PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910663

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910663

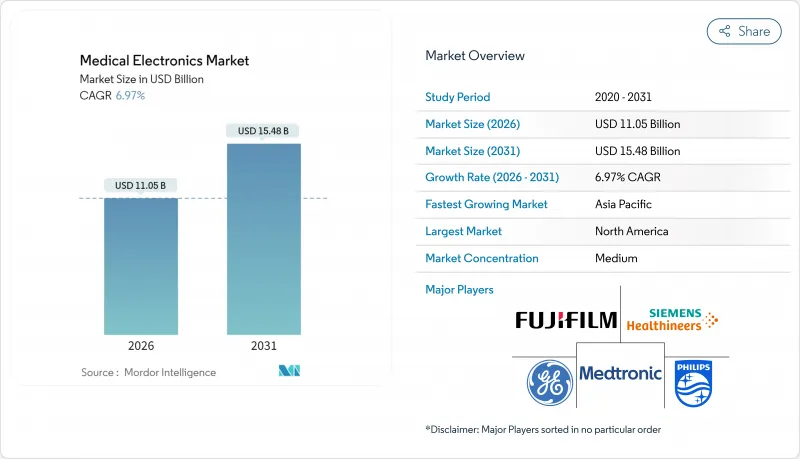

Medical Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Medical Electronics market is expected to grow from USD 10.33 billion in 2025 to USD 11.05 billion in 2026 and is forecast to reach USD 15.48 billion by 2031 at 6.97% CAGR over 2026-2031.

The expansion is propelled by regulatory modernization, the rapid shift toward hospital-at-home models that lower care costs by 30%, and accelerated adoption of AI-enabled diagnostics and monitoring solutions. Demand intensifies as nearly 20% of the global population will be 60 or older by 2030, creating sustained requirements for continuous, decentralized care. Semiconductor supply instability and tightening cybersecurity rules temper growth yet simultaneously stimulate supplier diversification, near-shoring, and product redesign. Asia-Pacific leads with a 17.79% CAGR, North America maintains technology leadership under new FDA cybersecurity mandates, and Europe balances innovation with complex compliance demands.

Global Medical Electronics Market Trends and Insights

Increasing Geriatric Population

An expanding senior demographic elevates lifetime treatment needs and multiplies demand for non-invasive cardiac and metabolic monitoring. Nearly 80% of older adults live independently, prompting uptake of remote sensors that relay real-time vitals to clinicians. Miniaturized patches such as Medical Blackbox platforms deliver automated alerts that match seniors' usability constraints. As governments prioritize "aging-in-place" strategies, device makers continue refining battery life, intuitive interfaces, and fall-detection algorithms to meet long-term home-care needs.

Widespread Adoption of Diagnostic Imaging Technologies

FDA clearance of AI tools like CLAIRITY BREAST, which forecasts five-year breast-cancer risk from routine mammograms, illustrates a diagnostic paradigm moving toward predictive medicine. GE Healthcare invests over USD 1 billion yearly in AI-enabled imaging, adding applications such as Flyrcado for myocardial perfusion scans. Forthcoming 6G networks aim to transmit radiology files instantly across cloud platforms, improving report turnaround and cutting repeat scans. Providers shift capital budgets into imaging suites that integrate algorithmic triage, lowering per-patient procedure cost while raising throughput.

Stringent Regulatory Frameworks

FDA rules effective October 2023 require every connected device to include a cybersecurity management plan, a software bill of materials, and post-market vulnerability processes. Compliance fees and longer review cycles raise barriers for start-ups and stretch R&D budgets of mid-tier firms. In parallel, the EU MDR 2017/745 extends submission timelines by 12-18 months for many applicants, concentrating approvals among large manufacturers with global regulatory departments.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Sensor Miniaturization

- Rising Prevalence of Chronic Diseases

- High Upfront Investment and Maintenance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-invasive devices delivered 61.12% medical electronics market share in 2025 as clinicians favored painless diagnostics that lower infection risk. MRI, CT, and X-ray platforms now bundle AI engines that automatically flag anomalies and reduce radiation exposure. The medical electronics market size for wearable and patch-based devices is projected to advance at 12.94% CAGR, supported by battery-sipping chipsets and FDA pathways for over-the-counter consumer use.

Invasive solutions maintain strategic importance for rhythm management, pain therapy, and endoscopy when non-invasive alternatives remain inadequate. Implantable loop recorders support cardiac monitoring for up to three years, while emerging resorbable pacemakers promise postoperative device-free recovery. Real-time closed-loop stimulators such as Inceptiv personalize therapy currents and extend battery life through adaptive algorithms. Procedural complexity and sterility requirements temper volumetric growth yet secure enduring demand in specialized surgical suites.

The Medical Electronics Market Report Segments the Industry Into by Product (Non-Invasive Products [MRI, X-Ray, CT Scan, and More], Invasive Products [Endoscopes, Pacemakers, and More]), Application (Diagnostics, Monitoring, Therapeutics), End User (Hospitals and Clinics, Ambulatory Surgical Centers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific records the fastest trajectory at 17.55% CAGR due to supportive industrial policy, rising middle-class healthcare spending, and rapid hospital construction. Venture funding receded during 2024, yet domestic accelerators and public grants continue to underwrite AI-enabled imaging start-ups that tailor products to regional epidemiology and price points.

North America retains 33.49% revenue leadership, aided by predictable FDA review pathways and strong early-adopter provider networks. Proposed semiconductor tariffs could lift input costs for more than half of US-registered devices, but near-shoring to Mexico, now the largest exporter of medical instruments to the United States, blunts longer-term supply-risk exposure. The medical electronics market size in North America benefits from hospital-at-home pilots that demonstrate 30% cost reduction and motivate payer coverage expansion.

Europe shares a sizable presence, balancing advanced R&D clusters with rigorous compliance regimes. EU MDR increases dossier complexity, yet initiatives such as Germany's Digital-Health-Applications framework broaden reimbursement for connected devices. Sustainability directives favor energy-efficient imaging suites and circular-economy packaging, encouraging manufacturers to redesign product lifecycles. Regional growth remains steady as aging populations demand multi-pathology management and governments invest in digital records interoperability.

- GE Healthcare

- Koninklijke Philips

- Siemens Healthineers

- Medtronic

- Canon

- FUJIFILM

- Mindray Medical Int'l Ltd.

- Nihon Kohden Corp.

- Boston Scientific

- Abbott Laboratories

- Hologic

- Olympus Corp.

- Dragerwerk

- Getinge

- Mckesson

- Smiths Group

- Masimo

- B. Braun

- Baxter

- Esaote

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Geriatric Population

- 4.2.2 Widespread Adoption of Diagnostic Imaging Technologies

- 4.2.3 Technological Advances in Sensor Miniaturization

- 4.2.4 Rising Prevalence of Chronic Diseases

- 4.2.5 Integration of AI and Edge Analytics

- 4.2.6 Emergence of Hospital-At-Home Care Models

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Frameworks

- 4.3.2 High Upfront Investment and Maintenance Costs

- 4.3.3 Volatility in Semiconductor Supply Chains

- 4.3.4 Rising Cybersecurity and Data Privacy Compliance Costs

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Non-invasive Products

- 5.1.1.1 MRI

- 5.1.1.2 X-Ray

- 5.1.1.3 CT Scan

- 5.1.1.4 Ultrasound

- 5.1.1.5 Nuclear Imaging Systems

- 5.1.1.6 Cardiac Monitors

- 5.1.1.7 Respiratory Monitors

- 5.1.1.8 Hemodynamic Monitors

- 5.1.1.9 Multiparameter Monitors

- 5.1.1.10 Digital Thermometers

- 5.1.1.11 Wearable & Patch-based Devices

- 5.1.1.12 Other Non-invasive Products

- 5.1.2 Invasive Products

- 5.1.2.1 Endoscopes

- 5.1.2.2 Pacemakers

- 5.1.2.3 Implantable Cardioverter-Defibrillators (ICD)

- 5.1.2.4 Implantable Loop Recorders

- 5.1.2.5 Spinal Cord Stimulators

- 5.1.2.6 Other Invasive Products

- 5.1.1 Non-invasive Products

- 5.2 By Application

- 5.2.1 Diagnostics

- 5.2.2 Monitoring

- 5.2.3 Therapeutics

- 5.3 By End User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Home Healthcare Settings

- 5.3.4 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 GE HealthCare

- 6.3.2 Koninklijke Philips N.V.

- 6.3.3 Siemens Healthineers AG

- 6.3.4 Medtronic plc

- 6.3.5 Canon Medical Systems Corp.

- 6.3.6 Fujifilm Corporation

- 6.3.7 Mindray Medical Int'l Ltd.

- 6.3.8 Nihon Kohden Corp.

- 6.3.9 Boston Scientific Corp.

- 6.3.10 Abbott Laboratories

- 6.3.11 Hologic Inc.

- 6.3.12 Olympus Corp.

- 6.3.13 Dragerwerk AG & Co. KGaA

- 6.3.14 Getinge AB

- 6.3.15 McKesson Corporation

- 6.3.16 Smiths Medical

- 6.3.17 Masimo Corporation

- 6.3.18 B. Braun Melsungen AG

- 6.3.19 Baxter International Inc.

- 6.3.20 Esaote SpA

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment