PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842628

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842628

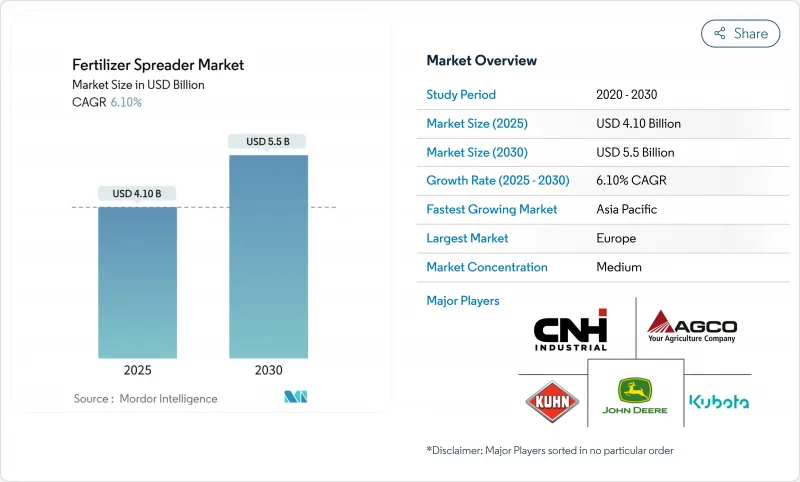

Fertilizer Spreader - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The fertilizer spreader market size is valued at USD 4.1 billion in 2025 and is forecast to climb to USD 5.5 billion by 2030, translating into a 6.1% CAGR.

Evolving precision-farming practices, acute labor shortages, and tightening environmental regulations are compelling growers to replace or upgrade conventional equipment with GPS-enabled variable-rate machines. Rotary spinner designs still dominate large-acreage grain production because of their wide swath coverage, yet pneumatic airflow systems are gaining traction where uniformity and multi-nutrient accuracy drive yield. Subsidy programs in North America and Europe are shortening payback cycles for high-specification spreaders, and digital sales channels are unlocking new routes to market for smaller brands. Meanwhile, rising demand for granular micronutrient blends and in-season liquid fertilization is widening the product mix that manufacturers must support.

Global Fertilizer Spreader Market Trends and Insights

Rising Global Calorie Demand and Arable-Land Scarcity

Steady population growth and changing diets are escalating yield-per-acre expectations. Because land expansion potential is limited, uniform nutrient placement through advanced airflow machines is becoming critical for high-value crops. Variable-rate spreaders that sync with soil-mapping platforms let growers fine-tune application, squeezing more output from existing hectares. These capabilities support export-oriented producers in Asia-Pacific and Africa, trying to lift productivity without aggravating soil degradation. Manufacturers able to prove field-level return on investment are well-positioned to ride this secular demand wave.

Shortage and Rising Cost of Agricultural Labour Stimulate Mechanization

Farm operations in North America and Western Europe face double-digit wage inflation and persistent operator gaps. Self-propelled spreaders reduce crew requirements and can finish multi-field routes before weather windows close, turning labor scarcity into a catalyst for adoption. GPS autosteer and blockage sensors allow less-experienced drivers to achieve overlap accuracy comparable to skilled operators, mitigating the talent bottleneck. South American growers confronting seasonal labor migration trends are also adopting higher-capacity PTO units to maintain throughput. Equipment suppliers that bundle remote diagnostics and operator training stand to capture additional service revenue.

High Upfront Cost vs. Conventional Broadcast Methods

Price tags on advanced spreaders range from USD 25,000 to USD 200,000, a hurdle for small and medium farms operating on thin margins. Credit access is uneven across emerging economies, so growers prioritize near-term liquidity over multi-year efficiency gains. Equipment-as-a-service models that charge per-hectare usage and retrofit VRT kits targeting legacy spinners are gaining popularity as bridge solutions. OEMs are experimenting with subscription packages bundling hardware, software updates, and agronomic advice to flatten capital spikes and widen market reach.

Other drivers and restraints analyzed in the detailed report include:

- Subsidy Programmes for Precision-Fertilizer Equipment

- Adoption of Variable-Rate Technology (VRT) for Fertilizer

- Low Farmer Awareness in Smallholder Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The fertilizer spreader market size for rotary/spinner units reached a substantial scale in 2024, commanding 46% of global sales as large-acreage grain farms value wide coverage and low operating costs. Pneumatic airflow designs, though currently smaller in volume, are expanding at a 9.6% CAGR because airflow paths deliver even distribution of multi-density blends critical to vegetables, orchards, and seed crops.

Airflow spreaders also support controlled-release pellets and coated nutrients without particle segregation, positioning them as the technology of choice for premium-price input programs. In regions with frequent wind events, their enclosed boom design minimizes drift, aligning with tightening buffer-zone regulations. Manufacturers investing in boom length optimization and hydraulic fan drive efficiency expect continued share gain as input suppliers broaden granular micronutrient offerings. Activated-carbon-lined drop hoppers and corrosion-resistant alloys are being introduced to lengthen machine life, a key buying consideration given rising capital costs within the fertilizer spreader market.

Conventional non-GPS spreaders still occupy 72% of the fertilizer spreader market share, reflecting the sheer installed base and the appeal of lower ticket prices in cost-sensitive geographies. Precision/GPS-guided platforms, however, are registering 11.0% CAGR backed by quantifiable input savings and environmental-compliance mandates that require digital record keeping.

VRT prescriptions transmitted over cellular networks let operators alter rates on the go, ensuring nutrient applications match high-resolution soil layers. Leading OEMs are integrating ISOBUS-compatible controllers so that mixed-brand fleets can share maps and machine health data, a capability prized by custom-applicator service providers managing multi-client routes. Augmented-reality calibration tools accessed via smartphones reduce set-up errors, lowering the learning curve that historically deterred upgrades within the fertilizer spreader market.

The Fertilizer Spreader Market Report is Segmented by Machine Type (Drop Spreaders and More), Technology (Conventional, Precision/GPS-Guided, and More), Drive Mechanism (PTO-Driven Mounted and More), Fertilizer Form (Granular and More), End-Use Application (Row-Crop Farms and More), Sales Channel (OEM and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe leads the fertilizer spreader market with a 29% share in 2024, reflecting mature precision-agriculture infrastructure and Common Agricultural Policy incentives that subsidize technology adoption. Stringent nitrate directives and watershed protection regulations make variable-rate application a near-requirement for large arable operations. The region's strong dealer networks and established financing channels smooth the path to high-specification machines. Manufacturers targeting this market emphasize software integration with farm management platforms and compatibility with European satellite correction signals that enable sub-meter accuracy.

The Asia-Pacific region is advancing at a 7.8% CAGR through 2030, the fastest regional growth rate globally. China's policy shift toward reduced fertilizer intensity while maintaining yields creates demand for spreaders that optimize placement efficiency. The government's agricultural modernization program subsidizes mechanization, particularly for cooperatives serving multiple smallholders. India's expanding agrochemical sector, valued at USD 32.4 billion in 2024, signals growing investment capacity for application equipment. Manufacturers are adapting designs for Asian conditions by offering narrower working widths for paddy fields and simplified controls for operators with limited technical training.

North America maintains a significant fertilizer spreader market size despite recent headwinds from commodity price volatility and rising equipment costs. Large-scale grain operations value precision technology integration and data management capabilities that align with established digital farming practices. However, AGCO's 15.1% sales decline in Q2 2024 reflects cautious capital spending as farmers prioritize equipment longevity over replacement. Manufacturers are responding with retrofit packages that add variable-rate capability to existing spreaders at lower entry points. South American growth is uneven due to currency fluctuations, though Brazil's expanding soybean acreage drives demand for high-capacity machines that can cover vast plantations during narrow application windows.

- AGCO Corporation

- CNH Industrial N.V. (Exor N.V.)

- Deere & Company

- Kubota Corporation

- Kuhn Group (Bucher Industries)

- Mahindra & Mahindra Ltd.

- Amazone Werke

- BOGBALLE A/S (Erhvervsinvest)

- Rauch Landmaschinenfabrik

- Salford Group (Linamar Corporation)

- Jacto

- IRIS Spreaders Co., Ltd.

- Adams Fertilizer Equipment (Reppert Capital Partners)

- Teagle Machinery Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising global calorie demand and arable-land scarcity

- 4.2.2 Shortage and the rising cost of agricultural labor stimulate mechanization

- 4.2.3 Subsidy programmes for precision-fertiliser equipment

- 4.2.4 Adoption of variable-rate technology (VRT) for fertilizer

- 4.2.5 Shift to granular micronutrient blends requiring high-accuracy spread

- 4.2.6 The surge of carbon credit schemes rewarding optimized nutrient use

- 4.3 Market Restraints

- 4.3.1 High upfront cost vs. conventional broadcast methods

- 4.3.2 Low farmer awareness in smallholder economies

- 4.3.3 Fragmented after-sales and calibration service networks

- 4.3.4 Sensitivity to fertilizer price volatility and farm income swings

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Machinery Type

- 5.1.1 Drop Spreaders

- 5.1.2 Rotary/Spinner Spreaders

- 5.1.3 Pendulum Spreaders

- 5.1.4 Air-Flo/Pneumatic Spreaders

- 5.1.5 Liquid Fertilizer Sprayers

- 5.2 By Technology

- 5.2.1 Conventional

- 5.2.2 Precision/GPS-guided

- 5.2.3 Autonomous/Robotics-enabled

- 5.3 By Drive Mechanism

- 5.3.1 PTO-driven Mounted

- 5.3.2 Trailed

- 5.3.3 Self-propelled

- 5.3.4 Walk-behind/Manual

- 5.4 By Fertilizer Form

- 5.4.1 Granular

- 5.4.2 Powdered

- 5.4.3 Liquid

- 5.5 By End-use Application

- 5.5.1 Row-crop Farms

- 5.5.2 Specialty/Horticulture

- 5.5.3 Turf and Landscaping

- 5.5.4 Orchard and Vineyard

- 5.6 By Sales Channel

- 5.6.1 OEM

- 5.6.2 Dealer/Distributor

- 5.6.3 Online

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.1.4 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Spain

- 5.7.3.5 Russia

- 5.7.3.6 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 Turkey

- 5.7.5.3 UAE

- 5.7.5.4 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Egypt

- 5.7.6.3 Rest of Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 AGCO Corporation

- 6.4.2 CNH Industrial N.V. (Exor N.V.)

- 6.4.3 Deere & Company

- 6.4.4 Kubota Corporation

- 6.4.5 Kuhn Group (Bucher Industries)

- 6.4.6 Mahindra & Mahindra Ltd.

- 6.4.7 Amazone Werke

- 6.4.8 BOGBALLE A/S (Erhvervsinvest)

- 6.4.9 Rauch Landmaschinenfabrik

- 6.4.10 Salford Group (Linamar Corporation)

- 6.4.11 Jacto

- 6.4.12 IRIS Spreaders Co., Ltd.

- 6.4.13 Adams Fertilizer Equipment (Reppert Capital Partners)

- 6.4.14 Teagle Machinery Limited

7 Market Opportunities & Future Outlook