PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844580

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844580

Spain Dental Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

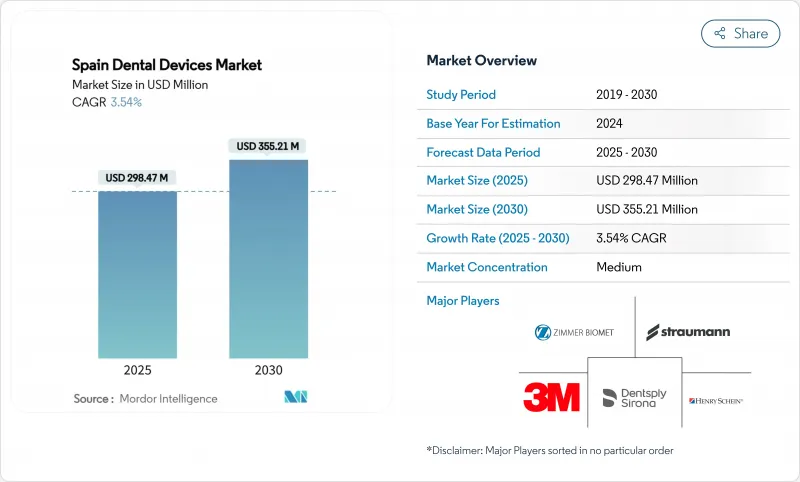

The Spanish dental equipment market size stands at USD 298.47 million in 2025 and is forecast to reach USD 355.21 million by 2030, advancing at a 3.54% CAGR.

A mix of public-sector funding, technology renewal linked to EU-MDR compliance, and a steadily ageing population sustains demand for new chairs, imaging systems, and digital prosthodontic tools. Urban concentration in Madrid, Catalonia, and Valencia fuels premium equipment sales because household incomes and dental-tourism inflows are highest there. Therapeutic equipment keeps its lead thanks to continuous upgrades in CAD/CAM and implantology, while consumables benefit from recurring use and deeper insurance coverage for older adults. Consolidation among clinic chains is beginning to lower procurement costs but is also nudging independent practices toward subscription models that smooth cash flows. Vendors able to combine hardware with software and training retain a competitive edge, and opportunities persist in AI-guided diagnostics that shorten chair time and improve reimbursement economics.

Spain Dental Devices Market Trends and Insights

Rapidly Ageing Spanish Population Raising Prosthodontic Demand

Spain's over-65 cohort reached 20.2% of total residents in 2025 and is on track to top 26.5% by 2035. This demographic uses multiple-tooth replacements 3.2 times more often than younger adults, elevating equipment usage for milling machines and intraoral scanners. Implant and bridge procedures already represent 33.50% of all dental treatments, and regions where seniors exceed 25% of inhabitants-Asturias and Castile and Leon-demonstrate the fastest uptake of CAD/CAM systems. Practices specialising in geriatric care reported 18% higher capital spending during 2024-2025. Vendors that bundle prosthetic workflows with chairside 3D printing gain traction because they reduce turnaround time and laboratory fees.

Expansion of Public Oral-Health Coverage for Children & Vulnerable Adults

The national oral-health plan secured total funding of EUR 180 million between 2022 and 2024 and prioritises diagnostics and preventive care in public clinics. Spending boosted annual patient volume in those facilities by near 17% in 2024, which translated into higher demand for panoramic X-ray units and basic treatment chairs. Early adopter regions such as Andalusia and Catalonia placed bulk orders via central tenders that capture equipment discounts of 12-18%. Public centres favour robust devices with low total cost of ownership, prompting suppliers to extend warranty periods. By 2027, basic dental service access is forecast to climb from 72% to 85% of the population.

EU-MDR Compliance Cycle Triggering Replacement of Legacy Equipment

The May 2024 cut-off for European Medical Device Regulation certification drove a 22% year-on-year spike in Spanish capital expenditure on dental equipment. Class IIa and IIb devices such as intraoral cameras and CBCT units faced stricter evidence requirements; 11% of submissions were rejected, forcing replacement purchases. Practices accelerated upgrades to avoid service gaps, favouring systems with remote firmware updates to stay compliant. Manufacturers equipped authorised reps to manage technical files and vigilance reporting, which reassures buyers seeking post-sale support. Demand is expected to normalise once the installed base conforms fully by 2026.

Other drivers and restraints analyzed in the detailed report include:

- Dental-Tourism Inflow Boosting High-End Implant Sales

- Private-Equity Roll-ups of Spanish Clinic Chains Driving Bulk Procurement

- Import Tariffs on Non-EU Devices Inflating End-User Prices

- High Cost of Dental Procedures

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Therapeutic equipment retained 48.50% of Spanish dental equipment market share in 2024, reflecting its vital role in everyday procedures and revenue generation. CAD/CAM systems posted an 18% annual adoption jump as clinicians demanded in-house milling to cut laboratory turnaround. Diagnostic equipment, which accounted for roughly 28% of revenue, benefited from EU-MDR driven replacement, with extra-oral radiology units showing the sharpest order growth. Dental consumables contributed smaller ticket values yet recorded the fastest 3.93% CAGR outlook, propelled by recurring implants, cements, and aligner supplies.

Growing implant utilisation-up 60.5% since insurance broadened coverage for seniors-supports steady refill cycles for impression materials and biomaterials. Equipment vendors now bundle starter kits with implant purchases to secure long-term consumable contracts. In parallel, 3D printing resins gain traction because chairside additive manufacturing shortens delivery from days to hours. Spain's academic institutes procure simulation blocks and phantom heads at higher cadence, creating adjacent demand for small instruments. Overall, widening clinical indications for minimally invasive surgery ensure that therapeutic tools and their consumables maintain intertwined growth in the Spanish dental equipment market.

The Report Covers Spain Dental Implants Market and the Market is Segmented by Product Type (General and Diagnostics Equipment, Dental Consumables, and Other Dental Devices), Treatment (Orthodontic, Endodontic, Periodontic, Prosthodontic), and End Users (Hospitals, Clinics, and Other End Users). The Market Provides the Value (in USD Million) for the Above-Mentioned Segments.

List of Companies Covered in this Report:

- Dentsply Sirona

- Straumann Group

- Envista Holdings (Kerr, Nobel Biocare)

- Align Technology

- Henry Schein

- Planmeca

- 3M ESPE

- GC Corporation

- Ivoclar Vivadent

- Coltene Holding

- VDW GmbH

- Septodont

- Carestream Dental

- Acteon Group

- Bego GmbH

- Zirkonzahn GmbH

- Biotech Dental SAS

- Acteon Group

- Klockner Implant System

- W&H Iberica

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapidly Ageing Spanish Population Raising Prosthodontic Demand

- 4.2.2 Expansion of Public Oral-Health Coverage for Children & Vulnerable Adults

- 4.2.3 Dental-Tourism Inflow to Boosting High-End Implant Sales

- 4.2.4 Private-Equity Roll-ups of Spanish Clinic Chains Driving Bulk Procurement

- 4.2.5 EU-MDR Compliance Cycle Triggering Replacement of Legacy Equipment

- 4.3 Market Restraints

- 4.3.1 Import Tariffs on Non-EU Devices Inflating End-User Prices

- 4.3.2 High Cost of Dental Procedures

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Diagnostics Equipment

- 5.1.1.1 Dental Laser

- 5.1.1.1.1 Soft Tissue Lasers

- 5.1.1.1.2 Hard Tissue Lasers

- 5.1.1.2 Radiology Equipment

- 5.1.1.2.1 Extra Oral Radiology Equipment

- 5.1.1.2.2 Intra-oral Radiology Equipment

- 5.1.1.3 Dental Chair and Equipment

- 5.1.2 Therapeutic Equipment

- 5.1.2.1 Dental Hand Pieces

- 5.1.2.2 Electrosurgical Systems

- 5.1.2.3 CAD/CAM Systems

- 5.1.2.4 Milling Equipment

- 5.1.2.5 Casting Machine

- 5.1.2.6 Other Therapeutic Equipments

- 5.1.3 Dental Consumables

- 5.1.3.1 Dental Biomaterial

- 5.1.3.2 Dental Implants

- 5.1.3.3 Crowns and Bridges

- 5.1.3.4 Other Dental Consumables

- 5.1.4 Other Dental Devices

- 5.1.1 Diagnostics Equipment

- 5.2 By Treatment

- 5.2.1 Orthodontic

- 5.2.2 Endodontic

- 5.2.3 Peridontic

- 5.2.4 Prosthodontic

- 5.3 By End User

- 5.3.1 Dental Hospitals

- 5.3.2 Dental Clinics

- 5.3.3 Academic & Research Institutes

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Dentsply Sirona

- 6.4.2 Straumann Group

- 6.4.3 Envista Holdings (Kerr, Nobel Biocare)

- 6.4.4 Align Technology Inc.

- 6.4.5 Henry Schein Inc.

- 6.4.6 Planmeca Oy

- 6.4.7 3M ESPE

- 6.4.8 GC Corporation

- 6.4.9 Ivoclar Vivadent

- 6.4.10 Coltene Holding AG

- 6.4.11 VDW GmbH

- 6.4.12 Septodont Holding

- 6.4.13 Carestream Dental

- 6.4.14 Acteon Group

- 6.4.15 Bego GmbH

- 6.4.16 Zirkonzahn GmbH

- 6.4.17 Biotech Dental SAS

- 6.4.18 ACTEON Group

- 6.4.19 Klockner Implant System

- 6.4.20 W&H Iberica

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment