PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842674

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842674

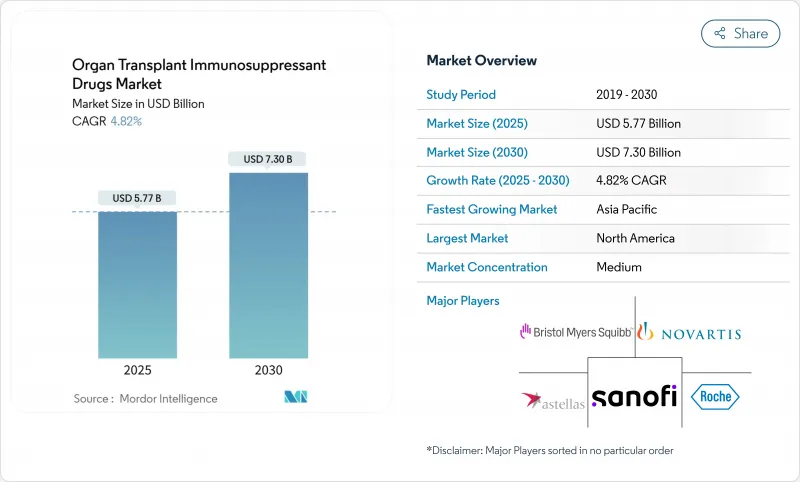

Organ Transplant Immunosuppressant Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The organ transplant immunosuppressant drugs market is valued at USD 5.77 billion in 2025 and is forecast to reach USD 7.30 billion by 2030, advancing at a 4.82% CAGR.

Steady transplant volumes, record organ-donation milestones, and continual protocol upgrades underpin expansion. Accelerated approvals of cost-saving generics broaden patient access, while nephron-sparing regimens and ex vivo perfusion technologies sharpen clinical outcomes. Digital dispensing channels, precision diagnostics, and AI-guided dosing further reinforce demand despite intensifying cost pressures and donor shortages. North America retains volume leadership, but Asia-Pacific's rapid program build-outs are redefining geographic dynamics, lifting the organ transplant immunosuppressant drugs market toward sustained mid-single-digit growth through the decade.

Global Organ Transplant Immunosuppressant Drugs Market Trends and Insights

Growing Organ-Failure Burden Boosts Transplants

Escalating incidences of end-stage kidney, liver, heart, and lung diseases fuel surgery volumes and, by extension, immunosuppressant uptake. More than 37 million Americans live with chronic kidney disease, while COVID-19 exacerbated liver morbidity. Aging demographics deepen the candidate pool and require more intensive regimens because older patients possess diminished immune resilience. Early diagnostics flag organ failure sooner and feed transplant pipelines once deemed unreachable. Artificial-intelligence matching systems now predict compatibility with 98% accuracy, lowering rejection events and optimizing dosing protocols, thereby creating reinforcing demand cycles.

Rapid Approvals of Generic Tacrolimus & MMF

Uptake of multiple tacrolimus and mycophenolate mofetil generics slashes regimen costs, allowing funding bodies to treat more recipients within fixed budgets. Medicare Part D outlays for key drugs fell 48-67% after successive generic launches, and ready-to-use oral suspensions widened pediatric access. Nonetheless, the FDA's recent BX rating on an Accord tacrolimus lot highlights vigilance over bioequivalence. Price relief is especially pivotal in emerging economies, where drug expenditure remains the primary bottleneck to post-surgery adherence.

High Lifetime Cost of Multi-Drug Regimens

Annual therapy expenses exceeding USD 30,000 per U.S. liver recipient strain payers and patients alike. Medicare coverage lapses three years post-surgery, leaving 32% of middle-aged recipients without adequate drug insurance. Complication-driven hospitalizations further inflate health-system costs, prompting calls to extend public reimbursement, which economic models show would yield both savings and quality-of-life gains. In low- and middle-income countries, out-of-pocket exposure often forces dose skimping, undermining outcomes and constraining organ transplant immunosuppressant drugs market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Improved HLA-Typing & Transplant Diagnostics

- Adoption of Organ Ex-Vivo Perfusion Systems

- Chronic Donor-Organ Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Calcineurin inhibitors retained 34.55% revenue in 2024, anchoring the organ transplant immunosuppressant drugs market. Proven agents such as tacrolimus remain first-line for most graft types. Yet mTOR inhibitors are on a 10.25% CAGR trajectory due to nephron-sparing and cardiometabolic benefits. Early conversion to everolimus within 12 months post-liver transplant improved renal function in 55% of patients. Rapamycin-based quadruple therapy delivered 20-year graft survival of 20.9%, eclipsing tacrolimus benchmarks. Co-stimulation blockers like belatacept and antiproliferatives such as mycophenolic acids round out therapeutic backbones, while antibody induction remains situational for high-risk recipients.

Novel delivery systems catalyze growth. Self-assembled rapamycin nanoparticles sustain plasma concentrations with lower systemic toxicity, and pegylated CD28-targeting fragments (VEL-101) progress through Phase 2. As generic penetration rises and patents sunset, price competition will intensify, but innovation in targeted or localized formulations should offset margin pressures, reinforcing the organ transplant immunosuppressant drugs market's mid-term growth outlook.

Kidney grafts continued to dominate 61.53% of the organ transplant immunosuppressant drugs market size in 2024, supported by mature protocols and high disease prevalence. Lung transplants, however, register the briskest 10.15% CAGR. Normothermic ex vivo perfusion elevates marginal lungs to transplantable status, eliminating primary graft dysfunction in donation-after-circulatory-death cohorts. Heart graft programs leverage veno-arterial ECMO back-up during acute dysfunction, boosting one-year survival. Liver and pancreas volumes expand steadily but face competition from evolving non-surgical disease-management options. Stem-cell transplants and vascularized composite allografts adopt tailored immunomodulation, indicating future niche demand pockets within the broader organ transplant immunosuppressant drugs market.

Growth in lung and emerging composite procedures will keep overall therapy volumes rising despite xenotransplantation experiments, whose success could either dampen maintenance-drug need or create new induction niches if human graft limitations persist.

The Organ Transplant Immunosuppressant Drugs Market Report is Segmented by Drug Class (Calcineurin Inhibitors, Antiproliferative Agents, MTOR Inhibitor, and More), Transplant Type (Heart, Kidney, Liver, Lung, and More), Route of Administration (Oral, Intravenous, and More), Distribution Channel (Hospital Pharmacies, and More), and Geography (North America, Europe and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 42.72% of 2024 sales on the back of 46,000 transplants and comprehensive payer coverage. The United States posts high tacrolimus utilization despite rising generic substitution, and Canada's early adoption of machine perfusion further amps volumes. Europe maintains balanced growth, though reimbursement reforms and cross-border harmonization debates shape access in smaller member states.

Asia-Pacific is the fastest-growing contributor at 9.22% CAGR. China's state-sponsored transplant network, India's 13,426 kidney operations in 2023, and Japan's approval of LIVTENCITY for post-transplant CMV all illustrate momentum. Improvements in regulatory clarity, donor-registry digitization, and insurance expansion underline a structural shift that will raise the region's share of the organ transplant immunosuppressant drugs market through 2030.

South America and the Middle East & Africa remain nascent yet strategic. Brazil's established liver and kidney centers anchor South American progress, while Saudi Arabia and South Africa spearhead regional adoption of perfusion systems. Limited donor pools and funding constraints temper uptake, but targeted public-private partnerships could unlock incremental opportunity for the organ transplant immunosuppressant drugs market in the later forecast window.

- Astellas Pharma

- Roche

- Novartis

- Bristol-Myers Squibb

- Sanofi

- Viatris

- GlaxoSmithKline

- Dr. Reddy's Laboratories

- Veloxis Pharmaceuticals

- Pfizer

- Abbott Laboratories

- CSL Behring

- Lupin

- Sun Pharmaceuticals Industries

- Cipla

- Hikma Pharmaceuticals

- Intas Pharma

- Chiesi Farmaceutici

- Sandoz Group

- Albireo Pharma

- Takeda Pharmaceuticals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Organ-Failure Burden Boosts Transplants

- 4.2.2 Rapid Approvals of Generic Tacrolimus & MMF

- 4.2.3 Improved HLA-Typing & Transplant Diagnostics

- 4.2.4 Adoption of Organ Ex-Vivo Perfusion Systems

- 4.2.5 Implantable Local-Delivery Systems Cut Toxicity

- 4.3 Market Restraints

- 4.3.1 High Lifetime Cost of Multi-Drug Regimens

- 4.3.2 Chronic Donor-Organ Shortage

- 4.3.3 Shift To CNI-Sparing Protocols Lowers Volumes

- 4.3.4 Emerging Xenotransplantation Could Disrupt Demand

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

5 Market Size & Growth Forecasts (value, USD)

- 5.1 By Drug Class

- 5.1.1 Calcineurin Inhibitors

- 5.1.2 Antiproliferative Agents (IMPDH inhibitors)

- 5.1.3 mTOR Inhibitors

- 5.1.4 Steroids

- 5.1.5 Co-stimulation Blockers (Belatacept)

- 5.1.6 Polyclonal/Monoclonal Antibodies

- 5.1.7 Other Classes

- 5.2 By Transplant Type

- 5.2.1 Kidney

- 5.2.2 Liver

- 5.2.3 Heart

- 5.2.4 Lung

- 5.2.5 Pancreas

- 5.2.6 Bone-Marrow / HSCT

- 5.2.7 Other Types

- 5.3 By Route of Administration

- 5.3.1 Oral

- 5.3.2 Intravenous

- 5.3.3 Topical / Implantable

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 Online Pharmacies

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Astellas Pharma Inc.

- 6.3.2 F. Hoffmann-La Roche Ltd

- 6.3.3 Novartis AG

- 6.3.4 Bristol Myers Squibb Co.

- 6.3.5 Sanofi SA

- 6.3.6 Viatris Inc

- 6.3.7 GSK plc

- 6.3.8 Dr. Reddy's Laboratories

- 6.3.9 Veloxis Pharmaceuticals

- 6.3.10 Pfizer Inc.

- 6.3.11 Abbott Laboratories

- 6.3.12 CSL Behring

- 6.3.13 Lupin Ltd

- 6.3.14 Sun Pharma

- 6.3.15 Cipla Ltd

- 6.3.16 Hikma Pharmaceuticals

- 6.3.17 Intas Pharma

- 6.3.18 Chiesi Farmaceutici

- 6.3.19 Sandoz AG

- 6.3.20 Albireo Pharma

- 6.3.21 Takeda Pharmaceutical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment