PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844491

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844491

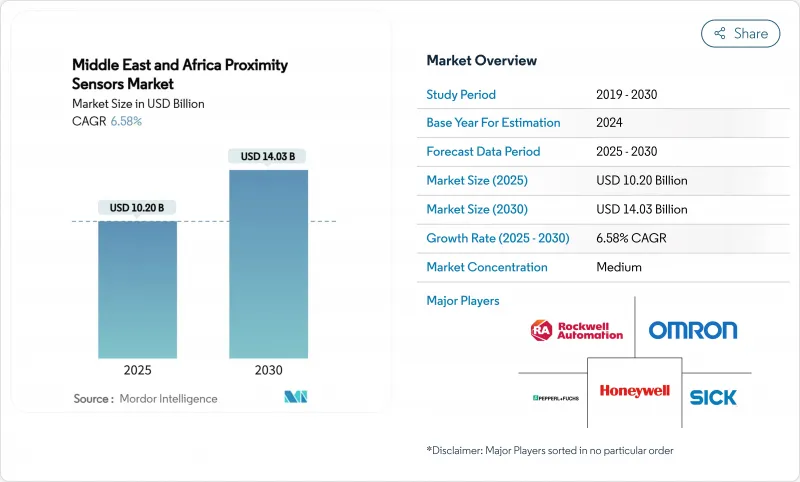

Middle East And Africa Proximity Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Middle East and Africa proximity sensors market stood at USD 10.2 billion in 2025 and is forecast to reach USD 14.03 billion by 2030, registering a 6.58% CAGR.

The region's diversification push, large-scale renewable-energy roll-outs and growing automotive hubs are creating sustained demand for non-contact sensing devices. Saudi Arabia, the United Arab Emirates (UAE) and South Africa continue to concentrate the bulk of industrial automation projects, while Egypt's wind corridors and Morocco's export-oriented vehicle plants are driving the fastest incremental volumes. Import-substitution incentives in GCC states favour suppliers that can localise final assembly, and the steady adoption of IO-Link is tilting preference toward digital-output devices. Long-range ultrasonic and ruggedised inductive types are gaining visibility as harsh desert and mining environments expose the limits of legacy photoelectric alternatives. Cooperative ventures among European and Japanese vendors signal a strategic shift toward shared regional production and service networks that can meet local certification demands.

Middle East And Africa Proximity Sensors Market Trends and Insights

Industrial-automation investments in GCC discrete manufacturing

GCC governments are mandating higher automation ratios in new factories under national industrial strategies, pushing plant operators toward sensor networks that can withstand high ambient temperatures and fine dust. Integrated IO-Link connectivity is now a de-facto specification in major Saudi and Emirati green-field projects, enabling device-level diagnostics that cut unscheduled downtime. Local content rules grant tariff relief for proximity-sensor sub-assemblies finished within GCC free zones, steering global suppliers toward joint manufacturing with regional distributors. These policies, coupled with subsidised energy, keep the Middle East and Africa proximity sensors market on a steady uptrend.

Automotive assembly expansion across Morocco and South Africa

Morocco produced 614,000 vehicles in 2024 and has become the European Union's largest external vehicle supplier, a status that necessitates near-zero defect tolerances on body-in-white lines. Tier-1 suppliers in Tangier's free zone are specifying long-range laser and ultrasonic sensors for battery-pack positioning, raising per-line sensor counts by up to 20%. South Africa, while contending with lower overall volumes, is automating battery-assembly stages to stay globally competitive, further stimulating the Middle East and Africa proximity sensors market.

Photonic-sensor performance degradation in desert dust conditions

Severe sandstorms can slash optical-sensor reliability by more than 80%, triggering unplanned stoppages on conveyor and packaging lines. Operators resort to monthly cleaning cycles and protective air-purge systems, lifting the total cost of ownership and restraining wider adoption of photoelectric models within the Middle East and Africa proximity sensors market.

Other drivers and restraints analyzed in the detailed report include:

- Surge in UAE smart-packaging lines for halal foods

- Wind-turbine build-out in Saudi Arabia and Egypt

- Volatile capex cycles in Sub-Saharan automotive Tier-2 suppliers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Inductive devices contributed 41.3% to the Middle East and Africa proximity sensors market in 2024, valued at a Middle East and Africa proximity sensors market size of USD 4.2 billion. Their sealed construction eliminates optical windows that accumulate dust, extending mean-time-between-failure in mines and steel mills. Ultrasonic units, though only 14% of revenue, are on track for the fastest 9.8% CAGR as wind-energy operators standardise on long-range detection. Photoelectric adoption is restricted by dust-induced false triggers, while capacitive variants retain a foothold in food-and-beverage lines where non-contact level sensing prevents contamination. Magnetic Hall-effect sensors meet niche automotive and marine applications, and emerging eddy-current models serve aerospace composites inspection. Across all formats, native IO-Link support is becoming a decisive purchase criterion, reinforcing the digitalisation theme in the Middle East and Africa proximity sensors market.

Second-generation inductive platforms now bundle on-chip temperature compensation and self-healing algorithms that isolate partial coil faults. Suppliers emphasise conformity to IECEx standards to secure placement in petrochemical zones, a regulatory hurdle that favours established European manufacturers. Meanwhile, Japanese and Korean vendors are expanding regional stockholding to shorten lead times, a key differentiator where project schedules are compressed by government funding milestones.

Short-range models below 10 mm dominated at 48.7% share thanks to high unit volumes on assembly lines and pick-and-place robots. Yet long-range units above 40 mm are forecast to chart an 8.9% CAGR, closing the gap as turbine and utility-scale solar plants specify wider detection envelopes. A 2.9 GW tranche of Saudi wind projects alone will require an incremental 50,000 long-range sensors during 2025-2027. Medium-range devices (10-40 mm) keep a balanced presence in automated storage and packaging systems where conveyor widths vary.

Sensor makers now incorporate micro-power radar for long-range slots, raising competitive pressure on legacy ultrasonic lines. At the ultra-short end, high-frequency capacitive probes are gaining interest for semiconductor backend assembly, an application cluster still nascent in the region but flagged in GCC technology roadmaps.

The Middle East and Africa Proximity Sensors Market is Segmented by Technology (Inductive, Capacitive), Sensing Range (Short, Medium, Long), Output Type (Digital, Analog), End-User Industry (Automotive, Industrial Manufacturing and Automation), and Country (Saudi Arabia, UAE, South Africa, Egypt, Nigeria, and Rest of Middle East and Africa). The Market Size and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- SICK AG

- Omron Corporation

- Pepperl+Fuchs SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- STMicroelectronics N.V.

- Datalogic S.p.A.

- IFM Electronic gmbh

- Balluff gmbh

- Keyence Corporation

- Delta Electronics Inc.

- Banner Engineering Corp.

- Schneider Electric SE

- Panasonic Industry

- Turck gmbh and Co. KG

- Baumer Holding AG

- Contrinex SA

- Carlo Gavazzi Holding AG

- Autonics Co. Ltd.

- Riko Opto-electronics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Industrial-Automation Investments in GCC Discrete Manufacturing

- 4.2.2 Automotive Assembly Expansion across Morocco and South Africa

- 4.2.3 Surge in UAE Smart-Packaging Lines for Halal Foods

- 4.2.4 Wind-Turbine Build-Out in Saudi Arabia and Egypt Driving Long-Range Sensors

- 4.2.5 Maintenance-Free Inductive Sensors in Harsh Mining Sites (RSA, Namibia)

- 4.3 Market Restraints

- 4.3.1 Photonic-Sensor Performance Degradation in Desert Dust Conditions

- 4.3.2 Volatile Capex Cycles in Sub-Saharan Automotive Tier-2 Suppliers

- 4.3.3 Low Local Value-Add = High Import Tariffs in Nigeria and Kenya

- 4.3.4 Counterfeit Low-Cost Sensors Diluting Brand Premiums (informal trade)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook (IEC Ex, SASO, GSO)

- 4.6 Technological Outlook (IO-Link, ASIC miniaturization)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Inductive

- 5.1.2 Capacitive

- 5.1.3 Photoelectric

- 5.1.4 Ultrasonic

- 5.1.5 Magnetic (Hall-Effect)

- 5.1.6 Others (Eddy-Current, Optical)

- 5.2 By Sensing Range

- 5.2.1 Short Range (less than 10 mm)

- 5.2.2 Medium Range (10-40 mm)

- 5.2.3 Long Range (greater than 40 mm)

- 5.3 By Output Type

- 5.3.1 Digital (NPN, PNP)

- 5.3.2 Analog (Current, Voltage)

- 5.4 By End-User Industry

- 5.4.1 Automotive

- 5.4.2 Industrial Manufacturing and Automation

- 5.4.3 Consumer Electronics

- 5.4.4 Food and Beverage

- 5.4.5 Aerospace and Defense

- 5.4.6 Packaging and Logistics

- 5.4.7 Renewable Energy

- 5.4.8 Others

- 5.5 By Country

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 South Africa

- 5.5.4 Egypt

- 5.5.5 Nigeria

- 5.5.6 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 SICK AG

- 6.4.2 Omron Corporation

- 6.4.3 Pepperl+Fuchs SE

- 6.4.4 Rockwell Automation Inc.

- 6.4.5 Honeywell International Inc.

- 6.4.6 STMicroelectronics N.V.

- 6.4.7 Datalogic S.p.A.

- 6.4.8 IFM Electronic gmbh

- 6.4.9 Balluff gmbh

- 6.4.10 Keyence Corporation

- 6.4.11 Delta Electronics Inc.

- 6.4.12 Banner Engineering Corp.

- 6.4.13 Schneider Electric SE

- 6.4.14 Panasonic Industry

- 6.4.15 Turck gmbh and Co. KG

- 6.4.16 Baumer Holding AG

- 6.4.17 Contrinex SA

- 6.4.18 Carlo Gavazzi Holding AG

- 6.4.19 Autonics Co. Ltd.

- 6.4.20 Riko Opto-electronics

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment