PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842641

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842641

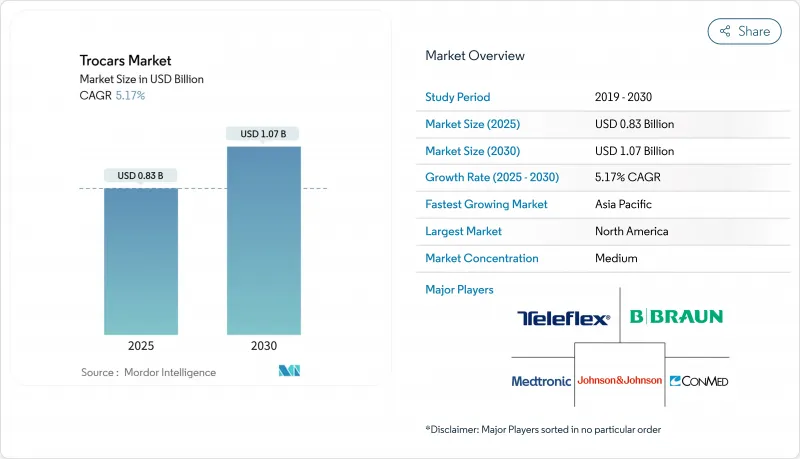

Global Trocars - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Global Trocars Market size is estimated at USD 0.83 billion in 2025, and is expected to reach USD 1.07 billion by 2030, at a CAGR of 5.17% during the forecast period (2025-2030).

Growth is tied to the continued shift from open surgery toward minimally invasive techniques, the rapid penetration of optical entry systems, and expanding procedure volumes in ambulatory settings. Asia-Pacific is projected to post the strongest 6.87% CAGR as governments underwrite laparoscopic skills programs that broaden access to sophisticated care. In North America, bulk-purchase agreements between device makers and ambulatory surgery centers (ASCs) are driving higher unit volumes while tightening price points. Meanwhile, sustainability-driven regulations on sharps disposal are amplifying interest in reposable hybrids that balance infection control with lower waste profiles. Competitive intensity is moderate: two diversified med-tech leaders dominate global channels, but niche companies are winning specialty contracts by offering bariatric-specific shafts and low-force optical tips.

Global Trocars Market Trends and Insights

Rapid Shift from Open to Minimally Invasive Procedures

Surgeons now favor laparoscopy over laparotomy because it cuts mortality odds by 90% and major complications by 62% in trauma diagnostics. Shorter inpatient stays translate to leaner hospital budgets and faster bed turnover, intensifying institutional preference for trocar-dependent approaches. Device makers answer with procedure-specific kits that package access ports, insufflation filters, and smoke evacuation valves, a shift that fuels premium pricing. The surge in evidence-backed clinical benefits propels the trocars market, especially in systems that integrate optical guidance for safer first entry. Hospitals are therefore rewriting capital expenditure plans to prioritize laparoscopic towers and complementary trocar disposables, anchoring recurring revenue streams for vendors.

Driver - Accelerated Replacement Cycles for Disposable Trocars

The CDC's 2024 surgical site infection (SSI) update elevates single-use instruments as first-line defense against contamination cdc.gov. Facilities now rotate disposables at a faster clip to comply, even as ESG officers weigh landfill burdens. Financially, each prevented SSI avoids USD 20,000-40,000 in incremental care, dwarfing the extra trocar spend. Consequently, supply-chain committees are extending multi-year volume contracts that lock in rebate tiers for compliant single-use lines, a trend that bolsters the trocars market across North America and Western Europe. Environmental pushback is redirecting R&D toward recyclable polymers and reduced-metal cutting elements, yet infection control remains the overriding decision driver during current procurement cycles.

Driver - Government-Funded Laparoscopic Skills Programs

Middle-income nations are underwriting simulation labs and mentorship networks that shrink the learning curve for complex laparoscopy. In India, regional skills centers now train more than 5,000 surgeons annually, creating pent-up demand for entry-level trocar kits with integrated safety shields. Manufacturers tailor SKUs with pared-down accessory sets and bilingual IFUs to meet cost and language needs, unlocking volume in previously under-penetrated districts. As proficiency rises, surgeons upgrade to optical or bladeless variants, levering ASPs upward. These capacity-building grants thus nurture a self-reinforcing ecosystem that propels the trocars market in Asia-Pacific and parts of Latin America.

Rising Bariatric Surgery Volumes

Obesity prevalence keeps bariatric interventions on a 6.96% CAGR upswing, spurring demand for long-shaft, low-drag trocars able to traverse thicker abdominal walls . Robotic single-anastomosis duodeno-ileal bypass (SADI) techniques that enable same-day discharge further accelerate adoption, as payers reward outpatient metabolic surgery. Engineering teams now model trocar tips to cut insertion torque while safeguarding pneumoperitoneum, an advance valued by high-BMI patient cohorts. Vendors that secure bariatric center-of-excellence endorsements capture sticky channel partnerships because surgeons tend to standardize on a single platform for workflow familiarity. This bariatric momentum compounds overall trocars market growth through dependable case volumes and procedure-specific up-sells such as extended-length optical obturators.

OEM-ASC Bulk-Purchase Contracts

ASCs treated 3.3 million Medicare beneficiaries, with USD 6.1 billion in payments, underlining their bargaining clout . To secure this channel, manufacturers negotiate tiered rebates contingent on case volumes, bundling trocars with insufflators or robotic arms. ASCs value predictable, sterile disposables that forgo reprocessing overhead, and their lean supply models favor single-vendor continuity. The resulting locked-in contracts amplify annualized unit shipments, sustaining trocars market expansion despite ASP compression.

Other drivers and restraints analyzed in the detailed report include:

- Industry Migration toward Optical Entry Systems

- Trocar-related complications

- Increasing Regulatory Scrutiny on Sharps Waste Disposal

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Disposable units commanded 61.5% of trocars market share in 2024 due to ready-to-use sterility and zero reprocessing labor. Hospitals running high laparoscopy volumes accept the recurrent spend because SSI avoidance outweighs unit cost. Yet sustainability mandates and capital-budget pressures are redirecting attention to hybrid models whose reusable handle pairs with a sterile cannula. This hybridization captured 22% of the trocars market size and is projected to outpace the overall industry at a 6.1% CAGR. Life-cycle assessments show hybrid designs cut greenhouse emissions by 50% compared with fully disposable sets. Providers that invest in validated washer-disinfector workflows realize decade-scale savings as handle amortization lowers effective cost per case. Consequently, purchasing committees in Europe and Canada now embed carbon-reduction scoring into tenders, strengthening hybrid demand.

Reusables maintain a foothold in teaching hospitals where sterile-processing staffing is ample and capital amortization spreads over thousands of cases. Some U.S. integrated delivery networks (IDNs) record six-year payback periods on reusable ports, inclusive of maintenance contracts. Even so, surgeon preference for lightweight polymer housings keeps fully reusable stainless-steel sets niche. Over the forecast horizon, competitive positioning will revolve around modular designs that allow single-handed obturator release, integrated insufflation valves, and RFID tags for usage tracking. Vendors optimizing those features without inflating upfront price are poised to win incremental trocars market share across value-conscious health systems.

Bladeless devices delivered 46.65% of 2024 revenue, favored for their tissue-separating cones that lower peritoneal puncture force. However, optical/direct-vision models are expanding 7.56% annually as outcomes data vindicate real-time entry visualization. One multi-center trial reported zero major vascular injuries when an optical obturator was employed in 1,187 cases. The superior safety profile aligns with payer quality metrics and malpractice risk reduction, allowing hospitals to justify premium pricing

Bladed trocars, historically the mainstay for high-resistance tissue, still populate trauma and bariatric sets where rapid access is paramount. Innovations such as atraumatic shields that retract only upon reaching peritoneum mitigate cut-through risk, preserving their relevance. Direct trocar insertion techniques are gaining endorsement after a 2024 comparative study showed a 3.3% complication rate versus 15.7% with Veress needle entry. Future competitive edge lies in multi-modal ports that toggle between optical and bladeless modes, extending utility across diverse patient anatomies and thereby deepening vendor penetration into the trocars market.

The Trocars Market Report Segments the Industry Into by Product Type (Disposable Trocars, Reusable Trocars), by Tip Type (Bladeless Trocars, Optical Trocare and More), by Application (General Surgery, Gynaecological Surgery, and More), by End User (hospital, Ambulatory Surgical Centers and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America occupied 42.34% of the trocars market in 2024, anchored by 4 million laparoscopic cases and aggressive ASC growth. Canada's universal payment system reimburses optical upgrades for rural trauma centers, while Mexico benefits from cross-border medical tourism that channels U.S. retirees into private hospitals. Regulatory predictability and established sterilization standards sustain premium ASPs, reinforcing North America's contribution to overall trocars market size.

Asia-Pacific posts the highest 6.87% CAGR. China funds laparoscopic skill labs in county hospitals, spurring double-digit trocar volume gains and shortening the capability gap with coastal tertiary centers. India's middle class increasingly opts for private bariatric packages, translating into robust reorder activity for extended-length optical ports. Japan favors early adoption of optical entry systems due to its aging surgeon workforce seeking safer insertions. South Korea and Australia champion top-of-the-line disposable kits integrated with smoke evacuation. Together these dynamics underpin the region's growing slice of trocars market share and justify localized manufacturing to curb import tariffs.

Europe represents around 28% revenue, with Germany, France, and the United Kingdom leading procedure counts. The EU's Green Deal forces hospitals to file annual environmental impact disclosures, pressuring them to shift from all-plastic disposables to hybrid handles. Scandinavian tenders now award up to 20% weightage to lifecycle carbon metrics, accelerating reposable adoption. Central and Eastern Europe trail in spending power but attract donor-funded laparoscopic programs that stimulate baseline trocar demand. Beyond the EU, the Middle East's GCC states are outfitting new mega-hospitals with robotic suites and high-spec optical ports, while Africa's uptake centers on South Africa's academic hospitals and Nigeria's private centers.

Latin America holds a mid-single-digit share yet offers upside as Brazil liberalizes import duties on critical medical devices. Argentina's volatile currency restricts capital imports but creates gray-market demand for reusable stainless-steel sets. Pan-regional distributors filling these gaps build first-mover advantage ahead of regulatory harmonization. Collectively, geographic diversification insulates the global trocars market against localized reimbursement or supply chain shocks, sustaining a steady aggregate demand curve.

List of Companies Covered in this Report:

- Ethicon Inc. (Johnson & Johnson)

- Medtronic

- B. Braun

- Teleflex

- Conmed

- Applied Medical Resources

- The Cooper Companies

- Olympus

- Karl Storz

- Stryker

- Richard Wolf

- Purple Surgical UK Ltd

- GENICON Inc.

- Grena

- LaproSurge Ltd

- Microline Surgical Inc.

- KLS Martin Group

- SeonMed Tech Co. Ltd

- Zhejiang Geyi Medical Instrument Co. Ltd

- Trokamed GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Shift from Open to Minimally-Invasive Procedures

- 4.2.2 Rising Bariatric Surgery Volumes owing to Soaring Obesity Prevalence

- 4.2.3 Accelerated Replacement Cycles for Disposable Trocars Driven by Strict Infection-Control Mandates

- 4.2.4 Government-Funded Laparoscopic Skills Programs Boosting Adoption in Middle-Income Countries

- 4.2.5 Industry Migration toward Optical Entry Systems to Reduce Visceral Injury Risk

- 4.2.6 OEM-ASC Bulk-Purchase Contracts Elevating Unit Sales Volumes in the U.S.

- 4.3 Market Restraints

- 4.3.1 Increasing Regulatory Scrutiny on Sharps Waste Disposal

- 4.3.2 Complications Associated With the Use of Trocars

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Disposable

- 5.1.2 Reusable

- 5.2 By Tip Design

- 5.2.1 Bladed

- 5.2.2 Bladeless

- 5.2.3 Optical

- 5.3 By Application

- 5.3.1 General & Gastrointestinal Surgery

- 5.3.2 Gynecological Surgery

- 5.3.3 Urological Surgery

- 5.3.4 Bariatric Surgery

- 5.3.5 Other Laparoscopic Procedures

- 5.4 By End-user

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgery Centers (ASCs)

- 5.4.3 Specialty Clinics

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia- Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Ethicon Inc. (Johnson & Johnson)

- 6.4.2 Medtronic plc

- 6.4.3 B. Braun Melsungen AG

- 6.4.4 Teleflex Incorporated

- 6.4.5 CONMED Corporation

- 6.4.6 Applied Medical Resources Corp.

- 6.4.7 CooperSurgical Inc.

- 6.4.8 Olympus Corporation

- 6.4.9 Karl Storz SE & Co. KG

- 6.4.10 Stryker Corporation

- 6.4.11 Richard Wolf GmbH

- 6.4.12 Purple Surgical UK Ltd

- 6.4.13 GENICON Inc.

- 6.4.14 Grena Ltd

- 6.4.15 LaproSurge Ltd

- 6.4.16 Microline Surgical Inc.

- 6.4.17 KLS Martin Group

- 6.4.18 SeonMed Tech Co. Ltd

- 6.4.19 Zhejiang Geyi Medical Instrument Co. Ltd

- 6.4.20 Trokamed GmbH

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment