angle explains why corporate offices adopting hybrid work models continue to invest in spray systems despite lower on-site headcounts.

The Surface Disinfectant Market is Segmented by Composition (Quaternary Ammonium Compounds, Hypochlorite, and More), Formulation (Liquids, Wipes, and More), Distribution Channel (Direct Institutional Sales, Distributor/Wholesaler Sales, and More), End-User (Hospitals & Clinics, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained a 34.7% Surface Disinfectants market share in 2024, with reimbursement rules tying infection-prevention metrics to funding levels, effectively institutionalising demand. Hospital purchasing groups increasingly issue tenders that bundle liquid concentrates, ready-to-use wipes, and electrostatic sprayer fluids under a single contract, an arrangement that favours suppliers offering complete portfolios. The region is also a first mover in adopting hydrogen peroxide vapour decontamination for isolation rooms, lifting the average revenue per square metre disinfected. Suppliers notice that state procurement teams now request carbon-footprint disclosures alongside efficacy data, signalling that environmental metrics may soon influence bid scoring as strongly as price.

Asia-Pacific is projected to deliver an 8.9% CAGR between 2025 and 2030, the fastest regional pace in the Surface Disinfectants market. Government incentives supporting new hospital construction in China, India, and Indonesia are translating into early-stage framework agreements with disinfectant vendors, embedding long-run revenue visibility. Local producers leverage familiarity with fragmented distribution networks to win tenders in secondary cities, yet premium international brands still dominate tertiary-level facilities. Because construction codes now specify built-in disinfection storage and dispensing systems, upfront chemical specifications are being locked during architectural tendering, not post-commissioning-a nuance that reorders sales cycles. Incremental demand from pharmaceutical cleanrooms and medical-device factories adds a parallel industrial revenue stream, allowing suppliers to amortise formulation R&D across dual end-markets.

Europe remains a regulatory bellwether, guiding ingredient restrictions and efficacy testing protocols that often prefigure global norms. Regional emphasis on circular packaging has spurred concentrated refills and cardboard canisters, practices that later migrate to North America once proven viable. Southern and Eastern European hospitals, facing tighter capital budgets, opt for mixed approaches that combine legacy chlorine solutions for non-critical areas with peroxide wipes in intensive-care units, showing how cost-tiering strategies shape vendor portfolios. In March 2024, the European Chemicals Agency advanced proposals on quaternary ammonium compound re-classification, a move that could accelerate product reformulation cycles and spur demand for alternative actives. The continent's variable reimbursement structures, from single-payer to mixed systems, create a patchwork market that rewards suppliers adept at tailoring value propositions by country.

- Ecolab

- 3M

- STERIS

- The Clorox Company (CloroxPro)

- Reckitt Benckiser Group

- GOJO Industries Inc.

- PDI Healthcare (Nice-Pak)

- Diversey Holdings Ltd.

- Metrex Research

- Medline Industries

- Kimberly-Clark Worldwide

- Whiteley Corporation

- Christeyns NV

- Lonza (Arxada)

- Sanosil AG

- Spartan Chemical Co.

- Betco Corporation

- Zep Inc.

- Evonik Industries

- Acuro Organics Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Global HAI Penalties Pushing Hospitals Toward Routine Surface Disinfection Audits

- 4.2.2 Expansion of Healthcare Infrastructure Fuelling Institutional Purchases

- 4.2.3 Post-COVID Consumer Hygiene Sensitization Sustaining Household & Workplace Demand

- 4.2.4 R&D Shift Toward Low-Residue, Rapid-Kill Formulations Enhancing Product Replacement Cycles

- 4.2.5 Mandatory HACCP & FSMA Compliance Elevating Disinfection Budgets in NA & EU Food Plants

- 4.2.6 Accelerated Urbanization in Emerging Markets Driving Contract Cleaning Growth

- 4.3 Market Restraints

- 4.3.1 Surface Damage Concerns on Sensitive Medical Equipment Limiting Chlorine & Aldehyde Use

- 4.3.2 Emergence of UV-C & Electrostatic Technologies Offering Chemical-Free Alternatives

- 4.3.3 Intensifying Green-Chemical Regulations in EU & California Curtailing High-VOC Formulations

- 4.3.4 Volatility in Alcohol & Chlor-Alkali Raw Material Prices Compressing Manufacturer Margins

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Composition

- 5.1.1 Quaternary Ammonium Compounds

- 5.1.2 Hypochlorite

- 5.1.3 Alcohols

- 5.1.4 Aldehydes

- 5.1.5 Peroxides (Hydrogen & Peracetic Acid)

- 5.1.6 Phenolics

- 5.1.7 Iodophors

- 5.1.8 Others

- 5.2 By Formulation

- 5.2.1 Liquids

- 5.2.2 Wipes

- 5.2.3 Sprays & Aerosols

- 5.2.4 Powders & Granules

- 5.3 By Distribution Channel

- 5.3.1 Direct Institutional Sales

- 5.3.2 Distributor / Wholesaler Sales

- 5.3.3 Online & E-commerce

- 5.4 By End-User

- 5.4.1 Hospitals & Clinics

- 5.4.2 Outpatient Surgical Centers

- 5.4.3 Long-Term Care Facilities

- 5.4.4 Diagnostic & Research Laboratories

- 5.4.5 Other End-Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Ecolab Inc.

- 6.3.2 3M Company

- 6.3.3 STERIS plc

- 6.3.4 The Clorox Company (CloroxPro)

- 6.3.5 Reckitt Benckiser Group plc

- 6.3.6 GOJO Industries Inc.

- 6.3.7 PDI Healthcare (Nice-Pak)

- 6.3.8 Diversey Holdings Ltd.

- 6.3.9 Metrex Research LLC

- 6.3.10 Medline Industries LP

- 6.3.11 Kimberly-Clark Corporation

- 6.3.12 Whiteley Corporation

- 6.3.13 Christeyns NV

- 6.3.14 Lonza (Arxada)

- 6.3.15 Sanosil AG

- 6.3.16 Spartan Chemical Co.

- 6.3.17 Betco Corporation

- 6.3.18 Zep Inc.

- 6.3.19 Evonik Industries AG

- 6.3.20 Acuro Organics Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment