PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842589

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842589

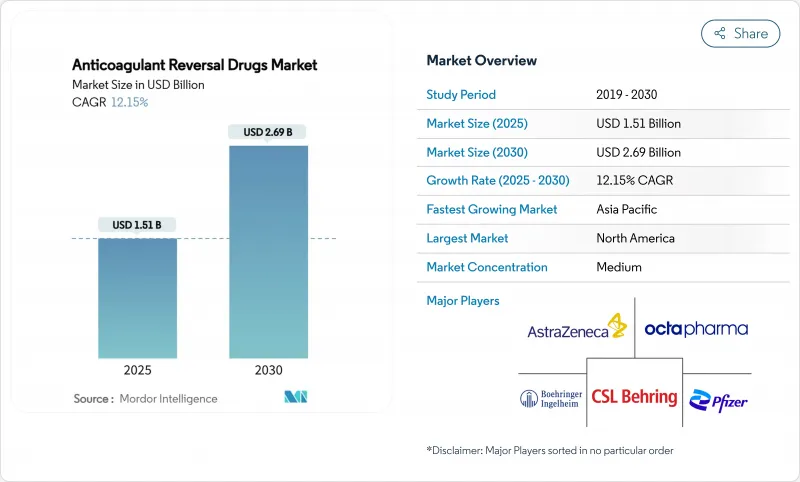

Anticoagulant Reversal Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The anticoagulant reversal drugs market size reached USD 1.51 billion in 2025 and is forecast to attain USD 2.69 billion by 2030, advancing at a 12.15% CAGR.

Growth stems from greater adoption of direct oral anticoagulants (DOACs), an expanding elderly population, and faster regulatory approvals that shorten time-to-market for new reversal agents. Hospitals are widening DOAC-first protocols, which in turn heighten demand for rapid, specific reversal solutions. Rising use of AI-driven coagulation diagnostics is improving bleed detection and guiding earlier intervention, while on-shored plasma collection strengthens prothrombin complex concentrate (PCC) supply resilience. Competitive momentum intensified after Novartis secured abelacimab, a Factor XI inhibitor linked to 67% bleeding reduction compared with rivaroxaban, signalling a shift toward next-generation agents that could further reposition the anticoagulant reversal drugs market.

Global Anticoagulant Reversal Drugs Market Trends and Insights

Aging Population & Rising Prevalence of Blood-Borne Disorders

Growing life expectancy pushes atrial fibrillation prevalence to 9% among those over 80 years, increasing chronic exposure to anticoagulants and heightening reversal needs. Hospitals now embed geriatric-specific anticoagulation pathways that guarantee availability of multiple reversal options for elderly patients who often cycle through varied regimens. This demographic shift elevates the strategic value of stocking both broad-spectrum PCCs and targeted agents for DOAC-associated bleeds.

Accelerated US FDA/EMA Fast-Track Approvals

Regulators prioritize unmet urgency over traditional timelines; andexanet alfa advanced under accelerated approval, while MK-2060 gained Fast Track status in 2025, cutting typical development windows from 8-12 years to roughly 5-7 years. The European Medicines Agency now accepts surrogate endpoints and real-world evidence for life-saving reversal therapies, allowing firms with robust data packages to capture early-mover advantage.

High Cost of Novel Agents

Andexanet alfa costs USD 25,000-50,000 per treatment, a 10-25 fold premium over PCCs, prompting insurers to impose prior-authorization hurdles and emerging-market hospitals to restrict use. Economic models still debate net savings relative to reduced ICU stays, slowing adoption despite proven anti-Factor Xa reversal efficacy.

Other drivers and restraints analyzed in the detailed report include:

- Hospital Adoption of DOAC-First Protocols Driving Demand for Reversal Agents

- AI-Driven Coagulation Diagnostics Enabling Earlier Reversal Intervention

- Thrombo-Embolic Risk & Black-Box Warnings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Prothrombin complex concentrates generated the largest revenue in 2024, holding 39.35% of anticoagulant reversal drugs market share, buoyed by decades of clinical familiarity and recent approval of Balfaxar that ensures diversified domestic supply. Hospitals value PCC versatility across warfarin and certain off-label DOAC emergencies, cementing a stable baseline within the anticoagulant reversal drugs market.

Recombinant decoy proteins such as andexanet alfa headline the fastest-growing cohort with a projected 14.25% CAGR through 2030. Their precise neutralization of Factor Xa inhibitors positions them as the contemporary standard for specific DOAC reversal, albeit at a high cost. Monoclonal antibodies could follow a similar trajectory once abelacimab concludes late-stage trials, potentially reshaping competitive hierarchies inside the anticoagulant reversal drugs market.

Life-threatening hemorrhage accounted for 47.53% of the anticoagulant reversal drugs market size in 2024, as rapid antidote access remains vital for intracranial, gastrointestinal, and trauma-related bleeds. Emergency clinicians prioritize agents with short onset and proven hemostatic efficacy, sustaining robust utilization across stroke centers and trauma networks.

Elective surgery posts the highest 13.85% CAGR, reflecting wider adoption of prophylactic reversal in planned cardiac or neurological procedures where anticoagulant continuation elevates bleed risk. Protocolized peri-operative management increases predictable demand and encourages manufacturers to explore longer-acting formulations suitable for scheduled care, thereby adding depth to the anticoagulant reversal drugs market.

The Anticoagulant Reversal Drugs Market Report is Segmented by Drug Class (Prothrombin Complex Concentrates, Coagulation Factors, Phytonadione, and More), Indication (Life-Threatening Bleeding, and More), Route of Administration (Intravenous Bolus/Infusion, and Sub-Cutaneous), End User (Hospital Pharmacies, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America delivered 41.82% of global revenue in 2024, supported by FDA-guided protocols that favor specific reversal agents and strong reimbursement for premium-priced products. Level 1 trauma systems and comprehensive stroke networks uphold steady consumption, while Health Canada's 2024 clearance of Ondexxya widened continental access.

Asia-Pacific is projected to outpace all regions at 14.51% CAGR. Japan's approval of Ondexxya, rising DOAC usage in China and India, and cardiovascular disease prevalence across urbanizing economies are converging forces expanding the anticoagulant reversal drugs market. National databases such as South Korea's highlight major bleeding incidence that reinforces policy mandates for antidote availability.

Europe remains stable with coordinated EMA guidance and mature plasma supply chains backing PCC production. Germany, the United Kingdom, and France adopt cost-effectiveness metrics, compelling manufacturers to pair clinical evidence with economic value propositions. Middle East & Africa trail but represent white-space potential as tertiary-care capacity grows, albeit tempered by pricing constraints that currently limit widespread penetration of next-generation agents.

- Alexion Pharmaceuticals Inc.

- CSL Behring

- Pfizer

- AstraZeneca

- Octapharma

- Boehringer Ingelheim

- Fresenius

- Bausch Health

- Amneal Pharmaceuticals

- Ferring Pharmaceuticals

- Baxter

- Johnson & Johnson

- Perosphere Pharma

- Nichi-Iko Pharma

- Grifols

- Sanquin Blood Supply Foundation

- Octava Pharma USA (Balfaxar)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging Population & Rising Prevalence Of Blood-Borne Disorders

- 4.2.2 Accelerated US FDA/EMA Fast-Track Approvals

- 4.2.3 Hospital Adoption Of DOAC-First Protocols Driving Demand For Reversal Agents

- 4.2.4 AI-Driven Coagulation Diagnostics Enabling Earlier Reversal Intervention

- 4.2.5 Supply-Chain On-Shoring Of Plasma-Derived Pccs

- 4.3 Market Restraints

- 4.3.1 High Cost Of Novel Agents

- 4.3.2 Thrombo-Embolic Risk & Black-Box Warnings

- 4.3.3 Competition From Point-Of-Care Coagulation Devices Reducing Drug Need

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Drug Class

- 5.1.1 Prothrombin Complex Concentrates

- 5.1.2 Coagulation Factors

- 5.1.3 Monoclonal Antibodies

- 5.1.4 Recombinant Decoy Proteins

- 5.1.5 Phytonadione

- 5.1.6 Other Classes

- 5.2 By Indication

- 5.2.1 Life-threatening Bleeding

- 5.2.2 Emergency Surgery

- 5.2.3 Elective Surgery

- 5.3 By Route of Administration

- 5.3.1 Intravenous Bolus/Infusion

- 5.3.2 Sub-cutaneous

- 5.4 By End User

- 5.4.1 Hospital Pharmacies

- 5.4.2 Emergency Departments/Trauma Centers

- 5.4.3 Retail Pharmacies

- 5.4.4 Ambulatory Surgery Centers

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Alexion Pharmaceuticals Inc.

- 6.3.2 CSL Behring

- 6.3.3 Pfizer Inc.

- 6.3.4 AstraZeneca

- 6.3.5 Octapharma AG

- 6.3.6 Boehringer Ingelheim

- 6.3.7 Fresenius Kabi

- 6.3.8 Bausch Health

- 6.3.9 Amneal Pharmaceuticals

- 6.3.10 Ferring Pharmaceuticals

- 6.3.11 Baxter International

- 6.3.12 Johnson & Johnson (Ethicon)

- 6.3.13 Perosphere Pharma

- 6.3.14 Nichi-Iko Pharma

- 6.3.15 Grifols S.A.

- 6.3.16 Sanquin Blood Supply Foundation

- 6.3.17 Octava Pharma USA (Balfaxar)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment