PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842558

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842558

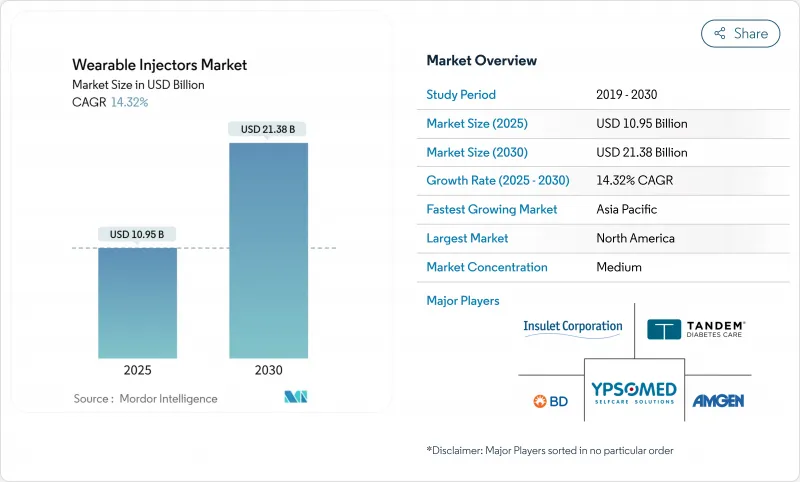

Wearable Injectors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Wearable Injectors Market size is estimated at USD 10.95 billion in 2025, and is expected to reach USD 21.38 billion by 2030, at a CAGR of 14.32% during the forecast period (2025-2030).

The surge is anchored in rising biologics approvals, an expanding global chronic-disease population, and the healthcare sector's pivot to patient-centric, home-based care models. Device makers are prioritizing connected platforms, high-viscosity capability, and user-friendly designs to support self-administration trends. Pharmaceutical companies leverage these devices to improve adherence, shorten infusion times, and lower hospital utilization, while payers increasingly reimburse for home infusion to curb care costs. Competitive intensity is set by established med-tech firms partnering with drug manufacturers, yet supply-chain constraints in specialty polymers and battery-life sustainability challenge near-term scaling.

Global Wearable Injectors Market Trends and Insights

Growing Prevalence of Chronic Diseases

Diabetes affected 536.6 million adults worldwide in 2021 and is projected to reach 783.2 million by 2045, underpinning sustained demand for automated delivery systems that can manage polypharmacy outside hospital settings. Multi-morbidity affects 27.1% of US adults, up from 21.8% a decade earlier, amplifying the need for connected injectors that track complex dosing schedules. These trends position the wearable injectors market as a critical enabler of chronic disease management by reducing clinic visits, improving adherence, and elevating patient quality of life.

Technological Advancements in Wearable Injector Platforms

Micro-MEMS innovations now push high-viscosity biologics above 15 cP through slender cannulas, enabling on-body systems to deliver 10 mL volumes without patient discomfort. Real-time connectivity, automatic needle retraction, and IoT analytics refine dosing accuracy and generate adherence data for payers and clinicians. FDA draft guidance on essential drug-delivery outputs establishes performance benchmarks that accelerate device clearances. Piezoelectric micropumps attaining 4 mL/min flow at 35.7 kPa further illustrate the precision gains that are reshaping the wearable injectors market.

Preference for Alternative Drug-Delivery Modes

Hospital infusion centers still rely on traditional IV workflows that generate billable events, slowing transition to wearable injectors. Needle-free technologies such as InsuJet attract patients wary of self-injection, while oral biologic capsules from Rani Therapeutics could eventually bypass device-based delivery. These alternatives anchor provider inertia and temper the near-term growth of the wearable injectors market.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Home-Based Treatment & Self-Administration

- Rising Pipeline of Biologics & Large-Molecule Drugs

- Unfavorable Reimbursement in Developing Nations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Smart devices recorded the fastest 15.93% CAGR, buoyed by integrated sensors and mobile apps that furnish real-time adherence data to clinicians and payers. On-body patches remained dominant, controlling 61.62% of the wearable injectors market share in 2024, underpinned by entrenched use in diabetes therapy. High-volume injectors, often exceeding 5 mL, address bariatric biologics and cancer therapeutics, while off-body belt formats fill niche needs requiring prolonged wear and large reservoirs.

BD's alliance with Ypsomed couples glass prefillable syringes with high-viscosity autoinjectors to deliver biologics over 15 cP viscosity, an advance aligning with pharma's pipeline of dense formulations. Artificial-intelligence algorithms embedded in next-generation smart injectors personalize dosing intervals by analyzing glucose or biomarker feedback, improving outcomes, and cementing customer loyalty to specific device ecosystems.

The Wearable Injectors Market Report is Segmented by Product Type (On-Body Injectors, Off-Body Injectors, and More), Therapy Area (Oncology, Autoimmune Disease, Diabetes, Cardiovascular Disease, and More), End-User (Hospitals & Clinics, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 43.21% of the wearable injectors market in 2024, undergirded by clear FDA regulatory pathways, entrenched healthcare connectivity, and a high burden of chronic disease. Insulet's Omnipod platform alone exceeded 500,000 active users after posting 22% revenue growth in 2024, illustrating robust device adoption. Most payers now reimburse connected injectors that transmit adherence data into electronic health records, aligning incentives for self-administration.

Asia-Pacific is projected to register the swiftest 15.08% CAGR through 2030, propelled by middle-class expansion, government digital-health policies, and rising biologic launches. China and Japan spearhead volume demand and regulatory modernization, while India, Indonesia, and Thailand show accelerating uptake owing to chronic-disease prevalence and mobile-health penetration. Fragmented reimbursement and lower device-spending ratios, however, temper immediate scale-up.

Europe benefits from harmonized medical-device regulations that streamline cross-border approvals, ensuring predictable adoption in Germany, France, and the United Kingdom. National health systems emphasize patient-centric chronic-care pathways that incorporate connected injectors into integrated disease-management programs. Latin America and the Middle East & Africa hold latent potential but remain inhibited by infrastructure deficits and limited payer coverage, steering vendors toward tiered-pricing and public-private-partnership models to seed early demand.

- Amgen

- Insulet

- West Pharmaceutical Services

- Ypsomed

- Beckton Dickinson

- Enable Injections

- Stevanato Group

- Eitan Medical

- Tandem Diabetes Care

- Sensile Medical

- United Therapeutics

- Subcuject

- CeQur

- Sorrel Medical

- Medtronic

- Vetter Pharma

- Nemera

- Oval Medical Technologies

- Gerresheimer

- Recipharm

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Prevalence of Chronic Diseases

- 4.2.2 Technological Advancements in Wearable Injector Platforms

- 4.2.3 Shift Toward Home-Based Treatment & Self-Administration

- 4.2.4 Rising Pipeline of Biologics & Large-Molecule Drugs

- 4.2.5 Micro-MEMS Enabling High-Viscosity Formulation Delivery

- 4.2.6 Payer Adoption of Digital Adherence Analytics

- 4.3 Market Restraints

- 4.3.1 Preference for Alternative Drug-Delivery Modes

- 4.3.2 Unfavorable Reimbursement in Developing Nations

- 4.3.3 Battery-Life & E-Waste Disposal Concerns

- 4.3.4 Shortage Of Specialty Polymers for Injector Housings

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 On-body Patch Injectors

- 5.1.2 Off-body Belt Injectors

- 5.1.3 Smart Injectors

- 5.1.4 High-volume (>=5 mL) Injectors

- 5.2 By Therapy Area

- 5.2.1 Oncology

- 5.2.2 Autoimmune Disorders

- 5.2.3 Diabetes

- 5.2.4 Cardiovascular Diseases

- 5.2.5 Rare & Orphan Diseases

- 5.3 By End User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Home Care Settings

- 5.3.3 Specialty Infusion Centers

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Amgen

- 6.3.2 Insulet Corporation

- 6.3.3 West Pharmaceutical Services

- 6.3.4 Ypsomed

- 6.3.5 Becton, Dickinson and Company

- 6.3.6 Enable Injections

- 6.3.7 Stevanato Group

- 6.3.8 Eitan Medical

- 6.3.9 Tandem Diabetes Care

- 6.3.10 Sensile Medical

- 6.3.11 United Therapeutics

- 6.3.12 Subcuject

- 6.3.13 CeQur

- 6.3.14 Sorrel Medical

- 6.3.15 Medtronic

- 6.3.16 Vetter Pharma

- 6.3.17 Nemera

- 6.3.18 Oval Medical Technologies

- 6.3.19 Gerresheimer

- 6.3.20 Recipharm

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment