PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844510

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844510

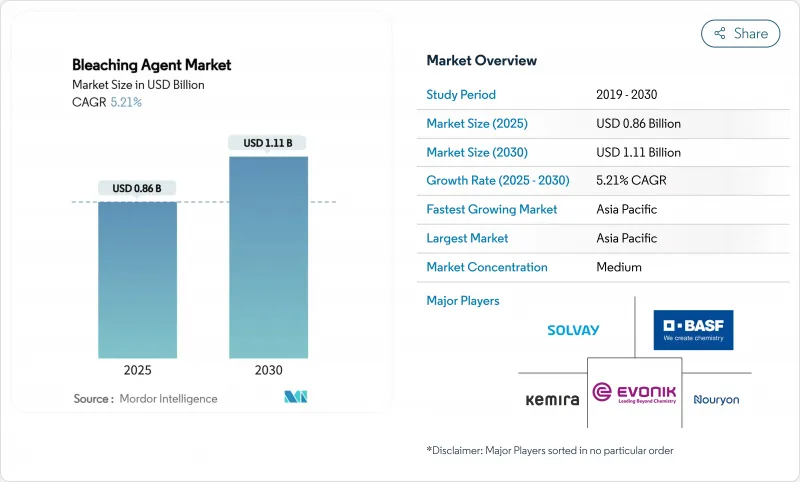

Bleaching Agent - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Bleaching Agent Market size is estimated at USD 0.86 billion in 2025, and is expected to reach USD 1.11 billion by 2030, at a CAGR of 5.21% during the forecast period (2025-2030).

This projected expansion underscores a steady rise in the bleaching agent market size and the sector's ability to adapt despite supply-chain disruptions and stricter environmental oversight. Persistent demand from municipal and industrial water treatment, continued preference for chlorine formulations because of cost and efficacy, and rapid uptake of on-site chlorine-dioxide generation underpin market momentum. Powder products, which offer logistical and dosing advantages, deepen manufacturers' cost leadership, while Asia Pacific's sizable production base and escalating consumption of bleaching agents in pulp, paper, and textiles keep the region at the forefront of growth.

Global Bleaching Agent Market Trends and Insights

Rising Demand for Municipal & Industrial Water Treatment

Utilities worldwide are replacing legacy chlorination systems with chlorine-dioxide solutions because these deliver stronger pathogen control while curbing trihalomethane formation. Installations of on-site generators are growing more than 20% each year as operators aim to bypass hazardous chemical transport and enhance dosage precision. Parallel growth stems from industrial users in food, beverage, and pharmaceutical plants that must meet tighter microbial standards. Heightened hygiene awareness that emerged during the COVID-19 pandemic sustains elevated consumption in health-care and institutional settings. In regions experiencing water scarcity, utilities favor bleaching agents that can treat increasingly contaminated sources without escalating byproducts.

Surging Pulp & Paper Output in APAC

Rapid urbanization and e-commerce have boosted packaging demand, lifting pulp and paper output and, consequently, bleaching agent consumption across China, India, Japan, and South Korea. Mill operators are transitioning from elemental chlorine to chlorine-dioxide and enzyme-aided sequences, which cut chemical oxygen-demand while maintaining brightness targets. Hydrogen peroxide remains pivotal in elemental-chlorine-free processes as producers raise brightness from 88 to more than 92 ISO. Regional producers also continue to invest in safety retrofits to curb incidents in high-pressure oxidation units.

Acute & Chronic Toxicity Concerns of Chlorinated Bleaches

Occupational-exposure limits for chlorine-dioxide vapors are set at 0.1 ppm (8-hour TWA) in several jurisdictions, prompting industrial users to install advanced ventilation and leak-detection systems. Publicized poisoning events during the pandemic reinforced consumer skepticism and spurred retailers to offer alternatives with lower hazard symbols. Healthcare and food sectors increasingly favor peroxide or peracetic-acid blends, even at higher unit costs, to reduce staff training and storage controls.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Textile Processing CapacityExpanding Textile Processing Capacity

- Tightening Potable-Water Residual-Chlorine Regulations

- Stringent Environmental Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The chlorine segment retained 35.11% of bleaching agent market share in 2024-largely due to entrenched infrastructure, low raw-material cost, and diversified supply controlled by vertically integrated chlor-alkali producers. Chlor-alkali cogeneration ensures continuous chlorine gas availability, allowing large players to honor long-term supply contracts, especially for municipal disinfection plants. Despite scrutiny over chlorinated byproducts, replacement remains gradual because many facilities lack immediate capital for new reactors or safety retrofits. Hydrogen peroxide and sodium percarbonate together posted the fastest 5.76% CAGR, buoyed by pulp and paper mills striving for elemental-chlorine-free status and laundry formulators marketing eco-labels. Catalyzed peroxide, which decomposes into water and oxygen, appeals to food, beverage, and pharmaceutical processors seeking residue-free sanitation. Specialty oxidants such as potassium permanganate and activated bleaching earth fill high-value but lower-volume niches in semiconductor, oil-refining, and edible-oil purification.

The Bleaching Agent Market Report is Segmented by Product Type (Chlorine, Peroxides, Sodium, Calcium, Others), Form (Powder, Liquid), End-User Industry (Pulp and Paper, Textile, Construction, Electrical and Electronics, Healthcare, Water Treatment, Others), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific's 45.22% revenue share in 2024 underscores its combined manufacturing scale and rising local consumption. Government incentives for paper recycling, coupled with export-oriented textile clusters, underpin a 6.21% CAGR outlook. Mills across coastal China have upgraded to multi-stage chlorine-dioxide sequences that raise brightness while cutting adsorbable-organic-halide discharge. India's downstream paper and garment sectors, supported by new sodium-chlorate and hydrogen-peroxide plants, contribute to steady regional demand growth.

North America benefits from advanced process control, high regulatory awareness, and recent capital projects that reduce reliance on transported chlorine gas. A USD 70 million plant in Arizona converting salt brine to sodium hypochlorite typifies the on-shoring trend, which enhances supply security for western utilities. Healthcare facilities favor chlorine-dioxide for hot-water-line disinfection; Johns Hopkins Hospital's multi-decade performance record demonstrates sustained Legionella suppression without pipe corrosion.

Europe confronts the costliest compliance burden. REACH dossier fees and upcoming emissions ceilings push producers toward lower-hazard formulations and raise interest in bio-based or enzyme-aided bleaching. Pilot installations in Scandinavian pulp mills demonstrate 25% chemical-consumption cuts when replacing the first alkaline extraction with laccase-mediated steps. Latin American and Middle-Eastern markets remain comparatively small but present upside through infrastructure projects that expand potable-water networks and cellulose fiber capacity.

- Accepta Water Treatment

- Aditya Birla Group

- ANSA McAL

- Arkema

- Ashland

- BASF

- Chemtrade International Corporation

- Chlorum Solutions

- Clariant

- Dow

- Ecolab Inc

- Erco Worldwide

- Evonik Industries AG

- Gujarat Alkalies and Chemicals Limited

- Hawkins

- Kemira

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Nouryon

- Olin Corporation

- Solenis

- Solvay

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for municipal & industrial water treatment

- 4.2.2 Surging pulp & paper output in APAC

- 4.2.3 Expanding textile processing capacity

- 4.2.4 Tightening potable-water residual-chlorine regulations

- 4.2.5 Rapid uptake of chlorine-dioxide generators in decentralized disinfection

- 4.3 Market Restraints

- 4.3.1 Acute & chronic toxicity concerns of chlorinated bleaches

- 4.3.2 Stringent environmental regulations

- 4.3.3 Volatility in raw material costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Chlorine

- 5.1.2 Peroxides

- 5.1.3 Sodium

- 5.1.4 Calcium

- 5.1.5 Others (Permanganate, Activated Bleaching Earth, etc.)

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Liquid

- 5.3 By End-user Industry

- 5.3.1 Pulp and Paper

- 5.3.2 Textile

- 5.3.3 Construction

- 5.3.4 Electrical and Electronics

- 5.3.5 Healthcare

- 5.3.6 Water Treatment

- 5.3.7 Others (Food, Oil and Gas, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Accepta Water Treatment

- 6.4.2 Aditya Birla Group

- 6.4.3 ANSA McAL

- 6.4.4 Arkema

- 6.4.5 Ashland

- 6.4.6 BASF

- 6.4.7 Chemtrade International Corporation

- 6.4.8 Chlorum Solutions

- 6.4.9 Clariant

- 6.4.10 Dow

- 6.4.11 Ecolab Inc

- 6.4.12 Erco Worldwide

- 6.4.13 Evonik Industries AG

- 6.4.14 Gujarat Alkalies and Chemicals Limited

- 6.4.15 Hawkins

- 6.4.16 Kemira

- 6.4.17 MITSUBISHI GAS CHEMICAL COMPANY, INC.

- 6.4.18 Nouryon

- 6.4.19 Olin Corporation

- 6.4.20 Solenis

- 6.4.21 Solvay

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment