PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842678

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842678

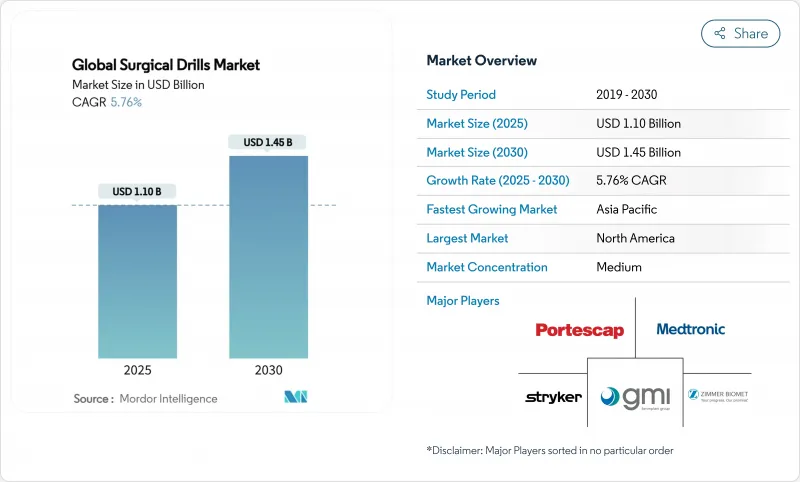

Global Surgical Drills - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The surgical drills market stands at USD 1.10 billion in 2025 and is on course to reach USD 1.45 billion by 2030, growing at a 5.76% CAGR.

Demand is powered by climbing surgical volumes, rapid improvements in battery chemistry, and the migration of procedures toward minimally invasive techniques that call for ever-tighter drilling tolerances. Hospitals are shifting capital budgets from pneumatic lines to cordless systems because smart batteries cut turnover time, while software-guided drill profiles give surgeons repeatable accuracy regardless of bone density. Rare-earth-efficient motors, lighter composite housings, and autoclavable lithium packs have pushed performance parity with corded gear, setting the stage for cordless dominance. Aging demographics and the steady rise of robotic and navigation platforms further tighten the link between drill performance and overall surgical workflow efficiency, elevating engineering quality over simple unit sales growth.

Global Surgical Drills Market Trends and Insights

Rising Orthopedic & Trauma Surgery Volume

Primary total knee arthroplasties in the United States alone are forecast to jump 673% by 2030, while hip replacements rise 174%, creating an unprecedented load for precision drilling systems. Similar trajectories play out in fast-urbanizing Asian economies where traffic-related trauma lifts fracture repairs. As cases migrate from inpatient theaters to outpatient suites, battery-powered platforms that bypass built-in compressor lines win favor, especially in ambulatory orthopedic centers posting double-digit growth. High procedure complexity in elderly bone drives torque-controlled drills that avoid micro-cracks, raising demand for programmable speed profiles. These factors combine to keep the surgical drills market on a sturdy upward arc.

Rapid Ergonomics & Power-Train Innovation

New generations of cordless drills match, and in some tasks exceed, pneumatic torque while eliminating hose drag that can contaminate sterile fields. CONMED's Hall Lithium Battery system recharges in 30 minutes and withstands repeated autoclave cycles, solving the durability gap that once hampered lithium packs. Stryker's Signature 2 delivers 75,000 RPM from a slim handle that reduces surgeon fatigue, and its software lets teams preload speed-torque curves for specific bone types. Hospitals measure such gains in minutes saved per case, turning capital-equipment debates into workflow decisions rather than pure price comparisons. As AI overlays guide depth and angle, drills become data nodes in the wider digital OR ecosystem.

Post-Surgery Complications Linked to Drilling

Bone temperatures above 47 °C impair osteogenesis; conventional drills can exceed 100 °C in dense cortical bone, expanding osteonecrosis zones.Studies show even sequential reaming fails to eliminate heat trauma entirely, fueling legal and cost concerns for hospitals. Ultrasonic-assisted drilling lowers force and heat but costs more and requires surgeon retraining, slowing uptake. Until embedded cooling or smarter torque governors become mainstream, risk-averse buyers in emerging markets may postpone upgrades, restraining part of the surgical drills market.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Minimally Invasive & Robot-Assisted Procedures

- Growing Geriatric Musculoskeletal Burden

- High Acquisition & Lifecycle Cost of Power Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electric drills currently generate 55.78% of revenue, reflecting decades of OR familiarity and steady performance. Yet cordless units are climbing at 6.36% CAGR as battery swaps under 30 seconds and autoclave-safe packs free teams from fixed power outlets. Pneumatic drills retain a niche in high-volume trauma centers that already own central air, but their share erodes as compressors age out. Accessory kits-sterile bits, backup batteries, docking carts-form a steady annuity stream, so vendors align channel programs to lock hospitals into platform ecosystems. The surgical drills market size for cordless platforms is forecast to eclipse corded revenue by the late 2020s, driven by procedure mobility in hybrid ORs.

Custom-tuned power management chips now stretch runtime past eight complex orthopedic cases per charge, erasing prior downtime criticism. Arthrex's 2025 cordless launch paired a carbon-fiber shell with AI-based cell-health analytics, signaling a trend toward predictive maintenance that minimizes unplanned stoppages. Suppliers that retrofit compatibility sleeves for legacy shafts lower switching friction, accelerating fleet conversion within budget-sensitive systems.

High-speed drills topping 60,000 RPM hold 61.42% share and still grow at 6.14% CAGR, underscoring surgeon preference for crisp cutting in minimally invasive corridors. These handpieces integrate micro-vent channels and ceramic bearings to dissipate friction heat and preserve bone viability. The surgical drills market size for high-speed models is projected to reach USD 900 million by 2030 as ENT and spine teams demand burrs that navigate tight anatomy without chatter. Standard-speed drills remain important in trauma units and revision arthroplasty where dense callus calls for controlled advancement.

Recent design shifts favor adaptive-speed controllers that drop rpm automatically when sensors detect thin cortical layers, protecting underlying tissue. Stryker's servo loop caps overshoot within 50 microseconds, and firmware updates ship over secure Wi-Fi, linking handpieces to central device-management dashboards.

The Surgical Drills Market is Segmented by Product (Pneumatic Drills, Electric Drills, and More), by Speed (High-Speed (above 60, 000 Rpm), Standard Speed (below 60, 000 Rpm)), by Application (Orthopedic Surgeries, Dental Surgeries, and More), by End User (Hospitals and Clinics, Ambulatory Surgery Centers, and More), by Geography (North America, Europe, Asia-Pacific, and More).

Geography Analysis

North America holds 40.74% of 2024 revenue, powered by early adoption of integrated digital ORs, solid reimbursement, and the world's highest orthopedic caseload per capita. Leading U.S. centers embed cordless drills into robotic workstations, tightening vendor partnerships around ecosystem compatibility. Canada's single-payer provinces purchase through group tenders that favor platform breadth over niche innovation, while Mexico's private hospitals import premium U.S. gear to capture medical-tourism flows. Despite maturity, the region's keen appetite for AI-enabled upgrades keeps the surgical drills market vibrant, though annual growth moderates below emerging-market pace.

Europe offers a stable but sustainability-sensitive landscape. Germany, France, and the United Kingdom remain the anchor buyers, yet environmental directives and post-Brexit regulatory divergence add compliance layers. Hospitals in Italy and Spain increasingly stipulate low-waste packaging and end-of-life recycling plans in tenders. Eastern European states, buoyed by EU structural funds, retrofit theaters with cordless drills to leapfrog aging pneumatic lines. With CE-plus-UKCA dual marking now standard, vendors streamline filings to avoid product-launch lags, keeping continental share competitive.

Asia-Pacific is set to grow at 7.48% CAGR, the fastest worldwide. China funnels public funding into trauma centers and invests in in-house robotic ecosystems, often pairing domestic drill makers with locally built arms to reduce import spend. Japan's super-aged population continues to swell arthroplasty lists, compelling hospitals to adopt torque-controlled drills that minimize cortical burn in osteoporotic bone. India's tier-I private chains equip new ASCs with battery suites, while government facilities still favor budget electric sets, carving a two-tier segment. Australia and South Korea, at technology frontiers, serve as regional reference sites for 75,000 RPM handpieces with cloud-based service logs. Collectively, this mix pushes the surgical drills market toward diversified, region-specific product roadmaps.

- Stryker

- Medtronic

- Zimmer Biomet

- Johnson & Johnson

- Conmed

- De Soutter Medical Ltd.

- Brasseler USA

- NSK Nakanishi Inc.

- Adeor Medical

- B. Braun

- Arthrex

- Joimax

- Shanghai Bojin Electric Instrument

- Portescap US Inc.

- GMI Ilerimplant

- Hubly Surgical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising volume of orthopedic & trauma surgeries

- 4.2.2 Rapid ergonomics & power-train innovation in drills

- 4.2.3 Surge in minimally invasive & robot-assisted procedures

- 4.2.4 Growing geriatric musculoskeletal burden

- 4.2.5 Shift toward single-use drills to curb infection

- 4.2.6 3-D-printed custom drill guides accelerating adoption

- 4.3 Market Restraints

- 4.3.1 Post-surgery complications linked to drilling

- 4.3.2 High acquisition & lifecycle cost of power systems

- 4.3.3 Sterilization waste & sustainability pressures

- 4.3.4 Rare-earth magnet supply bottlenecks for high-torque motors

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Pneumatic Drills

- 5.1.2 Electric Drills

- 5.1.3 Battery-Powered Drills

- 5.1.4 Accessories

- 5.2 By Speed

- 5.2.1 High-Speed (above 60,000 rpm)

- 5.2.2 Standard Speed (below 60,000 rpm)

- 5.3 By Application

- 5.3.1 Orthopedic Surgeries

- 5.3.2 Dental Surgeries

- 5.3.3 ENT Surgeries

- 5.3.4 Neurosurgery

- 5.3.5 Other Applications

- 5.4 By End User

- 5.4.1 Hospitals and Clinics

- 5.4.2 Ambulatory Surgery Centers

- 5.4.3 Specialty Dental and ENT Centers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Stryker Corporation

- 6.3.2 Medtronic plc

- 6.3.3 Zimmer Biomet Holdings Inc.

- 6.3.4 Johnson & Johnson (DePuy Synthes)

- 6.3.5 CONMED Corporation

- 6.3.6 De Soutter Medical Ltd.

- 6.3.7 Brasseler USA

- 6.3.8 NSK Nakanishi Inc.

- 6.3.9 Adeor Medical AG

- 6.3.10 B. Braun SE

- 6.3.11 Arthrex Inc.

- 6.3.12 Joimax GmbH

- 6.3.13 Shanghai Bojin Electric Instrument

- 6.3.14 Portescap US Inc.

- 6.3.15 GMI Ilerimplant

- 6.3.16 Hubly Surgical