PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844442

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844442

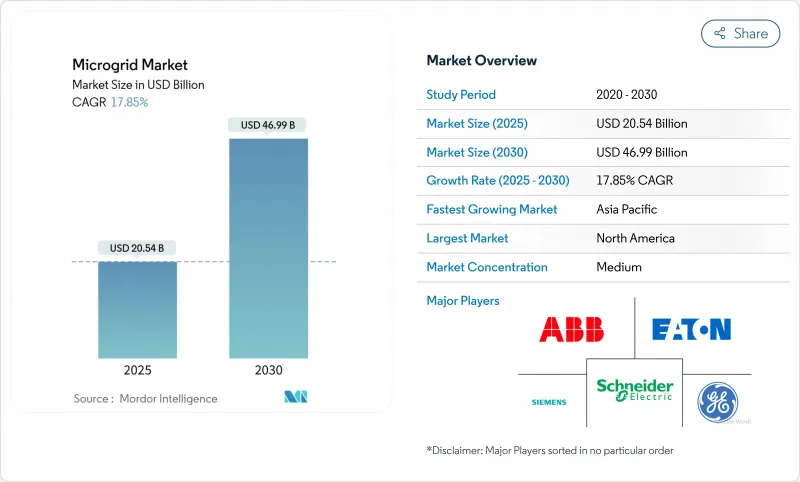

Microgrid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Microgrid Market size is estimated at USD 20.54 billion in 2025, and is expected to reach USD 46.99 billion by 2030, at a CAGR of 17.85% during the forecast period (2025-2030).

Growth is catalyzed by IT/OT convergence that embeds edge analytics, digital twins, and cybersecurity layers into advanced controllers, enabling real-time optimization across hardware fleets. Large-scale rural electrification, notably the World Bank's Mission 300 targeting 300 million Africans by 2030, is expanding off-grid demand. The commercial and industrial segment's need for uninterrupted power and defense-funded net-zero base programs accelerates hybrid microgrid configurations. Meanwhile, declining solar PV and battery costs open new value streams, although lithium-ion price volatility and fragmented interconnection codes temper near-term project timelines.

Global Microgrid Market Trends and Insights

Accelerated Rural Electrification in Africa & South Asia

Rural microgrid rollouts hit a new high in 2024 as concessional finance, falling hardware prices, and streamlined procurement converged. The Democratic Republic of Congo approved Africa's largest solar mini-grid in October 2024: a USD 50.3 million project backed by the Multilateral Investment Guarantee Agency to serve 28,000 households and small businesses. The "State of the Global Mini-Grids Market 2024" report shows that sub-Saharan Africa now hosts more than 5,000 operational mini-grids, triple the fleet counted in 2020, with solar providing 59% of installed generation capacity. In Bangladesh, a 2024 case study on a solar-wind-battery microgrid designed for an isolated village demonstrated a levelized cost of USD 0.0688/kWh-less than regional grid extension benchmarks-illustrating the economic viability of renewables-only designs. Multiple governments have adopted results-based financing windows that disburse subsidies upon verified customer connections, cutting first-loss risk for private developers and accelerating deployment pipelines scheduled for 2025. These developments collectively enlarge the near-term demand pool and underpin the forecast CAGR uplift for the microgrid market.

IT/OT Convergence Spurs Advanced Microgrid Controllers in North America

Advanced controllers now integrate SCADA data, cloud analytics, and AI-driven cybersecurity, allowing assets to self-optimize under changing market signals. Siemens and Microsoft extended their partnership in March 2025, blending PLC data with Azure-based models to shrink unplanned downtime for microgrid operators. Digital twins enable real-time simulation of operating states, accelerating fault detection and dispatch decisions. The White House Energy Modernization Cybersecurity plan anticipates distributed energy resources climbing from 90 GW in 2024 to 380 GW by 2025, heightening the need for secure OT protocols. An AI anomaly-detection framework has reached 96.5% accuracy, sharply reducing response time to cyber threats. These capabilities elevate confidence among utilities and military users, reinforcing the microgrid market growth outlook.

Fragmented Interconnection Codes Impede Market Growth

Project queues in several U.S. Independent System Operators have exceeded five years. The Valencia Gardens storage project in San Francisco was abandoned after unforeseen interconnection costs, illustrating regulatory risk. The Department of Energy urges distribution utilities to build bottom-up load models to ease bottlenecks. European developers also cite divergent standards between member states, increasing engineering overheads. Lack of harmonization discourages investors and slows utility procurement cycles, constraining the microgrid market expansion over the medium term.

Other drivers and restraints analyzed in the detailed report include:

- Modular "Box" Microgrids for Disaster-Recovery in Caribbean Islands

- Utility-Led Programs Redefine Community Energy Resilience

- Lithium-Ion Volatility Forces Storage Diversification Strategies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Grid-connected projects held 62% of the microgrid market share in 2024, equating to USD 10.7 billion of the global microgrid market size. Their appeal stems from tariff arbitrage opportunities and the ability to island during outages. Utility resilience mandates and community programs support a projected 19% CAGR through 2030. Dual-mode architectures now integrate synchrophasor data so systems switch in sub-200 ms, maintaining power-quality standards during wildfires or storms. Though smaller in aggregate value, off-grid microgrids underpin the rural electrification push across Africa and South Asia. World Bank-backed schemes prove that solar-storage hybrids can meet 24/7 demand at competitive rates, expanding the funnel for off-grid EPC contracts and adding depth to the microgrid market.

Off-grid deployments attract concessionary finance from climate funds, allowing longer paybacks and subsidized tariffs. Developers leverage standardized container designs to minimize on-site construction days and improve bankability. Community ownership models also enhance revenue recovery and boost local economic development. As telecom towers and mining operations seek cleaner power, self-sufficient microgrids broaden the microgrid industry footprint beyond pure electrification plays. Over the forecast horizon, connectivity choice will depend on tariff structures, outage statistics, and policy incentives, but mixed portfolios are expected to dominate investor pipelines.

In 2024, hardware generated USD 10.9 billion, representing 63% of the microgrid market size. Controllers, inverters, and battery racks form the physical core. Grid-forming inverters keep systems stable even when renewable penetration exceeds 90% in Nordic pilots. Storage innovation is accelerating as vendors test hybrid battery packs and integrate supercapacitors for fast ramping. Software, although accounting for just 15% of traditional budgets, is growing at 22% CAGR, driven by digital twins and market-participation algorithms. These platforms extend asset life, cut dispatch errors, and unlock ancillary-service revenues, amplifying total microgrid market returns.

Service providers cover site assessment, permitting, EPC, and operations. Growing complexity, particularly in multi-vendor environments, raises demand for specialized integrators who guarantee system-level cybersecurity and service-level agreements. Consultancy practices are expanding into performance assurance, leveraging machine-learning models that predict degradation rates. As customers prioritize outcome-based contracts, microgrid-as-a-service offerings bundle hardware, software, and operations into a single subscription fee, lowering the entry barriers for small commercial clients.

The Microgrid Market Report is Segmented by Connectivity (Grid-Connected and Off-Grid), Offering (Hardware, Software, and Services), Power Sources (Solar Photovoltaic, Combined Heat and Power, Fuel Cell, and More), Type (AC Microgrids, DC Microgrids, and Others), Power Rating (Below 1 MW, 1 To 5 MW, and Others), End-User (Utilities, Commercial and Industrial, and Residential) and Geography (North America, Asia-Pacific, and Others).

Geography Analysis

North America generated 38% of 2024 revenue, supported by USD 10.5 billion in Department of Energy Grid Resilience and Innovation Partnerships funding that targets extreme-weather mitigation.The Department of Defense allocated USD 548 million for energy-resilience upgrades at bases, channeling procurement toward hybrid microgrids. Cybersecurity remains a regional focus; a layered AI-based framework recorded 96.5% threat-detection accuracy, reinforcing trust in critical-facility deployments. Collectively, these programs solidify North America's leadership in the microgrid market.

Asia-Pacific is forecast to expand at a 24% CAGR to 2030, propelled by rural electrification and urban congestion relief. India's PM-KUSUM scheme underwrites agricultural solar pumps that interface with community microgrids, although subsidy claw-backs pose short-term risk. A Bangladeshi pilot combining PV, wind, and batteries achieved an energy cost below USD 0.07/kWh, demonstrating economic viability even without grid extension. China is scaling industrial park microgrids that integrate hydrogen storage, while Japan refines neighborhood-scale systems for seismic resilience. These diverse initiatives enlarge the regional microgrid market faster than any other geography.

Europe concentrates on high-renewables penetration and grid-forming technology. A Finnish 35 MW battery system supplied by Fluence supports 100% renewable operation during islanding trials. The European Court of Auditors states that reaching net-zero will demand EUR 1.9-2.3 trillion in grid investments by 2050, part of which will fund microgrids to relieve congestion and balance supply. South America and the Middle East & Africa are smaller today but show escalating activity, highlighted by the Congo's largest mini-grid rollout that will serve 28,000 connections. These projects underscore the global diffusion of microgrids into regions previously reliant on diesel generation, enriching the overall microgrid market landscape.

- ABB Ltd

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Hitachi Energy Ltd

- Eaton Corporation PLC

- Honeywell International Inc.

- Toshiba Corporation

- S&C Electric Company

- ENGIE EPS SA

- Standard Microgrid Inc.

- PowerSecure Inc.

- Bloom Energy Corporation

- Caterpillar Inc.

- Wartsila Corporation

- Rolls-Royce Power Systems AG (MTU)

- Ameresco Inc.

- Tesla Inc.

- Enphase Energy Inc.

- Heila Technologies

- Spirae LLC

- Xendee Corporation

- HOMER Energy LLC

- AutoGrid Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Rural Electrification in Africa & South Asia

- 4.2.2 IT/OT Convergence Spurs Advanced Microgrid Controllers in North America

- 4.2.3 Modular "Box" Microgrids for Disaster-Recovery in Caribbean Islands

- 4.2.4 Utility-led Community Resilience Programs in U.S. & Australia

- 4.2.5 Grid-Forming Inverters Enabling 90%+ Renewables in Nordic Markets

- 4.2.6 Defense-Funded Net-Zero Bases Driving Hybrid Microgrids (NATO & INDOPACOM)

- 4.3 Market Restraints

- 4.3.1 Fragmented Codes Stalling Inter-connection Approvals in U.S. States

- 4.3.2 Subsidy Claw-Back Risk in India's PM-KUSUM Programme

- 4.3.3 Lithium-ion Price Volatility Disrupting CAPEX Planning 2024-25

- 4.3.4 Limited Cyber-security Standards for Multi-Vendor Projects

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook (Targets, Policies)

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Connectivity

- 5.1.1 Grid-Connected Microgrids

- 5.1.2 Off-Grid/Islanded Microgrids

- 5.2 By Offering

- 5.2.1 Hardware (Power Generators, Energy-Storage Systems, Power Converters & Inverters, and Controllers)

- 5.2.2 Software (Energy Management Platforms, and Microgrid Controllers)

- 5.2.3 Services (Engineering, Procurement & Construction (EPC), Operations & Maintenance (O&M), and Consulting & Advisory)

- 5.3 By Power Source

- 5.3.1 Solar Photovoltaic (PV)

- 5.3.2 Combined Heat and Power (Natural Gas)

- 5.3.3 Diesel Generators

- 5.3.4 Wind

- 5.3.5 Fuel Cells

- 5.3.6 Others (Biomass, Hydro)

- 5.4 By Type

- 5.4.1 AC Microgrids

- 5.4.2 DC Microgrids

- 5.4.3 Hybrid AC/DC Microgrids

- 5.5 By Power Rating

- 5.5.1 Below 1 MW

- 5.5.2 1 to 5 MW

- 5.5.3 5 to 10 MW

- 5.5.4 Above 10 MW

- 5.6 By End-User

- 5.6.1 Utilities

- 5.6.2 Commercial and Industrial

- 5.6.3 Residential

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 United Kingdom

- 5.7.2.2 Germany

- 5.7.2.3 France

- 5.7.2.4 Spain

- 5.7.2.5 Nordic Countries

- 5.7.2.6 Russia

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 South Korea

- 5.7.3.5 ASEAN Countries

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Colombia

- 5.7.4.4 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 United Arab Emirates

- 5.7.5.2 Saudi Arabia

- 5.7.5.3 South Africa

- 5.7.5.4 Egypt

- 5.7.5.5 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 ABB Ltd

- 6.4.2 Siemens AG

- 6.4.3 Schneider Electric SE

- 6.4.4 General Electric Company

- 6.4.5 Hitachi Energy Ltd

- 6.4.6 Eaton Corporation PLC

- 6.4.7 Honeywell International Inc.

- 6.4.8 Toshiba Corporation

- 6.4.9 S&C Electric Company

- 6.4.10 ENGIE EPS SA

- 6.4.11 Standard Microgrid Inc.

- 6.4.12 PowerSecure Inc.

- 6.4.13 Bloom Energy Corporation

- 6.4.14 Caterpillar Inc.

- 6.4.15 Wartsila Corporation

- 6.4.16 Rolls-Royce Power Systems AG (MTU)

- 6.4.17 Ameresco Inc.

- 6.4.18 Tesla Inc.

- 6.4.19 Enphase Energy Inc.

- 6.4.20 Heila Technologies

- 6.4.21 Spirae LLC

- 6.4.22 Xendee Corporation

- 6.4.23 HOMER Energy LLC

- 6.4.24 AutoGrid Systems

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment