PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842626

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842626

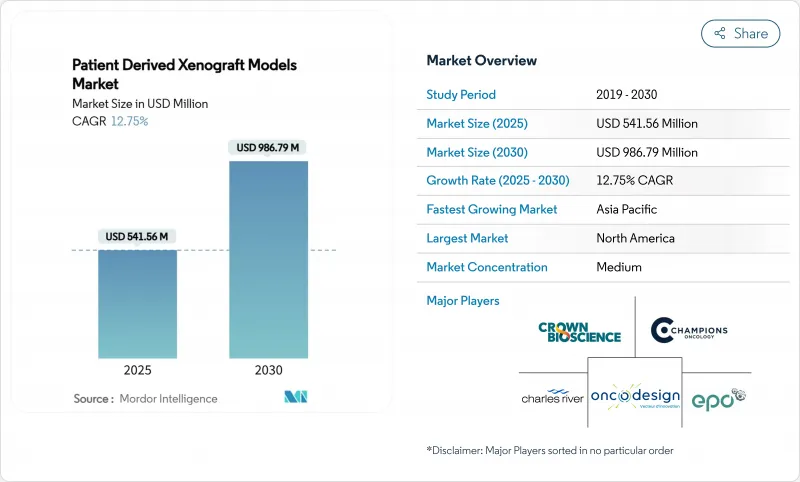

Patient Derived Xenograft Models - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The patient-derived xenograft models market is valued at USD 541.56 million in 2025 and is projected to reach USD 986.79 million by 2030, expanding at a 12.75% CAGR.

Growth stems from the rising global cancer burden, modernized regulations that recognize PDX data in investigational filings, and steady improvements in humanized mouse, zebrafish, and AI-integrated imaging platforms. Federal oncology funding, notably the USD 650 million Peer Reviewed Cancer Research Program, preserves a pipeline of translational studies that rely on patient-derived xenografts for target validation and efficacy profiling. Consolidation among suppliers, paired with strategic acquisitions targeting rare-tumor assets, is reshaping competitive dynamics as larger players look to embed CRISPR-engineered, immune-humanized platforms within integrated discovery workflows.

Global Patient Derived Xenograft Models Market Trends and Insights

Rising cancer incidence & earlier detection

Global oncology incidence reached 20 million new cases in 2022, and forecasts point to 35 million by 2050, a trend that multiplies demand for clinically relevant pre-clinical systems. In the United States, 2,041,910 new cases were logged during 2025, with faster growth observed in women under 50, thereby requiring tumor models that capture age-specific biology. Earlier diagnosis programs enlarge the population eligible for precision therapies, and PDX platforms replicate patient heterogeneity better than immortalized cell lines. Public investments such as ARPA-H's USD 25 million at-home multi-cancer screening initiative create downstream demand for xenografts that evaluate subtype-specific regimens. Collectively, these forces sustain double-digit expansion across the patient-derived xenograft models market.

Surge in pharma/biotech R&D outsourcing to CROs

Pharmaceutical pipelines added hundreds of early-stage programs during 2024-2025, stretching in-house capacity and steering sponsors toward external partners with turnkey xenograft capabilities. Leading Asian CROs report record revenues, underpinned by cost advantages and expanded vivarium space that accommodates large PDX colonies. Integrated CRDMO offerings unite model generation, pharmacology, bioanalytics, and clinical supply, shrinking timelines and lowering coordination risk. As outsourcing becomes the default option for complex studies, contract providers specialising in PDX services achieve above-market growth and reinforce regional leadership in China, Singapore, and India. The broader outsourcing wave, therefore, propels incremental demand across the patient-derived xenograft models market.

High cost & lengthy timelines versus 3-D organoid alternatives

Patient-derived organoids form within weeks and run on lower budgets than several-month PDX engraftments, narrowing the economic appeal of animal studies. Organoid-on-chip systems integrate perfusion bioreactors, enabling dynamic drug exposure assays that enhance throughput and reduce reagent use. Regulators are increasingly receptive to such in-vitro platforms, adding near-term pressure on sponsors to justify animal work. These cost-time considerations shave up to 1.2 percentage points from the forecast CAGR but do not negate the long-term relevance of PDX for whole-organism pharmacology studies.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory acceptance of PDX data in IND filings

- Emergence of CRISPR-engineered, humanized PDX models

- Stringent animal-welfare regulations & ethical scrutiny

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mice xenografts represent USD 375 million of 2025 revenue and held 69.35% share in 2024, a position supported by well-defined immunocompromised strains and extensive historical datasets. The patient-derived xenograft models market size for mice-based platforms is projected to reach USD 670 million by 2030, equal to a 12.1% CAGR, as CRISPR engineering embeds fully human cytokine circuits to improve immune-oncology modelling. Although scale advantages persist, growth tapers relative to alternative organisms.

Zebrafish models deliver the fastest rise at 14.25% CAGR on the strength of transparent embryos and automated screening lines that enable rapid compound efficacy assessment. Low maintenance cost and high fecundity make zebrafish attractive for early phenotypic screens, prompting sponsors to deploy dual-organism strategies that marry zebrafish speed with murine translational depth. This complementary usage sustains expansion across the patient-derived xenograft models market while preventing direct cannibalisation of mice revenue.

Gastro-intestinal xenografts generated 28.53% of 2024 billings, equating to USD 154 million, and are projected to reach USD 278 million by 2030 at an 11.9% CAGR, anchored in colorectal and pancreatic indications. Orthotopic colon models replicate metastatic cascades to liver and lung, a capability mandatory for anti-metastatic drug screening. Consequently, researchers continue prioritising GI tissues within their patient-derived xenograft models market budgets.

Hematological malignancy xenografts expand 13.85% per annum, driven by MISTRG and similar cytokine-humanised mouse innovations that overcome prior engraftment failures in acute myeloid leukaemia and myelodysplastic syndrome. As these platforms mature, sponsors gain access to clinically faithful blood-cancer avatars that guide combination therapy design. The resulting volume uptick further diversifies demand across the patient-derived xenograft models market.

The Patient Derived Xenograft Models Market Report is Segmented by Model Type (Mice Models, and More), Tumor Type (Gastro-Intestinal Tumors, and More), Engraftment Technique (Heterotopic Implantation and Orthotopic Implantation), Application (Drug Discovery & Pre-Clinical Testing, and More), End User (Pharmaceutical & Biotechnology Companies, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 44.63% of 2024 revenue on the back of USD 4 billion-plus federal cancer funding, extensive biopharma pipelines, and proactive regulatory stances that recognise PDX evidence in IND submissions. The region's forecast CAGR of 11.4% reflects a mature but still expanding customer base that prioritises CRISPR-humanised mice and AI-enabled imaging. Strategic consortia such as PDXNet ensure protocol standardisation, lowering technical barriers for new entrants.

Asia-Pacific is the growth pacesetter at 13.27% CAGR, supported by rising oncology incidence, cost-efficient CRO capacity, and government initiatives that incentivise digital biomarker R&D. China and Singapore are establishing expansive vivariums, while Japan leverages strong regulatory clarity to attract multinational trials. Combined, these factors increase the region's importance within global procurement strategies for the patient-derived xenograft models market.

Europe maintains a balanced 10.2% CAGR, anchored in rigorous academic research and progressive welfare rules that reward refined xenograft practices. Harmonised quality frameworks and public-private projects such as Cancer Grand Challenges keep utilisation high, although cost pressures encourage selective outsourcing to lower-cost geographies. The continent thus remains an essential but efficiency-focused contributor to patient-derived xenograft models market volumes.

- Champions Oncology

- Charles River

- Crown Bioscience

- WuXi App Tec

- Oncodesign

- Hera BioLabs

- EPO Berlin-Buch

- Pharmatest Services

- Urolead

- XenTech

- The Jackson Laboratory

- Explora BioLabs

- Inotiv Inc.

- Models Genetix

- GEMPharmatech

- ENVIGO

- Novotech

- SOPHiA GENETICS

- Shanghai LIDE Biotech

- Reaction Biology Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence & Earlier Detection Of Cancer

- 4.2.2 Surge In Pharma/Biotech R&D Outsourcing To Cros

- 4.2.3 Favorable Regulatory Acceptance Of PDX Data In IND Filings

- 4.2.4 Growing Public-Private Oncology Funding Pools

- 4.2.5 Emergence Of CRISPR-Engineered, Humanized PDX Models

- 4.2.6 Integration Of AI-Enabled Imaging & Digital Biomarker Analytics

- 4.3 Market Restraints

- 4.3.1 High Cost & Lengthy Timelines Versus 3-D Organoid Alternatives

- 4.3.2 Stringent Animal-Welfare Regulations & Ethical Scrutiny

- 4.3.3 Limited Engraftment Success For Hematologic & Immune-Rich Tumors

- 4.3.4 Competitive Uptake Of In-Silico & Organ-On-Chip Models

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Model Type

- 5.1.1 Mice Models

- 5.1.1.1 Nude (Athymic)

- 5.1.1.2 NOD/SCID

- 5.1.1.3 NSG

- 5.1.1.4 Humanized Mice

- 5.1.2 Rat Models

- 5.1.3 Zebrafish Models

- 5.1.4 Avian CAM Models

- 5.1.1 Mice Models

- 5.2 By Tumor Type

- 5.2.1 Gastro-intestinal Tumors

- 5.2.2 Gynecological Tumors

- 5.2.3 Respiratory (Thoracic) Tumors

- 5.2.4 Central Nervous System Tumors

- 5.2.5 Hematological Malignancies

- 5.2.6 Dermatological (Melanoma) Tumors

- 5.2.7 Other Solid Tumors

- 5.3 By Engraftment Technique

- 5.3.1 Heterotopic (Subcutaneous) Implantation

- 5.3.2 Orthotopic Implantation

- 5.4 By Application

- 5.4.1 Drug Discovery & Pre-clinical Testing

- 5.4.2 Biomarker Identification & Companion Dx

- 5.4.3 Personalized Oncology (Avatar Trials)

- 5.4.4 Translational & Co-clinical Trials

- 5.5 By End User

- 5.5.1 Pharmaceutical & Biotechnology Companies

- 5.5.2 Contract Research Organizations (CROs)

- 5.5.3 Academic & Research Institutions

- 5.5.4 Others

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Champions Oncology

- 6.3.2 Charles River Laboratories

- 6.3.3 Crown Bioscience

- 6.3.4 WuXi AppTec

- 6.3.5 Oncodesign

- 6.3.6 Hera BioLabs

- 6.3.7 EPO Berlin-Buch GmbH

- 6.3.8 Pharmatest Services Ltd

- 6.3.9 Urolead

- 6.3.10 Xentech

- 6.3.11 The Jackson Laboratory

- 6.3.12 Explora BioLabs

- 6.3.13 Inotiv Inc.

- 6.3.14 Models Genetix

- 6.3.15 GEMPharmatech

- 6.3.16 Envigo

- 6.3.17 Novotech

- 6.3.18 SOPHiA GENETICS

- 6.3.19 Shanghai LIDE Biotech

- 6.3.20 Reaction Biology Corp.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment