PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844505

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844505

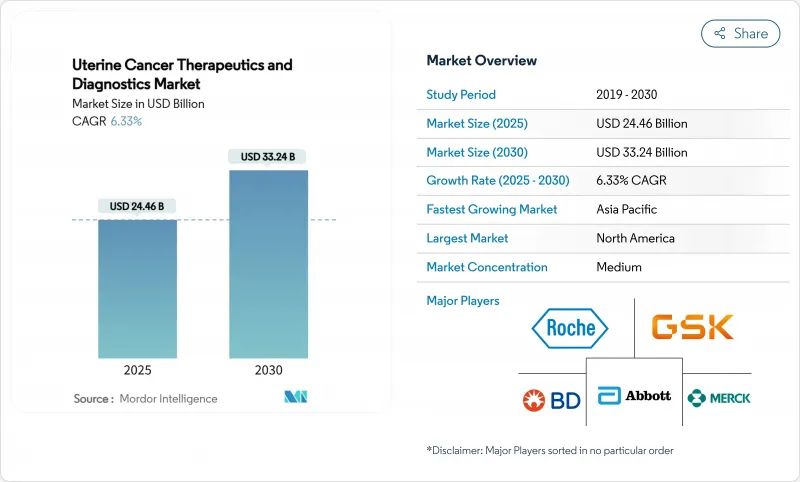

Uterine Cancer Therapeutics And Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The uterine cancer therapeutics & diagnostics market size is USD 24.46 billion in 2025 and will expand to USD 33.24 billion by 2030, advancing at a 6.33% CAGR.

Growing obesity-linked endometrial adenocarcinoma prevalence, swift immunotherapy adoption, and roll-outs of artificial-intelligence diagnostic platforms are redefining care pathways and sustaining demand. Regulatory support-illustrated by the 2024 U.S. approval of pembrolizumab plus chemotherapy for primary advanced disease-continues to shorten bench-to-bedside timelines. Segment momentum remains strongest in therapeutics, yet double-digit growth in next-generation diagnostics signals a structural shift toward precision medicine. Regional leadership rests with North America, while Asia-Pacific delivers the fastest incremental revenue as cancer centers proliferate and screening programs broaden. Competitive activity is moderate; leading multinationals defend share with immuno-oncology portfolios as start-ups commercialize micro-injectors, liquid biopsies, and machine-learning algorithms.

Global Uterine Cancer Therapeutics And Diagnostics Market Trends and Insights

Rising Prevalence of Obesity-Linked Endometrial Adenocarcinoma

Body-mass-index data reveal that every 5 kg/m2 increase raises endometrial cancer risk through estrogen-driven pathways. Non-alcoholic fatty-liver disease further multiplies risk among women aged 20-39, intensifying disease onset in younger cohorts. Tumor-promoting extracellular vesicle proteins such as TMEM205 and STAT5 have emerged as dual biomarkers and therapeutic targets, steering pharmaceutical pipelines toward metabolic-oncology combinations. The trend reframes adenocarcinoma as a metabolic disorder, prompting integrated treatment regimens that tackle insulin resistance alongside tumor suppression. Consequently, the uterine cancer therapeutics & diagnostics market benefits from higher diagnosis volumes and extended treatment durations.

Growing Adoption of Immunotherapy as First-Line or Maintenance Therapy

Dostarlimab's 2024 U.S. label expansion validated immune checkpoint blockade for biomarker-agnostic populations and established durable survival benchmarks. Median overall survival of 44.6 months in the RUBY trial outperformed historical controls, accelerating payer acceptance for premium-priced regimens. Pembrolizumab plus carboplatin-paclitaxel secured approval weeks later, underscoring a regulator-endorsed shift to first-line immunotherapy. Maintenance protocols extend dosing cycles, expanding lifetime revenue per patient and reinforcing the competitive moat for PD-1/PD-L1 innovators. As emerging markets relax import barriers, global uptake is set to scale rapidly.

High Cost of Combination ICI + Targeted-Therapy Regimens

Cost-effectiveness analyses report incremental ratios above USD 150,000 per quality-adjusted life-year for durvalumab combinations, breaching conventional payer thresholds. Affordability gaps widen in low-middle-income countries, where immunotherapy penetration lags despite rising incidence. Global oncology spending reached USD 223 billion in 2023 and is forecast to jump to USD 409 billion by 2028, prompting insurers to demand value-based contracts. Biosimilar pipelines worth USD 25 billion by 2029 could ease access but compress margins. Manufacturers are testing tiered pricing and risk-sharing agreements to safeguard uptake in cost-sensitive regions.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Awareness & Screening Initiatives in High-Risk Populations

- Launch of AI-Enabled Diagnostic Imaging Platforms

- Low Historical Clinical-Trial Success Rates in Uterine Sarcoma

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Endometrial adenocarcinoma generated 54.51% of 2024 revenue in the uterine cancer therapeutics & diagnostics market, reflecting its high incidence and reliance on multimodal therapy. Combination regimens pairing immunotherapy with targeted agents have become front-line standards, prolonging treatment courses and sustaining double-digit prescription volumes. Obesity and metabolic syndrome continue to enlarge the patient pool, reinforcing adenocarcinoma's share dominance. AI-assisted histopathology now detects p53abn-like NSMP adenocarcinomas, enabling more aggressive adjuvant strategies that lengthen survival windows. Genomic classifiers integrated into electronic health records accelerate personalized protocol selection, trimming diagnostic turnaround times from weeks to days.

Uterine sarcoma, while representing a smaller cohort, leads segment growth at a 9.25% CAGR through 2030. Breakthroughs such as selinexor-eribulin combinations have revitalized drug pipelines for leiomyosarcoma, and multi-omics biomarker panels identify actionable TP53 or ATRX mutations. The FIGO 2023 staging overhaul improves prognostic accuracy for carcinosarcomas, sharpening patient stratification. Precision-therapy roll-outs broaden clinical-trial enrollment, which in turn accelerates regulatory pathways. Consequently, venture funding is shifting toward sarcoma-specific biologics and drug-device hybrids that can penetrate historically refractory tumors.

The Uterine Cancer Therapeutics & Diagnostics Market Report is Segmented by Cancer Type (Endometrial Adenocarcinoma, Adenosquamous Carcinoma, Papillary Serous Carcinoma, and More), Product (Therapeutics [Surgery and More] and Diagnostics), End User (Hospitals & Clinics, Specialty Cancer Centers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the uterine cancer therapeutics & diagnostics market with 45.32% revenue in 2024, underpinned by sophisticated insurance coverage, robust clinical-trial infrastructure, and rapid adoption of checkpoint inhibitors. Rising incidence-projected to spike by 2050-has prompted public health responses such as the Cancer Moonshot, which funds screening programs for underserved communities. Black women's mortality remains nearly three times that of white women, steering industry initiatives toward disparity mitigation, including GSK's awareness campaign and community-based trial sites. Academic centers deploy AI-powered pathology and liquid-biopsy tools to shorten diagnostic timelines. Despite premium pricing, reimbursement remains favorable, and biosimilar entrants are yet to exert downward pressure.

Asia-Pacific is forecast to advance at a 10.61% CAGR, driven by expanding middle-class populations, improved insurance penetration, and healthcare-infrastructure upgrades. China's gynecologic cancer burden now mirrors that of developed economies, presenting a sizable addressable cohort. Private-equity investment in "core-plus" cancer assets accelerates construction of tertiary-level centers equipped with linear accelerators and immunotherapy infusion suites. Telehealth and hospital-at-home programs widen access to specialist care across Indonesia, Thailand, and India. In parallel, local regulators are aligning with ICH guidelines, expediting multinational trial approvals and enhancing time-to-market for novel agents.

Europe remains a mature yet evolving market that balances innovation with cost containment. Value-based procurement shapes formulary inclusion, pushing manufacturers to link price with outcome metrics. A continental shortage of medical radioisotopes disrupted brachytherapy schedules in 2024, instigating projects such as a proposed USD 400 million actinium-225 facility in Wales to secure domestic supply. Precision-medicine mandates propel uptake of molecular diagnostics, with German and Scandinavian payers reimbursing ctDNA-based minimal-residual-disease tests. Eastern European nations follow a catch-up curve, leveraging EU structural funds to modernize oncology centers.

The Middle East, Africa, and South America collectively offer long-run upside but face reimbursement and infrastructure hurdles. Gulf Cooperation Council states procure leading-edge radiotherapy and robotic-surgery systems, aiming to reverse outbound medical tourism. South African insurers pilot bundled-payment programs for endometrial cancer, whereas Brazilian hospital networks integrate AI-ultrasound platforms to alleviate radiologist shortages. The regions' adoption trajectory depends on macroeconomic stability and expansion of universal health-coverage schemes.

- Merck

- Roche

- GlaxoSmithKline

- Novartis

- Abbott Laboratories

- Beckton Dickinson

- Siemens Healthineers

- Hologic

- Boston Scientific

- Intuitive Surgical

- AstraZeneca

- Pfizer

- Eisai

- Bristol-Myers Squibb

- Regeneron Pharmaceuticals

- Illumina

- Myriad Genetics

- Thermo Fisher Scientific

- Daiichi Sankyo

- Clovis Oncology Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence Of Obesity-Linked Endometrial Adenocarcinoma

- 4.2.2 Growing Adoption Of Immunotherapy As First-Line Or Maintenance Therapy

- 4.2.3 Increasing Awareness & Screening Initiatives In High-Risk Populations

- 4.2.4 Launch Of AI-Enabled Diagnostic Imaging Platforms

- 4.2.5 Commercialisation Of Ctdna-Based Minimal-Residual-Disease Tests

- 4.2.6 Novel Intratumoural Micro-Injectors Improving Local Drug Delivery

- 4.3 Market Restraints

- 4.3.1 High Cost Of Combination ICI + Targeted-Therapy Regimens

- 4.3.2 Low Historical Clinical-Trial Success Rates In Uterine Sarcoma

- 4.3.3 Limited Reimbursement For Advanced Molecular Diagnostics In Lmics

- 4.3.4 Supply-Chain Bottlenecks For Radio-Isotopes Used In Brachytherapy

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Cancer Type

- 5.1.1 Endometrial Adenocarcinoma

- 5.1.2 Adenosquamous Carcinoma

- 5.1.3 Papillary Serous Carcinoma

- 5.1.4 Uterine Sarcoma

- 5.1.5 Clear Cell Carcinoma

- 5.1.6 Others

- 5.2 By Product

- 5.2.1 Therapeutics

- 5.2.1.1 Surgery

- 5.2.1.2 Radiation Therapy

- 5.2.1.3 Chemotherapy

- 5.2.1.4 Immunotherapy

- 5.2.1.5 Targeted Therapy

- 5.2.1.6 Hormone Therapy

- 5.2.1.7 Others

- 5.2.2 Diagnostics

- 5.2.2.1 Imaging (Ultrasound, CT, MRI, PET)

- 5.2.2.2 Biopsy (Aspiration, Core Needle, D&C)

- 5.2.2.3 Hysteroscopy

- 5.2.2.4 Liquid Biopsy (ctDNA)

- 5.2.2.5 Genomic & Molecular Tests

- 5.2.2.6 Pap Smear / Cytology

- 5.2.2.7 Others

- 5.2.1 Therapeutics

- 5.3 By End User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Specialty Cancer Centers

- 5.3.3 Diagnostic Laboratories

- 5.3.4 Research Institutes

- 5.3.5 Ambulatory Surgical Centers

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Merck & Co., Inc.

- 6.3.2 F. Hoffmann-La Roche AG

- 6.3.3 GSK plc

- 6.3.4 Novartis AG

- 6.3.5 Abbott Laboratories

- 6.3.6 Becton, Dickinson and Company

- 6.3.7 Siemens Healthineers AG

- 6.3.8 Hologic Inc.

- 6.3.9 Boston Scientific Corporation

- 6.3.10 Intuitive Surgical Inc.

- 6.3.11 AstraZeneca plc

- 6.3.12 Pfizer Inc.

- 6.3.13 Eisai Co., Ltd.

- 6.3.14 Bristol-Myers Squibb Company

- 6.3.15 Regeneron Pharmaceuticals Inc.

- 6.3.16 Illumina Inc.

- 6.3.17 Myriad Genetics Inc.

- 6.3.18 Thermo Fisher Scientific Inc.

- 6.3.19 Daiichi Sankyo Company Ltd.

- 6.3.20 Clovis Oncology Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment