PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844575

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844575

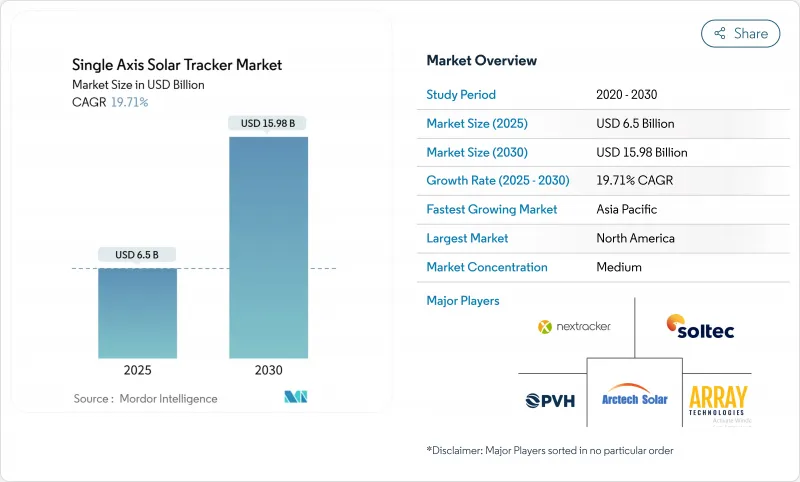

Single Axis Solar Tracker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Single Axis Solar Tracker Market size is estimated at USD 6.5 billion in 2025, and is expected to reach USD 15.98 billion by 2030, at a CAGR of 19.71% during the forecast period (2025-2030).

Utility-scale solar's dominance, the technology's 15-25% energy-yield premium over fixed-tilt arrays, and falling levelized cost of electricity in high-irradiance regions underpin this expansion. Vertical integration is mitigating steel cost volatility, while policies such as the United States Inflation Reduction Act's 10% domestic-content bonus are steering tracker manufacturing toward local supply chains. Product differentiation is shifting from pure cost competition to value-added features like hail-resistant stow modes and AI-enabled predictive maintenance. These shifts collectively reinforce strong developer preference for tracking systems in new solar capacity additions across mature and emerging markets.

Global Single Axis Solar Tracker Market Trends and Insights

Aggressive utility-scale procurement mandates drive tracker preference

Utility-scale tenders in the United States added 49 GW of solar capacity in 2024, and most projects required single-axis tracking to guarantee higher capacity factors. Spain, which hosts over 60% of European tracker installations, similarly specifies trackers in nationwide auctions to stabilize peak-period output. These mandates raise the baseline performance bar, effectively sidelining fixed-tilt alternatives in high-value utility projects. Developers gain premium pricing as mandated configurations create a captive market. Replication of this model in new growth regions is expected as grids tighten stability requirements.

Bifacial-tracking synergy revolutionizes desert economics

Horizontal trackers paired with bifacial modules in Chile and Australia now produce up to 2,555 kWh per kWp each year, driving levelized costs below 2.45 cents per kWh. Trackers maximise both direct and reflected irradiance capture, while high-albedo desert soils further boost rear-side gains. These combined benefits unlock sites once considered marginal, even where transmission distances are long. Project developers secure higher internal rates of return, which encourages additional large-scale investments in arid zones.

Wind-load certification delays create APAC bottlenecks

Typhoon-prone markets require aeroelastic tunnel testing for large-format modules, extending tracker approvals by 6-12 months in Japan and the Philippines. Developers face higher capital costs as they hold inventory during protracted certification cycles. Some shift to fixed-tilt arrays to protect schedules, despite losing energy yield benefits. Established tracker brands with pre-certified designs command premium prices, reinforcing market entry barriers for new entrants.

Other drivers and restraints analyzed in the detailed report include:

- Inflation Reduction Act domestic-content bonus reshapes North American supply chains

- Corporate PPA boom demands tracking precision

- Steel-price volatility pressures tracker economics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Horizontal configurations held a 70% slice of the single axis solar tracker market in 2024. They thrive on mature supply chains and straightforward installation procedures, making them the default choice for projects over 100 MW. This segment secures a large portion of the single axis solar tracker market size because energy gains justify their capital expenditure in high-irradiance sites. Vertical trackers grow at a 20.2% CAGR because land-constrained European farms and agrivoltaic setups need narrower row spacing. In these use cases, vertical-mounted bifacial modules provide comparable output while preserving ground use for crops.

Orientation selection is increasingly site-specific rather than one-size-fits-all. European agrivoltaic developers report 20-25% lower levelized costs with vertical systems than with elevated dual-row designs. Meanwhile inclined and articulated dual-axis solutions serve complex terrain or snow-prone regions. Technology diversity within this segment broadens the addressable single axis solar tracker market and cushions suppliers against regional demand swings across the single axis solar tracker industry.

Active drives captured 85% of the single axis solar tracker market size in 2024, providing precise sun-tracking, backtracking, and storm stow functions. Developers value these features for project bankability, especially where insurers require predefined hail mitigation routines. Yet passive thermal and gravity systems are scaling at more than 20% CAGR by eliminating motors and control electronics. Field data shows 62.3% efficiency gains over fixed-tilt baselines while lowering maintenance burdens in remote sites.

The cost-control advantage of passive drives is attractive where on-site maintenance crews are scarce. However, their inability to execute complex stow profiles limits adoption in hail-risk markets, preserving a revenue moat for active-drive suppliers. This interplay ensures robust competition and ongoing innovation across the single axis solar tracker market.

The Single Axis Solar Tracker Market Report is Segmented by Orientation (Horizontal Single-Axis Trackers, Vertical Single-Axis Trackers, and Others), Drive Type (Active and Passive), Technology (Photovoltaic, Concentrated Solar Power, and Concentrator Photovoltaic), Application (Utility-Scale, Commercial and Industrial, and Residential), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

North America retains a commanding portion of the single axis solar tracker market. United States projects routinely specify tracking systems for grid stability, and supply is now anchored by domestic factories in Texas, Ohio, and Arizona. Canada and Mexico add complementary demand through cross-border manufacturing and shared grid interconnections. Developers leverage well-established power-purchase agreement structures, ensuring predictable revenue flows that help de-risk investment in advanced tracker features.

Asia-Pacific is the fastest-growing region. India accelerated tracker adoption on its path toward 100 GW of new solar capacity, and China's manufacturing leaders are both scaling exports and meeting local demand. Southeast Asia shows a 220 GW pipeline of prospective utility-scale solar projects yet only 3% is under construction, hinting at vast untapped tracker demand once policy clarity improves. Japan tightens wind-resilience certification, setting global engineering benchmarks that benefit tracker reliability worldwide.

Europe and the Middle East share strong but varied growth narratives. European agrivoltaic developers cut levelized costs by as much as 25% through vertical tracker layouts that preserve farmland. Spain leads the continent with procurement rules that make tracking standard practice. In the Middle East and North Africa, expansion is driven by high solar resource and aggressive decarbonization targets. Saudi Arabia's single-axis tracker capacity grew more than fourfold over the past year, backed by large-scale tenders that reward high capacity factors.

- NEXTracker Inc.

- Array Technologies Inc.

- PV Hardware Solutions S.L.U. (PVH)

- Arctech Solar Holding Co. Ltd.

- Soltec Power Holdings S.A.

- Valmont Industries Inc. (Valmont Solar)

- Nclave Renewable S.L.

- STi Norland S.L.

- GameChange Solar

- FTC Solar Inc.

- Solar FlexRack (Northern States Metals)

- Ideematec Deutschland GmbH

- Convert Italia S.p.A.

- TrinaTracker (Trina Solar Co. Ltd.)

- SunPower Corporation

- AllEarth Renewables Inc.

- Sun Action Trackers

- Alion Energy Inc.

- Clenergy Co. Ltd.

- Exosun SAS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aggressive utility-scale procurement mandates in the U.S. & Spain favouring single-axis trackers

- 4.2.2 Rapid LCOE reduction for bifacial modules paired with horizontal trackers in Chile & Australia deserts

- 4.2.3 Inflation Reduction Act 10 % domestic-content bonus spurring North-American industrial projects

- 4.2.4 Corporate PPA boom in Brazil's Northeast requiring low-cost tracking for capacity-factor guarantees

- 4.2.5 AI-enabled predictive O&M lowering downtime of trackers in Middle-East dust zones

- 4.2.6 Vertical single-axis adoption in land-constrained high-latitude EU markets

- 4.3 Market Restraints

- 4.3.1 Wind-load certification delays in typhoon-prone APAC raising CAPEX

- 4.3.2 Steel-price volatility inflating tracker structure costs (EU & India)

- 4.3.3 Tracker "stow-mode" failure incidents tightening bankability criteria

- 4.3.4 High soiling-loss O&M burden in arid regions compared with fixed-tilt

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Orientation

- 5.1.1 Horizontal Single-Axis Trackers (HSAT)

- 5.1.2 Vertical Single-Axis Trackers (VSAT)

- 5.1.3 Tilted/Inclined Single-Axis Trackers (TSAT)

- 5.2 By Drive Type

- 5.2.1 Active (Electric/Hydraulic)

- 5.2.2 Passive (Thermal/Gravity)

- 5.3 By Technology

- 5.3.1 Photovoltaic (PV)

- 5.3.2 Concentrated Solar Power (CSP)

- 5.3.3 Concentrator Photovoltaic (CPV)

- 5.4 By Application

- 5.4.1 Utility-Scale

- 5.4.2 Commercial and Industrial

- 5.4.3 Residential

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 Spain

- 5.5.2.5 France

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 ASEAN Countries

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 NEXTracker Inc.

- 6.4.2 Array Technologies Inc.

- 6.4.3 PV Hardware Solutions S.L.U. (PVH)

- 6.4.4 Arctech Solar Holding Co. Ltd.

- 6.4.5 Soltec Power Holdings S.A.

- 6.4.6 Valmont Industries Inc. (Valmont Solar)

- 6.4.7 Nclave Renewable S.L.

- 6.4.8 STi Norland S.L.

- 6.4.9 GameChange Solar

- 6.4.10 FTC Solar Inc.

- 6.4.11 Solar FlexRack (Northern States Metals)

- 6.4.12 Ideematec Deutschland GmbH

- 6.4.13 Convert Italia S.p.A.

- 6.4.14 TrinaTracker (Trina Solar Co. Ltd.)

- 6.4.15 SunPower Corporation

- 6.4.16 AllEarth Renewables Inc.

- 6.4.17 Sun Action Trackers

- 6.4.18 Alion Energy Inc.

- 6.4.19 Clenergy Co. Ltd.

- 6.4.20 Exosun SAS

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment