PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844591

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844591

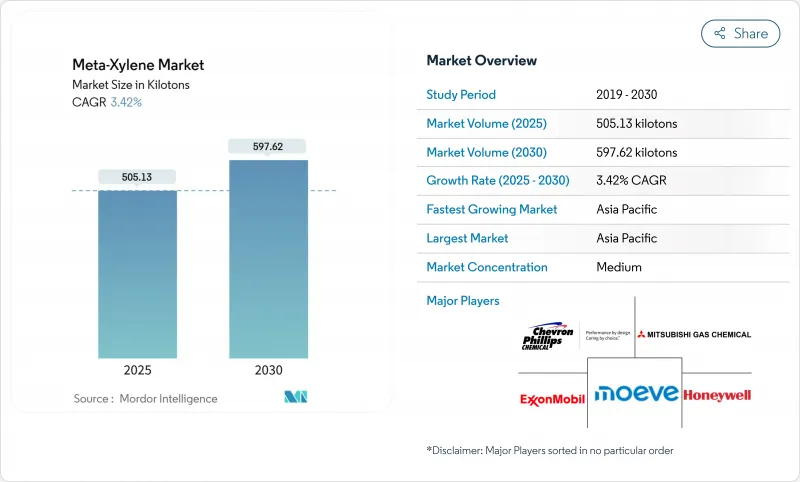

Meta-Xylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Meta-Xylene Market size is estimated at 505.13 kilotons in 2025, and is expected to reach 597.62 kilotons by 2030, at a CAGR of 3.42% during the forecast period (2025-2030).

Sustained PET and unsaturated polyester resin (UPR) consumption, together with a shift toward low-VOC and bio-based coating ingredients, underpins volume growth as producers leverage meta-xylene's role as the sole feedstock for isophthalic acid. Capacity additions inside integrated aromatics complexes across China, India, and the Middle East keep supply aligned with demand, while advanced extraction technologies lower unit costs and improve purity thresholds. On the demand side, regulatory pressure to curb solvent emissions is simultaneously reducing overall solvent volumes yet elevating the value of meta-xylene's balanced evaporation rate in premium, high-solids paints. As crude price volatility continues to influence aromatics spreads, the evolving dynamics among multinational energy-chemical giants and regional champions are reshaping the competitive landscape.

Global Meta-Xylene Market Trends and Insights

Growing Demand for Isophthalic Acid in PET & UPR Production

Isophthalic acid enhances thermal stability and gas-barrier performance in modified PET, making it indispensable for premium bottles, films and industrial fibers. Automotive and electronics manufacturers specify isophthalic acid-modified PET when temperatures exceed standard PET thresholds, reinforcing pull-through demand for meta-xylene. Innovation pipelines increasingly rely on renewable feedstocks such as 5-hydroxymethylfurfural (HMF); once commercial scale is reached, bio-based routes are expected to capture share within the next decade as brand owners pursue carbon-reduction goals. In UPR, isophthalic acid delivers higher corrosion resistance in wind-turbine nacelles and marine composites, supporting structural applications growth across Asia-Pacific shipyards and European offshore installations. The dual demand from PET and UPR accordingly registers the strongest positive impact on the meta-xylene market trajectory.

Shift Toward High-Solids/Low-VOC Industrial Coatings

The United States Environmental Protection Agency's 2024 Hazard Communication Standard update tightened labeling norms for xylene derivatives, pushing formulators toward higher-solids systems that still rely on meta-xylene for effective viscosity control. Europe's decarbonization roadmap similarly incentivizes low-VOC coatings, driving substitution of lighter, faster-evaporating solvents in favor of meta-xylene's more moderate evaporation profile. Although waterborne paints reduce aggregate solvent volumes, premium architectural and industrial maintenance products continue to incorporate meta-xylene as a coalescent aid, preserving demand through the forecast period.

Toxicological & Flammability Profile Driving Stricter Exposure Limits

The Agency for Toxic Substances and Disease Registry (ATSDR) underscores neurological concerns linked to chronic xylene exposure, prompting European regulators to contemplate lowering the 8-hour TWA occupational limit. Implementing enhanced ventilation, spark-proof handling systems, and personal protective equipment raises production costs, especially for small or standalone facilities. Where viable, coatings producers experiment with alternative solvents, yet meta-xylene's unique solvency and processing characteristics hinder full substitution, tempering but not eliminating demand.

Other drivers and restraints analyzed in the detailed report include:

- Capacity Expansions in Integrated PX-MX Aromatics Complexes

- Increasing Demand from Paints and Coatings Sector

- Crude-Oil Price Volatility Cascading to Aromatics Spreads

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Isophthalic acid production accounted for the largest share of the meta-xylene market size, at 46.17% in 2024, underscoring the segment's entrenched role in high-performance PET bottles and corrosion-resistant UPR laminates. The progressive switch toward bio-based isophthalic acid, projected to grow at 6.90% CAGR to 2030, signals a structural realignment in feedstock sourcing as renewable chemistries enter commercial deployment. Early adopters in Europe and Japan already certify mass-balance routines to capture brandowner premiums, while Asian producers erect greenfield units adjacent to biomass supply corridors.

Over the medium term, pesticide and pharmaceutical intermediates derived from 2,4- and 2,6-xylidine will preserve niche demand despite regulatory concerns around toxicology. Solvent applications shrink in absolute tonnage but exhibit value resilience where specialty electronics and pharmaceutical cleaning require meta-xylene's narrow boiling range. Taken together, the application mix is migrating from bulk solvent dependency toward higher-margin resin and specialty chemical use, elevating overall profitability despite moderate headline growth.

The Meta-Xylene Market Report is Segmented by Application (Isophthalic Acid, 2, 4- & 2, 6-Xylidine, and More), End-User Industry (Construction & Infrastructure, Packaging, Automotive & Transportation, and More), Purity/Grade (High-Purity MX, Industrial-Grade MX, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia-Pacific captured 53.45% of global volumes in 2024 and is forecast to clock a 5.50% CAGR through 2030, driven by vertically integrated complexes across China and India that harness feedstock flexibility and scale economics. China's Zhoushan aromatics hub and Guangdong CNOOC-Shell joint venture each broaden regional self-sufficiency, curbing import requirements from the United States and Europe. India's USD 87 billion petrochemical blueprint seeks to raise domestic xylene capacity to 5.5 million t by 2035, securing raw material availability for downstream polyester, coatings, and pharma corridors. Japan and South Korea confront structural margin pressure as Chinese exports intensify competition, spurring these economies to pivot toward high-purity specialties and differentiated formulations.

North America retains strategic significance through superior separation technologies, abundant shale-derived naphtha and proximity to a vast coatings customer base. However, upward pressure on energy costs and tightening environmental compliance increase operating expenditure. Chevron's potential USD 15 billion acquisition of Phillips 66's CPChem stake underscores the region's consolidation trajectory as companies chase scale and feedstock integration benefits. Mexico's emerging automotive value chain stimulates solvent and resin demand but relies heavily on United States imports, illustrating the importance of the USMCA's tariff stability.

Europe confronts the steepest operating challenges, with high utility costs and stringent carbon policies discouraging fresh investment in commodity aromatics. The European Green Deal's evolving carbon-border adjustment mechanism may partially shield domestic output yet adds administrative complexity. Shell's announcement to exit base chemicals by 2030 typifies how international energy majors reallocate capital toward LNG and renewables. Remaining European producers emphasize bio-based isophthalic acid and circular PET feedstocks, capitalizing on regulatory incentives for climate-neutral materials.

- Avantor, Inc.

- Chevron Phillips Chemical Company LLC

- Exxon Mobil Corporation

- Hengli Petrochemical

- Honeywell International Inc.

- JXTG Nippon Oil & Energy

- LOTTE Chemical CORPORATION

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Moeve

- Shell Chemicals

- S-OIL CORPORATION

- Suzhou Jiutai Group Co., Ltd.

- Vizag Chemicals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for isophthalic acid in PET and UPR production

- 4.2.2 Shift toward high-solids/low-VOC industrial coatings

- 4.2.3 Capacity expansions in integrated PX-MX aromatics complexes

- 4.2.4 Increasing demand from paints and coatings sector

- 4.2.5 Expansion of the automotive sector

- 4.3 Market Restraints

- 4.3.1 Toxicological and flammability profile driving stricter exposure limits

- 4.3.2 Crude-oil price volatility cascading to aromatics spreads

- 4.3.3 Capital-intensive isomer separation technology deterring newcomers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Industry Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Isophthalic Acid

- 5.1.2 2,4- and 2,6-Xylidine

- 5.1.3 Solvents

- 5.1.4 Other Applications (Pesticide Intermediates, etc.)

- 5.2 By End-user Industry

- 5.2.1 Construction and Infrastructure

- 5.2.2 Packaging

- 5.2.3 Automotive and Transportation

- 5.2.4 Pharmaceuticals and Agrochemicals

- 5.2.5 Electrical and Electronics

- 5.3 By Purity/Grade

- 5.3.1 Greater than or equal to 99.9 % MX (High-Purity)

- 5.3.2 Industrial-Grade MX

- 5.3.3 Mixed Xylenes Stream

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Avantor, Inc.

- 6.4.2 Chevron Phillips Chemical Company LLC

- 6.4.3 Exxon Mobil Corporation

- 6.4.4 Hengli Petrochemical

- 6.4.5 Honeywell International Inc.

- 6.4.6 JXTG Nippon Oil & Energy

- 6.4.7 LOTTE Chemical CORPORATION

- 6.4.8 MITSUBISHI GAS CHEMICAL COMPANY, INC.

- 6.4.9 Moeve

- 6.4.10 Shell Chemicals

- 6.4.11 S-OIL CORPORATION

- 6.4.12 Suzhou Jiutai Group Co., Ltd.

- 6.4.13 Vizag Chemicals

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment