PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844470

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844470

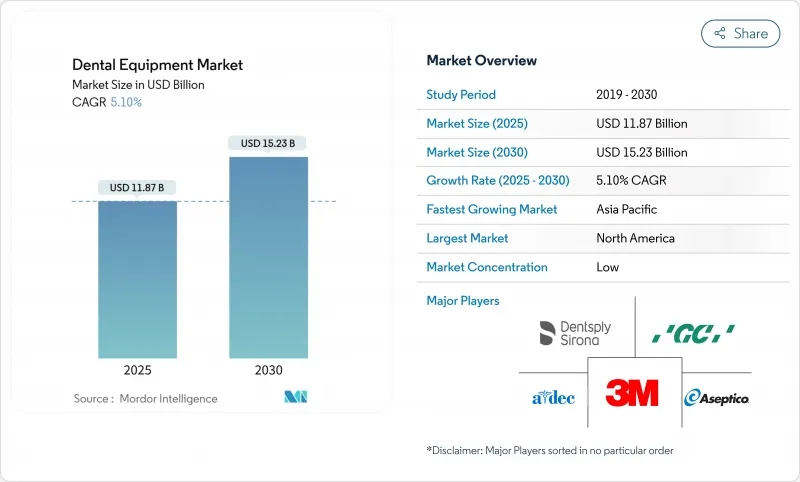

Dental Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The dental devices market stands at USD 11.87 billion in 2025 and is set to reach USD 15.23 billion by 2030, expanding at a 5.10% CAGR.

Adoption of digital imaging, artificial intelligence, and chairside manufacturing is shortening procedure times, improving diagnostic accuracy, and lifting patient acceptance rates. Demand is further supported by rising incidences of dental caries and periodontal disease, steady growth in elective cosmetic procedures, and a strong pipeline of restorative materials that pair high strength with natural aesthetics. Consolidation among large manufacturers is creating scale advantages in research, procurement, and global distribution, while new entrants concentrate on narrow specialties such as AI-based image analytics, robotic surgery aids, and bioceramic implants. Asia-Pacific clinics, buoyed by dental tourism and government incentives for digital radiography, are reshaping the competitive balance by purchasing advanced systems in bulk and offering cost-effective care. At the same time, stricter infection-control rules continue to drive recurring investments in sterilization equipment, instrument tracking, and autoclave upgrades.

Global Dental Equipment Market Trends and Insights

Rising prevalence of dental caries and periodontal disease

Global epidemiological studies show continuing growth in untreated decay and gum infection, particularly among aging adults and children in emerging economies. The resulting clinical workload sustains demand for basic restorative items, endodontic files, and periodontal instruments. National oral-health campaigns in India and Indonesia are bringing more first-time patients into clinics, expanding routine prophylaxis volumes and boosting sales of prophylaxis pastes and sealants.

AI-enabled imaging and diagnostics accelerating equipment upgrades

AI algorithms integrated into cone-beam CT and intraoral imaging platforms flag minute lesions, quantify bone levels, and auto-generate treatment plans that dentists can share chairside. Early adopters report 10-20% growth in case acceptance when AI visuals accompany explanations, sparking an upgrade cycle across mid-size practices. Overjet's regulatory-cleared software now processes millions of radiographs per month, signalling rapid normalization of AI diagnostics.

Limited insurance reimbursement for laser-assisted treatments

Insurers often classify laser gum surgery and caries ablation as elective, shifting costs to patients and slowing adoption despite shorter healing times and improved clinical outcomes. Manufacturers respond with hybrid devices that allow dentists to toggle between conventional and laser modes to remain within coverage limits.

Other drivers and restraints analyzed in the detailed report include:

- Dental tourism prompting clinic expansion and device spending

- Government incentives for digital radiography

- Shortage of technicians skilled in complex CAD/CAM workflows

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dental consumables captured 43.54% of the dental devices market in 2024 thanks to their recurring use in every clinical visit. Steady demand for impression materials, composites, burs, and anesthetics shields this segment from macro-economic cycles. Bioceramic implants and bio-active restoratives are gaining traction as ageing populations seek durable, naturally coloured options. Conversely, equipment sales, while smaller in absolute value, are rising faster. Diagnostic scanners, digital radiography panels, chairside mills, and diode lasers together are projected to grow at a 6.23% CAGR through 2030, fuelled by AI software updates and subscription models that smooth cash flows for clinics. Bundled service contracts and cloud licences increasingly define revenue for manufacturers, signalling a pivot from hardware outright sales to lifetime value. The dental devices market size for high-value equipment is therefore widening faster than historic averages, offering suppliers diversified growth beyond consumables.

The Dental Equipment Market Report Segments the Industry Into by Product (Operatory and Treatment Center Equipment, Dental Laboratory Equipment, Dental Lasers, Diagnostic Dental Equipment), by Treatment (Orthodontic, Endodontic, Peridontic, Prosthodontic), by End User (Hospitals, Clinics, Other End Users), and Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, South America).

Geography Analysis

North America remains the largest contributor to dental devices revenue due to high per-capita expenditure, insurance penetration, and widespread adoption of AI imaging and CAD/CAM fabrication. U.S. insurers reimburse intraoral scans for aligner case submission, reinforcing digital uptake. Workforce shortages and rising labour costs, however, encourage practices to automate documentation and sterilisation, raising demand for integrated software suites.

Europe ranks second, with Germany, France, and the United Kingdom leading purchases of premium implant systems and low-dose CBCT units. Sustainability regulations accelerate replacement of mercury-based amalgam separators and single-use plastics, pushing clinics toward eco-designed tools. EU conformity updates under the Medical Device Regulation have lengthened certification lead times, favouring established suppliers that possess the resources to comply.

Asia-Pacific is the fastest-growing region. Japan's public insurance now reimburses select CAD/CAM crowns, lifting scanner installations, while South Korean clinics advertise fully digital smile design to regional tourists. India's urban centres witness rapid expansion of mid-market chains offering clear aligner packages priced for the rising middle class. China continues to invest in domestic 3-D printer brands and zirconia block manufacturing, aiming to reduce import dependency. Overall, the dental devices market size in Asia-Pacific is expected to double across the decade, driven by both volume and technology mix upgrades.

- Dentsply Sirona

- Envista

- Straumann Group AG

- Align Technology

- Planmeca

- 3M Company (3M ESPE)

- Henry Schein

- Ivoclar Vivadent

- A-dec

- GC Corporation

- BIOLASE Inc.

- Carestream Dental

- Hu-Friedy Mfg. Co. LLC (Cantel Medical)

- VATECH Co. Ltd.

- Acteon Group

- Coltene Holding

- Midmark

- Septodont

- MORITA Corporation

- Shofu Inc.

- FONA Dental s.r.o.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of dental caries & periodontal diseases

- 4.2.2 Integration of AI-driven imaging & diagnostics accelerating equipment upgrades

- 4.2.3 Growing dental tourism driving clinic expansion & equipment investments

- 4.2.4 Government incentives for digital radiography in Japan & South Korea

- 4.2.5 Emergence of chairside 3-D printing cutting prosthetic turnaround times

- 4.2.6 Reusable-instrument sterilization demand amid stricter infection-control rules

- 4.3 Market Restraints

- 4.3.1 Reimbursement gaps for laser-assisted treatments

- 4.3.2 Shortage of skilled technicians for advanced CAD/CAM workflows

- 4.3.3 High upfront cost of incorporating AI imaging into small clinics

- 4.3.4 Supply-chain fragility in zirconia & titanium for implant production

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product

- 5.1.1 Diagnostics Equipment

- 5.1.1.1 Dental Laser

- 5.1.1.1.1 Soft Tissue Lasers

- 5.1.1.1.2 Hard Tissue Lasers

- 5.1.1.2 Radiology Equipment

- 5.1.1.2.1 Extra-oral Radiology Equipment

- 5.1.1.2.2 Intra-oral Radiology Equipment

- 5.1.1.3 Dental Chair & Equipment

- 5.1.2 Therapeutic Equipment

- 5.1.2.1 Dental Hand Pieces

- 5.1.2.2 Electrosurgical Systems

- 5.1.2.3 CAD/CAM Systems

- 5.1.2.4 Milling Equipment

- 5.1.2.5 Casting Machine

- 5.1.2.6 Other Therapeutic Equipments

- 5.1.3 Dental Consumables

- 5.1.3.1 Dental Biomaterial

- 5.1.3.2 Dental Implants

- 5.1.3.3 Crowns & Bridges

- 5.1.3.4 Other Dental Consumables

- 5.1.4 Other Dental Devices

- 5.1.1 Diagnostics Equipment

- 5.2 By Treatment

- 5.2.1 Orthodontic

- 5.2.2 Endodontic

- 5.2.3 Periodontic

- 5.2.4 Prosthodontic

- 5.3 By End User

- 5.3.1 Dental Hospitals

- 5.3.2 Dental Clinics

- 5.3.3 Academic & Research Institutes

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Dentsply Sirona Inc.

- 6.3.2 Envista Holdings Corporation

- 6.3.3 Straumann Group AG

- 6.3.4 Align Technology Inc.

- 6.3.5 Planmeca Oy

- 6.3.6 3M Company (3M ESPE)

- 6.3.7 Henry Schein Inc.

- 6.3.8 Ivoclar Vivadent AG

- 6.3.9 A-dec Inc.

- 6.3.10 GC Corporation

- 6.3.11 BIOLASE Inc.

- 6.3.12 Carestream Dental LLC

- 6.3.13 Hu-Friedy Mfg. Co. LLC (Cantel Medical)

- 6.3.14 VATECH Co. Ltd.

- 6.3.15 ACTEON Group

- 6.3.16 Coltene Holding AG

- 6.3.17 Midmark Corporation

- 6.3.18 Septodont Holding

- 6.3.19 MORITA Corporation

- 6.3.20 Shofu Inc.

- 6.3.21 FONA Dental s.r.o.

7 Market Opportunities & Future Outlook