PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844515

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844515

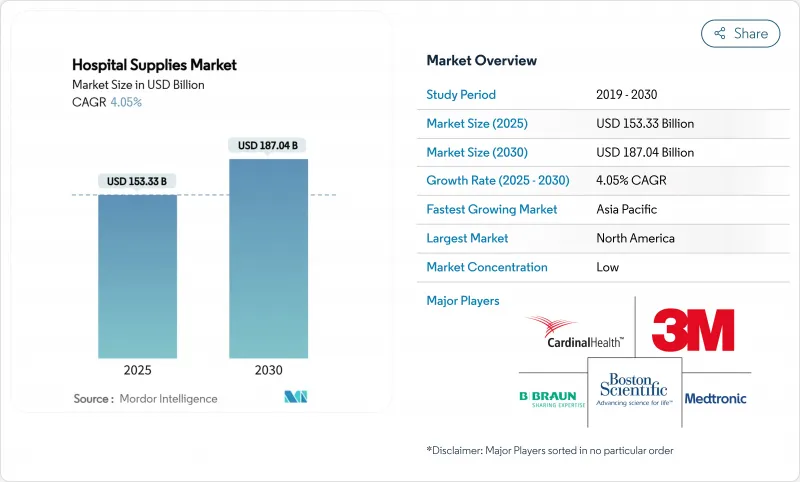

Hospital Supplies - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Hospital Supplies Market size is estimated at USD 153.33 billion in 2025, and is expected to reach USD 187.04 billion by 2030, at a CAGR of 4.05% during the forecast period (2025-2030).

This trajectory is supported by infection-control investments, technology-enabled inventory systems, and accelerating demand from developing regions. Disposable products, sterile processing equipment, and digital supply-chain solutions remain central to procurement decisions, while sustainability mandates are beginning to influence product selection. Asia-Pacific's rapid infrastructure build-out, coupled with post-pandemic surgery backlogs in developed nations, is reshaping global competitive dynamics. Suppliers that combine physical goods with analytics-driven efficiency tools are capturing share as hospitals seek to align clinical performance, cost control, and regulatory compliance within tighter budget cycles.

Global Hospital Supplies Market Trends and Insights

Increasing Incidences of Communicable and Chronic Diseases

Rising diabetes, cardiovascular, and respiratory case loads are forcing hospitals to re-think inventory plans to assure continuous availability of wound-care dressings, monitoring kits, and ventilation circuits. Diabetes alone affects 537 million adults and is projected to reach 783 million by 2045, pushing up specialized dressing use by 30% since 2024. Health systems now pair electronic health-record data with predictive stocking algorithms, enabling tighter alignment between anticipated caseloads and replenishment cycles. This patient-centric approach is steering capital allocations toward versatile sterile supplies, driving the hospital supplies market forward in both mature and emerging economies.

Growing Public Awareness about Hospital-Acquired Infections

Consumers increasingly select facilities based on perceived infection-control performance. Each HAI adds USD 28,400-33,800 in treatment costs, prompting administrators to adopt antimicrobial materials for high-touch surfaces and to publicize compliance metrics. The Centers for Disease Control and Prevention notes that 1 in 31 hospitalized patients contracts an HAI on any given day, spurring hospital supplies market investment into single-use drapes, barrier gowns, and self-disinfecting device casings. Suppliers offering verifiable sterility assurance and product traceability gain a competitive advantage.

Stringent Regulatory Framework

Efforts to curb ethylene-oxide emissions threaten the sterility pathways for roughly 20 billion medical devices annually. The FDA warned that abrupt closures of sterilization plants could disrupt care continuity, illustrating how environmental policy can ripple through hospital supplies market logistics. Firms now investigate alternative sterilants and invest in redundant capacity, adding cost and complexity to already tight production schedules.

Other drivers and restraints analyzed in the detailed report include:

- High Demand for Hospital Supplies in Developing Countries

- Hospital-Acquired Infection Penalties Catalyzing Investment in Sterilization Equipment

- Emergence of Home Care Services

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Disposable supplies retained a 47.21% hospital supplies market share in 2024, underscoring their role in combating cross-contamination. Bundled procedure packs and single-use gowns streamline operating-room turnover and reduce labor spent on laundering. However, sustainability policies have sparked pilot projects in selective re-processing and recyclable polymers, pressuring vendors to declare lifecycle emissions. Sterilization and disinfectant equipment, while only a mid-sized segment, is growing fastest at a 10.63% CAGR to 2030. The hospital supplies market size for sterilization equipment is forecast to climb in tandem with digital record-keeping mandates that tie device release to documented microbial kill parameters. Suppliers that bundle cloud-based validation software with low-temperature sterilizers see traction in tier-1 hospital systems.

Patient examination devices and operating-room equipment are integrating sensor arrays and IoT gateways. Smart stethoscopes, computer-assisted navigation, and AI-driven intraoperative imaging drive premium pricing tiers, with procurement decisions increasingly influenced by interoperability scores. Mobility aids and transportation equipment ride demographic trends as aging populations demand pressure-reducing mattresses, electric hoists, and bariatric wheelchairs. Sustainability credentials, spare-parts availability, and cloud-ready diagnostics are now weighted alongside upfront price when frameworks evaluate bids.

The Hospital Supplies Market Report is Segmented by Product (Patient Examination Devices, Operating Room Equipment, Mobility Aids and Transportation Equipment, and More), End User (Public Hospitals, Private & Chain Hospitals, and More), Sterility (Sterile Supplies, Non-Sterile Supplies), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's advanced infrastructure and strict infection-control mandates secured 34.34% share of global revenue in 2024. Large-scale adoption of RFID-enabled smart cabinets and AI-assisted demand-planning systems underpins supplier opportunities for analytics-rich value propositions. Tariff uncertainties threatened price stability, prompting distributors like Cardinal Health to consider pass-through mechanisms that could influence hospital supplies market elasticity in 2026.

Asia-Pacific delivers the strongest growth at an 8.29% CAGR, driven by healthcare capacity expansion in China, India, and Southeast Asia. Rapid investment in tertiary hospitals, coupled with government incentives for local manufacturing, shifts component sourcing closer to end-markets. The hospital supplies market size for sterilization consumables is rising briskly as accreditation bodies adopt Western infection-control benchmarks. Medical tourism growth in Thailand and Malaysia further widens procurement pipelines for high-quality but cost-competitive disposables.

Europe maintains a technology-oriented stance, with sustainability mandates encouraging suppliers to validate carbon footprints and integrate recycled polymers. Germany leads by volume, while Switzerland's high-tech niche manufactures propel segment innovation. Regulatory clarity around the Medical Device Regulation (MDR) encourages early-adopter hospitals to pilot smart labeling and tamper-evident packaging, sustaining premium price points in a mature hospital supplies market.

The Middle East and Africa witness marked divergence. Gulf Cooperation Council nations invest in flagship hospitals that demand state-of-the-art sterilization suites and automated inventory systems. Meanwhile, the International Finance Corporation's Africa Medical Equipment Facility funds small providers, creating distributed demand for essential devices across East and West Africa. Suppliers that bundle training, maintenance, and micro-leasing schemes gain traction in these price-sensitive yet volume-rich niches.

- 3M

- B. Braun

- Baxter

- Beckton Dickinson

- Boston Scientific

- Cardinal Health

- Medtronic

- GE HealthCare Technologies Inc.

- Johnson & Johnson

- Thermo Fisher Scientific

- Danaher

- Eurofins

- STERIS

- Getinge

- Smith+Nephew Plc

- Stryker

- Terumo

- Ecolab

- HARTMANN Group

- Nipro

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Incidences of Communicable and Chronic Diseases

- 4.2.2 Growing Public Awareness about Hospital Acquired Infections

- 4.2.3 High Demand for Hospital Supplies in Developing Countries

- 4.2.4 Hospital-Acquired Infection Penalties Catalyzing Investment in Sterilization Equipment

- 4.2.5 Surge in Surgical Volume Post-Pandemic in Developed Countries

- 4.2.6 Government Initiatives and Healthcare Spending

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Framework

- 4.3.2 Emergence of Home Care Services

- 4.3.3 High Costs of Advanced Equipment

- 4.3.4 Supply Chain Disruptions

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Patient Examination Devices

- 5.1.2 Operating Room Equipment

- 5.1.3 Mobility Aids & Transportation Equipment

- 5.1.4 Sterilization & Disinfectant Equipment

- 5.1.5 Disposable Hospital Supplies

- 5.1.6 Syringes & Needles

- 5.1.7 Smart RFID-Enabled Consumables

- 5.1.8 Other Products

- 5.2 By End User

- 5.2.1 Public Hospitals

- 5.2.2 Private & Chain Hospitals

- 5.2.3 Ambulatory Surgical Centers

- 5.2.4 Specialty Clinics & Trauma Centers

- 5.3 By Sterility

- 5.3.1 Sterile Supplies

- 5.3.2 Non-Sterile Supplies

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 3M

- 6.3.2 B. Braun Melsungen AG

- 6.3.3 Baxter International Inc.

- 6.3.4 Becton, Dickinson and Company

- 6.3.5 Boston Scientific Corporation

- 6.3.6 Cardinal Health Inc.

- 6.3.7 Medtronic

- 6.3.8 GE HealthCare Technologies Inc.

- 6.3.9 Johnson & Johnson

- 6.3.10 Thermo Fisher Scientific Inc.

- 6.3.11 Danaher Corporation

- 6.3.12 Eurofins Scientific

- 6.3.13 STERIS plc

- 6.3.14 Getinge AB

- 6.3.15 Smith+Nephew Plc

- 6.3.16 Stryker Corporation

- 6.3.17 Terumo Corporation

- 6.3.18 Ecolab Inc.

- 6.3.19 HARTMANN Group

- 6.3.20 Nipro Corporation

7 Market Opportunities & Future Outlook