PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842649

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842649

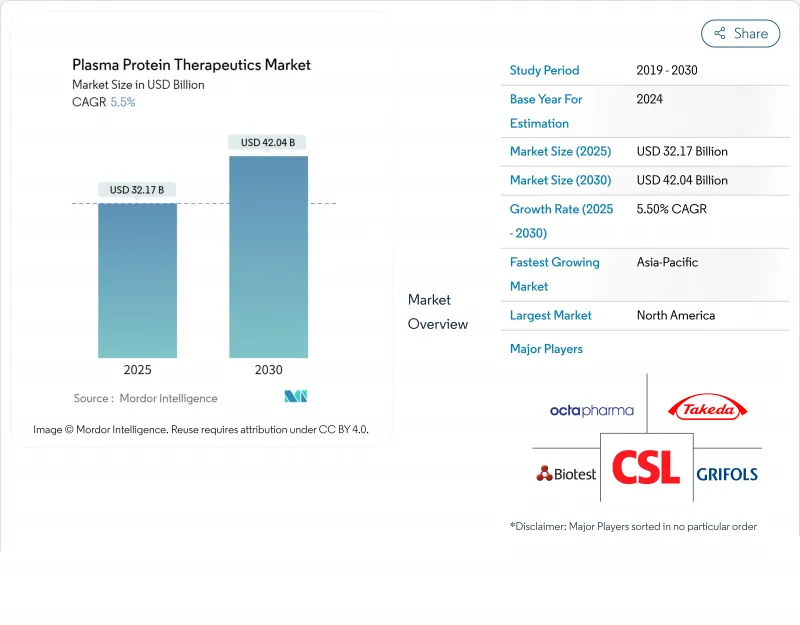

Plasma Protein Therapeutics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Plasma Protein Therapeutics Market size is estimated at USD 32.17 billion in 2025, and is expected to reach USD 42.04 billion by 2030, at a CAGR of 5.5% during the forecast period (2025-2030).

Immunoglobulins remain the economic backbone of the plasma protein therapeutics market, capturing 42.60% of 2024 revenues, while next-generation collection technologies-such as the FDA-cleared Rika Plasma Donation System-are cutting donation times from 75 to 35 minutes, easing long-standing supply constraints. Asia-Pacific is advancing at a projected 7.87% CAGR on the back of major infrastructure projects, including Indonesia's 600,000-liter fractionation facility. Competitive momentum is underlined by a 15% profit leap at CSL Behring in 2024 and Grifols' governance overhaul aimed at quicker execution. Regulatory headwinds persist, yet yield-boosting tools such as Haemonetics' iNomi algorithm, which lifts plasma volume by 9-12%, are widening margins and bolstering supply plasma.

Global Plasma Protein Therapeutics Market Trends and Insights

Rising Adoption of Home-Based Sub-Cutaneous Immunoglobulin Therapy

Rising Adoption of Home-Based Sub-Cutaneous Immunoglobulin Therapy

FDA approval of an expanded XEMBIFY label in July 2024 lets treatment-naive patients initiate subcutaneous therapy without prior IV dosing, slashing clinic visits and widening the addressable population [1]. Phase 4 data confirm biweekly dosing maintains total Ig levels, enhancing adherence. Home infusion lowers healthcare resource utilization by 69% versus IV administration, translating into payer savings and higher manufacturer margins. Direct-to-patient logistics support new revenue streams, while improved quality of life drives patient preference toward self-administration. Manufacturers are responding with nurse-support apps and wearable pump programs that further reduce treatment burden.

Expansion of Plasma Collection Centers

CSL Plasma's roll-out of the Rika system across nearly half its U.S. network trims donation sessions to 35 minutes, a 30-50% throughput gain that directly lifts plasma volume. Simultaneously, the FDA is drafting risk-based donor guidelines that replace rigid time-based deferrals with individual assessments, expected to enlarge the eligible donor pool. These moves relieve a chronic supply bottleneck hampering the plasma protein therapeutics market. Advanced centers also deploy comfort-enhancing lounges and digital booking, improving donor retention. Collectively, the infrastructure expansion sets higher capital barriers that smaller firms struggle to match, reinforcing incumbent advantages.

Strict Regulations for the Handling of Plasma Protein Products

The FDA mandates donor-specific collection volumes calculated by sex, weight and hematocrit, adding workflow complexity and software validation burden . Emerging economies face additional hurdles from limited cold-chain infrastructure and slower licensure processes, delaying product launches. The 2025 FDA guidance agenda lists five fresh documents on blood components, signaling further regulatory churn . Large incumbents leverage in-house regulatory affairs teams to navigate shifting rules, consolidating market power.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Incidence of Autoimmune and Neurological Diseases

- Increasing Approval of Extended Half-Life Coagulation Factors in Japan & South Korea

- High Cost & Limited Reimbursement

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Immunoglobulins generated 42.60% of 2024 revenue, demonstrating the single largest plasma protein therapeutics market share in a portfolio spanning primary immunodeficiencies and neurological disorders. The segment's sustained growth is fueled by subcutaneous formulations that migrate therapy from hospital to home, further enlarging demand. Innovations such as Grifols' XEMBIFY, which posted 15.8% annual sales growth, exemplify the resilience of this category. Simultaneously, the coagulation factor arena is shifting toward gene-based cures; approval momentum for CSL Behring's HEMGENIX underlines the gradual substitution of replacement therapy with potentially one-time interventions.

Alpha-1 antitrypsin products represent the fastest-expanding niche, advancing at a forecast 6.1% CAGR through 2030 as early-diagnosis programs uncover latent AATD patients. Gene-editing pipelines led by Prime Medicine promise disease-modifying potential, attracting institutional investors. C1 esterase inhibitors preserve a specialized yet essential role for hereditary angioedema management, with steady uptake driven by improved diagnostic awareness. Hyperimmune globulins, meanwhile, are carving new territory by targeting emerging infectious diseases, offering manufacturers a counter-cyclical revenue hedge.

The Plasma Protein Therapeutics Market Report Segments the Industry Into by Product (Immunoglobulin, Albumin, and More), by Application (Immunology & Neurology Disorders, Hematology & Coagulation Disorders, and More), by End -User (Hospital and Clinics, Homecare and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 41.60% of 2024 global revenue, anchored by more than 1,000 FDA-licensed plasma collection facilities and broad insurance coverage. The FDA's clearance of the Rika device, which halves collection time, directly addresses supply adequacy. Pending risk-based donor regulations could further expand the eligible donor base and cement regional leadership. Manufacturers leverage strong reimbursement ecosystems, although value-based contracts are emerging for high-cost gene therapies, reshaping long-term pricing models.

Asia-Pacific is forecast to grow at 7.87% CAGR, the quickest pace globally. China's blood products market aided by Terumo's USD 15 million localization investment earmarked for 2025. Indonesia's forthcoming 600,000-liter fractionation plant exemplifies public-private collaboration aimed at reducing import dependence. Japan and South Korea grant accelerated approvals for EHL coagulation factors, positioning the sub-region as an innovation testbed.

Europe maintains strategic importance but grapples with a projected 4-8 million-liter plasma gap by 2025, prompting calls for 2 million additional donors. The Proposed SoHO Regulation underscores donor safety and quality but may impose extra compliance costs. Nevertheless, recent positive reimbursement decisions for HEMGENIX illustrate payer readiness to fund transformative therapies. Middle East & Africa and South America, while smaller, are benefitting from gradual diagnostic expansion and donor-education campaigns, setting the stage for steady uptake

- CSL Behring

- Takeda Pharmaceuticals

- Grifols

- Octapharma

- Kedrion Biopharma

- China Biologics Products

- GC Pharma (Green Cross Corp.)

- Biotest

- Bio Products Laboratory Ltd (BPL)

- ADMA Biologics

- Kamada Ltd.

- LFB S.A.

- Sanquin Plasma Products B.V.

- Hualan Biological

- Bharat Serums & Vaccines Ltd.

- Emergent Bio Solutions

- Intas Pharmaceuticals Ltd. (Accord)

- Prothya Biosolutions

- Shenzhen Kangtai Biological Products

- ProMetic BioTherapeutics Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Rising Adoption of Home-Based Sub-Cutaneous Immunoglobulin Therapy in North America & Europe

- 4.1.2 Expansion of Plasma Collection Centers Across China & Southeast Asia

- 4.1.3 Growing Utilisation of Albumin in Critical Care Across Middle-Income Countries

- 4.1.4 Increasing Approval of Extended Half-Life Coagulation Factors in Japan & South Korea

- 4.1.5 Strategic Government Support for Rare-Disease Treatments in GCC and Scandinavia

- 4.1.6 Emergence of Hyperimmune Globulins for Novel Viral Threats (e.g., C-19, RSV)

- 4.2 Market Restraints

- 4.2.1 Persistent Plasma Supply Constraints Due to Donor Shortages in Europe

- 4.2.2 Price Pressures from National Tendering Systems in Brazil, Turkey & Thailand

- 4.2.3 Strict US FDA Fractionation Capacity Validation Delays

- 4.2.4 High Cost & Limited Reimbursement for Alpha-1 Antitrypsin in Emerging Asia

- 4.3 Value / Supply-Chain Analysis

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Immunoglobulins

- 5.1.1.1 Intravenous Ig

- 5.1.1.2 Sub-cutaneous Ig

- 5.1.1.3 Hyperimmune Globulins (Anti-D, Hep B, Varicella, RSV, others)

- 5.1.2 AlbuminCoagulation Factors

- 5.1.3 Coagulation Factors

- 5.1.3.1 Factor VIII

- 5.1.3.2 Factor IX

- 5.1.3.3 von Willebrand Factor

- 5.1.3.4 Fibrinogen Concentrate

- 5.1.4 Alpha-1 Antitrypsin

- 5.1.5 C1 Esterase Inhibitor

- 5.1.6 Other Plasma-Derived Proteins

- 5.1.1 Immunoglobulins

- 5.2 By Application

- 5.2.1 Immunology & Neurology Disorders

- 5.2.1.1 Primary Immunodeficiency (PID)

- 5.2.1.2 Secondary Immune Deficiency

- 5.2.1.3 Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

- 5.2.1.4 Myasthenia Gravis

- 5.2.2 Hematology & Coagulation Disorders

- 5.2.2.1 Hemophilia A

- 5.2.2.2 Hemophilia B

- 5.2.2.3 von Willebrand Disease

- 5.2.3 Respiratory Disorders

- 5.2.4 Critical Care & Trauma

- 5.2.5 Others

- 5.2.1 Immunology & Neurology Disorders

- 5.3 By End-User

- 5.3.1 Hospitals and clinics

- 5.3.2 Specialty Plasma Centers

- 5.3.3 Homecare

- 5.3.4 Research & Academic Institutes

- 5.4 By Geography (Value)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia- Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Nigeria

- 5.4.6.3 Egypt

- 5.4.6.4 Rest of Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 CSL Behring

- 6.3.2 Takeda Pharmaceutical Co. Ltd.

- 6.3.3 Grifols S.A.

- 6.3.4 Octapharma AG

- 6.3.5 Kedrion S.p.A.

- 6.3.6 China Biologic Products Holdings Inc.

- 6.3.7 GC Pharma (Green Cross Corp.)

- 6.3.8 Biotest AG

- 6.3.9 Bio Products Laboratory Ltd (BPL)

- 6.3.10 ADMA Biologics Inc.

- 6.3.11 Kamada Ltd.

- 6.3.12 LFB S.A.

- 6.3.13 Sanquin Plasma Products B.V.

- 6.3.14 Hualan Biological Engineering Inc.

- 6.3.15 Bharat Serums & Vaccines Ltd.

- 6.3.16 Emergent BioSolutions Inc.

- 6.3.17 Intas Pharmaceuticals Ltd. (Accord)

- 6.3.18 Prothya Biosolutions

- 6.3.19 Shenzhen Kangtai Biological Products

- 6.3.20 ProMetic BioTherapeutics Inc.

7 Market Opportunities & Future Outlook