PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846340

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846340

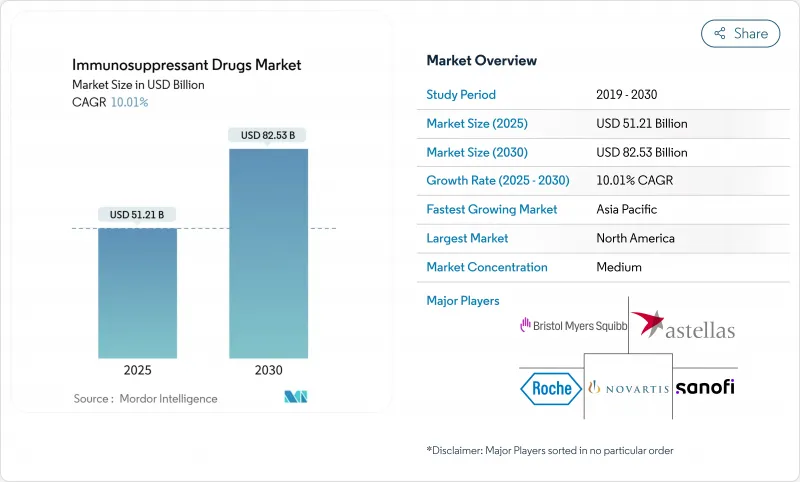

Immunosuppressant Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The immunosuppressant drugs market generated USD 51.21 billion in 2025 and is forecast to reach USD 82.53 billion by 2030, progressing at a 10.01% CAGR.

Rising autoimmune-disease incidence, record organ-transplant volumes, rapid uptake of next-generation biologics, and Medicare inflation-rebate reforms combine to pull demand upward . Additional momentum comes from wider off-label dermatology use of JAK inhibitors and biologics, biosimilar penetration that broadens patient access, and artificial-intelligence platforms that individualize dosing patterns. Commercial strategies now extend far beyond traditional transplant centers, with direct-to-patient digital distribution driving a structural shift in pharmacy channels. Against this backdrop, the immunosuppressant drugs market faces simultaneous threats from cell- and gene-therapy substitutes and from stringent multi-regional regulatory surveillance, keeping competitive stakes high.

Global Immunosuppressant Drugs Market Trends and Insights

Rising Prevalence of Autoimmune Diseases & Organ-Transplant Procedures

Autoimmune-disease recognition intensifies as advanced diagnostics uncover previously undetected patient pools requiring long-term pharmacologic suppression. The United States performed more than 48,000 organ transplants in 2024, a 3.3% rise over 2023, setting a new demand baseline for lifelong maintenance therapy . Enhanced organ-preservation technologies and expanded donor criteria raise procedure volumes further, while the OPTN target of 60,000 annual transplants by 2026 underscores sustained need for immunosuppressants. Aging demographics in developed economies add complexity to care plans, enlarging per-patient dosing and boosting aggregate spending. Collectively, these forces anchor the upward trajectory of the immunosuppressant drugs market.

Technological Advances in Tissue Engineering & Transplant Techniques

Gene-edited pig organs progress from proof-of-concept to early clinical evaluation, signaling a paradigm shift that could alleviate donor-organ scarcity and redefine immunologic protocols. FDA frameworks now detail expectations for xenograft submissions, positioning the United States at the forefront of next-generation transplant medicine. Concurrently, tissue-engineering innovations-such as biocompatible scaffolds and 3-D bioprinted constructs-lower immunogenicity, prompting novel immunosuppression regimens that blend biologics with nanoparticle-based delivery. Pharmaceutical companies that align R&D pipelines with these changes strengthen defensibility in an expanding immunosuppressant drugs market.

Stringent Multi-Regional Regulatory & Pharmacovigilance Hurdles

Regulatory divergence forces companies to navigate disparate approval timelines, safety requirements, and real-world-evidence obligations. FDA scrutiny now extends to in-utero exposure studies, lengthening clinical programs and escalating costs. Although trans-Atlantic harmonization efforts improve alignment, region-specific pharmacovigilance still mandates custom infrastructures, tilting competitive advantage toward incumbents with robust compliance resources. In aggregate, these complexities compress margins and temper expansion across the immunosuppressant drugs market.

Other drivers and restraints analyzed in the detailed report include:

- Launch of Next-Generation Biologics & Small-Molecule Formulations

- Wider Adoption of TDM-Driven Personalized Combination Regimens

- High Therapy Cost & Patchy Reimbursement

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Calcineurin inhibitors retained 44.23% immunosuppressant drugs market share in 2024 owing to long-standing clinical familiarity and broad guideline endorsement. Yet nephrotoxicity worries open white space for mTOR inhibitors, whose 10.78% CAGR marks the fastest segment growth to 2030. The immunosuppressant drugs market size for mTOR-based protocols is projected to expand at a notably brisk clip, helped by favorable renal-function outcomes among liver and kidney recipients. Tacrolimus and cyclosporine will continue to dominate early-post-transplant dosing, but belatacept and everolimus drive steroid-sparing approaches that appeal to multidisciplinary transplant teams.

Momentum toward precision combinations accelerates as therapeutic-drug-monitoring platforms pair calcineurin inhibitors with low-dose mTOR inhibitors to balance rejection risk and adverse-event profiles. Antiproliferative agents such as mycophenolate mofetil and emerging costimulation blockers round out cocktail regimens, creating high-moat portfolios for innovators that own multiple mechanisms of action. As biosimilar tacrolimus diffusion lowers unit prices, innovators lean on differentiated delivery technologies-nanoparticle encapsulation, once-weekly patches-to protect franchise economics inside the immunosuppressant drugs market.

The Immunosuppressant Drugs Market is Segmented by Drug Class (Calcineurin Inhibitors, Antiproliferative Agents, MTOR Inhibitors, Steroids, Other Classes), Application (Autoimmune Diseases, Organ Transplant, Other Applications), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained 40.87% market share in 2024 grounded in robust transplant ecosystems, comprehensive Medicare coverage, and rapid guideline adoption for novel dosing algorithms. Clinical research networks speed time-to-practice for late-stage products, raising revenue certainty for developers. Canada's provincial formularies and Mexico's Seguro Popular upgrades extend reach, yet pricing differentials complicate cross-border procurement strategies, a factor requiring vigilant trade-compliance oversight across the immunosuppressant drugs market.

Asia-Pacific exhibits the most rapid 10.84% CAGR to 2030 as China and India scale transplant capacity and as Japan's aging demographics swell autoimmune caseloads. Regional agencies craft accelerated review pathways for breakthrough biologics, which improves launch windows relative to historic precedents. Local biosimilar manufacturing cuts acquisition costs, spurring broader usage even in secondary-tier cities. Australia and South Korea lead uptake of AI-enabled TDM platforms, further enriching patient-management frameworks within the immunosuppressant drugs market.

Europe posts steady gains aided by universal coverage and strong pharmacovigilance structures, but health-technology-assessment price caps curb top-line growth for high-ticket entrants. Germany, United Kingdom, and France represent transplant volume leaders, while Southern European nations outpace on autoimmune prescriptions. Regulatory convergence with FDA eases multi-regional filing burdens; however, post-Brexit dual submissions add friction for manufacturers operating pan-European supply chains. Middle East & Africa and South America remain nascent but invest heavily in transplant-center accreditation and generic manufacturing respectively, signaling future relevance to the worldwide immunosuppressant drugs market.

- Novartis

- Astellas Pharma

- Bristol-Myers Squibb

- Roche

- Pfizer

- Abbvie

- Sanofi

- Janssen (Johnson & Johnson)

- Viatris

- Accord Healthcare (Intas)

- Veloxis (Asahi Kasei)

- GlaxoSmithKline

- Teva Pharmaceutical Industries

- Sun Pharmaceuticals Industries

- Dr. Reddy's Laboratories

- Hikma Pharmaceuticals

- Lupin

- Mitsubishi Tanabe Pharma

- Fresenius

- Sandoz (Novartis Generics)

- CSL Behring

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Autoimmune Diseases & Organ-Transplant Procedures

- 4.2.2 Technological Advances in Tissue Engineering & Transplant Techniques

- 4.2.3 Launch Of Next-Gen Biologics & Small-Molecule Formulations

- 4.2.4 Wider Adoption Of TDM-Driven Personalised Combination Regimens

- 4.2.5 Gene-Edited Xenotransplantation Breakthroughs

- 4.2.6 Off-Label Dermatology Use Surges in EMS

- 4.3 Market Restraints

- 4.3.1 Stringent Multi-Regional Regulatory & PV Hurdles

- 4.3.2 High Therapy Cost & Patchy Reimbursement

- 4.3.3 Curative Cell- & Gene-Therapy Substitutes

- 4.3.4 Rising AMR Burden Complicating Immunosuppression

- 4.4 Regulatory Landscape

- 4.5 Porters Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Drug Class

- 5.1.1 Calcineurin Inhibitors

- 5.1.2 Antiproliferative Agents

- 5.1.3 mTOR Inhibitors

- 5.1.4 Steroids

- 5.1.5 Other Classes

- 5.2 By Application

- 5.2.1 Autoimmune Diseases

- 5.2.2 Organ Transplant

- 5.2.3 Other Applications

- 5.3 By Distribution Channel

- 5.3.1 Hospital Pharmacy

- 5.3.2 Retail Pharmacy

- 5.3.3 Online Pharmacy

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Novartis AG

- 6.3.2 Astellas Pharma Inc.

- 6.3.3 Bristol-Myers Squibb Co.

- 6.3.4 F. Hoffmann-La Roche Ltd.

- 6.3.5 Pfizer Inc.

- 6.3.6 AbbVie (Allergan)

- 6.3.7 Sanofi (Genzyme)

- 6.3.8 Janssen (Johnson & Johnson)

- 6.3.9 Viatris Inc.

- 6.3.10 Accord Healthcare (Intas)

- 6.3.11 Veloxis (Asahi Kasei)

- 6.3.12 GlaxoSmithKline plc

- 6.3.13 Teva Pharmaceutical Industries

- 6.3.14 Sun Pharmaceutical

- 6.3.15 Dr. Reddy's Laboratories

- 6.3.16 Hikma Pharmaceuticals

- 6.3.17 Lupin Ltd.

- 6.3.18 Mitsubishi Tanabe Pharma

- 6.3.19 Fresenius Kabi

- 6.3.20 Sandoz (Novartis Generics)

- 6.3.21 CSL Behring

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment