PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842600

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842600

Global Dental Imaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

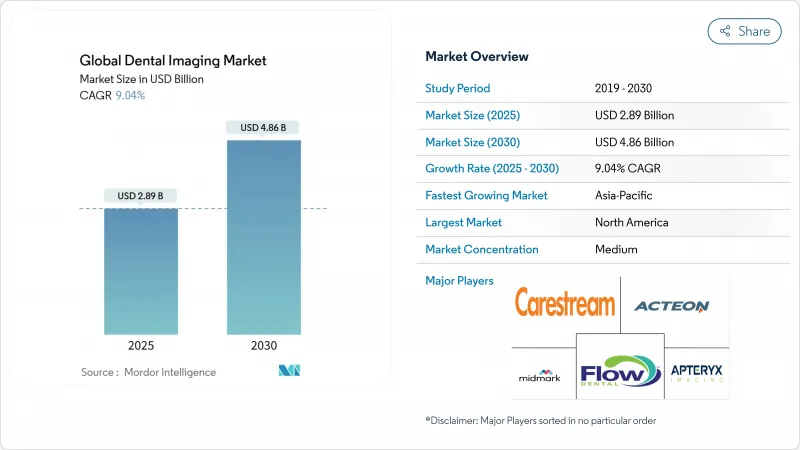

The dental imaging market stands at USD 2.89 billion in 2025 and is projected to reach USD 4.86 billion by 2030, reflecting a 10.96% CAGR.

This growth signals the shift from episodic care toward preventive models in which clinicians rely on data-rich images and algorithmic support to intervene earlier and plan treatments with greater certainty. AI-ready platforms now link imaging devices to practice management systems, creating a single data environment that shortens chair time, raises diagnostic confidence, and strengthens evidence-based case acceptance. Consolidation among dental service organizations (DSOs) enlarges capital budgets and encourages practices to standardize on advanced imaging suites, while regulators reduce approval cycle times for new hardware and software, which keeps the product pipeline active. An aging population frames the commercial opportunity: the 65+ cohort presents more complex clinical profiles that demand volumetric views of bone, nerve, and sinus anatomy at the moment of diagnosis, placing three-dimensional modalities at the center of practice investment strategies.

Global Dental Imaging Market Trends and Insights

AI Integration Drives Diagnostic Precision Revolution

FDA-cleared software such as VideaHealth's pathology detection engine raises clinically actionable findings by 26%, replacing subjective visual inspection with calibrated algorithmic review. Bigger data pools improve caries and lesion detection on panoramic radiographs where bone-loss patterns appear faint to the human eye. Consistent interpretation levels the quality gap between high-volume DSOs and small offices, creating a reliable baseline for remote consultations in teledentistry settings. Cloud hosting further scales this capability because image files, annotations, and audit trails reside in a single workspace that multiple clinicians can access without local servers. As reimbursement models favor early intervention, decision makers see AI-ready imaging as essential infrastructure rather than discretionary capital.

Aging Demographics Fuel Implant Planning Sophistication

The proportion of patients aged 65 and above is rising steadily, and with it comes multi-site edentulism, decreased bone density, and proximity of critical anatomical landmarks. CBCT offers voxel-level visualization that guides implant trajectory, reduces surgical surprises, and eliminates the 7% abort rate observed with 2-D orthopantomography. Cross-disciplinary teams-including periodontists, prosthodontists, and oral surgeons-now treat older adults in integrated care pathways in which CBCT becomes the common language. The sustained 11.31% CAGR for Implant Planning applications reflects the compound effect of demographic pressure and surgeon preference for radiation-efficient, high-resolution views that shorten chair time and healing cycles.

Cost Barriers Limit Adoption in Price-Sensitive Segments

A new CBCT platform can exceed USD 180,000, a figure that strains cash flow in solo practices already facing inflation and reimbursement plateaus. The 10% tariff on imported imaging systems introduced in April 2025 adds further expense for buyers dependent on Asian supply chains. In emerging markets currency volatility exacerbates the hurdle because loan repayments rise unpredictably. As a result, clinics delay upgrades, rely on referral imaging centers, or opt for refurbished equipment, creating disparities in service quality between urban hubs and rural catchment areas.

Other drivers and restraints analyzed in the detailed report include:

- Digital Transformation of Dental Practices

- Regulatory Standardization Enables Global Market Expansion

- Training Complexity Slows Technology Integration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Intraoral X-ray systems captured 37.28% of the dental imaging market share in 2024, underscoring their entrenched role in routine diagnostics across general and specialty practices. Even so, cone-beam CT (CBCT) platforms represent the clear growth engine as clinicians prioritize three-dimensional visualization for implant, endodontic, and airway assessments U.S. Food and Drug Administration. Extraoral panoramic units retain relevance in orthodontic and trauma evaluations, while AI overlays on these images-such as VideaHealth's FDA-cleared software that lifts treatment opportunity identification by 26%-extend the clinical value of legacy systems Denti.AI. The bifurcation now evident separates volume-driven intraoral screening from value-driven CBCT diagnostics, with the latter segment justifying higher capital outlays through measurably better surgical outcomes.

Competitive activity maps to this transition. Traditional intraoral platforms migrate toward direct digital sensors, cordless handpieces, and lightweight control modules that streamline workflow integration and reduce retake rates. CBCT manufacturers double down on dose-reduction algorithms, faster reconstruction times, and small-footprint designs that suit space-constrained operatories. Component suppliers such as Vieworks reported a 28.9% year-on-year jump in detector sales dedicated to cone-beam applications, signaling robust back-end demand that underpins system-level growth Vieworks. Emerging categories-including intraoral scanners and optical imaging heads-gain ground through CAD/CAM convergence, while early-stage MRI-based dental platforms from Dentsply Sirona and Siemens Healthineers create future pathways for radiation-free soft-tissue imaging MDPI. The product trajectory therefore points toward premiumized, all-in-one suites that connect acquisition hardware, cloud analytics, and chairside visualization inside a single diagnostic ecosystem.

The Dental Imaging Market Report Segments the Industry Into by Product (Intra Oral X-Ray Systems, Extra Oral X-Ray Systems and More), by Imaging Technology (2-D X-Ray, 3-D X-ray/CBCT and More), by Application (Diagnostics and Detection, Implant Planning and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 33.45% of 2024 revenue, benefiting from clear insurance codes, accelerated FDA approvals, and a consolidation wave that channels capital toward advanced diagnostic suites. United States DSOs deploy AI algorithms across hundreds of sites, achieving uniform image quality and centralized analytics that inform preventive outreach programs. Canada follows a similar pattern as network operators integrate cloud-based viewers to bridge regional gaps in specialist access. Tariff-driven price hikes on imported equipment create short-term budgeting friction, yet robust reimbursement offsets the hurdle for most urban clinics. The region's mature regulatory environment reduces uncertainty, which encourages manufacturers to debut flagship platforms in North America before global rollout.

Asia-Pacific is expanding at 11.89% CAGR through 2030 as governments invest in digital health, fiber connectivity, and AI research. China's hospital reform plan prioritizes imaging upgrades, and public tenders now specify CBCT in maxillofacial departments. Japan's super-aging society demands low-dose volumetric scans for implant planning and geriatric pathology review, while South Korea's technology-savvy clinics embrace cloud workflows that sync chairside scans with in-house milling. India and Southeast Asia represent high-volume, mid-income prospects where lower equipment costs and financing programs spur first-time adoption. Regional suppliers partner with local distributors to navigate import duties and after-sales service, reinforcing the long-term trajectory of the dental imaging market in Asia-Pacific.

Europe posts steady growth, supported by EU-MDR harmonization that streamlines procurement across borders. Germany, France, and the United Kingdom lead adoption through well-funded public systems and private insurance coverage for digital diagnostics. Southern and Eastern Europe catch up as economic recovery funds modernize hospital infrastructure and subsidize small-practice upgrades. Pan-European DSOs scale AI pilots region-wide, contributing to a shared evidence base that accelerates algorithm refinement. Latin America, the Middle East, and Africa remain emerging fronts where urban private clinics purchase advanced systems, while public sectors adopt gradual refurbishment strategies. As manufacturing efficiency rises and refurbished units circulate, entry-level price points drop, opening new addressable volumes in these markets.

- Dentsply Sirona

- Planmeca

- Carestream Dental

- Vatech Co., Ltd.

- Acteon Group

- Envista Holdings (KaVo & Kerr)

- Midmark

- J. Morita Corp.

- Owandy Radiology

- Cefla (NewTom)

- Genoray Co., Ltd.

- Yoshida Dental Mfg.

- FONA Dental

- Carestream Health

- Apteryx Imaging

- Asahi Roentgen

- FujiFilm Holdings

- Imaging Sciences Intl.

- 3 Shape

- Align Technology (iTero)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of chair-side CBCT scanners

- 4.2.2 AI-powered image enhancement & diagnostics

- 4.2.3 Growing cosmetic dentistry demand

- 4.2.4 National oral-health screening mandates

- 4.2.5 Expansion of group dental practices (DSOs)

- 4.2.6 Oral-systemic health research linking periodontal disease & chronic illnesses

- 4.3 Market Restraints

- 4.3.1 High up-front equipment cost for clinics

- 4.3.2 Short product replacement cycles in 3-D modalities

- 4.3.3 Radiation-dose concerns among patients

- 4.3.4 Scarcity of trained radiographers in emerging nations

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Intraoral X-ray Systems

- 5.1.2 Extraoral X-ray Systems

- 5.1.3 Cone-Beam CT (CBCT) Systems

- 5.1.4 Imaging Software

- 5.2 By Imaging Technology

- 5.2.1 2-D X-ray

- 5.2.2 3-D X-ray / CBCT

- 5.2.3 Optical / Digital Impression

- 5.2.4 Others (MRI, Ultrasound)

- 5.3 By Application

- 5.3.1 Diagnostics & Detection

- 5.3.2 Implant Planning

- 5.3.3 Orthodontics

- 5.3.4 Endodontics

- 5.3.5 Oral & Maxillofacial Surgery

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Dentsply Sirona

- 6.3.2 Planmeca Oy

- 6.3.3 Carestream Dental LLC

- 6.3.4 Vatech Co., Ltd.

- 6.3.5 Acteon Group

- 6.3.6 Envista Holdings (KaVo & Kerr)

- 6.3.7 Midmark Corporation

- 6.3.8 J. Morita Corp.

- 6.3.9 Owandy Radiology

- 6.3.10 Cefla (NewTom)

- 6.3.11 Genoray Co., Ltd.

- 6.3.12 Yoshida Dental Mfg.

- 6.3.13 FONA Dental

- 6.3.14 Carestream Health

- 6.3.15 Apteryx Imaging

- 6.3.16 Asahi Roentgen

- 6.3.17 FujiFilm Holdings

- 6.3.18 Imaging Sciences Intl.

- 6.3.19 3Shape A/S

- 6.3.20 Align Technology (iTero)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment