PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842562

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842562

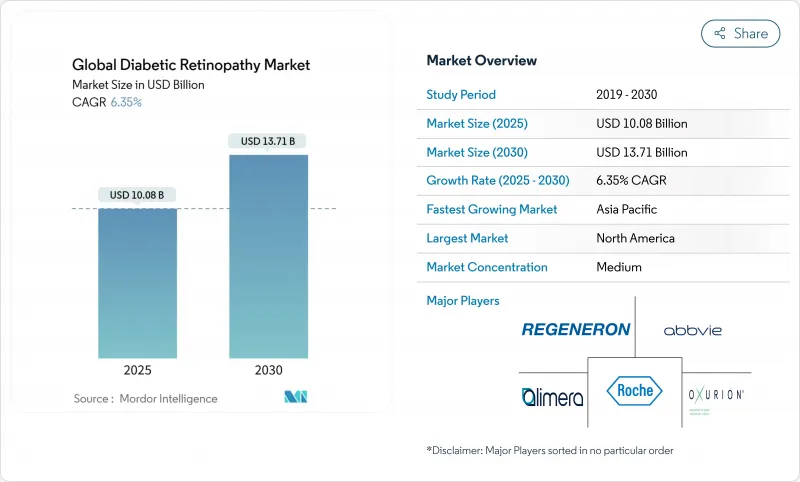

Global Diabetic Retinopathy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The diabetic retinopathy market reached USD 10.08 million in 2025 and is projected to expand to USD 13.71 million by 2030, reflecting a 6.35% CAGR.

Growth stems from the rising global diabetes burden, rapid uptake of AI-enabled screening, and broader therapeutic choices that now include sustained-release biologics and pipeline gene therapies. Aging populations amplify demand, with nearly 10 million patients in the United States and more than 100 million worldwide living with some form of diabetic retinopathy. North America retains leadership on the strength of advanced health systems, while Asia-Pacific shows the fastest gains as tele-ophthalmology programs scale across large diabetic populations. Competitive intensity rose sharply in 2024 when five aflibercept biosimilars entered the United States, triggering price competition and widening patient access.

Global Diabetic Retinopathy Market Trends and Insights

Rising Global Diabetes Prevalence & Earlier Screening

International Federation of Diabetes data foresee 12% of the world's adults living with diabetes by 2045, enlarging the treatable pool for the diabetic retinopathy market . Meta-analyses confirm disease rates above 22% in multiple screening programs, underlining a consistent burden across regions. AI tools that deliver 92-93% sensitivity now detect micro-aneurysms at routine primary-care visits, shifting diagnosis to earlier, more treatable stages. Chile's national tele-ophthalmology network cut specialist referrals to 15% while preserving coverage, showing scalable early detection in lower-resource settings.

Aging Population Increasing Vision-Threatening Cases

Patients with more than 10 years of diabetes carry 4.36-fold higher odds of retinopathy, and most are over 60 years old. China reports prevalence between 24.7% and 43.1%, highlighting the aging-duration nexus in the region. Female patients have shown bigger increases in blindness, suggesting the need for gender-specific care strategies. Vitrectomy demand mirrors these trends, expanding 8.14% annually as elderly patients present with complex proliferative disease.

Shortage of Retinal Specialists in Emerging Markets

The United States is projected to face a 12% fall in ophthalmologist supply versus a 24% rise in demand by 2035, and rural counties may meet only 26-29% of their staffing need . Asia-Pacific shows even sharper gaps as diabetic prevalence climbs faster than specialist training, prompting governments to fund telemedicine hubs and AI triage to extend reach. Arkansas illustrated scalable coverage using statewide teleretinal screening linked to urban retina centers, an approach now copied in Latin America and South Asia.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Indications & Reimbursement for Long-Acting Anti-VEGF Biologics

- AI-Enabled Retinal Screening Adoption in Primary-Care Clinics

- High Treatment Burden & Poor Adherence to Injection Regimens

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-proliferative disease accounted for 63.25% diabetic retinopathy market share in 2024, underscoring the impact of screening that now captures pathology earlier. AI systems detecting subtle micro-aneurysms push more patients into preventive care pathways rather than late-stage surgery. Proliferative cases, although smaller, will rise at 7.38% CAGR as aging and disease duration fuel advanced pathology, expanding demand for surgery and regenerative therapies.

Clinical management differs sharply. Non-proliferative patients benefit from systemic agents such as fenofibrate, which cut progression by 27% in trials. Proliferative disease increasingly involves vitrectomy, the fastest-growing modality at 8.14% CAGR. Early gene therapy data show 2-step DRSS improvement in 20% of treated non-proliferative patients, suggesting future disease-stage-specific regimens. The diabetic retinopathy market size for proliferative interventions is projected to outpace overall growth despite the segment's current smaller base.

The Report Covers Diabetic Retinopathy Market Forecast and It is Segmented by Type (Proliferative Diabetic Retinopathy, Non-Proliferative Retinopathy), Management Approach (Anti-VEGF Drug, Intraocular Steroid Injection, Laser Surgery, and Vitrectomy), End User (Hospitals, Ophthalmology Clinics, and More), and Geography. The Values are Provided in Terms of USD Million for Above Segments.

Geography Analysis

North America captured 43.35% of diabetic retinopathy market share in 2024, supported by early adoption of FDA-cleared AI devices, fast biosimilar uptake, and generous payer coverage. The region hosts 71.15% of global diabetic eye research publications from 2012-2021, reinforcing its innovation leadership. A looming 30% shortfall in ophthalmologist supply by 2035 tempers growth, particularly in rural areas, and fuels demand for tele-retina solutions.

Asia-Pacific is expected to grow at 8.25% CAGR through 2030, the highest of all regions, propelled by diabetes incidence and large population bases. China's diabetic retinopathy prevalence up to 43.1% among diabetics underscores the region's unmet need. India's plan to screen 1 billion eyes with AI-enabled handheld cameras highlights large-scale digital health adoption. Government reimbursement expansion and rising medical tourism further spur growth.

Europe demonstrates steady growth on the strength of robust universal health systems and swift biosimilar integration. Latin America leverages tele-ophthalmology, exemplified by Chile's network that detects retinopathy in 22% of screened diabetics while cutting unnecessary referrals. The Middle East and Africa remain nascent but attractive due to high diabetes prevalence in Gulf states and incremental investment in specialty care infrastructure.

- Abbvie

- Alimera Sciences

- BCN Peptides

- Bausch + Lomb Corp

- Carl Zeiss

- Roche

- Glycadia Pharmaceuticals

- Johnson & Johnson

- Novartis

- Ocuphire Pharma

- Oxurion

- Regeneron Pharmaceuticals

- Samsung Bioepis

- Viatris

- Bayer

- Adverum Biotechnologies

- Kodiak Sciences Inc.

- Annexon Biosciences

- Kubota Vision Inc.

- Clearside Biomedical

- Aerie Pharmaceutical

- Ocular Therapeutix Inc.

- Regenxbio Inc.

- Chengdu Kanghong Pharmaceuticals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Diabetes Prevalence & Earlier Screening

- 4.2.2 Aging Population Increasing Vision-Threatening Cases

- 4.2.3 Expanding Indications & Reimbursement For Long-Acting Anti-VEGF Biologics

- 4.2.4 Ai-Enabled Retinal Screening Adoption In Primary Care Clinics

- 4.2.5 Growth Of Tele-Ophthalmology Programs In Low-Resource Regions

- 4.2.6 Venture Funding In Regenerative Cell & Gene Therapies For Dr

- 4.3 Market Restraints

- 4.3.1 Shortage Of Retinal Specialists In Emerging Markets

- 4.3.2 High Treatment Burden & Poor Adherence To Injection Regimens

- 4.3.3 Delayed Regulatory Pathways For First-In-Class Biosimilars

- 4.3.4 Limited Real-World Evidence For Novel Combination Therapies

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD million)

- 5.1 By Type

- 5.1.1 Proliferative Diabetic Retinopathy

- 5.1.2 Non-proliferative Retinopathy

- 5.2 By Management Approach

- 5.2.1 Anti-VEGF Drug

- 5.2.2 Intraocular Steroid Injection

- 5.2.3 Laser Surgery

- 5.2.4 Vitrectomy

- 5.3 By End-user

- 5.3.1 Hospitals

- 5.3.2 Ophthalmology Clinics

- 5.3.3 Ambulatory Surgical Centers

- 5.3.4 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.2.1 AbbVie Inc. (Allergan)

- 6.2.2 Alimera Sciences

- 6.2.3 BCN Peptides

- 6.2.4 Bausch + Lomb Corp

- 6.2.5 Carl Zeiss Meditec AG

- 6.2.6 F. Hoffmann-La Roche Ltd (Genentech)

- 6.2.7 Glycadia Pharmaceuticals

- 6.2.8 Johnson & Johnson Vision

- 6.2.9 Novartis AG

- 6.2.10 Ocuphire Pharma

- 6.2.11 Oxurion NV

- 6.2.12 Regeneron Pharmaceuticals Inc

- 6.2.13 Samsung Bioepis

- 6.2.14 Viatris Inc.

- 6.2.15 Bayer AG

- 6.2.16 Adverum Biotechnologies

- 6.2.17 Kodiak Sciences Inc.

- 6.2.18 Annexon Biosciences

- 6.2.19 Kubota Vision Inc.

- 6.2.20 Clearside Biomedical

- 6.2.21 Aerie Pharmaceuticals

- 6.2.22 Ocular Therapeutix Inc.

- 6.2.23 Regenxbio Inc.

- 6.2.24 Chengdu Kanghong Pharmaceuticals

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment