PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842656

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842656

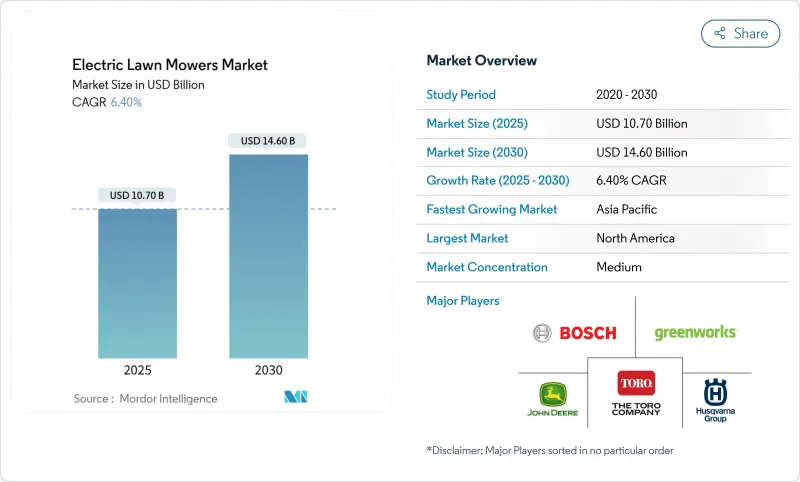

Electric Lawn Mowers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Electric Lawn Mowers Market size is estimated at USD 10.7 billion in 2025 and is projected to reach USD 14.6 billion by 2030, at a CAGR of 6.4% during the forecast period.

Expanding adoption stems from stronger emission rules, rapid battery innovation, and a growing consumer focus on quieter, low-maintenance equipment. Walk-behind cordless units led with 41.3% of 2024 revenue, while robotic and autonomous systems recorded a brisk 15.1% CAGR outlook to 2030. Residential do-it-yourself (DIY) owners generated 68.1% of demand in 2024, yet municipal procurement is accelerating at 14.2% CAGR as public agencies replace gasoline fleets with zero-emission alternatives. North America retained the largest regional base with a 35.2% share in 2024, whereas Asia-Pacific emerged as the growth engine at 11.1% CAGR, supported by urbanization and national clean-technology programs. Mid-duty 37-60 V batteries appeal to professional crews that seek a balance between runtime and maneuverability, and specialty dealers continue to dominate pro-level distribution even as e-commerce penetration rises.

Global Electric Lawn Mowers Market Trends and Insights

Rapid Decline in Lithium-Ion Battery Cost and Rising Energy Density

Lower battery costs are making cordless mowers more affordable, while improved energy density enhances runtime and power efficiency, allowing electric models to rival traditional gas-powered mowers. Lithium-ion pack prices dropped from USD 140 per kWh in 2023 to a projected USD 86 per kWh for 2035, helped by tax incentives in the United States and large-scale automotive cell output. Higher-nickel cathodes deliver 15-20% density gains, allowing walk-behind cordless mowers to run 45-60 minutes on a single charge without weight penalties. Pack life now extends to 5-7 years under advanced thermal management, pushing total operating cost below gasoline equivalents once routine maintenance is removed.

Stricter Worldwide Emission and Noise Standards on Small Gas Engines

Governments worldwide are enforcing tighter restrictions on pollutants, while municipalities impose noise limitations, making traditional gas-powered mowers less viable for residential and commercial use. California's Small Off-Road Engine (SORE) rule banned new gasoline lawn equipment sales from 2024, framing policy adoption for other U.S. states. Similar limits under U.S. EPA Phase 3 standards and Canada's aligned regulations raise compliance costs for spark-ignition manufacturers. Noise ordinances in dense metros further accelerate electric substitutions because battery mowers operate below 70 dBA and avoid time-of-day restrictions.

Higher Upfront Price Compared with Equivalent Gas-Powered Mowers

The higher upfront cost of electric lawnmowers compared to their gas-powered counterparts remains a key market restraint, slowing adoption among price-sensitive consumers. Commercial battery zero-turn models list at USD 15,000-25,000 versus USD 8,000-12,000 for gasoline units, widening the capital hurdle even after declining cell costs. U.S. duties on Chinese battery packs rose to 25% in 2024 and will reach 58% in 2025, inflating street prices while suppliers diversify sourcing. California and South Coast AQMD rebates of up to USD 15,000 for pro-grade equipment soften the impact and shorten payback to under three seasons.

Other drivers and restraints analyzed in the detailed report include:

- Growing Consumer Preference for Low-Maintenance Cordless Equipment

- Expansion of Private-Label Cordless Mower Lines by Large Retailers

- Limited Runtime and Recharge Speed for Large-Area Professional Usage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Walk-behind cordless mowers captured 41.3% of 2024 revenue, highlighting the largest segment within the electric lawn mowers market. Robotic and autonomous units post a 15.1% CAGR outlook as sensors, mapping software, and boundary-free navigation reduce labor dependency for residential and municipal turf. Corded walk-behinds retain a small-lot niche, while ride-on zero-turn formats cater to professional grounds crews prioritizing productivity on wide acreage. Product launches such as Positec's autonomous range and Husqvarna's satellite-guided units underscore OEM's focus on labor-saving value propositions. Stand-on designs remain a specialized play, yet their compact footprint suits tree-rich commercial sites where tight pivots matter more than outright deck width.

Residential DIY owners generated 68.1% of revenue in 2024, anchoring the largest stake in the electric lawn mowers market. Suburban homeowners choose battery platforms for convenience, while smaller lot sizes align well with 45-minute runtime limits. Municipal agencies and government fleets, though just 8.3% of 2024 shipments, will add a 14.2% CAGR as zero-emission procurement rules phase out gasoline stock. The electric lawn mowers market share for professional services is forecast to reach 18% by 2030.

The Electric Lawn Mowers Market Report is Segmented by Product Type (Walk-Behind Corded, Walk-Behind Cordless, and More), by End User (Residential DIY, and More), by Battery Voltage (Less Than or Equal To 36V, and More), by Distribution Channel (In-Store Retail, and More), and by Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the electric lawn mowers market in 2024 with 35.2% revenue, underpinned by state incentive schemes and California's 2024 SORE ban. Rebate programs ranging from USD 100 to USD 15,000 shorten payback horizons for homeowners and municipalities alike. Canada's mirrored exhaust rules allow vendors to treat both nations as one regulatory bloc, streamlining certification.

Asia-Pacific delivered the highest regional growth at 11.1% CAGR, moving from 21% to an anticipated 27% revenue share by 2030. China's 2024 "equipment renewal" stimulus, battery-cell cost advantages, and a burgeoning middle-class lift adoption. Japan's tech-savvy consumers are early adopters of robotic mowers integrated with smart-home ecosystems, while India's urban sprawl and government EV policies gradually unlock a sizeable homeowner base.

Europe maintains steady momentum on the back of strict noise rules and a consumer sustainability ethos. Robotic penetration exceeds 20% of regional mower sales, far above global norms, aided by Husqvarna's entrenched dealer web and product familiarity. Eastern Europe offers white space as GDP per capita rises, and EU eco-label incentives ripple eastward.

- Deere & Company

- Husqvarna Group

- The Toro Company

- Robert Bosch GmbH

- Stanley Black & Decker, Inc.

- STIGA S.p.A

- Honda Motor Co.

- Greenworks North America LLC

- Chervon (EGO Power+)

- Techtronic Industries Co. Ltd. (Ryobi)

- Positec (WORX)

- STIHL

- Segway Navimow

- Mammotion

- Makita

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid decline in lithium-ion battery cost and rising energy density

- 4.2.2 Stricter worldwide emission and noise standards on small gas engines

- 4.2.3 Growing consumer preference for low-maintenance cordless equipment

- 4.2.4 Expansion of private-label cordless mower lines by large retailers

- 4.2.5 Second-life e-bike/scooter battery supply chains cutting BOM costs

- 4.2.6 Emergence of 'mowing-as-a-service' subscription business models

- 4.3 Market Restraints

- 4.3.1 Higher upfront price compared with equivalent gas-powered mowers

- 4.3.2 Limited runtime and recharge speed for large-area professional usage

- 4.3.3 Trade tariffs and critical-minerals rules inflating battery expenses

- 4.3.4 Stricter fire-safety codes on storage/transport of high-capacity packs

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Walk-behind Corded

- 5.1.2 Walk-behind Cordless

- 5.1.3 Ride-on Lawn Tractor

- 5.1.4 Ride-on Zero-Turn

- 5.1.5 Stand-on

- 5.1.6 Robotic/Autonomous

- 5.2 By End User

- 5.2.1 Residential DIY

- 5.2.2 Professional Landscaping Services

- 5.2.3 Golf Courses and Sports Facilities

- 5.2.4 Municipal and Government

- 5.3 By Battery Voltage

- 5.3.1 Less than or equal to 36 V (Light-Duty)

- 5.3.2 37-60 V (Mid-Duty)

- 5.3.3 More than 60 V (Commercial-Grade)

- 5.4 By Distribution Channel

- 5.4.1 In-store Retail (Home Centers)

- 5.4.2 Specialty Dealer/Pro Dealer

- 5.4.3 Online Marketplaces

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 UAE

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Deere & Company

- 6.4.2 Husqvarna Group

- 6.4.3 The Toro Company

- 6.4.4 Robert Bosch GmbH

- 6.4.5 Stanley Black & Decker, Inc.

- 6.4.6 STIGA S.p.A

- 6.4.7 Honda Motor Co.

- 6.4.8 Greenworks North America LLC

- 6.4.9 Chervon (EGO Power+)

- 6.4.10 Techtronic Industries Co. Ltd. (Ryobi)

- 6.4.11 Positec (WORX)

- 6.4.12 STIHL

- 6.4.13 Segway Navimow

- 6.4.14 Mammotion

- 6.4.15 Makita

7 Market Opportunities and Future Outlook