PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844522

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844522

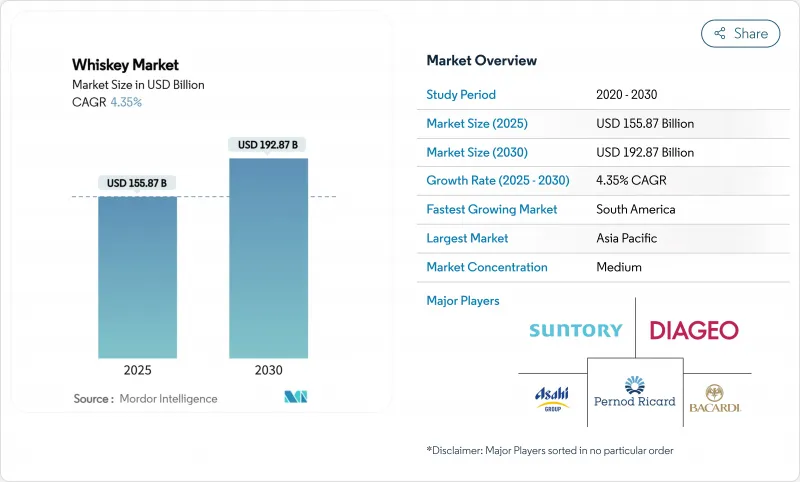

Whiskey - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

In 2025, the whiskey market is valued at USD 155.87 billion and is projected to grow to USD 192.87 billion by 2030, reflecting a steady 4.35% CAGR during the forecast period.

According to the Alcohol and Tobacco Tax and Trade Bureau, this growth is driven by evolving consumer preferences, the formal recognition of American Single Malt in January 2025, and a continued focus on premiumization. Scotch remains the dominant category; however, Irish whiskey is experiencing the fastest growth in terms of volume. Additionally, the increasing participation of female consumers and the expansion of e-commerce channels are significantly transforming market dynamics and distribution strategies. Regulatory reforms in major whiskey-producing countries are reducing barriers for craft distillers, fostering innovation and competition. Despite these positive developments, the market faces challenges such as potential EU tariffs and proposed U.S. labeling regulations, which could increase operational costs. On the supply side, capacity expansions, such as Buffalo Trace's USD 1.2 billion investment announced in January 2025, demonstrate confidence in the market's long-term growth potential. This expansion will increase the distillery's production capacity by 150%, enabling it to produce up to 500,000 barrels annually, ensuring readiness to meet future demand despite short-term inventory fluctuations.

Global Whiskey Market Trends and Insights

Premiumization and Demand for Aged, Limited-Edition Whiskeys

Driven by a growing consumer appetite for premium whisky, super-premium bottles are now commanding higher prices. Distillers, by emphasizing scarcity, heritage narratives, and innovative cask techniques, not only justify these elevated price points but also bolster their brand equity. Scotch, Irish, and American whiskies, celebrated for their unique production processes, enjoy a competitive edge in the premium segment. The rise of whiskey investment funds, backed by high-net-worth individuals seeking alternative assets, has tightened supply and extended aging cycles. Furthermore, producers who highlight transparent provenance data on their labels cultivate deeper trust with collectors. This robust demand not only supports ambitious warehouse expansions but also encourages extended maturation periods, collectively propelling the whiskey market upwards. A case in point: In May 2025, International Beverages Company unveiled a significant expansion of its whiskey warehouse in Scotland. This expansion, entailing an investment of USD 9.37 million, boosted the facility's capacity by 60,000 casks, bringing the total to an impressive 700,000 casks.

Expanding Global Cocktail Culture and Mixology Trends

Urbanization and the growing influence of social media have brought bartender creativity into the spotlight, driving whiskey's integration into both classic and contemporary cocktails. This trend reflects evolving social behaviors, with Diageo's 2025 trends report identifying "zebra striping" a practice where consumers alternate between alcoholic and non-alcoholic beverages as a response to the increasing focus on wellness while maintaining active social lives. The impact of mixology extends beyond bars and restaurants, influencing home consumption patterns as well. Consumers are increasingly seeking premium whiskeys that not only excel when consumed neat but also enhance the quality of cocktails. The expanding number of bars and pubs across the market has further fueled the demand for cocktails and mixed drinks. To capitalize on this growing trend, manufacturers are focusing on ready-to-drink cocktail offerings. In the Asia-Pacific region, bars are promoting flavored highballs and low-ABV spritzes, which are particularly appealing to younger, legal-age consumers, encouraging them to explore the category. Additionally, the rising popularity of ready-to-serve batched cocktails is blurring the lines between on-trade and off-trade consumption occasions, further driving the demand for versatile whiskey styles and increasing overall volume growth in the market.

Stringent Government Regulations

As trade complexities intensify between producing and consuming nations, the demand for whiskeys, including Scotch, Irish, and American varieties, is expected to face significant challenges in importing countries. These challenges stem from limited product availability and rising prices, which could deter consumer interest. The U.S. Tax and Trade Bureau is currently evaluating the introduction of "alcohol facts" panels and allergen disclosures on product labels. If implemented, these regulatory changes would likely impose substantial financial burdens on distillers, as they would require comprehensive label redesigns and extensive laboratory testing to ensure compliance. Additionally, a 50% tariff on American whiskey entering the European Union is set to take effect in April 2025. In response to these developments, distillers may consider redirecting their focus to emerging markets in Asia-Pacific and Latin America. However, this strategic shift would necessitate significant investments in developing new logistics frameworks and route-to-market strategies. Such efforts could compress profit margins and potentially dampen overall market demand, adding further complexity to the industry's growth trajectory.

Other drivers and restraints analyzed in the detailed report include:

- Rising Whiskey Appreciation and Connoisseurship

- Sustainability Initiatives and Innovative Packaging

- Consumers' Inclination Toward Healthy Beverages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, scotch whiskey held a significant 32.65% share of the global whiskey market, underscoring its enduring reputation and extensive global distribution network. The category's dominance is rooted in its premium age-statement expressions, which continue to be highly sought after, particularly in Asian markets where the strong gifting culture drives consistent demand. However, Scotch whiskey is not without its challenges. Rising costs, driven by the EU's carbon-border adjustment mechanisms, are expected to increase import expenses for glass bottles, potentially impacting pricing strategies. Additionally, the category faces growing competition from emerging whiskey types and evolving consumer preferences that lean toward innovation and variety. Despite these hurdles, Scotch whiskey's deep heritage, consistent quality, and established presence in the luxury segment ensure its position as a cornerstone of the global whiskey market remains unshaken.

Irish whiskey is experiencing rapid growth, with a projected CAGR of 4.86% through 2030. This growth is fueled by targeted investments in advanced triple-distillation techniques, diverse cask finishes, and immersive visitor experiences that enhance brand engagement. According to the Irish Whiskey Association, the number of operational distilleries in Dublin and Cork has seen a remarkable increase, rising from just four in 2010 to an anticipated 32 by 2025. These distilleries are leading the way in innovation, experimenting with unique cask finishes such as Calvados, Sauternes, and even tea barrels, creating distinctive flavor profiles that set Irish whiskey apart from traditional Highland and Speyside Scotch varieties. Globally, Irish whiskey brands are gaining traction on premium cocktail menus in cities ranging from Singapore to Sao Paulo. Their lighter, more approachable styles are particularly appealing to new legal-age consumers, further solidifying Irish whiskey's growing prominence in the global market.

In 2024, men continued to dominate global whiskey consumption, accounting for 67.46% of the market share. This demographic has long influenced whiskey culture and purchasing trends, favoring bold, barrel-strength expressions and traditional flavor profiles such as fermented rye florals. Distilleries have consistently catered to this core audience by focusing on offerings that emphasize depth, complexity, and heritage. However, marketing strategies are gradually evolving to strike a balance between honoring tradition and appealing to contemporary tastes. These strategies are incorporating more inclusive narratives while ensuring they do not alienate the loyal male consumer base.

Women are emerging as the fastest-growing demographic in the whiskey market, boasting a projected CAGR of 5.03% through 2030. Their rising involvement in formal tasting clubs underscores their significant sway over the market, influencing everything from flavor innovations and packaging designs to event programming. For instance, data from the Spanish Observatory on Drugs and Addictions indicates that, as of 2024, younger women are consuming more alcohol than their older counterparts . In light of this trend, distilleries are honing in on barrel-strength profiles and floral rye notes, tailoring them to female palates. Marketing strategies have evolved, shifting from traditional masculine narratives to inclusive storytelling that highlights the diversity of master blenders and distillery leaders. Women are gravitating towards premium whiskey segments, frequently opting for limited editions as gifts or personal acquisitions.

The Whiskey Market Report is Segmented by Product Type (American Whiskey, Irish Whiskey, Scotch Whiskey, Canadian Whiskey, Others), by End User (Men, Women), by Category (Mass, Premium), by Ingredient (Corn, Malt, Blended, Others), by Distribution Channel (On-Trade, Off-Trade), and by Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, Asia-Pacific holds a 30.65% share of the whiskey market, reflecting the region's growing affluence and evolving drinking habits. India, the largest whiskey market globally by volume, continues to benefit from increasing per-capita alcohol consumption and a strong focus on premiumization. This trend is further emphasized by Pernod Ricard's significant investment of INR 1,785 crore in a malt facility in Nagpur, set to enhance local sourcing capabilities in September 2024. Additionally, regulatory changes favoring higher-quality grain import quotas are creating a supportive environment for growth in the region.

South America is projected to achieve a 5.95% CAGR through 2030, driven by several key factors. Brazil's formal recognition of Scotch as a geographical indication in 2024 has provided greater legal clarity, enhancing consumer trust in the category. Furthermore, the expanding middle class and increasing inbound tourism in countries like Chile and Colombia are broadening the demand for premium whiskey imports. Local distillers in regions such as Sao Paulo and Patagonia are also leveraging native woods for cask finishing, which not only reinforces authenticity but also aligns with the growing narrative of import substitution and sustainability.

North America and Europe, while mature markets, remain critical for establishing and maintaining brand equity. In Europe, whiskey consumption continues to be deeply rooted in social settings, including cocktail bars and at-home gatherings, which sustain steady demand. Meanwhile, Africa and the Gulf regions, though still emerging markets, present significant growth opportunities. In Kenya, regulatory liberalization is paving the way for market expansion, while selective duty-free openings in the UAE are introducing premium whiskey categories to previously untapped consumer segments, signaling potential for long-term growth.

- Diageo PLC

- Pernod Ricard SA

- Suntory Holdings Ltd

- Asahi Group Holdings Ltd

- Bacardi Ltd

- Brown-Forman Corp.

- William Grant and Sons Ltd

- Edrington Group

- Kirin Holdings Co. Ltd

- Angus Dundee Distillers Plc

- Constellation Brands Inc.

- Campari Group

- Heaven Hill Brands

- Sazerac Company

- Ginglani Distillers Private Limited

- Nikka Whisky Distilling Co. Ltd

- Amrut Distilleries Ltd

- Allied Blenders & Distillers Ltd.

- Starward Distillery

- Archie Rose Distilling Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Premiumization of aged, limited releases

- 4.2.2 Global cocktail culture and mixology growth

- 4.2.3 Growing connoisseurship and education

- 4.2.4 Sustainability and eco-friendly packaging

- 4.2.5 Expansion of craft distilleries

- 4.2.6 Whiskey tourism and experiential marketing

- 4.3 Market Restraints

- 4.3.1 Stringent government regulations

- 4.3.2 Consumers' inclination towards healthy beverages

- 4.3.3 Climate change impact on raw material supply

- 4.3.4 Increasing consumer shift towards low-alcohol and non-alcoholic alternatives

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 American Whiskey

- 5.1.2 Irish Whiskey

- 5.1.3 Scotch Whiskey

- 5.1.4 Canadian Whiskey

- 5.1.5 Other Product Types

- 5.2 By End User

- 5.2.1 Men

- 5.2.2 Women

- 5.3 By Category

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 By Ingredient

- 5.4.1 Corn

- 5.4.2 Malt

- 5.4.3 Blended

- 5.4.4 Others

- 5.5 By Distribution Channel

- 5.5.1 On-Trade

- 5.5.2 Off-Trade

- 5.5.2.1 Specialty/Liquor Stores

- 5.5.2.2 Others Off Trade Channels

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 France

- 5.6.2.3 United Kingdom

- 5.6.2.4 Spain

- 5.6.2.5 Netherlands

- 5.6.2.6 Italy

- 5.6.2.7 Sweden

- 5.6.2.8 Norway

- 5.6.2.9 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Vietnam

- 5.6.3.7 Indonesia

- 5.6.3.8 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Chile

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Nigeria

- 5.6.5.3 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Diageo PLC

- 6.4.2 Pernod Ricard SA

- 6.4.3 Suntory Holdings Ltd

- 6.4.4 Asahi Group Holdings Ltd

- 6.4.5 Bacardi Ltd

- 6.4.6 Brown-Forman Corp.

- 6.4.7 William Grant and Sons Ltd

- 6.4.8 Edrington Group

- 6.4.9 Kirin Holdings Co. Ltd

- 6.4.10 Angus Dundee Distillers Plc

- 6.4.11 Constellation Brands Inc.

- 6.4.12 Campari Group

- 6.4.13 Heaven Hill Brands

- 6.4.14 Sazerac Company

- 6.4.15 Ginglani Distillers Private Limited

- 6.4.16 Nikka Whisky Distilling Co. Ltd

- 6.4.17 Amrut Distilleries Ltd

- 6.4.18 Allied Blenders & Distillers Ltd.

- 6.4.19 Starward Distillery

- 6.4.20 Archie Rose Distilling Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK