PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844507

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844507

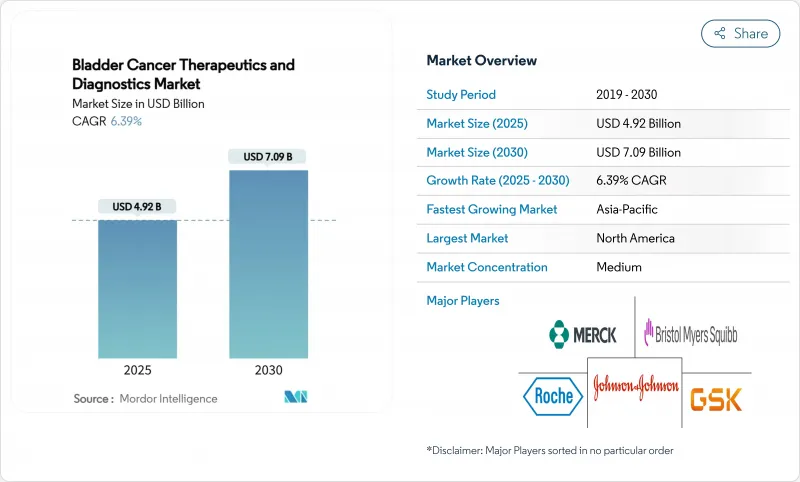

Bladder Cancer Therapeutics And Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Bladder Cancer Therapeutics And Diagnostics Market size is estimated at USD 4.92 billion in 2025, and is expected to reach USD 7.09 billion by 2030, at a CAGR of 6.39% during the forecast period (2025-2030).

The advance reflects a structural pivot from legacy chemotherapy toward precision immunotherapy, propelled by rapid FDA approvals for checkpoint inhibitors and antibody-drug conjugates that now form the backbone of combination protocols. Rising global incidence, earlier detection through blue-light cystoscopy, and reimbursement support for novel biologics further accelerate demand. New intravesical drug-delivery devices and AI-based urine-biomarker algorithms enhance clinical outcomes and streamline follow-up, magnifying procedural volumes in both inpatient and outpatient settings. Competitive intensity is increasing as pharmaceutical majors partner with focused biotechnology firms to align therapeutic and diagnostic innovations with value-based care metrics.

Global Bladder Cancer Therapeutics And Diagnostics Market Trends and Insights

Rising Global Bladder-Cancer Incidence

Incidence continues to climb as aging populations expand and occupational carcinogen exposure persists. Epidemiological data indicate a steady rise among individuals >=65 years, heightening demand for diagnostic surveillance and multi-line therapies. Earlier detection through imaging and urine-based assays swells the treatment-eligible cohort, particularly for non-muscle invasive disease. Health systems are scaling specialized urology centers and investing in trained personnel to cope with repeat interventions linked to high recurrence rates. These recurrent episodes sustain revenue generation for cystoscopy equipment, consumables, and adjuvant therapies. Economic models now incorporate indirect costs tied to lifetime monitoring, reinforcing the shift toward technologies that reduce recurrence risk.

Rapid Approvals of Immune-Checkpoint Inhibitors & ADCs

Accelerated regulatory pathways compress development cycles and hasten patient access to novel biologics. The FDA granted breakthrough status to agents such as enfortumab vedotin and durvalumab, enabling commercial launch within five years of pivotal trials. Survival gains are persuasive; combining pembrolizumab with enfortumab vedotin delivers 33.8-month median overall survival versus 15.9 months for chemotherapy. Market entrants with robust pipelines secure first-mover advantages and command premium pricing. Traditional chemotherapy suppliers must now co-develop biologics or risk market erosion in the bladder cancer therapeutic diagnostics market.

Patent Expiries & Generic Erosion of Key Chemo Drugs

The expiration of mitomycin C and cisplatin patents invites generic competition that compresses therapy margins. Price declines favour payers but constrain manufacturer revenues needed for R&D reinvestment. Although generics widen access, they split volumes across multiple suppliers, diluting scale efficiencies. Stakeholders explore hybrid regimens that pair low-cost cytotoxics with premium biologics, balancing affordability with efficacy. Yet negotiations over bundled pricing introduce complexity into procurement processes for hospital systems already under budget pressure.

Other drivers and restraints analyzed in the detailed report include:

- Wider Adoption of Blue-Light & 4K Cystoscopy

- AI-Driven Urine-Biomarker Algorithms

- High Cost / Reimbursement Hurdles for Novel Biologics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Therapeutics commanded 62.81% of 2024 revenue within the bladder cancer therapeutic diagnostics market, reflecting the repeated dosing and high unit prices of systemic and intravesical agents. Immunotherapy alone is forecast to grow at an 8.55% CAGR, backed by expanding labels for pembrolizumab, durvalumab, and nivolumab. Antibody-drug conjugates such as enfortumab vedotin open new salvage pathways, especially for platinum-ineligible cohorts. The bladder cancer therapeutic diagnostics market size for diagnostics is climbing, driven by blue-light scopes, 4K imaging towers, and AI-enabled urine assays that collectively enhance early detection.

Intravesical delivery platforms like TAR-200 and UGN-102 gain traction by releasing chemotherapy directly into the bladder wall, reducing systemic exposure while preserving efficacy. Diagnostic firms scale production of single-use scopes and fluorescent dyes as procedure volumes migrate to ambulatory settings. Molecular panels that combine DNA methylation and protein markers edge toward guideline endorsement, poised to redefine surveillance algorithms once reimbursement alignment occurs.

The Bladder Cancer Therapeutic Diagnostics Market Report is Segmented by Product (Therapeutics, Diagnostics), Cancer Type (Urothelial Carcinoma, Squamous-Cell Carcinoma, Adenocarcinoma & Other Rare Types), End User (Hospitals, Ambulatory Surgical Centers, Speciality Centers, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 44.74% of 2024 revenue, underscored by strong FDA acceleration programs, National Comprehensive Cancer Network guideline updates, and Medicare reimbursement that supports blue-light cystoscopy kits and urine-biomarker assays. Private payers increasingly align with federal determinations, smoothing nationwide access. Canada leverages pan-provincial buying groups to negotiate favorable biologic pricing, while Mexico expands public oncology coverage through Seguro Popular reforms. Cross-border patient flows remain limited but could rise as novel therapies diffuse into tertiary centers along the US-Mexico corridor.

Asia Pacific is expected to deliver the fastest regional CAGR at 10.85% through 2030 as China, Japan, and India undertake oncology infrastructure upgrades. China's local manufacturing partnerships reduce unit costs for checkpoint inhibitors, catalyzing uptake in provincial cancer centers. Japan maintains high adoption of enfortumab vedotin and pembrolizumab on the strength of robust national health insurance coverage. Indian private chains introduce blue-light cystoscopy gradually, prioritizing metropolitan cities where disposable incomes support out-of-pocket payments until wider insurance penetration occurs. ASEAN countries such as Singapore and Malaysia pilot AI-enabled urine diagnostics within value-based care pilots.

Europe exhibits balanced growth driven by the European Medicines Agency's coordinated review process and national health technology assessments that emphasize cost-benefit clarity. Germany's DRG system reimburses blue-light scopes within outpatient packages, encouraging migration away from admission-based cystoscopies. The United Kingdom's Cancer Drugs Fund accelerates conditional access to novel ADCs while collecting registry data to inform full NHS funding decisions. Southern European markets harmonize procurement via joint tenders, using pooled volumes to negotiate biologic discounts while maintaining open access to guideline-backed innovations.

- Roche

- Merck

- Bristol-Myers Squibb

- Pfizer

- Johnson & Johnson

- Novartis

- AstraZeneca

- GlaxoSmithKline

- Astellas Pharma

- Abbott Laboratories

- Olympus

- Pacific Edge Ltd (Cxbladder)

- UroGen Pharma Ltd

- CG Oncology

- ImmunityBio Inc.

- Teleflex

- Boston Scientific

- Coloplast

- Endo International

- Ameritech Diagnostic Reagent (Jiaxing) Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Bladder-Cancer Incidence

- 4.2.2 Rapid Approvals of Immune-Checkpoint Inhibitors & ADCs

- 4.2.3 Wider Adoption of Blue-Light & 4K Cystoscopy

- 4.2.4 Ai-Driven Urine-Biomarker Algorithms

- 4.2.5 Growth of ASC-Based Cystoscopy Volumes

- 4.2.6 Re-Fillable Intravesical Drug-Delivery Devices

- 4.3 Market Restraints

- 4.3.1 Patent Expiries & Generic Erosion of Key Chemo Drugs

- 4.3.2 High Cost / Reimbursement Hurdles for Novel Biologics

- 4.3.3 Global BCG Shortages Disrupting Therapy Patterns

- 4.3.4 Limited Blue-Light Equipment Availability in EMS

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Therapeutics

- 5.1.1.1 Chemotherapy

- 5.1.1.2 Immunotherapy

- 5.1.1.3 Antibody-Drug Conjugates

- 5.1.1.4 Intravesical Drug-Delivery Devices

- 5.1.2 Diagnostics

- 5.1.2.1 Cystoscopy

- 5.1.2.2 Bladder Ultrasound & Imaging

- 5.1.2.3 Urinalysis & Dipstick Tests

- 5.1.2.4 Urine & Liquid-biopsy Biomarker Panels

- 5.1.1 Therapeutics

- 5.2 By Cancer Type

- 5.2.1 Urothelial Carcinoma

- 5.2.2 Squamous-cell Carcinoma

- 5.2.3 Adenocarcinoma & Other Rare Types

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Speciality Centers

- 5.3.4 Academic and Research Institutes

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 F. Hoffmann-La Roche Ltd

- 6.3.2 Merck & Co. Inc.

- 6.3.3 Bristol-Myers Squibb Company

- 6.3.4 Pfizer Inc.

- 6.3.5 Johnson & Johnson (Janssen)

- 6.3.6 Novartis AG

- 6.3.7 AstraZeneca PLC

- 6.3.8 GlaxoSmithKline PLC

- 6.3.9 Astellas Pharma Inc.

- 6.3.10 Abbott Laboratories

- 6.3.11 Olympus Corporation

- 6.3.12 Pacific Edge Ltd (Cxbladder)

- 6.3.13 UroGen Pharma Ltd

- 6.3.14 CG Oncology

- 6.3.15 ImmunityBio Inc.

- 6.3.16 Teleflex Inc.

- 6.3.17 Boston Scientific Corp.

- 6.3.18 Coloplast A/S

- 6.3.19 Endo International plc

- 6.3.20 Ameritech Diagnostic Reagent (Jiaxing) Co.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment