PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842671

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842671

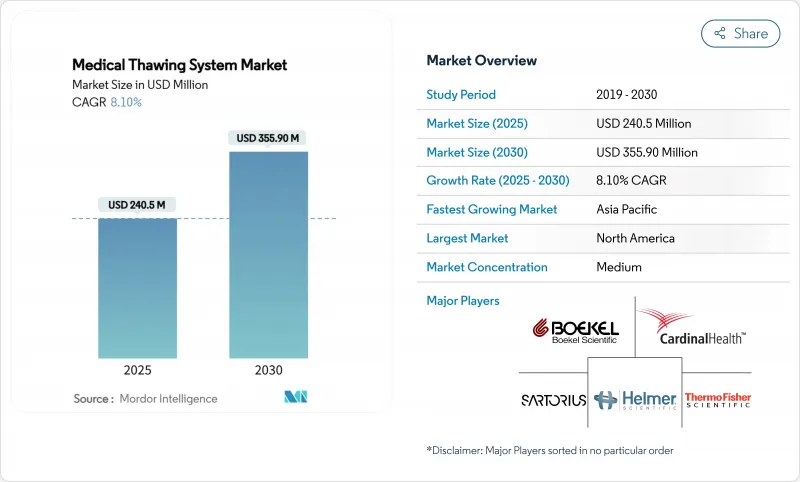

Medical Thawing System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The medical thawing system market is valued at USD 240.5 million in 2025 and is forecast to reach USD 355.9 million by 2030, representing an 8.1% CAGR.

Investment in cell and gene therapies, tighter GMP expectations, and the shift toward single-use closed consumables accelerate demand for rapid and uniform thawing platforms. Regulatory momentum, including multiple FDA cell-therapy approvals in 2024-2025 and targeted device guidance on thermal effects issued in March 2024, is catalyzing the adoption of automated solutions that eradicate operator variability. North America retains leadership owing to its mature cell-therapy pipeline, yet Asia-Pacific's expansion of biomanufacturing capacity and regulatory harmonization drives the fastest regional growth. Technology preferences are in transition: manual plate warmers still dominate, but dielectric radio-frequency (RF) systems and dry conduction platforms gain traction, especially for organ recovery and high-value biologics. End-users increasingly demand IoT-enabled units with native data-logging that streamline GMP record-keeping and create ancillary service revenues.

Global Medical Thawing System Market Trends and Insights

Expanding Cell & Gene-Therapy Volumes Require GMP-Grade Thawing Solutions

FDA approvals for products such as Casgevy and Lyfgenia have locked in strict temperature windows-typically 37 °C for <= 20 minutes-forcing manufacturers to adopt functionally closed, automated devices that guarantee repeatability. Transfusion services increasingly manage thawing for autologous therapies because of their legacy competence in cold-chain handling. Partnerships like Cell and Gene Therapy Catapult with Asymptote demonstrate how benchtop equipment now comes with barcode traceability, audit logs, and disposable inserts to reduce contamination risk. Investment in these systems is further justified as accelerated review pathways reward facilities that show robust GMP controls.

Rising Blood-Component Transfusions Mandate Standardized Fast Thawers

Blockchain, RFID, and AI have modernized blood-bank logistics, creating throughput bottlenecks at thaw steps. Terumo's Reveos automated processing platform, launched in February 2025, cuts manual touchpoints from over 20 to a handful, demanding equally swift thawing modules. High-capacity blast freezers now cool plasma to -90 °C within minutes, so downstream thawers must keep pace to sustain eight-fold productivity gains. Integration with digital inventory systems enables real-time temperature event alerts that support hemovigilance programs.

High Capital Cost of Fully Automated Platforms

Comprehensive units that include HEPA-filtered enclosures, IoT telemetry, and GMP-tier audit trails demand sizeable upfront budgets. Although Single Use Support's scalable RoSS.pFTU line ranges from benchtop to 500 L, capital outlays still deter smaller clinics. Economic models indicate automated thawers shave nearly four minutes per therapeutic dose and cut medication errors by 54%, offsetting costs over time. Investor activity, such as Novo Holdings buying 60% of Single Use Support in 2024, suggests hardware prices will decline as production volumes rise.

Other drivers and restraints analyzed in the detailed report include:

- Automation Reduces Contamination & Operator Variability

- Dielectric RF Organ-Warming Unlocks Frozen-Organ Banking

- Container-Device Incompatibility Limits Workflow Flexibility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manual plate warmers delivered 62.3% of 2024 revenue, underscoring entrenched use within blood centers that favor low complexity and familiar upkeep. However, dielectric RF thawers lead growth with an 8.2% CAGR as transplant programs pilot organ-banking concepts. Automated plate units and water-bath replacements serve laboratories looking for consistent run-to-run performance while keeping costs below RF platforms. The medical thawing system market now provides dry conduction chambers that appeal to facilities prioritizing contamination avoidance.

Adoption trends mirror tighter GMP oversight. Facilities preparing for late-stage commercial cell therapies increasingly replace manual warmers with PLC-driven devices that log every temperature excursion. The medical thawing system industry also experiments with magnetic nanoparticle nanowarming, which uses dispersed iron oxide particles to create volumetric heating under alternating magnetic fields. In peer-reviewed trials, the two-stage protocol maintained high post-thaw viability, pointing to future disruption once scale and regulatory hurdles are resolved.

Blood components accounted for 56.7% of 2024 sales, given the sheer volume of global transfusions and established thaw procedures. Yet tissues & organs segment posts a 10.5% CAGR, reflecting research breakthroughs that extend cold-storage horizons and enable centralized organ banks. Cell- and gene-therapy vials also expand quickly as the therapy pipeline widens, demanding precise, repeatable thawing to protect potency. Embryos and oocytes remain niche but vital, and modified rehydration protocols now improve oocyte survival to 89.8% post-thaw.

Sample diversity pushes vendors to diversify formats. Supercooling extends red-blood-cell storage to 63 days at -8 °C, which means thaw workflows must ensure gentle re-warming to avoid hemolysis. Isochoric preservation, applying constant-volume pressure rather than ice formation, may eliminate classical thaw steps for organs, upending established device design. Such paradigm shifts create incremental demand as laboratories invest in hybrid systems that can thaw traditional bags today yet evolve for next-generation protocols tomorrow.

The Thawing System Market is Segmented by Device Type (Manual Plate-Based Warmers, Dielectric RF Thawers, and More), Sample Type (Blood, Cell & Gene Therapy Vials, and More), End User (Hospitals & Diagnostic Labs, Blood Banks, and More), Thawing Technology (Conduction Plate Heating, and More), and Geography (North America, Europe, Asia Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 38.3% revenue in 2024. The region benefits from concentrated cell-therapy innovators, abundant GMP-grade contract manufacturing, and clear agency guidance on device thermal profiles. Temporary FDA staffing reductions in late 2024 raised review times, yet rigorous submissions also enhance equipment credibility once cleared. Canada's public health¬care networks continue to pilot portable thawers for rural transfusion hubs, further reinforcing regional uptake.

Europe ranks second in value, aided by stringent Medical Device Regulation that rewards manufacturers with mature quality systems. Initiatives such as the Cell and Gene Therapy Catapult's collaboration with Asymptote demonstrate public-private efforts to accelerate compliant automation. Getinge's 2024 Paragonix acquisition adds an organ transport portfolio, tightening integration between storage, shipping, and thaw steps. Energy-saving policies also spur interest in isochoric refrigeration, which lowers facility operating costs by up to 70% while aligning with EU sustainability targets.

Asia-Pacific is the fastest climber, projected at 11.2% CAGR for 2025-2030. China's device market, expected to hit EUR 30 billion, is buoyed by refreshed NMPA regulations that shorten foreign-device registration cycles. Japan is tackling its approval lag through accelerated pathways, opening earlier windows for advanced thawers. Regional cell-therapy centers in South Korea and Singapore anchor demand for fully automated, humidity-controlled equipment connected to national traceability platforms. The medical thawing system market thus faces its richest growth opportunity across Asia-Pacific's upgraded biomanufacturing corridors.

- Helmer Scientific

- Sartorius

- Boekel Scientific

- Barkey

- BioLife Solutions

- Terumo

- Cardinal Health

- Sarstedt

- CytoTherm

- Single Use Support

- Thermo Fisher Scientific

- GE Healthcare

- MedCision LLC

- Plasma Solutions

- REM? Group

- Stericox India

- 3M

- Dragerwerk

- Eppendorf

- Praxair Cryogenics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding Cell & Gene-Therapy Volumes Require GMP-Grade Thawing Solutions

- 4.2.2 Rising Blood-Component Transfusions Mandate Standardized Fast Thawers

- 4.2.3 Automation Reduces Contamination & Operator Variability

- 4.2.4 Dielectric RF Organ-Warming Unlocks Frozen-Organ Banking

- 4.2.5 Single-Use Closed Thaw Bags Accelerate Equipment Replacement

- 4.2.6 IoT-Enabled Cryochain Analytics Create Service-Revenue Streams

- 4.3 Market Restraints

- 4.3.1 High Capital Cost Of Fully Automated Platforms

- 4.3.2 Container-Device Incompatibility Limits Workflow Flexibility

- 4.3.3 Uneven Temperature Gradients Risk Viability In Large Bags

- 4.3.4 Regulatory Uncertainty For Dielectric Organ Warming

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Device Type

- 5.1.1 Manual Plate-Based Warmers

- 5.1.2 Automated Plate-Based Warmers

- 5.1.3 Automated Water-Bath Thawers

- 5.1.4 Dry-Conduction Thawers

- 5.1.5 Dielectric RF Thawers

- 5.1.6 Others

- 5.2 By Sample Type

- 5.2.1 Blood

- 5.2.2 Cell & Gene-Therapy Vials

- 5.2.3 Embryos & Oocytes

- 5.2.4 Tissues & Organs

- 5.2.5 Others

- 5.3 By End-User

- 5.3.1 Hospitals & Diagnostic Labs

- 5.3.2 Blood Banks & Transfusion Centers

- 5.3.3 Cell-Therapy & Biopharma Manufacturers

- 5.3.4 IVF & Fertility Centers

- 5.3.5 Research Institutes

- 5.3.6 Others

- 5.4 By Thawing Technology

- 5.4.1 Conduction Plate Heating

- 5.4.2 Water-Bath Circulation

- 5.4.3 Dielectric RF Warming

- 5.4.4 Convective Air Warming

- 5.4.5 Microwave / Infra-Red

- 5.4.6 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Helmer Scientific

- 6.3.2 Sartorius AG

- 6.3.3 Boekel Scientific

- 6.3.4 Barkey GmbH & Co. KG

- 6.3.5 BioLife Solutions

- 6.3.6 Terumo Corporation

- 6.3.7 Cardinal Health

- 6.3.8 Sarstedt AG & Co. KG

- 6.3.9 CytoTherm

- 6.3.10 Single Use Support

- 6.3.11 Thermo Fisher Scientific

- 6.3.12 GE HealthCare

- 6.3.13 MedCision LLC

- 6.3.14 Plasma Solutions

- 6.3.15 REM? Group

- 6.3.16 Stericox India

- 6.3.17 3M Company

- 6.3.18 Dragerwerk AG & Co. KGaA

- 6.3.19 Eppendorf SE

- 6.3.20 Praxair Cryogenics

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment