PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842526

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842526

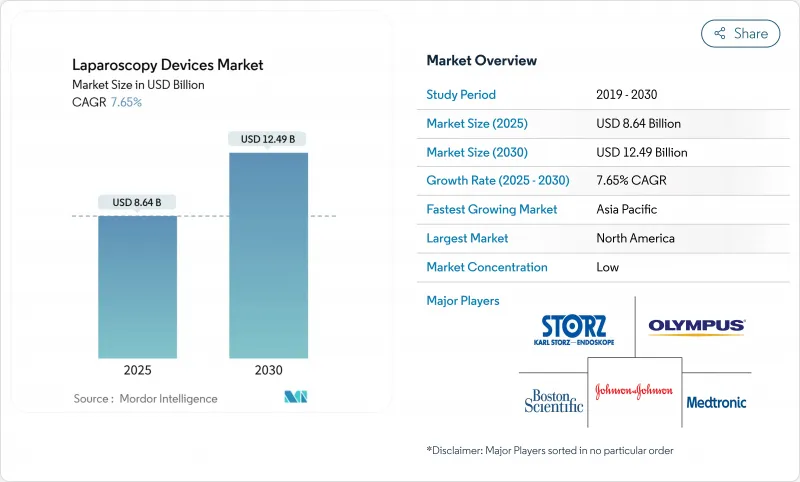

Laparoscopy Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The laparoscopic devices market is valued at USD 8.64 billion in 2025 and is forecast to reach USD 12.49 billion by 2030, advancing at a 7.65% CAGR.

Momentum is underpinned by the rising preference for minimally invasive procedures, steady regulatory support for AI-enabled surgical systems, and wider availability of ambulatory surgical centers. Sustained demand also comes from the convergence of 4K and 3D imaging, robotic platforms that improve dexterity, and growth in obesity-related metabolic surgeries. Manufacturers are responding with reusable tool innovations that address sustainability concerns while maintaining sterility standards. Simultaneously, regional supply-chain diversification mitigates logistics risks and tightens delivery timelines for key components.

Global Laparoscopy Devices Market Trends and Insights

Rising Demand for Minimally-Invasive Procedures

Elective and acute surgeries increasingly favor laparoscopic techniques because average hospital stays fall by 2-3 days, and postsurgical recovery accelerates. Hospitals benefit from lower readmission rates, while patients report less postoperative pain and faster return to work. Fellowship enrollments in minimally invasive surgery have risen, ensuring a steady pipeline of skilled practitioners. The virtuous cycle of patient preference, payer support, and surgeon competency continues to lift the laparoscopic devices market.

Technological Leaps Including 4K/3D/AR and AI Vision

New imaging stacks quadruple resolution and add depth perception that reduces error rates in intricate dissections. AI-enabled systems such as the da Vinci 5 supply predictive analytics that anticipate instrument trajectory, helping surgeons identify critical structures sooner. Augmented reality overlays align preoperative scans with live anatomy and shorten operative times, improving operating-room turnover.

High Capital & Maintenance Outlay

Fully-featured robotic suites can cost USD 2-3 million with ongoing service fees topping USD 200,000 annually, delaying purchases by mid-tier hospitals. Supply chain turbulence has lifted logistics costs, causing providers to scrutinize total cost of ownership. Pay-per-use financing and shared-ownership models have emerged to counterbalance these barriers.

Other drivers and restraints analyzed in the detailed report include:

- Growing Prevalence of Obesity & Metabolic Disease

- Rapid Ambulatory Surgical Centers Build-Out in High-Income Economies

- Shortage of Advanced-Skill Laparoscopic Surgeons

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Energy instruments held the largest slice of the laparoscopic devices market at 27.41% in 2024 because almost every procedure requires electrosurgery or tissue sealing. Robotic-assisted systems, while smaller in absolute volume, are forecast to post an 8.61% CAGR through 2030. That expansion will lift the laparoscopic devices market size for robotic suites to USD-denominated double-digit billions by decade-end. Next-generation laparoscopes integrate 4K/3D optics, automated white-balance, and leak-proof trocar seals that maintain stable pneumoperitoneum. Hand instruments adopt haptic feedback motors that lessen surgeon fatigue during lengthy bariatric cases. Disposable trocars continue shifting toward plant-based or recyclable materials to address environmental targets. Manufacturers also bundle service analytics that predict instrument wear, limiting unplanned downtime.

The pivot to single-use instruments spreads quickly across suction-irrigation and stapler lines because hospitals calculate that reprocessing costs can surpass USD 200 per item. Smart energy devices now feature tissue-contact sensors that moderate thermal spread, improving safety in confined spaces. Premium accessory lines thus supply recurring revenue that softens pricing pressure on capital equipment.

General surgery contributed the largest 29.87% slice of the laparoscopic devices market in 2024, owing to high volumes of cholecystectomy and anti-reflux procedures. Gynecology, however, shows the highest 8.29% CAGR as robotic hysterectomy adoption widens. That trajectory will lift gynecology's laparoscopic devices market share notably by 2030.

In colorectal and urological surgery, AI-enabled cameras help clinicians consistently achieve critical-view benchmarks, slashing intraoperative injuries. Bariatric volumes rise steadily with obesity growth, while robotic platforms further shorten hospital stays. Thoracic and pediatric segments remain smaller yet gain momentum from tool miniaturization.

The Laparoscopy Devices Market is Segmented by Product (Energy Devices, Laparoscopes, and More), Application (General Surgery, Bariatric Surgery, and More), Age Group (Adults, Pediatric, and More), End User (Hospitals, Ambulatory Surgical Centers (ASCs) and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 40.39% of global revenue in 2024, anchored by dense installed bases and favorable reimbursement. United States facilities logged double-digit growth in robotic general surgery cases after the da Vinci 5 launch. Canadian hospitals replicate performance through provincial funding schemes, while Mexico increases private-sector adoption to serve cross-border medical tourists.

Asia-Pacific is forecast to post the fastest 8.56% CAGR. Chinese hospitals continue large-scale build-outs and accelerate local production of cost-optimized robotic platforms following recent domestic approvals. Japan and South Korea leverage their imaging expertise to export high-resolution camera stacks. India's tier-one cities witness robust demand, though rural uptake remains slower due to capital limitations. Medical-tourism corridors in Thailand and Malaysia further boost case volumes.

European growth is stable, supported by national health insurance and surgeon training networks. Budget caps, however, can delay broad robotic acquisition outside Northern Europe. Intra-region initiatives promote reusable instrument procurement to align with decarbonization goals. The Middle East and Africa observe rising adoption in Gulf Cooperation Council states investing in flagship medical cities, whereas sub-Saharan Africa relies heavily on donor-funded MIS programs . South America sees moderate gains centered on Brazil's private insurers and Argentina's public-sector modernization.

- Olympus

- Medtronic

- Johnson & Johnson

- Karl Storz

- Stryker

- Boston Scientific

- B. Braun

- Conmed

- Richard Wolf

- Smiths Group

- Intuitive Surgical

- Teleflex

- Applied Medical Resources

- Erbe Elektromedizin

- Genicon

- Microline Surgical

- Ackermann Instrumente

- Genesis MedTech

- Endoso Life

- Akino Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for minimally-invasive procedures

- 4.2.2 Technological leaps including 4K/3D/AR and AI vision

- 4.2.3 Growing prevalence of obesity & metabolic disease

- 4.2.4 Rapid Ambulatory Surgical Centers build-out in high-income economies

- 4.2.5 Shift to single-use laparoscopic instruments

- 4.2.6 AI-enabled intra-operative analytics & pay-per-use models

- 4.3 Market Restraints

- 4.3.1 High capital & maintenance outlay

- 4.3.2 Shortage of advanced-skill laparoscopic surgeons

- 4.3.3 Sustainability backlash on disposable plastics

- 4.3.4 Endoluminal therapies cannibalising laparoscopic surgery volumes

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Energy Devices

- 5.1.1.1 Electrosurgical / Bipolar Generators

- 5.1.1.2 Ultrasonic & RF Energy Systems

- 5.1.2 Laparoscopes

- 5.1.2.1 Video Laparoscopes (HD/4K/3D)

- 5.1.2.2 Fibre-optic Laparoscopes

- 5.1.3 Insufflation & Access Devices

- 5.1.3.1 CO2 Insufflators

- 5.1.3.2 Trocars & Cannulas

- 5.1.4 Handheld Instruments

- 5.1.4.1 Graspers & Dissectors

- 5.1.4.2 Scissors & Shears

- 5.1.5 Suction / Irrigation Devices

- 5.1.6 Robotic-Assisted Laparoscopy Systems

- 5.1.7 Accessories & Consumables

- 5.1.1 Energy Devices

- 5.2 By Application

- 5.2.1 General Surgery

- 5.2.2 Bariatric Surgery

- 5.2.3 Gynecological Surgery

- 5.2.4 Urological Surgery

- 5.2.5 Colorectal Surgery

- 5.2.6 Other Applications

- 5.3 By Age Group

- 5.3.1 Adults

- 5.3.2 Pediatric

- 5.3.3 Geriatric

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers (ASCs)

- 5.4.3 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Olympus Corporation

- 6.3.2 Medtronic plc

- 6.3.3 Johnson & Johnson (Ethicon)

- 6.3.4 Karl Storz SE & Co. KG

- 6.3.5 Stryker Corporation

- 6.3.6 Boston Scientific Corporation

- 6.3.7 B. Braun SE

- 6.3.8 CONMED Corporation

- 6.3.9 Richard Wolf GmbH

- 6.3.10 Smith & Nephew plc

- 6.3.11 Intuitive Surgical Inc.

- 6.3.12 Teleflex Incorporated

- 6.3.13 Applied Medical Resources

- 6.3.14 Erbe Elektromedizin GmbH

- 6.3.15 Genicon Inc.

- 6.3.16 Microline Surgical

- 6.3.17 Ackermann Instrumente GmbH

- 6.3.18 Genesis MedTech

- 6.3.19 Endoso Life

- 6.3.20 Akino Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment