PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844546

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844546

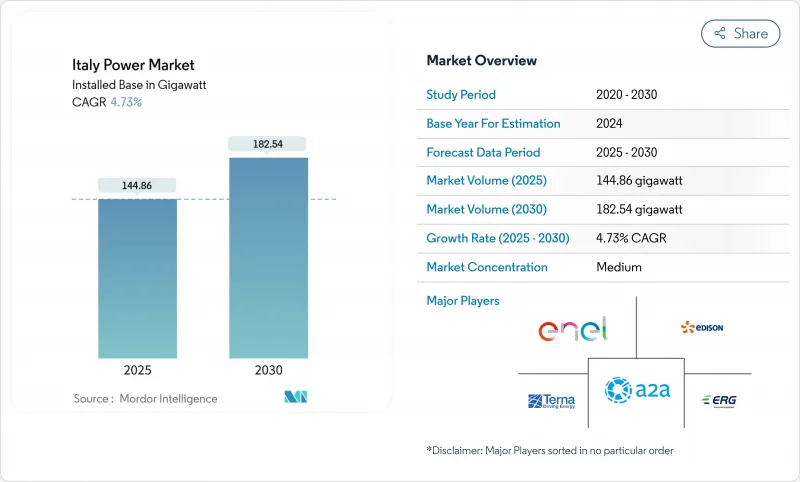

Italy Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Italy Power Market size in terms of installed base is expected to grow from 144.86 gigawatt in 2025 to 182.54 gigawatt by 2030, at a CAGR of 4.73% during the forecast period (2025-2030).

The expansion is anchored in rapid renewable energy deployment, grid-modernization spending of EUR 23 billion through 2030, and deliberate diversification away from Russian gas. Renewable generation satisfied a record 41.2% of national electricity demand in 2024, led by a 19.3% surge in solar output and a 30.4% rebound in hydro generation. Natural gas remains the dominant dispatchable resource, but streamlined permitting under Legislative Decree 199/2021 and corporate power-purchase agreements are accelerating photovoltaic additions. Grid-scale battery auctions scheduled for September 2025 will unlock 9 GW of storage by 2030, further supporting intermittent renewables. Persistently high wholesale prices-143.03 EUR/MWh in January 2025-underscore the urgency of supply diversification and cost-stable renewables.

Italy Power Market Trends and Insights

Accelerated Permitting Reforms under Legislative Decree 199/2021

Implementation of Legislative Decree 199/2021 has trimmed authorization timelines for renewable projects by about one third, thanks to digitalized permitting portals and clearer zoning of "suitable areas". Photovoltaic capacity caps were raised and wind-farm buffer zones narrowed, boosting application volumes in 2024. Northern regions clear projects fastest because of higher administrative capacity and greater availability of certified installers. The August 2024 FER2 decree complemented the reform by introducing two-way contracts-for-difference for offshore wind, targeting 4.6 GW by 2028. Remaining bottlenecks revolve around environmental impact assessments for projects exceeding 30 MW, yet the overall framework is lowering investor barriers and accelerating the Italy power market transition.

Grid-scale Battery Capacity Market Auctions (Terna)

Terna's MACSE mechanism is Europe's first dedicated storage capacity market, aiming to contract 9 GW by 2030 through 15-year pay-as-bid auctions. Battery additions reached 2.1 GW in 2024, representing over half of new grid connections. The inaugural September 2025 auction will award 10 GWh, attracting international developers seeking revenue certainty. Southern Italy offers superior arbitrage spreads due to high renewable curtailment, whereas industrialized northern zones require storage for peak-shaving and frequency support. The auction design complements Italy's power market needs by monetizing capacity, energy, and ancillary services, enabling storage to act as the critical enabler for higher renewable penetration.

Grid Congestion in Apulia & Sicily (>=36-month Delays)

More than 348 GW of renewable projects await interconnection, dwarfing the current 137.53 GW system. Apulia and Sicily suffer the longest queues, with developers waiting over 36 months for grid access. The bottleneck stems from weak north-bound transmission corridors and complex environmental approvals for new lines. Terna's EUR 16.5 billion five-year plan allocates significant funding to relieve southern congestion, yet construction lead times remain protracted. Delays raise capital costs, erode PPA competitiveness, and slow solar and wind build-outs, constraining the Italy power market growth outlook.

Other drivers and restraints analyzed in the detailed report include:

- Coal Phase-out by 2025 Creating Capacity Gap

- REPowerEU-funded HVDC Projects (Tyrrhenian Link)

- Offshore Wind Tender Under-realisation (Adriatic)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thermal power generation controlled 59% of Italy's power market size in 2024, supplying flexible baseload and balancing services. Renewable, while accounting for roughly 41% of generation, is expanding fastest at a 5.32% CAGR through 2030 under declining module prices and streamlined permitting. Hydroelectric contribution rebounded to 35% of renewable output after wetter 2024 conditions, and wind reached 20% of renewable capacity with significant offshore upside. Coal slipped to 1.3% of total production and will exit by 2025.

Solar's growth owes much to corporate PPAs and utility-scale projects, yet price cannibalization drives Enel to tilt its new-build mix toward 5.7 GW of wind versus 3.2 GW of solar by 2027. Biomass and geothermal provide baseload renewable capacity, which is increasingly valuable as coal retires and gas costs rise. The Italy power market share of dispatchable gas may decline beyond 2028 as storage and demand-response scale, but its role remains pivotal until HVDC links and batteries neutralize intermittency.

The Italy Power Market Report is Segmented by Power Generation From Source (Thermal and Renewable Power), End-Users (Utilities, Commercial and Industrial, and Residential), and Power Transmission and Distribution (Qualitative Analysis Only). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Enel SpA

- Terna SpA

- Edison SpA

- A2A SpA

- ERG SpA

- Acea SpA

- Sorgenia SpA

- Hera Group

- Eni Plenitude

- ENGIE SA (Italy)

- Renantis (Falck Renewables)

- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy SA

- Prysmian Group

- Sonnedix Power Holdings Ltd

- SunPower Corporation

- RWE Renewables Italia

- Iberdrola Renovables Italia

- InterGen SpA

- PLT Energia SRL

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Permitting Reforms under Legislative Decree 199/2021

- 4.2.2 Grid-scale Battery Capacity Market Auctions (Terna)

- 4.2.3 Coal Phase-out by 2025 Creating Capacity Gap

- 4.2.4 REPowerEU-funded HVDC Projects (e.g., Tyrrhenian Link)

- 4.2.5 Corporate PPAs Surge among Luxury & FMCG Majors

- 4.2.6 Superbonus 110 % Stimulus for Rooftop PV

- 4.3 Market Restraints

- 4.3.1 Grid Congestion in Apulia & Sicily (>=36-month Delays)

- 4.3.2 Offshore Wind Tender Under-realisation (Adriatic)

- 4.3.3 Gas-Import Exposure to Geopolitical Shocks (~90 %)

- 4.3.4 Landscape-related Permit Litigation for Wind Farms

- 4.4 Italy Renewable Energy Mix, 2024

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook (Digitalisation, HVDC, Storage)

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 Power Generation by Source

- 5.1.1 Thermal Power (Natural Gas, Oil, Coal)

- 5.1.2 Renewable Power (Solar, Wind, Hydro, Geothermal, etc)

- 5.2 By End-User

- 5.2.1 Utilities

- 5.2.2 Residential

- 5.2.3 Commercial and Industrial

- 5.3 Power Transmission & Distribution (Qualitative)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Enel SpA

- 6.4.2 Terna SpA

- 6.4.3 Edison SpA

- 6.4.4 A2A SpA

- 6.4.5 ERG SpA

- 6.4.6 Acea SpA

- 6.4.7 Sorgenia SpA

- 6.4.8 Hera Group

- 6.4.9 Eni Plenitude

- 6.4.10 ENGIE SA (Italy)

- 6.4.11 Renantis (Falck Renewables)

- 6.4.12 Vestas Wind Systems A/S

- 6.4.13 Siemens Gamesa Renewable Energy SA

- 6.4.14 Prysmian Group

- 6.4.15 Sonnedix Power Holdings Ltd

- 6.4.16 SunPower Corporation

- 6.4.17 RWE Renewables Italia

- 6.4.18 Iberdrola Renovables Italia

- 6.4.19 InterGen SpA

- 6.4.20 PLT Energia SRL

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment