PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844473

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844473

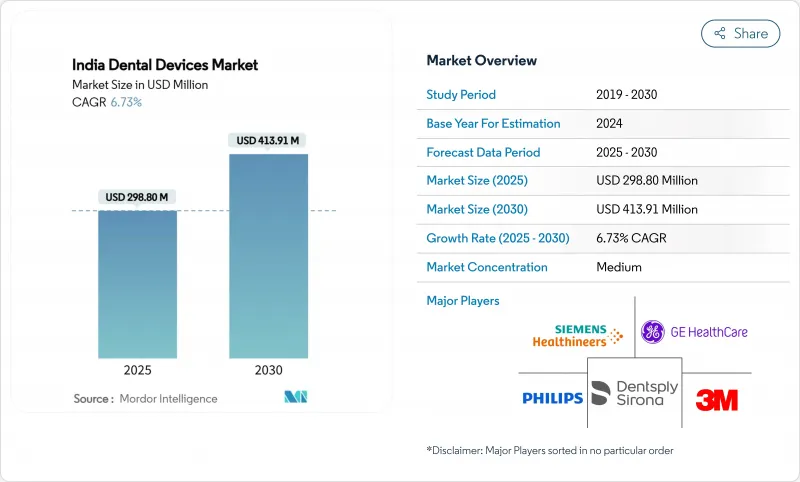

India Dental Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India dental devices market size is valued at USD 298.80 million in 2025 and is forecast to reach USD 413.91 million by 2030, expanding at a 6.73% CAGR.

Continued growth reflects rising oral-health awareness, strengthening disposable incomes and an improving care-delivery infrastructure that extends from metropolitan hubs to semi-urban clusters. The India dental devices market is also benefiting from the government's Production-Linked Incentive scheme, which is spurring domestic manufacturing capacity and lowering import dependence. Rapid adoption of digital workflows-particularly CAD/CAM milling, intra-oral scanning and 3-D printing-reinforces demand for precision equipment and premium consumables, while expanded social-media influence is lifting aesthetic procedures among urban millennials. Dental-tourism inflows into Goa and Karnataka are adding high-value procedure volumes, although inconsistent GST classification and a shortage of certified dental technicians still inhibit optimal growth trajectories for the India dental devices market.

India Dental Devices Market Trends and Insights

Government-led National Oral Health Programme Raising Preventive Visits

The National Oral Health Programme has undertaken 32.80 crore oral-cancer screenings under Ayushman Bharat, reinforcing routine preventive check-ups across 1,75,338 Ayushman Arogya Mandirs nationwide. This scale-up is fostering sustained demand for portable diagnostic devices that match rural deployment needs while remaining cost-efficient for public procurements. Standardized electronic health-record protocols within the Ayushman Bharat Digital Mission further stimulate adoption of digital imaging and chairside documentation systems, helping manufacturers of integrated equipment platforms secure multi-year procurement contracts. Although infrastructure gaps linger in remote districts, the momentum of state-wise roll-outs is expected to permeate smaller practices, thereby broadening the India dental devices market over the medium term.

Urban Millennials' Cosmetic Dentistry Boom Fueled by Social Media

Urban millennials increasingly view dental care as an element of personal branding, accelerating elective procedures such as clear-aligner therapy and digital smile-design workflows. A recent cross-sectional study reported significantly higher awareness (41.22) and perception (42.18) scores for aligners among dental students compared with medical and paramedical peers, underscoring the readiness of future practitioners to champion aesthetic solutions. For manufacturers, this trend translates into brisk sales of high-translucency ceramic brackets, customized aligner workflows and chairside milling units that enable same-day veneers. Intensified social-media advertising, however, places pressure on clinics to consistently meet appearance-oriented expectations, making quality differentiation through advanced imaging and precise restorative materials critical to retaining clientele within the India dental devices market.

Inconsistent GST Classification Raising Compliance Costs

Variable GST slabs and inverted-duty structures complicate supply-chain planning, especially for small and mid-sized manufacturers that frequently straddle multiple product codes. A recent Standing Committee report highlighted how inverted duties inflate working-capital needs and hamper competitiveness for locally-made handpieces and impression materials. For distributors, inconsistent input-tax credits slow inventory turnover, raising channel margins and ultimately equipment prices. The dental-trade associations continue lobbying for slab rationalization, but until harmonization materializes, compliance overheads are expected to temper profitability across the India dental devices market.

Other drivers and restraints analyzed in the detailed report include:

- Ayushman Bharat & Private Dental Insurance Expanding Affordability

- Dental-Tourism Hot-Spots in Goa & Karnataka Driving High-Value Procedures

- Shortfall of Formally-Trained Dental Technicians

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dental consumables retained a 68.53% revenue share in 2024, driven by their recurrent usage pattern across routine and specialized cases. Equipment, however, is expected to climb at a 13.23% CAGR to 2030, the fastest pace within the India dental devices market. The shift stems from widespread deployment of chairside CAD/CAM mills, whose local assembly costs have fallen nearly 25% since domestic component sourcing under the PLI scheme began. The India dental devices market size for digital scanners reached USD 0.11 billion in 2024 and is projected to exceed USD 0.24 billion by 2030 as clinics pursue impression-free workflows. Innovative consumables such as bioactive restorative materials and nano-hydroxyapatite-enhanced composites are supporting value growth even as unit prices remain competitive.

Parallel advances within therapeutic equipment include electrosurgery units and sonic irrigation systems that quicken soft-tissue management, although penetration remains limited to multi-chair practices in metropolitan areas. Diagnostic gear, particularly panoramic and CBCT systems, is recording double-digit adoption as government screening initiatives and dental-tourism requirements emphasize radiographic accuracy. Domestic manufacturers have responded by scaling output; Dantech Digital Dental Solutions lifted daily prosthetic-manufacturing capacity from 200 to 1,000 units in 2025, demonstrating the maturation of India-based production ecosystems.

The India Dental Devices Market Report Segments the Industry Into by Product (General and Diagnostic Equipment, Dental Consumables, Other Dental Devices), by Treatment (Orthodontic, Endodontic, Periodontic, Prosthodontic), by End User (Dental Hospitals and Clinics, Academic and Research Institutions, Other End Users), and Geography. Get Five Years of Historical Data Alongside Five-Year Market Forecasts.

List of Companies Covered in this Report:

- 3M

- Canon

- Carestream Health

- GE Healthcare

- Dentsply Sirona

- Koninklijke Philips

- Danaher

- Osstem

- Siemens Healthineers

- Kavo Dental

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Burden of Oral Diseases and Ageing Population

- 4.2.2 Technological Advancements in Dentistry

- 4.2.3 Growing Demand for Cosmetic Dentistry

- 4.3 Market Restraints

- 4.3.1 Excessive Costs of Treatment

- 4.3.2 Lack of Awareness Regarding Oral Health

- 4.4 Porters' Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Product

- 5.1.1 General and Diagnostic Equipment

- 5.1.1.1 Dental Lasers

- 5.1.1.1.1 Soft Tissue Dental Lasers

- 5.1.1.1.2 Hard Tissue Dental Lasers

- 5.1.1.2 Radiology Equipment

- 5.1.1.3 Dental Chair and Equipment

- 5.1.1.4 Other General and Diagnostic Equipment

- 5.1.2 Dental Consumables

- 5.1.2.1 Dental Biomaterial

- 5.1.2.2 Dental Implants

- 5.1.2.3 Crowns and Bridges

- 5.1.2.4 Other Dental Consumables

- 5.1.3 Other Dental Devices

- 5.1.1 General and Diagnostic Equipment

- 5.2 By Treatment

- 5.2.1 Orthodontic

- 5.2.2 Endodontic

- 5.2.3 Periodontic

- 5.2.4 Prosthodontic

- 5.3 By End User

- 5.3.1 Dental Hospitals and Clinics

- 5.3.2 Academic and Research Institutions

- 5.3.3 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 3M

- 6.1.2 Canon

- 6.1.3 Carestream Health

- 6.1.4 GE Healthcare

- 6.1.5 Dentsply Sirona

- 6.1.6 Philips Healthcare

- 6.1.7 Danaher Corporation

- 6.1.8 Osstem

- 6.1.9 Siemens Healthineers

- 6.1.10 Kavo Dental

7 MARKET OPPORTUNITIES AND FUTURE TRENDS