PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844520

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844520

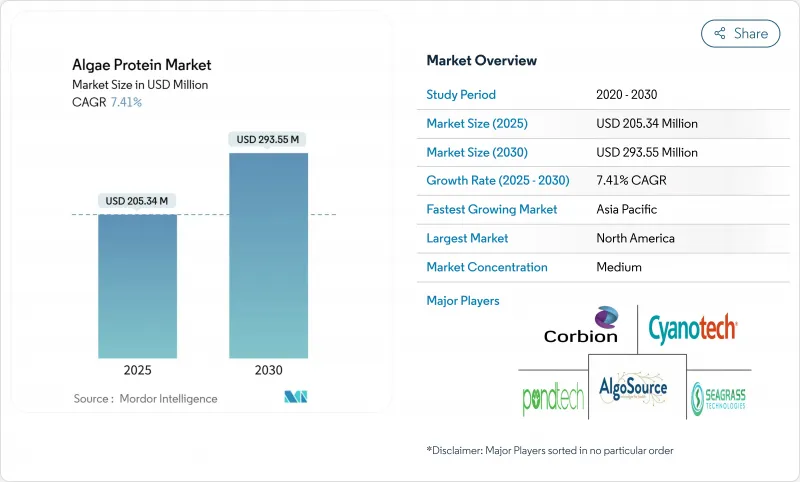

Algae Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

In 2025, the algae protein market is expected to be valued at USD 205.34 million, and by 2030, it's projected to climb to USD 293.55 million, marking a steady growth rate of 7.41% CAGR.

Regulatory nods, especially the FDA's endorsement of Galdieria extract blue in June 2025 and Europe's approval of over 20 algae species in 2024, are broadening product applications. The swift uptake of closed photobioreactor systems, advancements in strain engineering, and a growing consumer preference for sustainable protein are propelling commercial expansion. Investment is pouring into expansive, automated facilities: For instance, Brevel's 27,000 ft2 plant in Israel has commenced operations in early 2025, aiming for a substantial annual output. These developments, alongside established nutritional and functional benefits, drive strong global demand for supplements, functional foods, and animal feed. Moreover, as consumers shift toward plant-based and climate-resilient proteins, algae stands out for requiring minimal land, water, and energy compared to soy or animal sources, making it highly attractive in an era of environmental concern. Along the same line, algae, especially microalgae like Chlorella and Spirulina, being rich in complete protein, containing all essential amino acids, along with antioxidants, omega-3s, vitamins, and minerals, is further attracting manufacturers to consider algae protein, driving the market's growth.

Global Algae Protein Market Trends and Insights

Large-scale Investments in Photobioreactors

Fully enclosed photobioreactor farms are transforming production economics, thanks to commercial funding. Brevel's latest plant showcases this evolution, utilizing LED-based illumination and continuous harvesting to achieve protein concentrations exceeding 60% dry weight. Photobioreactors create controlled environments that fine-tune light, temperature, and CO2 levels, guaranteeing a consistent biomass output vital for commercial uses. For example, a peer-reviewed study in Sustainability (May 2025) highlighted that column units with funnel-shaped spoilers enhanced biomass yield by 18.18% and CO2 fixation by 13.95%. Furthermore, tech advancements have slashed operating costs, making algae protein increasingly competitive. Both nations and corporations are bolstering algae initiatives through subsidies and strategic alliances. Solar Foods' factory in Finland, with a capacity of 160 tons per year, is pioneering microbial fermentation using captured CO2 and green hydrogen, as reported by BIOCOM Interrelations GmbH. Collectively, these moves not only mitigate risks but also strengthen the global supply chain.

Rising Demand for Plant-based and Sustainable Proteins

Driven by health, ethical, and environmental concerns, consumers are increasingly turning to alternatives to animal-based proteins. Algae protein stands out with its complete amino acid profile, making it a compelling nutritional choice. For example, the International Food Information Council reported that in 2023, about 28% of United States respondents indicated they had increased their consumption of whole-plant protein sources over the past year. In a related development, blue-green strains, engineered at the University of Copenhagen, now replicate meat fibers, addressing the texture challenges that previously hindered the adoption of plant-based options. Furthermore, as highlighted by the Danish Technological Institute, national feed initiatives like Denmark's ReMAPP are incorporating microalgae into livestock diets, reducing reliance on soy. This blend of health consciousness, sustainability, and innovative strides is transforming the protein landscape, with algae emerging as a pivotal player.

Sensory Acceptance Gap such as Odor, Flavor, and Texture

Many consumers find the strong marine or earthy taste and smell of certain algae strains off-putting, particularly when these strains are incorporated into mainstream food products. Additionally, the naturally gritty or slimy texture of some algae formulations poses challenges for making them more palatable. Similarly, Neutral-pH Chlorella protothecoides receives low liking scores unless enhanced with masking agents. These sensory challenges restrict the use of algae protein in popular products such as beverages, dairy alternatives, and snacks. Addressing these challenges often necessitates expensive processing techniques or flavor-masking additives, driving up production costs and diminishing the appeal of clean-label products. For example, USDA-funded studies are pioneering advanced sensory methods to identify and counteract undesirable odors and tastes in novel foods, with potential applications for algae-based products.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements in Algae Cultivation

- Expansion in Functional Foods and Nutraceuticals

- High Production Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Marine species are set to be the fastest-growing source, with projections indicating a 7.86% CAGR from 2025 to 2030. In 2024, freshwater strains commanded a dominant 77.34% share of the algae protein market. Freshwater frontrunners, Spirulina and Chlorella, maintain their lead in the algae protein market, bolstered by established global infrastructure and GRAS authorizations from the U.S. Food and Drug Administration. Furthermore, Aliga's innovative approach cultivates Chlorella sorokiniana through heterotrophic fermentation, achieving impressive CO2 emissions of less than 1 kg per kg of biomass. Such advancements not only shrink land footprints but also enhance economies of scale. A notable trend is the emergence of hybrid operations: freshwater strains flourish in open ponds for bulk feed, while marine strains are cultivated in photobioreactors, targeting high-value ingredients. This strategy offers a diverse product portfolio and mitigates risks across varying climatic zones.

Moreover, the ability to withstand high salt and heat conditions facilitates cultivation in seawater and on marginal lands, reducing competition for resources with traditional crops. Biofilm reactors, adept at processing seawater wastewater, achieve an impressive rate of 5.66 g m2d1 while simultaneously purifying effluents. Highlighting the commercial potential of extremophiles, the EU-backed ProFuture initiative is delving into Galdieria sulphuraria, a strain boasting a protein content of 62-65%.

The Report Covers Global Algae Protein Supplements Market and is Segmented by Source (Freshwater Algae and Marine Algae); Type (Spirulina, Chlorella, and Others); by Application (Food and Beverages, Supplements, and Animal Feed); and by Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America held a 29.53% share of the algae protein market, buoyed by FDA GRAS pathways and a strong culture of functional foods. FDA's regulatory nods, combined with a surge in supplement adoption, bolster product launches and instill market confidence. Companies such as Corbion, Cyanotech, and Earthrise are at the forefront of algae protein innovation. Enhanced food processing techniques are facilitating the integration of algae protein into mainstream products, boosting sales. Notably, Cyanotech achieved net sales of USD 23.1 million in fiscal 2024, with its Hawaiian Spirulina and astaxanthin lines commanding premium shelf space. Furthermore, Canada, through Health Canada, is endorsing colorant and ingredient approvals, while Mexico's warm climate is being harnessed for cost-effective pond cultivation, fueling market expansion.

In Europe, a pronounced consumer shift towards sustainable, plant-based proteins, alongside stringent environmental regulations advocating for eco-friendly food production, propels market growth. European innovation is evident, with policy and project funding leading the charge. In February 2024, over 20 species received food use clearance, slashing compliance costs by a notable EUR 10 million, as highlighted by the European Commission. The EU's commitment to sustainability and backing for alternative protein research has hastened the adoption of algae protein across diverse sectors, spanning food and beverages to animal feed. A testament to this momentum, the European Commission, in October 2024, unveiled a EUR 5.7 million initiative under the European Maritime, Fisheries and Aquaculture Fund (EMFAF).

Asia-Pacific is on an upward trajectory, boasting an 8.48% CAGR. China's ProTi Food Technology has clinched funding from Dao Foods, propelling its agenda for gene-engineered strains. India's extensive coastline and rich biodiversity hint at a future of cost-effective marine cultivation, contingent on clearer regulations. As of 2024, the Government of India, via the Ministry of Home Affairs, has officially updated the nation's coastline length to a sprawling 11,098.81 kilometers. Meanwhile, nations like Japan, Australia, and Singapore are harnessing precision fermentation and R&D incentives. In contrast, Indonesia and Thailand are delving into open-pond aquaculture, collectively positioning the region as a burgeoning hub of innovation, further energizing the market's growth.

- AlgoSource S.A.

- Cyanotech Corporation

- Corbion N.V.

- Pond Technologies Holdings Inc.

- Seagrass Tech Private Limited

- Algenol Biotech LLC

- Algenuity Limited

- Duplaco BV

- Phycom BV

- E.I.D-Parry (India) Ltd.

- Sun Chlorella Corporation

- DIC Corporation (Earthrise)

- Aliga Microalgae

- Japan Algae Co., Ltd.

- Far East Bio-Tec Co., Ltd

- NB Laboratories

- NutraPharm

- Mrida Greens & Development Private Limited

- Grenera Nutrients Pvt Ltd

- Greenwell Impex

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Large-scale investments in photobioreactors

- 4.2.2 Rising demand for plant-based and sustainable proteins

- 4.2.3 Technological advancements in algae cultivation

- 4.2.4 Expansion in functional foods and nutraceuticals

- 4.2.5 Increasing vegan and vegetarian population globally

- 4.2.6 Rich nutritional profile of algae

- 4.3 Market Restraints

- 4.3.1 Sensory acceptance gap such as ordor, flavor, and texture

- 4.3.2 High production costs

- 4.3.3 Limited consumer awareness

- 4.3.4 Competition from other plant-based and microbial proteins

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Source

- 5.1.1 Freshwater Algae

- 5.1.2 Marine Algae

- 5.2 By Type

- 5.2.1 Spirulina

- 5.2.2 Chlorella

- 5.2.3 Others

- 5.3 By Application

- 5.3.1 Food & Beverages

- 5.3.1.1 Bakery

- 5.3.1.2 Dairy and Dairy Alternative Products

- 5.3.1.3 Meat/Poultry/Seafood and Meat Alternative Products

- 5.3.2 Supplements

- 5.3.2.1 Sport/Performance Nutrition

- 5.3.2.2 Elderly Nutrition and Medical Nutrition

- 5.3.3 Animal Feed

- 5.3.1 Food & Beverages

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 AlgoSource S.A.

- 6.4.2 Cyanotech Corporation

- 6.4.3 Corbion N.V.

- 6.4.4 Pond Technologies Holdings Inc.

- 6.4.5 Seagrass Tech Private Limited

- 6.4.6 Algenol Biotech LLC

- 6.4.7 Algenuity Limited

- 6.4.8 Duplaco BV

- 6.4.9 Phycom BV

- 6.4.10 E.I.D-Parry (India) Ltd.

- 6.4.11 Sun Chlorella Corporation

- 6.4.12 DIC Corporation (Earthrise)

- 6.4.13 Aliga Microalgae

- 6.4.14 Japan Algae Co., Ltd.

- 6.4.15 Far East Bio-Tec Co., Ltd

- 6.4.16 NB Laboratories

- 6.4.17 NutraPharm

- 6.4.18 Mrida Greens & Development Private Limited

- 6.4.19 Grenera Nutrients Pvt Ltd

- 6.4.20 Greenwell Impex

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK