PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844577

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844577

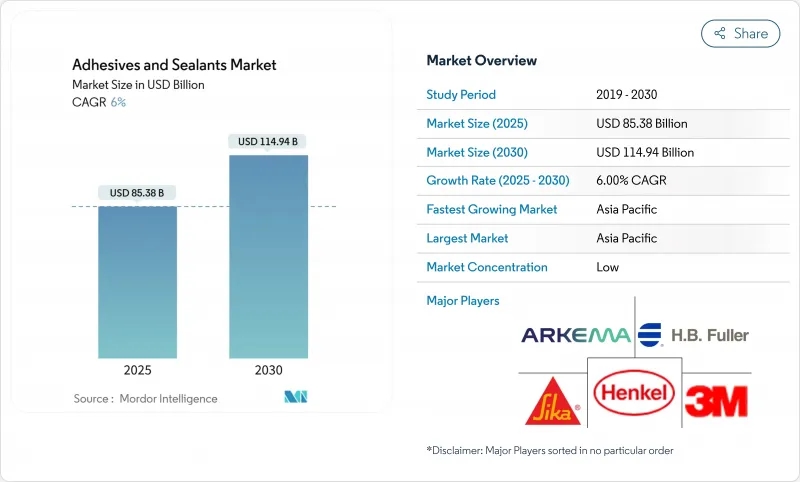

Adhesives And Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Adhesives And Sealants Market size is estimated at USD 85.38 billion in 2025, and is expected to reach USD 114.94 billion by 2030, at a CAGR of 6% during the forecast period (2025-2030).

Strong gains stem from rising demand for high-performance bonding solutions that support light-weighting in vehicles, automated e-commerce packaging, and modular construction. Regulatory pressure for lower-emission chemistries, especially under the EU Green Deal, is accelerating the shift toward bio-based and low-VOC formulations. Asia-Pacific remains the growth engine, supported by industrial expansion and infrastructure spending, while North America and Europe focus on technology upgrades that meet strict sustainability rules. Supply chain fragility for isocyanates and acrylic monomers continues to influence pricing, prompting producers to diversify feedstocks and invest in bio-based routes. Competitive dynamics are increasingly shaped by silicone and reactive technologies, which promise superior durability, higher temperature resistance, and improved processing speeds.

Global Adhesives And Sealants Market Trends and Insights

Surge in Lightweight Multi-material Vehicle Assemblies Boosting Structural Adhesive Uptake

Electric-vehicle makers are replacing welds and rivets with structural adhesives to save weight, improve crash performance, and enable joining of aluminum, composites, and high-strength steel. Adhesives also secure battery housings, where they manage heat and provide electrical insulation. Thermal interface materials inside packs prevent runaway and extend battery life, creating a specialized niche within the adhesives and sealants market. Automakers expect bonding technologies to remain dimensionally stable across wide temperature swings and resist fluid exposure for the entire vehicle lifespan. Such stringent requirements are pushing formulators toward reactive polyurethane hot-melts and modified epoxies that combine strength with flexibility. Growing EV penetration therefore acts as a structural demand catalyst for the adhesives and sealants market.

Explosive Growth of E-commerce Requiring High-Performance Packaging Adhesive Solutions Globally

Direct-to-consumer shipping exposes cartons to vibration, humidity, and temperature extremes, prompting brand owners to adopt high-tack hot-melt and water-based systems that keep packages sealed throughout complex logistics chains. Packaging represents 43% of the adhesives and sealants market and continues to expand as e-commerce volumes rise. Sustainability standards now require adhesives compatible with recycling streams; Henkel and Packsize introduced Eco-Pax, a bio-based hot-melt that can cut greenhouse gas emissions by 32% per 340 million boxes produced annually. Automated case-erection lines also demand low-viscosity grades that flow at reduced temperatures to save energy. Innovation in this driver underpins steady volume growth in the adhesives and sealants market.

Volatile Isocyanate & Acrylic Monomer Supply Chains Creating Cost Pressures

New EU rules require special training for anyone handling polyurethane systems with greater than 0.1% free isocyanate, adding administrative cost and limiting smaller converters' access. Parallel tightness in acrylic acid supply elevates price volatility, prompting end users to renegotiate contracts quarterly. Producers hedge by localizing feedstock procurement and adopting bio-routes from vegetable oils, yet these measures involve capital outlays that weigh on margins. Sudden spikes in raw-material indices ripple through downstream prices, delaying project approvals in construction and automotive. The adhesives and sealants market must therefore navigate cost inflation while maintaining performance, a balancing act that tempers the growth outlook.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Expansion of Modular & Prefabricated Construction Methods in Asia-Pacific

- EU Green Deal & Global Regulatory Push Accelerating Bio-based, Low-VOC Adhesives

- Stringent Environmental Regulations Regarding VOC Emissions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic resins generated 24% of the adhesives and sealants market revenue in 2024, favored for broad substrate compatibility and moderate cost. Nevertheless, silicone's 8.50% CAGR over 2025-2030 signals a pivot toward high-temperature, weather-resistant applications, notably in automotive electronics and building facades. Performance differentiation drives this shift. Silicone adhesives retain elasticity from -50 °C to 200 °C, remain electrically insulating, and resist UV degradation, making them fit for LED assemblies and 5G antenna modules. Acrylics respond with next-generation formulations that cure faster and bond low-surface-energy plastics through functional monomer modifications. Polyurethane remains the choice for structural joints exposed to dynamic loads, while cyanoacrylates serve precision medical and consumer electronics uses. Bio-based epoxies produced from glycerol and lignin showcase early-stage potential, signaling a gradual decarbonization of the adhesives and sealants industry.

Water-based systems held 42% revenue in 2024, aided by compliance with regional VOC caps and robust adhesion on porous substrates. They dominate corrugated box sealing, label lamination, and furniture assembly, all critical subsegments of the adhesives and sealants market. Product advances in polymer dispersion lower drying times, addressing historical speed constraints on automated lines.

Reactive technologies deliver the fastest 8.20% CAGR because they crosslink into thermoset networks, achieving structural strength once considered exclusive to epoxies. Reactive polyurethane hot-melts supply instant green strength plus final chemical bonding after moisture exposure, reducing assembly time for appliance and transportation manufacturers. UV-cured acrylates address electronics and medical devices where solvent elimination and rapid throughput are essential. Solvent-borne and rubber-based systems persist in niche uses, such as automotive interior trim and footwear, where their unique balance of tack and peel strength offsets regulatory hurdles.

The Adhesives and Sealants Market Report is Segmented by Adhesive Resin (Polyurethane, Epoxy, and More), Adhesives Technology (Solvent-Borne, Reactive, and More), Sealant Resin (Silicone, Polyurethane, and More), End-User Industry (Aerospace, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 37% of global revenue in 2024 and is growing at 6.60% CAGR, driven by infrastructure megaprojects and the relocation of electronics supply chains into ASEAN nations. China continues large-scale high-speed rail and renewable-energy investments, stimulating demand for structural sealants and wind blade bonding systems. India's USD 1.4 trillion National Infrastructure Pipeline channels adhesive consumption into roads, airports, and affordable housing. Electronics manufacturing in Vietnam and South Korea deepens regional requirements for low-void, high-thermal-conductivity adhesives used in semiconductors and display panels. Silicone products benefit most, given relentless pursuit of temperature stability in these sectors, ensuring Asia-Pacific retains primacy within the adhesives and sealants market.

North America represents a mature arena emphasizing technology differentiation and rapid regulatory alignment. U.S. electric-vehicle output surpassed 1 million units in 2024, raising consumption of structural, crash-durable adhesives for battery packs and body-in-white assemblies. Federal funding for bridges and broadband further elevates demand for civil-engineering sealants that remain flexible under extreme climates. Canadian wood-frame construction accelerates adoption of polyurethane adhesives that improve energy efficiency through airtight assemblies. The adhesives and sealants market shows steady mid-single-digit growth as producers offer drop-in water-borne alternatives conforming to CARB and EPA VOC limits.

Europe is shaped by the EU Green Deal's call for carbon-neutral products by 2050. Manufacturers accelerate the transition to lignin-based phenolic alternatives and bio-renewable epoxies to retain market access. German and Nordic prefabrication plants rely on certified low-VOC adhesives in cross-laminated timber modules, reinforcing silicone demand for window and facade sealing. The adhesives and sealants market in Europe benefits from stringent quality expectations, though compliance costs lower EBIT margins. Eastern European vehicle plants broaden production footprints, amplifying regional adhesive requirements.

South America remains a small but vibrant arena. Brazil's housing deficit spurs government-funded social programs that channel silicone and acrylic sealants into low-cost housing. Argentina's agricultural packaging sector benefits from hot-melt upgrades to address prolonged storage and export routes. Chilean miners apply hybrid sealants that withstand acid exposure, adding niche growth pockets inside the adhesives and sealants market.

The Middle East & Africa lean on infrastructure ambitions such as Saudi Arabia's NEOM city and Nigeria's Lagos-Ibadan railway. Harsh climates reward silicone and polysulfide sealants with elevated UV and sand-abrasion resistance. Import substitution policies in the Gulf encourage local adhesive plants, reducing freight costs and delivery times. Overall, diverse climatic and regulatory landscapes shape differentiated product lineups for regional players in the adhesives and sealants market.

- 3M

- Aica Kogyo Co. Ltd.

- Akzo Nobel N.V.

- Arkema S.A. (Bostik)

- Avery Dennison Corporation

- DELO Industrial Adhesives

- DIC Corporation

- Dow

- DuPont

- Dymax

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- MAPEI S.p.A.

- Nanpao Resins Chemical Group

- Parker Hannifin

- Permabond LLC

- Pidilite Industries Ltd.

- RPM International Inc.

- Sika AG

- Soudal Group

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Lightweight Multi-material Vehicle Assemblies Boosting Structural Adhesive Uptake

- 4.2.2 Explosive Growth of E-commerce Requiring High-Performance Packaging Adhesive Solutions Globally

- 4.2.3 Rapid Expansion of Modular and Prefabricated Construction Methods in Asia-Pacific

- 4.2.4 EU Green Deal and Global Regulatory Push Accelerating Bio-based, Low-VOC Adhesives

- 4.2.5 Healthcare Wearables Adoption Driving Medical-grade Reactive Hot-Melt Adhesives

- 4.3 Market Restraints

- 4.3.1 Volatile Isocyanate and Acrylic Monomer Supply Chains Creating Cost Pressures

- 4.3.2 Stringent Environmental Regulations Regarding VOC Emissions

- 4.3.3 Low Substitution Cost of Mechanical Fasteners in Emerging Markets Limiting Penetration

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Adhesive Resin

- 5.1.1 Polyurethane

- 5.1.2 Epoxy

- 5.1.3 Acrylic

- 5.1.4 Silicone

- 5.1.5 Cyanoacrylate

- 5.1.6 VAE / EVA

- 5.1.7 Other Resins (Polyester, Rubber, etc.)

- 5.2 By Adhesive Technology

- 5.2.1 Solvent-borne

- 5.2.2 Reactive

- 5.2.3 Hot Melt

- 5.2.4 UV-cured

- 5.2.5 Water-borne

- 5.3 By Sealant Resin

- 5.3.1 Silicone

- 5.3.2 Polyurethane

- 5.3.3 Acrylic

- 5.3.4 Epoxy

- 5.3.5 Other Resins (Bituminous, Polysulfide UV-curable, etc.)

- 5.4 By End-user Industry

- 5.4.1 Aerospace

- 5.4.2 Automotive

- 5.4.3 Building and Construction

- 5.4.4 Footwear and Leather

- 5.4.5 Healthcare

- 5.4.6 Packaging (Paper and Flexible)

- 5.4.7 Woodwork and Joinery

- 5.4.8 Other End-user Industries (Electronics, Consumer/DIY, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Indonesia

- 5.5.1.6 Malaysia

- 5.5.1.7 Thailand

- 5.5.1.8 Vietnam

- 5.5.1.9 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Turkey

- 5.5.3.8 Nordic Countries

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 Egypt

- 5.5.5.5 South Africa

- 5.5.5.6 Algeria

- 5.5.5.7 Rest of Middle and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments}

- 6.4.1 3M

- 6.4.2 Aica Kogyo Co. Ltd.

- 6.4.3 Akzo Nobel N.V.

- 6.4.4 Arkema S.A. (Bostik)

- 6.4.5 Avery Dennison Corporation

- 6.4.6 DELO Industrial Adhesives

- 6.4.7 DIC Corporation

- 6.4.8 Dow

- 6.4.9 DuPont

- 6.4.10 Dymax

- 6.4.11 H.B. Fuller Company

- 6.4.12 Henkel AG & Co. KGaA

- 6.4.13 Illinois Tool Works Inc.

- 6.4.14 MAPEI S.p.A.

- 6.4.15 Nanpao Resins Chemical Group

- 6.4.16 Parker Hannifin

- 6.4.17 Permabond LLC

- 6.4.18 Pidilite Industries Ltd.

- 6.4.19 RPM International Inc.

- 6.4.20 Sika AG

- 6.4.21 Soudal Group

- 6.4.22 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 Increasing Awareness of Renewable and Eco-friendly Products

- 7.2 White-space and Unmet-need Assessment