PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842577

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842577

High-Barrier Packaging Film - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

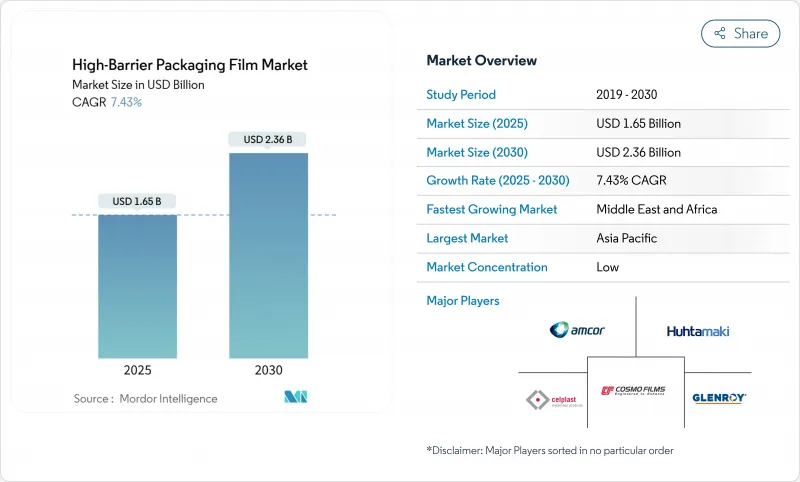

The high barrier packaging films market size was valued at USD 1.65 billion in 2025 and is forecast to reach USD 2.36 billion by 2030, reflecting a 7.43% CAGR.

Rapid adoption of recyclable mono-material films, stronger demand for biologics cold-chain solutions, and surging e-grocery volumes underpin this expansion. The industry is also reacting to tougher Extended Producer Responsibility (EPR) rules that tie fees to recyclability, prompting converters to pivot toward machine-direction-oriented polyethylene (MDO-PE) and solvent-free organic coatings. Resin price volatility, supply pressure for key barrier resins such as PVDC and EVOH, and the capital intensity of new orientation lines are creating a cost pass-through race that rewards integrated players able to hedge raw-material swings.

Asia-Pacific anchors the high barrier packaging films market with 42.67% of 2024 revenue, propelled by regional migration from rigid containers to stand-up pouches. The Middle East and Africa is on a faster trajectory at 9.78% CAGR on the back of new pharmaceutical filling capacity and a widening cold-chain footprint. Bags and pouches remain the workhorse format, taking 35.45% share, while vacuum skin packs enjoy 9.84% CAGR because retailers of premium fresh foods demand longer shelf life. Polyethylene leads the material mix at 32.54%, yet biopolymers, despite a 40-60% price premium, are expanding at 10.48% as brand owners try to pre-empt stricter plastic-waste laws. Metallized films keep a 41.72% hold, although transparent organic-coated structures are gaining ground at 8.66% as pack designers look to decouple barrier performance from aluminum usage.

Global High-Barrier Packaging Film Market Trends and Insights

Pharma blister Boom in Biologics and Cold-chain Logistics

Global biologics therapies require oxygen transmission rates below 0.1 cc/m2/day and temperature stability from -20 °C to +25 °C, pushing converters to specify multilayer films containing EVOH and novel coatings that meet these strict thresholds. DS Smith's TailorTemp fiber pack keeps chilled conditions for 36 hours, illustrating a switch to recyclable formats acceptable to regulators and hospitals. Oncology drugs valued at more than USD 10,000 per dose tolerate packaging cost premiums, allowing suppliers to command margins that offset higher-performance resin prices. Investment in regional cold warehouses in the United States and Germany is also lifting demand for heat-stable, puncture-resistant films compatible with dry-ice shipping.

E-grocery Surge Driving Pouch and Film Demand

Online retailers handle each grocery order three to five times before delivery, making puncture resistance and flawless seals mandatory. Converters respond by thickening sealing layers and adding higher-density tie resins that retain flexibility over a wider temperature range. Vietnam's packaging sector, racing toward USD 3.5 billion by 2026, exemplifies how e-commerce economies jump directly to lightweight flexible formats. Sauces, condiments, and baby food moving into large stand-up pouches show 12% fewer breakages than glass jars during last-mile transit, underpinning brand conversions announced by multinational food manufacturers in 2025.

Volatile PE/PP Resin Prices

North American polypropylene rose 4-5 cents per pound in early 2025 after refinery shutdowns tightened polymer-grade propylene supply, squeezing converters' margins. Asian film makers also face competition from China's planned 2.6 million-tonne PP export push in 2024, creating a price whipsaw and deterring long-term supply contracts. Smaller converters pass through costs more slowly, prompting some to scale back high barrier packaging films production until hedging tools become affordable.

Other drivers and restraints analyzed in the detailed report include:

- Shift from Rigid to Lightweight Stand-up Pouches in Asia-Pacific

- Mono-material MDO-PE/BOPE Adoption for Recyclability

- PVDC and EVOH Supply Crunch Post-2027

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The segment led by bags and pouches banked 35.45% of 2024 revenue, while vacuum skin packs are projected to record a 9.84% CAGR through 2030, reflecting premium fresh meat and seafood brands' need for up to 13-day shelf life in chilled supply chains. This portion of the high barrier packaging films market also benefits from attractive product visibility that drives higher cart values in e-grocery channels. Stand-up pouches continue to replace glass jars in sauces and infant food, aided by shipping-cost savings that run to USD 100 per pallet. Meal kit suppliers favor tray lidding films with peelable options compatible with microwave reheating, supporting moderate growth.

Vacuum skin packs require deeper forming and stronger puncture resistance, prompting film formulators to add linear low-density polyethylene seal webs and EVOH tie layers. Such packs often preserve 97% of modified-atmosphere oxygen at day eight, extending the sell-by date and shrinking food waste. Thermoforming films, mostly PET or PP-based, remain essential for blister packs in pharma, but growth lags as mono-material PE replacements pass regulatory audits. Sachets and flow wraps face consumer backlash in Southeast Asia, notably Indonesia's 30% reduction target for sachet waste by 2029, pushing converters toward recyclable alternatives. Blister base films, despite regulatory headwinds, preserve share for high-value tablets that demand near-zero moisture ingress; converters hedge risk by offering bio-based PET versions.

Polyethylene retains the lion's share at 32.54%, anchored by broad processing compatibility, although price volatility triggers quarterly reforms in sealing-layer blends to protect margin. Biopolymers such as PLA and PHA, while accounting for a single-digit slice, are clocking a brisk 10.48% CAGR, buoyed by retailer commitments to compost-ready packaging. The high barrier packaging films market size for biopolymers is still limited, but becomes meaningful when a large confectionery brand rolls out pouch lines across Europe, scaling annual demand to 12,000 tons.

Polypropylene follows as the solution for hot-fill applications and transparency, whereas BOPET retains importance for dimensional stability. EVOH's sub-0.1 cc/m2/day oxygen barrier secures its premium price point even during raw-material shortfalls because no drop-in substitute matches performance at similar thickness. PVDC, though under scrutiny, remains the workhorse in coffee and seasoning sachets. Aluminum foil use recedes in flexible laminates due to sustainability claims, yet still prevails in retort pouches for ready-to-eat meals where 121 °C sterilization cycles demand metal performance. Organic coatings based on micro-fibrillated cellulose or chitosan draw interest because they add less than 1 µm of deposit yet cut overall weight, integrating well within existing gravure-coated production lines.

The High Barrier Packaging Films Market Report is Segmented by Packaging Product (Bags and Pouches, Stand-Up Pouches, and More), Material (Polyethylene, Polypropylene, and More), End-User Industry (Food and Pet Food, Beverages, and More), Barrier Type (Metallized Films, and More), Technology (Multilayer Co-Extrusion Layers), High-Layer Co-Extrusion, and More) and Geography (North America, Asia-Pacific, and More).

Geography Analysis

Asia-Pacific retained 42.67% of 2024 revenue, sustained by rising middle-class consumption and a shift from rigid jars to flexible pouches that pare logistics costs. The Chinese government's push to export 2.6 million tons of polypropylene in 2024 dampened resin prices, allowing regional converters to quote aggressive bids in export tenders yet exposing them to price whiplash. Japan's positive list for food contact materials, effective June 2025, obliges film suppliers to qualify 21 polymer classes and 827 additives, lengthening time-to-market for new structures. Southeast Asia's sachet dilemma sparks innovation in refillable pouches, aligning with Indonesia's 30% waste-cut target by 2029.

Middle East and Africa expands at 9.78% CAGR, fueled by investment in pharmaceutical blister capacity and improved refrigerated transport corridors linking the Gulf to North and East Africa. Governments funnel health budgets into local vaccine plant start-ups that specify multilayer cold-chain pouches, propelling demand for EVOH-rich structures. Energy subsidies in Saudi Arabia reduce ethylene costs, giving regional integrated producers margin to support downstream barrier film investments.

North America, though mature, gains from biologics fill-finish expansions and premium pet food formats that rely on multi-layer pouches. EPR laws in California and Oregon levy fees by recyclability index, steering retailers toward mono-material solutions. Canada's single-use plastics ban accelerates moves from thermoform clamshells to resealable PE pouches. Mexico leverages USMCA to attract co-extrusion investments, positioning itself as a near-shoring hub.

Europe remains a bellwether for circular economy mandates. EPR charges of up to EUR 0.80 per kilogram drive adoption of mono-material BOPE and barrier-coated papers. Amcor's AmFiber paper received an EU patent for high barrier recyclable performance, validating movement away from foil amcor.com. Eastern Europe's lower operating costs entice western brand owners to shift volume, yet cold winters test film toughness, spurring higher-impact resins.

South America records stable growth, hinged on processed foods and agricultural exports. Argentina and Brazil see currency swings that challenge import resin parity pricing, causing periodic substitution of barrier layers with cheaper blends. Regional recyclers lack capacity for metallized scrap, but new chemical recycling plants in Brazil promise to close loops by 2027.

- Amcor plc

- Mondi Group plc

- Sealed Air Corp.

- Huhtamaki Oyj

- Taghleef Industries

- Toppan Printing Co. Ltd.

- Cosmo Films Ltd.

- Polyplex Corp. Ltd.

- Uflex Ltd.

- Glenroy Inc.

- Winpak Ltd.

- Jindal Films

- Bemis (now Amcor)

- Toray Advanced Film

- Mitsubishi Chemical Group

- Dow Inc.

- SABIC

- BASF SE

- Kuraray Co. Ltd.

- ExxonMobil Chemical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Pharma blister boom in biologics and cold-chain logistics

- 4.2.2 E-grocery surge driving pouch and film demand

- 4.2.3 Shift from rigid to lightweight stand-up pouches in APAC

- 4.2.4 High-protein pet-food formats relying on barrier pouches

- 4.2.5 Mono-material MDO-PE/BOPE adoption for recyclability (new)

- 4.2.6 NIR-detectable nano-coatings reducing EPR fees (new)

- 4.3 Market Restraints

- 4.3.1 Volatile PE/PP resin prices

- 4.3.2 Plastic-waste regulations vs multilayer films

- 4.3.3 Limited recycling for SiOx/AlOx BOPE (new)

- 4.3.4 PVDC and EVOH supply crunch post-2027 (new)

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Packaging Product

- 5.1.1 Bags and Pouches

- 5.1.2 Stand-up Pouches

- 5.1.3 Tray-Lidding Films

- 5.1.4 Thermoforming Films

- 5.1.5 Stretch and Shrink Wrap

- 5.1.6 Blister Base Film

- 5.1.7 Flow-wrap and Sachets

- 5.1.8 Vacuum Skin Packs

- 5.2 By Material

- 5.2.1 Polyethylene (LDPE, HDPE, MDO-PE)

- 5.2.2 Polypropylene (BOPP, CPP)

- 5.2.3 Biaxially Oriented Polyethylene Terephthalate (BOPET)

- 5.2.4 Ethylene Vinyl Alcohol Copolymer (EVOH)

- 5.2.5 Polyamide

- 5.2.6 Aluminium Foil

- 5.2.7 Polyvinylidene Chloride (PVDC)

- 5.2.8 Biopolymers (PLA, PHA)

- 5.2.9 Other Material

- 5.3 By End-user Industry

- 5.3.1 Food and Pet Food

- 5.3.1.1 Meat and Seafood

- 5.3.1.2 Dairy and Cheese

- 5.3.1.3 Snacks and Confectionery

- 5.3.2 Beverages

- 5.3.3 Pharmaceutical and Medical

- 5.3.4 Personal Care and Cosmetics

- 5.3.5 Electronics

- 5.3.6 Agriculture and Chemicals

- 5.3.1 Food and Pet Food

- 5.4 By Barrier Type

- 5.4.1 Metallized Films

- 5.4.2 Clear High-Barrier Films

- 5.4.3 Organic-coated Films

- 5.4.4 Inorganic Oxide Films

- 5.5 By Technology

- 5.5.1 Multilayer Co-extrusion (?7 layers)

- 5.5.2 High-layer (>7) Co-extrusion

- 5.5.3 Mono-material Barrier Films

- 5.5.4 Other Technology

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 ASEAN

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 Saudi Arabia

- 5.6.4.1.2 United Arab Emirates

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Kenya

- 5.6.4.2.3 Rest of Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Mondi Group plc

- 6.4.3 Sealed Air Corp.

- 6.4.4 Huhtamaki Oyj

- 6.4.5 Taghleef Industries

- 6.4.6 Toppan Printing Co. Ltd.

- 6.4.7 Cosmo Films Ltd.

- 6.4.8 Polyplex Corp. Ltd.

- 6.4.9 Uflex Ltd.

- 6.4.10 Glenroy Inc.

- 6.4.11 Winpak Ltd.

- 6.4.12 Jindal Films

- 6.4.13 Bemis (now Amcor)

- 6.4.14 Toray Advanced Film

- 6.4.15 Mitsubishi Chemical Group

- 6.4.16 Dow Inc.

- 6.4.17 SABIC

- 6.4.18 BASF SE

- 6.4.19 Kuraray Co. Ltd.

- 6.4.20 ExxonMobil Chemical

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment