PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844462

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844462

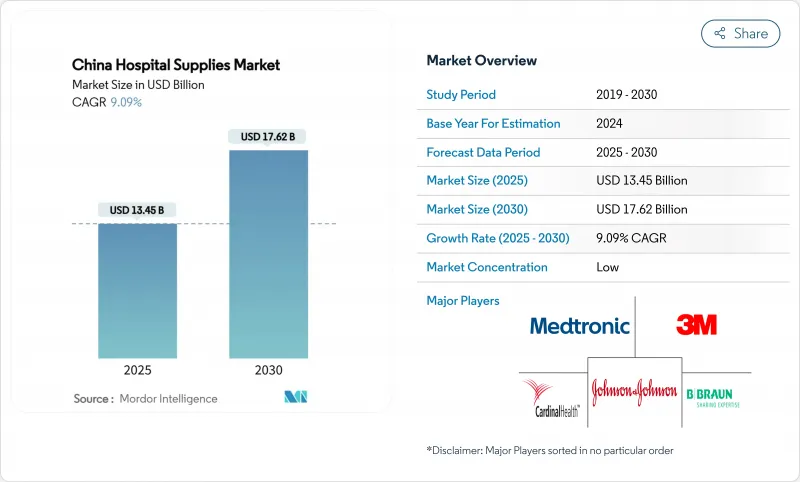

China Hospital Supplies - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The China Hospital Supplies Market size is estimated at USD 13.45 billion in 2025, and is expected to reach USD 17.62 billion by 2030, at a CAGR of 9.09% during the forecast period (2025-2030).

Expansion of hospital infrastructure, intensified infection-control protocols, and localization policies that prioritize domestic manufacturers are collectively shaping demand patterns. Disposable supplies continue to dominate procurement lists because single-use items minimize infection risk and streamline workflows, while sterilization solutions draw heightened interest as hospitals tackle hospital-acquired infection rates. Centralized purchasing mechanisms have increased volume predictability but have also intensified price competition, prompting suppliers to balance cost efficiencies with quality assurances. These factors are converging to redistribute competitive advantage toward local firms that can meet tender price caps without sacrificing regulatory compliance.

China Hospital Supplies Market Trends and Insights

Expansion of National Healthcare Infrastructure & Capacity Upgrades

China reported 39,000 hospitals and 10.37 million hospital beds in 2024, indicating the broadest capacity expansion in the country's history. New and renovated facilities in tier-2 and tier-3 cities require comprehensive clinical inventories ranging from basic disposables to advanced diagnostic systems. Government grants tied to regional medical-center programs compel hospital administrators to acquire standardized, high-quality supplies that align with national tender lists. Bed growth also stimulates stable procurement for patient-care items such as infusion sets, wound dressings, and catheters. Local manufacturers that can guarantee rapid fulfillment and competitive pricing are well positioned to capture incremental orders as construction projects reach completion.

Rising Burden of Chronic Diseases and Aging Population Boosting Procedure Volumes

Older adults already account for 66.3% of chronic-disease cases, and 33.7% experience multimorbidity, placing sustained pressure on acute-care wards. Procedure volumes for cardiology, oncology, and dialysis services are rising, creating downstream demand for consumables ranging from surgical drapes to implantable devices. Hospitals must also stock higher quantities of monitoring equipment to manage chronic comorbidities during inpatient stays. The financial stress associated with average out-of-pocket hospitalization costs of USD 1,199.24 has led purchasing managers to favor cost-efficient, domestically produced items over imported equivalents.

Regulatory Tightening & Lengthy NMPA Approvals Slowing New-Product Launches

The draft Medical Device Administration Law expands post-market surveillance and increases penalties for non-compliance. While domestic innovators benefit from fast-track pathways, multinational firms face longer review cycles and additional documental requirements, delaying commercial timelines. Hospitals therefore postpone the adoption of new imported devices, sustaining reliance on existing SKUs. The new legal framework also obliges manufacturers to increase investment in real-world evidence to support renewal applications, boosting compliance costs. Despite the constraints, companies that complete localized clinical evaluations may eventually secure preferential slots in provincial value-based purchasing initiatives.

Other drivers and restraints analyzed in the detailed report include:

- Government Spending Growth through "Healthy China 2030" Initiatives

- Infection Control Awareness Post-COVID

- Emergence of Home Care Services

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Disposable hospital supplies claimed 38.45% of China hospital supplies market share in 2024 and continue to experience steady volume growth because single-use items reduce cross-contamination risk and simplify waste-management protocols. The China hospital supplies market size for disposable syringes, gloves, and surgical drapes is projected to expand in tandem with rising procedure counts among elderly and chronic-disease cohorts. Imported brands still dominate premium catheter categories, but local firms increasingly supply commoditized disposables at price points that meet provincial tender caps. Technological upgrades such as RFID-tagged surgical packs support more precise traceability, aligning with new regulatory reporting obligations.

Sterilization & disinfection equipment is poised to register the fastest 9.54% CAGR over 2025-2030, driven by hospital-acquired infection targets and upgrades to central sterile services departments. Urban hospitals are replacing aging ethylene-oxide systems with low-temperature hydrogen-peroxide plasma units that reduce cycle times and improve occupational safety. The China hospital supplies market size for automated washer-disinfectors is expanding as tertiary hospitals move toward full ISO 13485 compliance. Domestic manufacturers have moved up the value chain with competitively priced, locally serviced sterilizers that incorporate IoT dashboards, thereby eroding the historic premium enjoyed by multinational suppliers.

The China Hospital Supplies Market Report is Segmented by Product Type (Patient Examination Devices, Operating Room Equipment, Mobility Aids and Transportation Equipment, Sterilisation and Disinfectant Equipment, Disposable Hospital Supplies, and Other Product Types), End User (Public Hospitals, Private Hospital, Specialty and Rehabilitation Centers). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- 3M

- B. Braun

- Baxter

- Beckton Dickinson

- Boston Scientific

- Cardinal Health

- Medtronic

- Johnson & Johnson

- Terumo

- Smiths Group

- Stryker

- Mindray Bio-Medical Electronics Co. Ltd.

- Shandong Weigao Group Medical Polymer Co. Ltd.

- Jiangsu Yuyue Medical Equipment & Supply Co. Ltd.

- Shinva Medical Instrument

- Lepu Medical Technology (Beijing) Co. Ltd.

- Kindly Medical Instruments Co. Ltd.

- Zhende Medical Co. Ltd.

- Henan Tuoren Medical Device Co. Ltd.

- Shanghai Kinetic Medical Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Expansion of National Healthcare Infrastructure & Capacity Upgrades

- 4.1.2 Rising Burden of Chronic Diseases and Aging Population Boosting Procedure Volumes

- 4.1.3 Government Spending Growth through "Healthy China 2030" Initiatives

- 4.1.4 Infection Control Awareness Post-COVID

- 4.1.5 Growth in Public Hospital Procurement

- 4.1.6 Digital Healthcare & Smart Hospital Adoption

- 4.2 Market Restraints

- 4.2.1 Regulatory Tightening & Lengthy NMPA Approvals Slowing New-Product Launches

- 4.2.2 Emergence of Home Care Services

- 4.2.3 Counterfeit Products & Quality Variability

- 4.2.4 Urban-Rural Healthcare Disparities

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Patient Examination Devices

- 5.1.2 Operating Room Equipment

- 5.1.3 Mobility Aids & Transportation Equipment

- 5.1.4 Sterilisation & Disinfectant Equipment

- 5.1.5 Disposable Hospital Supplies

- 5.1.6 Other Product Types

- 5.2 By End User

- 5.2.1 Public Hospital

- 5.2.2 Private Hospital

- 5.2.3 Specialty & Rehabilitation Centers

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 3M

- 6.3.2 B. Braun Melsungen AG

- 6.3.3 Baxter International Inc.

- 6.3.4 Becton, Dickinson and Company

- 6.3.5 Boston Scientific Corporation

- 6.3.6 Cardinal Health Inc.

- 6.3.7 Medtronic

- 6.3.8 Johnson & Johnson

- 6.3.9 Terumo Corporation

- 6.3.10 Smith & Nephew PLC

- 6.3.11 Stryker Corporation

- 6.3.12 Mindray Bio-Medical Electronics Co. Ltd.

- 6.3.13 Shandong Weigao Group Medical Polymer Co. Ltd.

- 6.3.14 Jiangsu Yuyue Medical Equipment & Supply Co. Ltd.

- 6.3.15 Shinva Medical Instrument Co. Ltd.

- 6.3.16 Lepu Medical Technology (Beijing) Co. Ltd.

- 6.3.17 Kindly Medical Instruments Co. Ltd.

- 6.3.18 Zhende Medical Co. Ltd.

- 6.3.19 Henan Tuoren Medical Device Co. Ltd.

- 6.3.20 Shanghai Kinetic Medical Co. Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment