PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906986

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906986

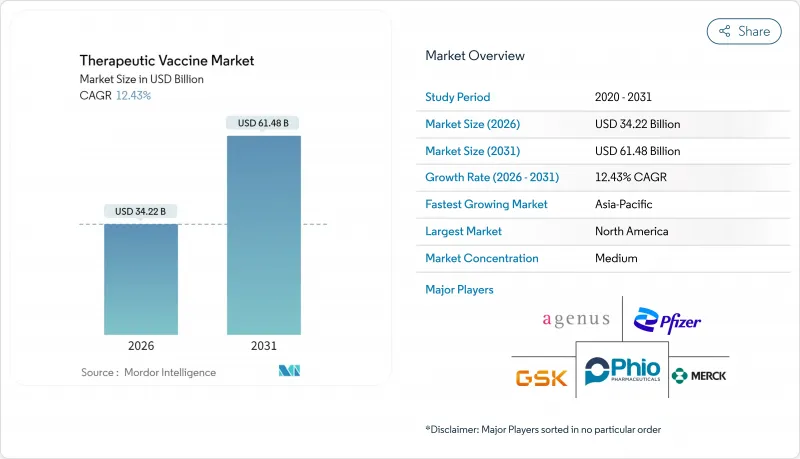

Therapeutic Vaccine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The therapeutic vaccines market size in 2026 is estimated at USD 34.22 billion, growing from 2025 value of USD 30.44 billion with 2031 projections showing USD 61.48 billion, growing at 12.43% CAGR over 2026-2031.

Demand expands as companies shift from preventive inoculation toward treatment-focused immunotherapy platforms that tackle active disease, particularly cancer and chronic viral infections. Breakthrough mRNA approvals, together with AI-assisted neo-antigen discovery, shorten development cycles and improve clinical precision, bolstering investor confidence and prompting regulators to formalize expedited pathways. Manufacturing capacity added during the pandemic now underpins rapid scale-up for new pipelines, while government programs such as Project NextGen supply non-dilutive capital that reduces early-stage risk. Competitive advantage accrues to firms that integrate R&D, clinical manufacturing, and cold-chain distribution, allowing faster launch of modular, personalized regimens across multiple indications .

Global Therapeutic Vaccine Market Trends and Insights

Rising Prevalence of Chronic & Infectious Diseases

Global aging drives higher cancer incidence, while evolving pathogens sustain viral and bacterial disease burdens. Therapeutic vaccines address these unmet needs by training the immune system to combat existing illness rather than preventing exposure. Oncology, chronic hepatitis B, and recurrent genital herpes comprise high-volume targets where durable responses lessen lifelong drug therapy . Public health authorities view therapeutic regimens as budget-friendly once-or-limited-course alternatives to chronic medication, encouraging reimbursement frameworks that reward curative potential. The result is sustained expansion of the therapeutic vaccines market across both developed and middle-income economies.

Government Funding Intensification for Vaccine R&D

The United States launched Project NextGen with USD 5 billion earmarked for next-generation platforms, including therapeutic applications beyond prevention. BARDA's milestone-based awards prioritize dual-use technologies able to pivot between pandemic response and chronic-disease therapy, accelerating GMP build-outs and de-risking scale-up. Similar instruments appear in the EU Horizon framework, while CEPI coordinates global clinical-trial standardization that shortens multi-country approvals. Public money now supplies early-stage capital that private investors historically avoided, fortifying the therapeutic vaccines market against downturns.

Capital-Intensive, High-Risk Clinical Development Cycle

Therapeutic vaccines require multi-year, multimillion-dollar investments before pivotal data emerge. Biological manufacturing often commits USD 100 million ahead of approval, straining balance sheets of early-stage firms. Immunological variability raises late-phase attrition rates above those for small molecules, complicating valuation models and prompting cautious syndicates. Consequently, some pipelines slow, offsetting a portion of forecast growth within the therapeutic vaccines market.

Other drivers and restraints analyzed in the detailed report include:

- Pharma/Biotech Surge in Oncology Vaccine Pipelines

- Breakthrough mRNA-Based Therapeutic Vaccine Approvals

- Stringent Multi-Jurisdictional Regulatory Hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cancer vaccines delivered USD 12.98 billion in 2025, equal to 42.63% of therapeutic vaccines market size, affirming oncology as the anchor of commercial adoption. The segment benefits from validated antigens, robust biomarker infrastructure, and reimbursement aligned to high-value indications. Combination regimens with checkpoint inhibitors enhance response durability, cementing cancer's contribution to the broader therapeutic vaccines market. Infectious-disease therapeutics, although smaller at USD 7.22 billion, expand at 13.06% CAGR as chronic hepatitis B and herpes candidates advance. Autoimmune and neurological categories remain nascent yet critical for pipeline diversity, attracting platform developers eager to leverage shared manufacturing and regulatory learning curves. Overall, diversified product baskets reduce portfolio risk and help sustain long-term expansion within the therapeutic vaccines industry.

A second-order effect is the reallocation of venture dollars toward inverse and tolerance-inducing vaccines, targeting diseases such as multiple sclerosis where existing therapies only manage symptoms. Neurological projects-including tau and alpha-synuclein vaccines-progress through mid-stage trials, reinforcing confidence that immunotherapy can address protein-aggregation disorders. Together these dynamics sustain investor appetite, accelerate science translation, and increase the proportion of revenues derived from non-oncology indications by the end of the decade.

Allogeneic constructs generated USD 19.7 billion in 2025, equivalent to 64.72% of therapeutic vaccines market size, owing to standardized, off-the-shelf formats that simplify distribution. Their economies of scale produce lower per-dose cost and faster lot release, attractive for large public tenders. Autologous approaches, however, record a 13.01% CAGR through 2031 as sequencing and manufacturing automation shrink lead times. Patient-specific neo-antigens improve precision, particularly in solid tumors, yielding higher objective-response rates that justify premium pricing. Hybrid architectures emerge: shared lipid-nanoparticle cores paired with individualized mRNA inserts, thereby balancing scalability and personalization. As AI algorithms further refine epitope selection, autologous and "semi-personalized" formats are expected to raise their share of the therapeutic vaccines market.

Platform convergence also fosters operational agility. Facilities now host multi-modal suites able to switch between plasmid DNA, mRNA, and protein subunit runs within the same cleanroom footprint. This flexibility reduces idle capacity and supports lean manufacturing economics, traits that will be essential as pipelines become increasingly indication-specific.

The Therapeutic Vaccine Market is Segmented by Products (Autoimmune Disease Vaccines, Cancer Vaccines, and More), Technology (Allogeneic Vaccines and Autologous Vaccines), Age Group (Adults and More), Distribution Channel (Public and Private) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 41.12% of global revenue in 2025 on the strength of FDA breakthrough designations, concentrated VC funding, and rapid enrollment networks. Project NextGen and BARDA grants sustain academic-industry hubs from Boston to San Diego, while expansions such as Merck's USD 1 billion Durham plant and Pfizer's USD 465 million Kalamazoo upgrade create surplus fill-finish capacity. Reimbursement frameworks encourage early adoption, exemplified by CMS transitional-coverage rules for FDA-cleared breakthrough products.

Europe follows with substantial public-private consortia and Horizon Europe grants guiding translational research. EMA's PRIME and Conditional Approval programs align with value-based pricing pilots in Germany and France, enabling earlier market entry for high-need indications. Facilities such as WACKER's EUR 100 million mRNA center in Halle bolster continental supply security. However, fragmented national payer negotiations can delay uniform access, tempering uptake relative to North America.

Asia-Pacific posts the fastest 13.22% CAGR through 2031, anchored by China's regulatory modernization and manufacturing-cost advantage. Local biotechs leverage patent linkage to co-develop with Western firms, while new CDMO campuses in Singapore and South Korea supply global clients. Japan's aging demographic and premium reimbursement for oncology care lift unit prices, offsetting slower volume growth. Regional governments also fund cold-chain upgrades, broadening capacity for both domestic and export markets and reinforcing Asia-Pacific's rising influence in the therapeutic vaccines market.

- Agenus

- Argos Therapeutics Inc.

- Celldex Therapeutic

- Dendreon Corp.

- GlaxoSmithKline

- Merck

- Novartis

- Pfizer

- Phio Pharmaceuticals

- Inovio Pharmaceuticals

- AstraZeneca

- BioNTech

- Moderna

- Sanofi

- Bavarian Nordic

- Gilead Sciences

- Takeda Pharmaceutical Co.

- CSL Seqirus

- CureVac N.V.

- GeoVax Labs, Inc.

- Vaccitech plc

- Nykode Therapeutics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Chronic & Infectious Diseases

- 4.2.2 Government Funding Intensification for Vaccine R&D

- 4.2.3 Pharma/Biotech Surge in Oncology Vaccine Pipelines

- 4.2.4 Breakthrough mRNA-Based Therapeutic Vaccine Approvals

- 4.2.5 AI-Driven Neo-Antigen Discovery Accelerating Personalization

- 4.2.6 On-Site Modular Micro-Factory Manufacturing Models

- 4.3 Market Restraints

- 4.3.1 Capital-Intensive, High-Risk Clinical Development Cycle

- 4.3.2 Stringent Multi-Jurisdictional Regulatory Hurdles

- 4.3.3 Shortage Of GMP Viral-Vector / Plasmid Manufacturing Capacity

- 4.3.4 Late-Stage I-O Trial Failures Dampening Investor Sentiment

- 4.4 Regulatory Landscape

- 4.5 Porters Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Products

- 5.1.1 Autoimmune Disease Vaccines

- 5.1.2 Neurological Disease Vaccines

- 5.1.3 Cancer Vaccines

- 5.1.4 Infectious Disease Vaccines

- 5.1.5 Other Products

- 5.2 By Technology

- 5.2.1 Allogeneic Vaccines

- 5.2.2 Autologous Vaccines

- 5.3 By Age Group

- 5.3.1 Adult

- 5.3.2 Pediatric

- 5.3.3 Geriatric

- 5.4 By Distribution Channel

- 5.4.1 Public

- 5.4.2 Private

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Agenus Inc.

- 6.3.2 Argos Therapeutics Inc.

- 6.3.3 Celldex Therapeutics Inc.

- 6.3.4 Dendreon Corp.

- 6.3.5 GlaxoSmithKline plc

- 6.3.6 Merck & Co., Inc.

- 6.3.7 Novartis AG

- 6.3.8 Pfizer Inc.

- 6.3.9 Phio Pharmaceuticals Corp.

- 6.3.10 Inovio Pharmaceuticals

- 6.3.11 AstraZeneca plc

- 6.3.12 BioNTech SE

- 6.3.13 Moderna, Inc.

- 6.3.14 Sanofi SA

- 6.3.15 Bavarian Nordic A/S

- 6.3.16 Gilead Sciences (Kite Pharma)

- 6.3.17 Takeda Pharmaceutical Co.

- 6.3.18 CSL Seqirus

- 6.3.19 CureVac N.V.

- 6.3.20 GeoVax Labs, Inc.

- 6.3.21 Vaccitech plc

- 6.3.22 Nykode Therapeutics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment