PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844497

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844497

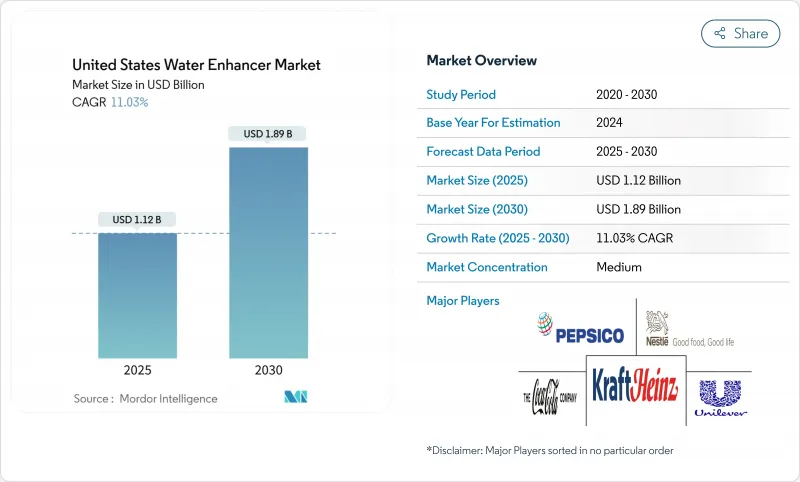

United States Water Enhancer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States water enhancer market size, valued at USD 1.12 billion in 2025, is expected to reach USD 1.89 billion by 2030, growing at a compound annual growth rate (CAGR) of 11.03%.

Water enhancer drops represent a fast-growing segment within the functional beverage market. This robust market trajectory is primarily fueled by shifting consumer preferences toward products that offer both convenience and health benefits. Water enhancer drops are favored for their portability, ease of use, and ability to instantly transform plain water into flavorful, nutrient-enriched drinks. This aligns with the growing trend of personalized nutrition, as consumers increasingly seek customizable hydration solutions that fit their individual taste preferences, dietary needs, and wellness goals. The market's expansion is further supported by the proliferation of health-conscious lifestyles, with consumers actively reducing their intake of sugary sodas and traditional soft drinks in favor of low-calorie, sugar-free, and functional alternatives. Leading brands have responded with innovative formulations that incorporate vitamins, electrolytes, antioxidants, and adaptogens, catering to demands for products that support energy, immunity, and overall well-being. The clean-label movement, emphasizing natural flavors, plant-based ingredients, and transparent sourcing, also plays a key role in driving adoption among discerning shoppers.

United States Water Enhancer Market Trends and Insights

Health-conscious consumers turning to low-calorie, sugar-free beverages drives demand

The increasing number of health-conscious consumers drives the demand for low-calorie and sugar-free beverages, as people aim to avoid health issues associated with excessive sugar consumption, such as obesity and diabetes. This trend is particularly evident in the United States, where beverage companies like Coca-Cola, PepsiCo, and Nestle are expanding their portfolios with functional waters. These products typically contain zero sugar, low calories, and are fortified with vitamins and proteins. The market is experiencing growth in clean-label and functional beverages, including probiotic kombuchas and vitamin-enhanced waters, driven by the rising prevalence of diabetes, obesity, and fitness-focused lifestyles. According to the Centers for Disease Control and Prevention (CDC), between August 2021 and August 2023, the adult obesity rate was 40.3%, with no significant differences between men and women. The prevalence of obesity was higher among adults aged 40-59 compared to those aged 20-39 and 60 and older .

Fitness and wellness trends drive surge in electrolyte enhancer usage

The expansion of the water enhancer market in the United States is primarily attributed to the increasing adoption of fitness and wellness practices, particularly within professional fitness establishments. The integration of structured exercise regimens, organized group sessions, and personalized training programs into daily routines has generated substantial demand for advanced hydration solutions. Health-conscious individuals and athletes recognize that rigorous physical activity can lead to significant electrolyte depletion through perspiration, necessitating proper replenishment to maintain optimal energy levels, prevent muscle cramps, and ensure efficient physiological function. As a result, fitness establishments have implemented strategic initiatives to distribute and retail water enhancement products through dedicated hydration facilities and automated dispensing systems. According to the Health & Fitness Association (HFA), the membership in professional fitness establishments, including gyms, studios, and specialized facilities, encompasses 77 million Americans, constituting 25% of the population aged six years and above in 2024 .

Stringent food and beverage regulations hinder product development and approvals.

The water enhancer industry faces significant barriers due to complex regulations. The FDA's Generally Recognized as Safe (GRAS) framework permits companies to self-determine ingredient safety without mandatory government review, which raises potential safety concerns and leads to stricter regulations. The European Food Safety Authority's assessment of steviol glycosides illustrates the impact of regulatory changes on product formulations, noting that proposed modifications could exceed acceptable daily intake levels for toddlers at 6.9 mg/kg body weight per day . Manufacturers must allocate substantial resources to compliance documentation and product reformulation, reducing investments in innovation and market expansion. Regional regulatory differences require product modifications for different markets, limiting the ability to scale successful formulations globally. The high costs of regulatory compliance particularly affect smaller companies, potentially increasing market concentration among larger companies with established regulatory departments.

Other drivers and restraints analyzed in the detailed report include:

- Major beverage firms' marketing and innovation fuel consumer engagement

- Beverage brands collaborate with fitness influencers, boosting market presence

- Intense competition from flavored bottled water and soft drinks curtails market share

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flavored water enhancers hold 61.21% of the market share in 2024, as consumers prefer taste-enhanced hydration options over plain water alternatives. This market leadership position results from the segment's effectiveness in making water more palatable, addressing the common consumer challenge of drinking unflavored water. Non-flavored water enhancers, despite their smaller market presence, are experiencing significant growth with an 11.23% CAGR through 2030. This growth is primarily due to increasing demand from health-focused consumers who seek functional benefits without artificial flavoring additives.

The market shows increased adoption of botanical and herbal extracts that combine taste with wellness attributes. Calming ingredients such as lavender, chamomile, and lemongrass are becoming popular in both alcoholic and non-alcoholic beverages. Consumer demand is shifting toward less sweet formulations with natural taste profiles, prompting manufacturers to develop products with exotic fruit flavors like yuzu and lychee. The market also sees growth in umami-based formulations using vegetable ingredients. These developments align with broader beverage industry trends toward complex flavor profiles that support premium pricing strategies while meeting diverse consumer preferences.

Powder water enhancers command a share of 35.22% in the United States Water Enhancers market. Their cost-effectiveness compared to liquid variants makes them an economical choice for both consumers and manufacturers. The extended shelf life of powder formulations, coupled with easier storage and transportation capabilities, significantly reduces logistics costs. Additionally, powder enhancers offer superior portion control and customization options, allowing consumers to adjust the flavor intensity according to their preferences. The convenience of single-serve packaging and portability has particularly resonated with the on-the-go lifestyle of American consumers.

Tablet water enhancers have emerged as the fastest-growing segment with a CAGR of 12.45% from 2025 to 2030 in the United States Water Enhancers market. The convenience and portability of tablet formats have significantly contributed to their rising popularity among consumers, particularly those leading active lifestyles. These tablets are compact, lightweight, and easy to store, making them ideal for on-the-go consumption. Additionally, tablet water enhancers offer precise dosing, eliminating the risk of over-flavoring that sometimes occurs with liquid enhancers. The segment's growth is further driven by eco-conscious consumers who appreciate the reduced plastic packaging compared to liquid alternatives. The tablets' longer shelf life and cost-effectiveness, as one tablet typically flavors multiple servings, have also contributed to their market dominance.

The United States Water Enhancer Market is Segmented by Category (Flavored and Non-Flavored), by Form (Powder, Tablets, and Liquids), Ingredient Source (Natural/Organic and Artificial/Synthetic), Sweetener Type (With Sugar and Without Sugar), and Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- The Kraft Heinz Company

- PepsiCo, Inc.

- The Coca-Cola Company

- Nestle S.A.

- Unilever PLC

- Arizona Beverages USA

- Cirkul Inc.

- True Citrus Company

- Church & Dwight Co., Inc.

- Liquid Death

- Hydrant Inc.

- Stur Drinks

- 4C Foods Corp.

- Heartland Food Products Group

- Kent Precision Foods Group, Inc.

- Dyla LLC

- The Jel Sert Company

- SweetLeaf

- BioTrust Nutrition

- Dreampak

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Health-conscious consumers turning to low-calorie, sugar-free beverages drives demand

- 4.2.2 Fitness and wellness trends drive surge in electrolyte enhancer usage

- 4.2.3 Major beverage firms' marketing and innovation fuel consumer engagement

- 4.2.4 Beverage brands collaborate with fitness influencers, boosting market presence

- 4.2.5 Wider retail channels enhance beverage accessibility throughout Europe

- 4.2.6 On-the-go hydration solutions gain favor amid rising convenience demand

- 4.3 Market Restraints

- 4.3.1 Stringent food and beverage regulations hinder product development and approvals.

- 4.3.2 Intense competition from flavored bottled water and soft drinks curtails market share

- 4.3.3 Consumer concerns over artificial sweeteners and additives reduce trust in some products.

- 4.3.4 Environmental worries about plastic packaging impact eco-conscious consumers.

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Category

- 5.1.1 Flavoured

- 5.1.2 Non-Flavored

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Tablets

- 5.2.3 Liquids

- 5.3 By Ingredient Source

- 5.3.1 Natural/Organic

- 5.3.2 Artificial/Synthetic

- 5.4 By Sweetener Type

- 5.4.1 With Sugar

- 5.4.2 Without Sugar

- 5.5 By Distribution Channel

- 5.5.1 Supermarkets/Hypermarkets

- 5.5.2 Convenience Stores

- 5.5.3 Online Retail Stores

- 5.5.4 Pharmacy and Health Stores

- 5.5.5 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials (if available), Strategic Information, Products & Services, and Recent Developments)}

- 6.4.1 The Kraft Heinz Company

- 6.4.2 PepsiCo, Inc.

- 6.4.3 The Coca-Cola Company

- 6.4.4 Nestle S.A.

- 6.4.5 Unilever PLC

- 6.4.6 Arizona Beverages USA

- 6.4.7 Cirkul Inc.

- 6.4.8 True Citrus Company

- 6.4.9 Church & Dwight Co., Inc.

- 6.4.10 Liquid Death

- 6.4.11 Hydrant Inc.

- 6.4.12 Stur Drinks

- 6.4.13 4C Foods Corp.

- 6.4.14 Heartland Food Products Group

- 6.4.15 Kent Precision Foods Group, Inc.

- 6.4.16 Dyla LLC

- 6.4.17 The Jel Sert Company

- 6.4.18 SweetLeaf

- 6.4.19 BioTrust Nutrition

- 6.4.20 Dreampak

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK