PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844503

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844503

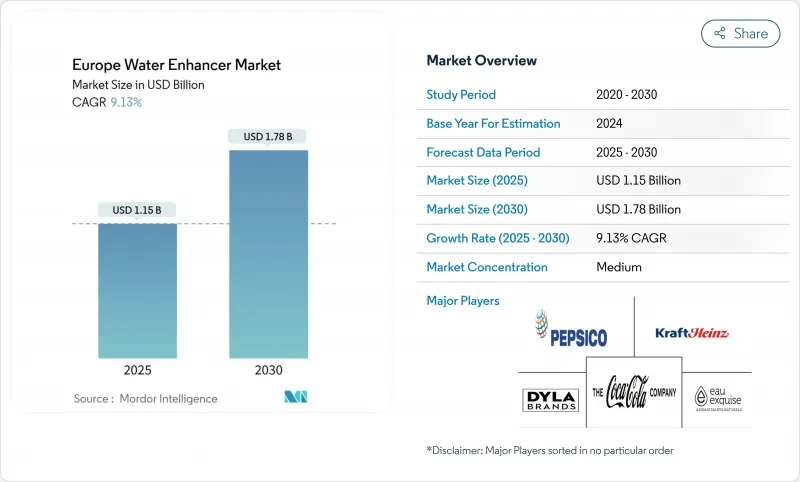

Europe Water Enhancer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe water enhancer market size, valued at USD 1.15 billion in 2025, demonstrates substantial growth potential with a projected value of USD 1.78 billion by 2030, representing a CAGR of 9.13%.

The market landscape is characterized by significant regional variations across European countries, with Western Europe maintaining a dominant market position. Consumer behavior analysis indicates a pronounced shift toward health-conscious beverage choices, particularly among urban populations. The market's fundamental growth drivers include increasing health awareness, demand for sugar-free alternatives, and the convenience factor associated with portable water enhancement solutions. Additionally, the market benefits from technological advancements in flavor development and preservation techniques, enabling manufacturers to offer diverse product portfolios. The competitive environment features both established beverage companies and emerging specialized manufacturers, contributing to product innovation and market expansion through various distribution channels.

Europe Water Enhancer Market Trends and Insights

Rising Health Consciousness Boosts Demand for Low-Calorie and Sugar-Free Beverage Alternatives

The European Water Enhancer Market is undergoing a substantial transformation driven by increasing health-conscious consumption patterns and consumer demand for low and zero-calorie alternatives. The Union of European Beverage Associations' (UNESDA) strategic initiative to reduce added sugars in soft drinks by 10% between 2019 and 2025 has generated significant market opportunities for water enhancers as healthier alternatives to conventional sweetened beverages. Consumer preferences have evolved considerably, moving beyond basic hydration requirements to products delivering comprehensive functional benefits, including essential vitamins, minerals, and electrolytes. In response to this market demand, manufacturers are implementing advanced product development strategies that incorporate specific formulations of magnesium and B vitamins to enhance mental clarity and stress reduction, targeting a diverse consumer base comprising students and professionals seeking sophisticated functional hydration solutions.

Increasing Preference for Convenient, On-The-Go Hydration Solutions Supports Market Growth

Water enhancers are experiencing significant growth across Europe due to their portable and customizable nature. Their compact format strongly appeals to urban professionals and active consumers who seek efficient ways to flavor water without carrying multiple beverage containers. The market expansion is propelled by continuous innovations in packaging, particularly squeeze bottles and single-dose formats that maximize convenience and user experience. Waterdrop, a prominent player in this segment, has successfully expanded its microdrinks presence to over 30 countries, serving more than 2 million customers. The versatility of water enhancers has transformed beverage consumption patterns, extending their usage from homes to workplaces, fitness centers, and travel locations, establishing them as an integral part of modern consumers' daily hydration routines. The growing emphasis on personalized hydration experiences and the increasing adoption of portable beverage solutions continue to drive market momentum across European regions.

Stringent EU Food and Beverage Regulations Slow Product Development and Approvals.

The European regulatory framework for food additives, particularly EU Regulation EC 1333/2008, requires manufacturers of water enhancers to conduct extensive safety assessments and provide technological justification for ingredients. These regulatory requirements create barriers for smaller market entrants and startups, who often lack the resources to complete complex approval processes. The varying interpretations and implementation of European Union directives across member states create additional compliance challenges, increasing costs and time-to-market for new product formulations. The Austrian Agency for Health and Food Safety mandates that additives must be safe, technologically necessary, and not misleading to consumers, with the European Food Safety Authority (EFSA) conducting regular safety assessments. These regulations have prompted manufacturers to shift toward natural ingredients and clean-label formulations, which typically face reduced regulatory scrutiny but may affect product flavor profiles and shelf stability.

Other drivers and restraints analyzed in the detailed report include:

- Strong Marketing and Product Innovation by Major Beverage Companies Drive Consumer Interest

- Rising Popularity of Fitness and Wellness Trends Increases Use Of Electrolyte-Boosting Enhancers

- Limited Consumer Awareness in Certain European Regions Restricts Market Penetration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flavored holds a 65.12% share of the European Water Enhancer Market in 2024, as consumers seek options to enhance plain water while avoiding calories and sugar. The segment's success comes from delivering familiar tastes that meet both flavor preferences and health requirements. Companies such as Kraft Heinz's MiO and Coca-Cola's Dasani Drops have introduced diverse flavor options, ranging from Lemonade, Berry Blast, and Orange Tangerine to refined taste profiles that match European preferences. Advances in flavor technology have improved taste authenticity and longevity in water applications.

Non-Flavored Drops are expected to grow at a CAGR of 10.54% from 2025-2030, driven by demand for functional hydration benefits. This segment provides specific nutritional elements such as electrolytes, vitamins, and minerals, appealing to health-focused consumers and active individuals. The growth reflects consumer interest in beverages with quantifiable functional benefits. Improvements in ingredient technology have enhanced the solubility and stability of functional components in water, allowing better delivery of active ingredients while maintaining product quality.

Despite the rise of natural options, artificial and synthetic ingredients held a 60.44% market share in 2024 due to their advantages in flavor intensity, stability, and cost efficiency. This segment benefits from established supply chains and consistent quality. However, advancements in natural ingredient technology are narrowing the gap with synthetic options. In Germany, sugar alternatives like inulin, carob, and natural syrups are gaining traction, while ingredients such as Palatinose and Fibersol are increasingly used in beverages for their health benefits. These shifts in preferences are creating opportunities for product differentiation through natural formulations that deliver both sensory appeal and wellness benefits.

From 2025 to 2030, the natural and organic ingredients segment in the European water enhancer market is projected to grow at a CAGR of 11.21%, outpacing the overall market. This growth is driven by consumers' focus on ingredient transparency and preference for plant-based components over synthetic ones. The trend aligns with the European food and beverage sector's shift toward clean-label products. Manufacturers are responding by creating water enhancers with botanical extracts, fruit essences, and natural sweeteners for authentic flavors without artificial additives. Data from the German Organic Food Industry Association (BOLW) shows German consumers spent EUR 16.99 billion on organic products in 2024, highlighting strong demand for natural offerings .

The Europe Water Enhancer Market Report is Segmented by Category (Flavoured and Non-Flavored Drops), Ingredient Source (Natural/Organic and Artificial/Synthetic), Sweetener Type (With Sugar and Without Sugar), Form (Powder, Tablets, and Liquids), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, and More) and Geography (Germany, United Kingdom, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- The Kraft Heinz Company

- The Coca-Cola Company (Dasani Drops)

- PepsiCo Inc.

- Eau Exquise

- Dyla LLC

- Britvic PLC

- Wisdom Natural Brands (SweetLeaf)

- DreamPak LLC

- The Jel Sert Company

- Pure Inventions, LLC

- Acquaroma Srl

- Quality First GmbH

- Spruce Water Limited

- Bev Co 2.0 Ltd

- Pure Flavour GmbH

- Phizz Ltd

- Waterdrop Microdrink GmbH

- Heartland Food Products Group

- Perfetti Van Melle Benelux B.V

- Manchester Drinks Company Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Health Consciousness Boosts Demand for Low-Calorie and Sugar-Free Beverage Alternatives

- 4.2.2 Increasing Preference for Convenient, On-The-Go Hydration Solutions Supports Market Growth

- 4.2.3 Strong Marketing and Product Innovation by Major Beverage Companies Drive Consumer Interest

- 4.2.4 Partnerships Between Beverage Brands and Fitness/Wellness Influencers Enhance Market Traction.

- 4.2.5 Expanding Retail Distribution Channels Improve Product Accessibility Across Europe

- 4.2.6 Rising Popularity of Fitness and Wellness Trends Increases Use Of Electrolyte-Boosting Enhancers

- 4.3 Market Restraints

- 4.3.1 Stringent EU Food and Beverage Regulations Slow Product Development and Approvals.

- 4.3.2 Limited Consumer Awareness in Certain European Regions Restricts Market Penetration

- 4.3.3 High Competition from Flavoured Bottled Water and Soft Drinks Limits Market Share.

- 4.3.4 High Price Points Compared to Traditional Beverages Reduce Mass Appeal.

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Category

- 5.1.1 Flavoured

- 5.1.2 Non-Flavored Drops

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Tablets

- 5.2.3 Liquids

- 5.3 By Ingredient Source

- 5.3.1 Natural/Organic

- 5.3.2 Artificial/Synthetic

- 5.4 By Sweetener Type

- 5.4.1 With Sugar

- 5.4.2 Without Sugar

- 5.5 By Distribution Channel

- 5.5.1 Supermarkets/Hypermarkets

- 5.5.2 Convenience Stores

- 5.5.3 Online Retail Stores

- 5.5.4 Pharmacy and Health Stores

- 5.5.5 Other Distribution Channels

- 5.6 By Geography

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 Italy

- 5.6.4 France

- 5.6.5 Spain

- 5.6.6 Netherlands

- 5.6.7 Poland

- 5.6.8 Belgium

- 5.6.9 Sweden

- 5.6.10 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)}

- 6.4.1 The Kraft Heinz Company

- 6.4.2 The Coca-Cola Company (Dasani Drops)

- 6.4.3 PepsiCo Inc.

- 6.4.4 Eau Exquise

- 6.4.5 Dyla LLC

- 6.4.6 Britvic PLC

- 6.4.7 Wisdom Natural Brands (SweetLeaf)

- 6.4.8 DreamPak LLC

- 6.4.9 The Jel Sert Company

- 6.4.10 Pure Inventions, LLC

- 6.4.11 Acquaroma Srl

- 6.4.12 Quality First GmbH

- 6.4.13 Spruce Water Limited

- 6.4.14 Bev Co 2.0 Ltd

- 6.4.15 Pure Flavour GmbH

- 6.4.16 Phizz Ltd

- 6.4.17 Waterdrop Microdrink GmbH

- 6.4.18 Heartland Food Products Group

- 6.4.19 Perfetti Van Melle Benelux B.V

- 6.4.20 Manchester Drinks Company Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK