PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842529

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842529

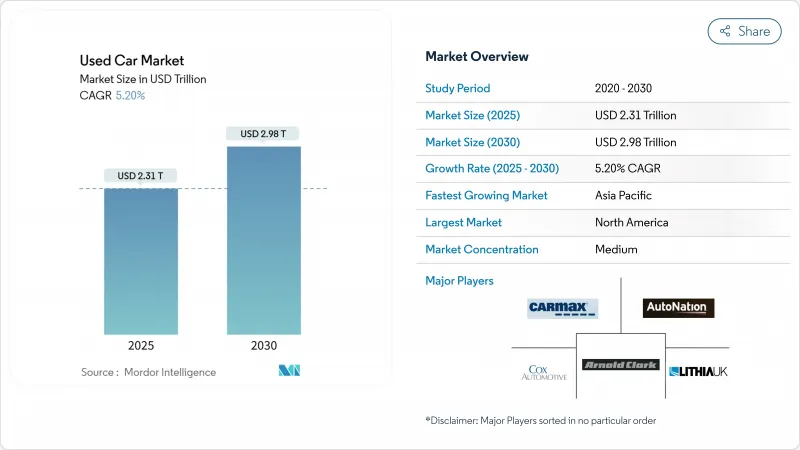

Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Used Car Market was valued at USD 2.31 trillion in 2025 and is forecast to climb to USD 2.98 trillion by 2030, translating into a steady 5.20% CAGR.

This trajectory confirms that the used car market remains resilient despite inflationary pressure on consumers and supply-chain volatility. Growth is supported by the widening price gap between new and pre-owned vehicles, the rise of digital retail platforms, and the maturing of certified-pre-owned (CPO) programs that ease quality concerns for second owners. Asia-Pacific delivers the fastest regional expansion as rising income levels and rapid urbanisation push first-time buyers toward affordable mobility. Meanwhile, supply shortages of near-new vehicles following the pandemic increase residual values and strengthen dealer pricing power, though they also constrain inventory turnover for many vendors.

Global Used Car Market Trends and Insights

Rising New-Car Prices

Average new vehicle prices climbed to USD 49,000 in 2024, widening the gap with used equivalents priced near USD 33,000. The USD 16,000 delta is the broadest on record and pushes even higher-income households toward pre-owned choices. Automakers concentrated output on premium trims during semiconductor shortages, inflating sticker prices on popular models such as the Cadillac CT5 by up to 23%. Consequently, one in five US buyers now faces monthly payments above USD 1,000, reinforcing demand for the more affordable used car market.

Expansion of Digital Retail Platforms

Online platforms recorded a major growth in transaction volume, as 83% of shoppers began their vehicle search on dealer websites. eBay's January 2025 acquisition of Caramel streamlines consumer-to-consumer trades, while Carvana's USD 2.2 billion purchase of ADESA's 56 auction sites secures upstream supply and logistics scale. These moves underline the capital intensity required to build nationwide, vertically-integrated ecommerce footprints in the used car market.

Limited Used-Car Financing

Average used loan rates rose to 14.73% APR in 2025 as lenders tightened score thresholds. High rates add thousands in lifetime interest, eroding affordability for mainstream buyers. In India and parts of Africa, many households remain outside formal credit databases, forcing cash purchases and suppressing addressable demand. Alternative credit scoring using mobile-wallet histories is emerging but still small-scale and faces regulatory review.

Other drivers and restraints analyzed in the detailed report include:

- OEM Certified-Pre-Owned Penetration

- OEM Buy-Back Guarantees

- Supply Crunch of Near-New Vehicles Post-COVID

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SUVs and MPVs controlled 48.21% used car market share in 2024. The segment is projected to grow at a robust 9.50% CAGR as automakers release successive generations of compact crossovers that combine fuel efficiency with higher seating. The Tesla Model Y and Ford Mustang Mach-E are now appearing in significant quantities, signalling that electric SUVs will deepen segment leadership. Sedans retain relevance among budget shoppers and ride-hailing fleets, while hatchbacks appeal to city commuters seeking lower operating costs and easier parking.

The continuing tilt toward larger body styles drives changes in dealership infrastructure. Service bays require higher-capacity lifts and more storage space for bulkier panels. Logistics partners also adjust carrier configurations to fit more SUVs per haul. Marketing strategies emphasise versatility and family safety, themes that resonate with a wider demographic spread in the used car market.

Unorganised dealers held 68.54% of the used car market size in 2024, yet organised chains are forecast for a 12.05% CAGR to 2030 due to superior transparency and nationwide warranty reach. Digital inspection reports, seven-day return policies, and integrated finance offer a differentiation between formal retailers and kerbside sellers. In India, the organised share is set to climb from 30% to 50% by 2030 as platforms such as Cars24 expand rural footprints and introduce doorstep pick-up services.

Capital expenditure on proprietary software and reconditioning hubs remains high. As a result, private equity continues to inject funds into players with network scale and technology roadmaps. Smaller independent lots face margin compression and often pivot to niche segments like vintage cars or commercial vans.

Gasoline units still command 65.65% of the used car market size, but pre-owned EVs outpace other fuels with a 16.40% CAGR to 2030. Early adopters are trading first-generation models for longer-range successors, releasing supply into dealer pipelines. Diesel volumes taper as low-emission zones expand in Europe, while hybrids secure a middle ground for buyers wary of limited charging infrastructure.

Battery-health grading becomes a decisive factor in price discovery. Vehicles with state-of-health scores above 90% secure premiums, whereas those below 80% face steep discounts. Vendors advertise complimentary home-charger bundles and discounted utility tariffs to sweeten EV deals in regions where public charging density remains low.

The Used Car Market Report is Segmented by Vehicle Type (Hatchback, Sedan, and More), Vendor Type (Organized and Unorganized), Fuel Type (Gasoline, Diesel, and More), Sales Channel (Online Platforms and More), Vehicle Age (Below 3 Years and More), Mileage (Less Than 20, 000 Kms and More), Price Band (Less Than USD 10, 000 and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

The North American used car market remains the largest regional contributor with a 38.06% share in 2024, benefiting from a steady flow of lease returns and a mature financing infrastructure that supports rapid inventory turnover. Growth is moderating as vehicle ownership levels approach saturation, yet omnichannel retailers keep adding capacity and deploy AI-driven pricing engines to smooth wholesale volatility. Europe follows in value terms, but its expansion is shaped by emission legislation that pushes buyers away from older diesel models toward low-emission gasoline and hybrid units. Cross-border trade inside the bloc enhances liquidity, particularly for right-hand-drive countries sourcing stock from the United Kingdom after BREXIT. At the same time, dealer groups accelerate consolidation to standardise certified-pre-owned protocols and compete with online entrants.

The Asia-Pacific region delivers the fastest growth with 7.90% among all geographies. China's used car market is projected to reach USD 385 billion in 2025 after regulators scrapped province-level transfer restrictions, unlocking intercity trades that shorten days-to-sale for Global Fleet. India aims for an INR 5 trillion turnover (USD 60.2 billion) by FY 2028 as GST harmonisation and smartphone penetration expand digital listings. Japan leverages a weak yen to export five-year-old compact SUVs to Africa and Oceania, cushioning domestic price pressure and widening the export-hub role of local auction houses. The result is a rising Asia-Pacific used car market size that offsets slower momentum in mature Western economies.

South America is regaining momentum as macro stability returns, with Brazil recording a 10-year high in new-vehicle sales during 2024 that will feed future supply for the regional used car market, Coatings World. Financing spreads remain wide, and currency volatility complicates inventory sourcing, prompting dealers to rely more on domestic lease returns and ex-rental fleets. In the Middle East and Africa, the United Arab Emirates and Saudi Arabia dominate volumes as Japanese and Korean brands enjoy strong resale values under harsh climate conditions. Dubai is piloting blockchain-based digital titles to curb odometer fraud, while South Africa's decade-long factory warranties boost confidence in late-model purchases. Together, these emerging regions provide long-term upside, although infrastructure gaps and credit access continue to restrain the used car market share capture.

- CarMax Inc.

- Cox Automotive

- AutoNation

- Penske Automotive Group

- Asbury Automotive Group

- Hertz Global Holdings

- Pendragon PLC

- Arnold Clark Automobiles

- Emil Frey AG

- Mahindra First Choice Wheels

- Maruti Suzuki True Value

- Carro

- Cars24

- AUTO1 Group

- Cazoo Group

- ACV Auctions

- BCA Marketplace

- Copart Inc.

- Vroom Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising new-car prices

- 4.2.2 Expansion of digital retail platforms

- 4.2.3 OEM certified-pre-owned penetration

- 4.2.4 Surging personal-mobility demand in emerging markets

- 4.2.5 OTA EV battery-health certification

- 4.2.6 OEM buy-back guarantees

- 4.3 Market Restraints

- 4.3.1 Limited used-car financing

- 4.3.2 Stricter import-emission rules

- 4.3.3 Supply crunch of near-new vehicles post-COVID production slump

- 4.3.4 Infotainment data-privacy concerns

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Hatchbacks

- 5.1.2 Sedans

- 5.1.3 SUVs & MPVs

- 5.2 By Vendor Type

- 5.2.1 Organized

- 5.2.2 Unorganized

- 5.3 By Fuel Type

- 5.3.1 Gasoline

- 5.3.2 Diesel

- 5.3.3 Hybrid

- 5.3.4 Electric

- 5.3.5 Other Alternative Fuels

- 5.4 By Sales Channel

- 5.4.1 Online Platforms

- 5.4.2 Offline Dealerships

- 5.5 By Vehicle Age

- 5.5.1 Below 3 Years

- 5.5.2 3 - 5 Years

- 5.5.3 5 - 8 Years

- 5.5.4 Above 8 Years

- 5.6 By Mileage

- 5.6.1 Less Than 20,000 km

- 5.6.2 20,001 - 50,000 km

- 5.6.3 Above 50,000 km

- 5.7 By Price Band

- 5.7.1 Less Than USD 10,000

- 5.7.2 USD 10,001 - USD 30,000

- 5.7.3 Above USD 30,000

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Rest of North America

- 5.8.2 South America

- 5.8.2.1 Brazil

- 5.8.2.2 Argentina

- 5.8.2.3 Rest of South America

- 5.8.3 Europe

- 5.8.3.1 Germany

- 5.8.3.2 United Kingdom

- 5.8.3.3 France

- 5.8.3.4 Spain

- 5.8.3.5 Russia

- 5.8.3.6 Rest of Europe

- 5.8.4 Asia-Pacific

- 5.8.4.1 China

- 5.8.4.2 India

- 5.8.4.3 Japan

- 5.8.4.4 South Korea

- 5.8.4.5 Rest of Asia-Pacific

- 5.8.5 Middle East

- 5.8.5.1 Saudi Arabia

- 5.8.5.2 United Arab Emirates

- 5.8.5.3 South Africa

- 5.8.5.4 Egypt

- 5.8.5.5 Turkey

- 5.8.5.6 Rest of the Middle East

- 5.8.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 CarMax Inc.

- 6.4.2 Cox Automotive

- 6.4.3 AutoNation

- 6.4.4 Penske Automotive Group

- 6.4.5 Asbury Automotive Group

- 6.4.6 Hertz Global Holdings

- 6.4.7 Pendragon PLC

- 6.4.8 Arnold Clark Automobiles

- 6.4.9 Emil Frey AG

- 6.4.10 Mahindra First Choice Wheels

- 6.4.11 Maruti Suzuki True Value

- 6.4.12 Carro

- 6.4.13 Cars24

- 6.4.14 AUTO1 Group

- 6.4.15 Cazoo Group

- 6.4.16 ACV Auctions

- 6.4.17 BCA Marketplace

- 6.4.18 Copart Inc.

- 6.4.19 Vroom Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment