PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842703

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842703

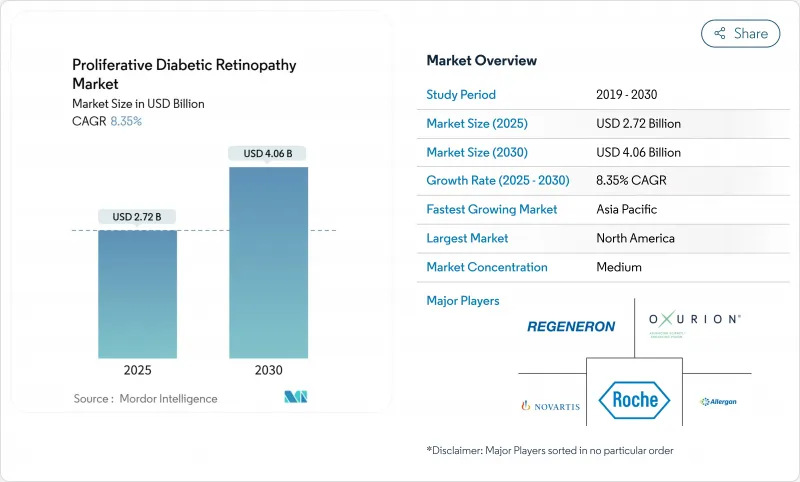

Proliferative Diabetic Retinopathy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The proliferative diabetic retinopathy market is valued at USD 2.72 billion in 2025 and is projected to reach USD 4.06 billion by 2030, advancing at an 8.35% CAGR.

This growth aligns with the steady rise in global diabetes prevalence, which has more than quadrupled since 1990 and now affects over 800 million adults worldwide. Demand is reinforced by the Centers for Disease Control and Prevention estimate that diabetic retinopathy will affect 14.7 million Americans by 2050. Innovation in sustained-release implants and AI-enabled screening supports early detection, while biosimilar approvals temper pricing pressure in many markets. At the same time, technology-driven surgical advances such as subthreshold micropulse laser platforms reduce treatment burden, creating fresh adoption catalysts. A persistent shortage of retinal specialists poses a risk to care access, especially in emerging economies, yet teleophthalmology programs help bridge that gap. Taken together, these forces underpin a healthy outlook for the proliferative diabetic retinopathy market through the decade.

Global Proliferative Diabetic Retinopathy Market Trends and Insights

Rising Prevalence of Diabetes and Longer Life Expectancy

Global diabetes prevalence doubled between 1990 and 2022, rising from 7% to 14% of the adult population. Longer lifespans mean patients live with the disease for decades, and epidemiologic studies show a 4.36-fold higher retinopathy risk after 10 years of diabetes . The International Diabetes Federation projects 783.2 million cases by 2045, with middle-income economies facing the largest increases. Germany illustrates this path; analysts expect type 2 diabetes prevalence to reach 14.2 million by 2040. As prevalence climbs, the proliferative diabetic retinopathy market gains a stable patient base for both pharmacologic and surgical care.

Increasing Adoption of Intravitreal Anti-VEGF Biologics

Medicare claims show aflibercept injections rose 138% between 2014 and 2023, reflecting clinician confidence in anti-VEGF therapy. In May 2025 the FDA cleared Genentech's Susvimo for diabetic retinopathy, enabling continuous delivery with biannual refills. Regional access remains uneven: physician density drives large differences in injection rates across U.S. states, while biosimilars such as Yesafili and Opuviz began easing price barriers in 2025. Comparable efficacy data from Iran's ATRIA trial further validate the biosimilar pathway. Wider biologic uptake elevates the proliferative diabetic retinopathy market by expanding the treated population and encouraging longer therapy duration.

Extended Regulatory Approval Timelines for Ophthalmic Biologics

New entrants face multiyear data requirements for biologic comparability, toxicology, and device-drug combinations. Regeneron's Eylea HD secured priority review in April 2025 yet still waits for an August action date. Oculis needed more than three years to complete Phase 3 enrollment for a topical steroid therapy. Gene and cell therapies demand bespoke manufacturing audits that lengthen review cycles. Smaller firms often cede ground to incumbents that can finance lengthy development and navigate diverse regional rules, tempering overall market growth.

Other drivers and restraints analyzed in the detailed report include:

- Availability of Minimally Invasive Retinal Laser & Vitrectomy Platforms

- Growing Healthcare Expenditure Boosting Access to Eye-Care Services

- AI-Enabled Screening Programs Enabling Earlier Detection

- Long-Acting Ocular Implants Reducing Treatment Burden

- High Cost of Anti-VEGF Injections Limiting Adherence

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In revenue terms, anti-VEGF biologics generated 67.41% of proliferative diabetic retinopathy market share in 2024, reflecting proven vision-saving efficacy. Laser surgery has become the fastest-advancing option, growing at 9.13% CAGR on the back of subthreshold micropulse platforms that avoid tissue damage. Corticosteroids remain relevant through implants such as Ozurdex that release medication over four to six months. Vitrectomy is adopting 23-gauge and 25-gauge tools, which shorten procedure time and recovery. Combination agents like faricimab target both VEGF-A and Ang-2, yielding superior durability in real-world studies.

Sustained-release implants position manufacturers for durable revenue streams. Genentech's Susvimo expansion into diabetic retinopathy in 2025 underscores the trend, while gene therapy candidates such as ABBV-RGX-314 advance toward pivotal trials. Novel mechanisms, including plasma kallikrein inhibition, broaden the therapeutic playbook. Across modalities, a shift toward personalized regimens catering to disease severity and patient preferences widens addressable demand in the proliferative diabetic retinopathy market.

The Report Covers Global Proliferative Diabetic Retinopathy Market Size and It is Segmented by Treatment Type (Anti-VEGF Agents, Corticosteroids, Laser Surgery, and More), Mode of Administration (Intravitreal, Sub-Retinal, and More), End User (Hospitals, Ophthalmology Clinics, and Ambulatory Surgical Centres), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 43.25% proliferative diabetic retinopathy market share in 2024, supported by broad insurance coverage, fast regulatory cycles, and early adoption of sustained-release therapies. Yet workforce deficits present a strategic obstacle; a 12% decline in ophthalmologist supply against 24% growth in demand through 2035 has already triggered consolidation and tele-ophthalmology rollouts. AI-based screening initiatives now log sensitivities above 92%, reinforcing North America's leadership in digital health integration.

Asia-Pacific is the fastest-growing region, expanding at a 10.32% CAGR as demographic shifts, urbanization, and rising incomes drive disease incidence and treatment access. Chinese studies indicate diabetic retinopathy prevalence between 24.7% and 43.1% among diagnosed diabetics. India's SMART DROP protocol illustrates scalable public-health approaches that raise detection in rural districts. Japan and South Korea leverage established reimbursement systems to absorb premium implants and gene therapies, while Southeast Asia focuses on mobile screening units and subsidized biologic procurement. These layered strategies widen the addressable segment of the proliferative diabetic retinopathy market across diverse APAC economies.

Europe, the Middle East and Africa, and South America show varied trajectories. Germany may see diabetes cases climb to 14.2 million by 2040 because of post-pandemic incidence trends. Brazil's Type 1 diabetes registry recorded a 35.7% retinopathy rate, showing room for expanded retina services. Tele-ophthalmology helps overcome geographic barriers across Pacific Island Countries and Territories, hinting at replication potential for other dispersed geographies.

- F. Hoffmann-La Roche (Genentech)

- Regeneron Pharmaceuticals

- Novartis

- Bayer

- Abbvie

- Oxurion

- Alimera Sciences

- Santen Pharmaceutical

- Kodiak Sciences

- Adverum Biotechnologies

- Clearside Biomedical

- MeiraGTx

- Jiangsu Hansoh Pharma

- Samsung Bioepis

- Bausch + Lomb

- Kowa

- BCN Peptides

- Opthea Ltd

- Glycadia Pharmaceuticals

- EyePoint Pharmaceuticals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence Of Diabetes And Longer Life Expectancy

- 4.2.2 Increasing Adoption Of Intravitreal Anti-Vegf Biologics

- 4.2.3 Availability Of Minimally-Invasive Retinal Laser & Vitrectomy Platforms

- 4.2.4 Growing Healthcare Expenditure Boosting Access To Eye-Care Services

- 4.2.5 Ai-Enabled Screening Programmes Enabling Earlier Pdr Detection

- 4.2.6 Long-Acting Ocular Implants Reducing Treatment Burden

- 4.3 Market Restraints

- 4.3.1 Extended Regulatory Approval Timelines For Ophthalmic Biologics

- 4.3.2 High Cost Of Anti-Vegf Injections Limiting Adherence

- 4.3.3 Safety Concerns With Repeated Intravitreal Injections

- 4.3.4 Shortage Of Retinal Specialists In LMICS

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Treatment Type

- 5.1.1 Anti-VEGF Agents

- 5.1.2 Corticosteroids

- 5.1.3 Laser Surgery

- 5.1.4 Vitrectomy

- 5.1.5 Sustained-release Implants

- 5.1.6 Others

- 5.2 By Mode of Administration

- 5.2.1 Intravitreal

- 5.2.2 Sub-retinal

- 5.2.3 Topical & Periocular

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Ophthalmology Clinics

- 5.3.3 Ambulatory Surgical Centres

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 F. Hoffmann-La Roche (Genentech)

- 6.3.2 Regeneron Pharmaceuticals

- 6.3.3 Novartis AG

- 6.3.4 Bayer AG

- 6.3.5 AbbVie (Allergan)

- 6.3.6 Oxurion NV

- 6.3.7 Alimera Sciences

- 6.3.8 Santen Pharmaceutical

- 6.3.9 Kodiak Sciences

- 6.3.10 Adverum Biotechnologies

- 6.3.11 Clearside Biomedical

- 6.3.12 MeiraGTx

- 6.3.13 Jiangsu Hansoh Pharma

- 6.3.14 Samsung Bioepis

- 6.3.15 Bausch + Lomb

- 6.3.16 Kowa Company Ltd

- 6.3.17 BCN Peptides

- 6.3.18 Opthea Ltd

- 6.3.19 Glycadia Pharmaceuticals

- 6.3.20 EyePoint Pharmaceuticals

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment