PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844615

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844615

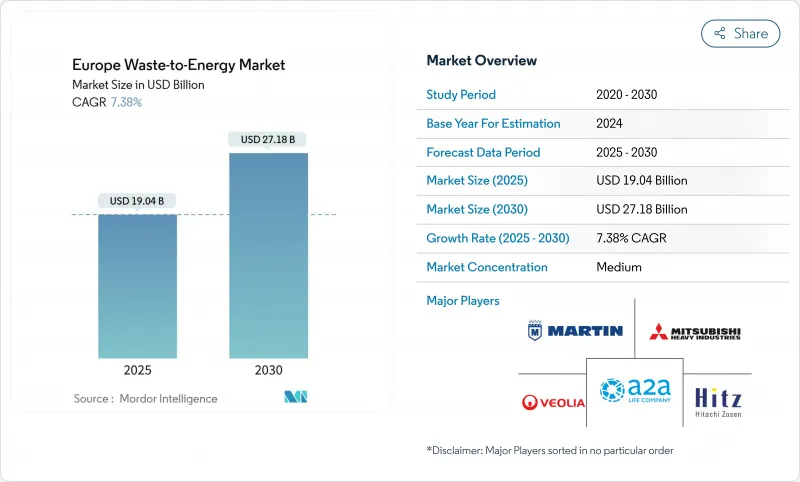

Europe Waste-to-Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe Waste-to-Energy Market size is estimated at USD 19.04 billion in 2025, and is expected to reach USD 27.18 billion by 2030, at a CAGR of 7.38% during the forecast period (2025-2030).

Policy alignment across EU waste and climate directives, shrinking coal capacity, and rising landfill gate fees lift facility utilization rates. Carbon-linked incentives such as the EU Carbon Border Adjustment Mechanism (CBAM) create new revenue streams while district-heating build-outs in Nordic and Central-Eastern Europe improve project bankability. Large-scale plants above 750 tpd gain momentum because scale lowers capture-ready retrofit costs and eases EU Innovation Fund capital access. Public sensitivity toward urban emissions and wholesale power-price softness temper growth have not derailed newbuild pipelines in Germany, Italy, Poland, the Nordics, and the United Kingdom. As a result, the European waste-to-energy market is consolidating its role as a firm capacity provider that drives landfill diversion.

Europe Waste-to-Energy Market Trends and Insights

EU Waste Framework Directive 2018/851 Targets Driving Diversion from Landfill

The Directive caps municipal landfills at 10% by 2035, pushing member states to add thermal capacity for residual waste streams. Landfilled volumes fell 27.5% between 2010-2020, yet 14 nations risk infringement, accelerating procurement for new incineration and anaerobic digestion plants . Poland and Romania prioritize EU cohesion funds to finance turnkey facilities, compressing approval windows to meet the deadline. Because energy recovery sits above disposal in the hierarchy, municipalities justify higher gate fees that improve project returns. Eastern European authorities see waste-to-energy as a twin answer to landfill diversion and winter-peak electricity deficits, underpinning demand across the European waste-to-energy market.

Upcoming EU Carbon Border Adjustment Mechanism Boosting Demand for Waste-Derived Energy Credits

CBAM's full launch in 2026 monetizes avoided emissions when waste-to-energy electricity displaces fossil generation. Facilities demonstrating lower carbon intensity earn premium certificates that industrial buyers must surrender, effectively subsidizing plant revenues. With EU ETS prices trending above EUR 80/tCO2, certificates enhance internal rates of return for new builds. Developers have started embedding advanced flue-gas treatment to verify carbon factors. The mechanism indirectly shields domestic operators because importers of carbon-heavy electricity face equivalent levies, further strengthening the European waste-to-energy market.

Escalating Public Opposition and Litigation in Urban Hubs

Environmental groups leverage the 2024 European Court of Human Rights ruling on climate action to contest permits, lengthening approval processes. Amsterdam halted a planned plant after resident petitions, while Madrid faces similar pushback. Legal uncertainties raise lender risk premiums and oblige developers to prove exhaustive recycling efforts before incineration. Although public-sector owners such as Copenhagen record higher social acceptance, private concessions increasingly include citizen oversight boards. These dynamics slow project roll-outs in dense cities and curb near-term capacity additions within the European waste-to-energy market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Decommissioning of Coal Power Plants in Germany Creating Baseload Demand

- District-Heating Expansion in Nordics & CEE Favouring CHP Plants

- Declining Wholesale Power Prices from Wind & Solar Surge

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thermal routes generated 60% of segment revenue in 2024, driven by established grate combustion fleets spread across 19 EU members. Gasification and pyrolysis pilots now secure EU Innovation Fund support, indicating policy preference for capture-ready designs. The biological cluster grows at a 12.2% CAGR as anaerobic digestion aligns with the REPowerEU biomethane goal of 35 bcm by 2030. Integrated sites that marry front-end sorting with digestion for organics and combustion for refuse-derived fuel cut residual landfill volumes, boosting circularity metrics. The Europe waste-to-energy market size linked to biological solutions is projected to climb from USD 5.4 billion in 2025 to USD 8.2 billion in 2030, underscoring investor appetite for low-carbon gases.

Thermal suppliers such as Hitachi Zosen Inova, Martin GmbH, and Babcock & Wilcox respond by modularising grate lines and embedding oxy-fuel capture ports. Project sponsors now design flue-gas treatment to exceed Industrial Emissions Directive ceilings, shortening later capture integration lead times. Biological technology providers focus on containerized digesters suitable for small municipalities, broadening addressable volumes. Digital controls that adjust air flow, slag handling, and digester retention times raise availability by close to 92%, enhancing revenue resilience across the European waste-to-energy market.

Municipal solid waste (MSW) represented 62% throughput in 2024, thanks to mature collection logistics and minimum disposal mandates. However, agricultural and agro-industrial residues grow 11.4% annually as farmers monetise manure and crop residues to meet the nitrates directives. The European waste-to-energy market size attributable to agricultural feedstock could reach USD 6.7 billion by 2030, supported by gas-grid injection premiums in Italy and Denmark.

Meat-processing offal and cheese whey supply high-yield biogas streams that cut payback to under 12 months, attracting co-operative-owned digesters. Sewage sludge volumes climb with urban population growth and tighter wastewater rules, prompting water utilities to install sludge incinerators for energy self-sufficiency. Commercial and industrial recyclables such as packaging and textiles offer higher calorific value but demand pre-sort robotics to remove PVC and metals. Blended-feed strategies even out calorific swings and secure year-round supply chains, enhancing plant utilization across the European waste-to-energy market.

The Europe Waste-To-Energy Market Report is Segmented by Technology (Physical, Thermal, and Biological), Waste Type (Municipal Solid Waste, Industrial Waste, Agricultural and Agro-Industrial Residues, Sewage Sludge, and Others), Energy Output (Electricity, Heat, and More), End-User (Industrial Captive Plants, Transport Fuel Distributors, and More), and Country (Germany, United Kingdom, Italy, France, Nordic Countries, and More).

List of Companies Covered in this Report:

- Veolia Environnement SA

- SUEZ SA

- Hitachi Zosen Inova AG

- Mitsubishi Heavy Industries Environmental & Chemical Engineering Co.

- Martin GmbH

- A2A SpA

- STEAG Energy Services GmbH

- Wheelabrator Technologies

- EEW Energy from Waste GmbH

- Indaver NV

- AVR Afvalverwerking BV

- Viridor Ltd.

- FCC Environment Ltd.

- Zabalgarbi S.A.

- Tiru S.A. (Paprec Group)

- Cory Group

- Geminor AS

- Remondis SE & Co. KG

- Babcock & Wilcox Volund A/S

- Keppel Seghers Belgium NV

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU Waste Framework Directive 2018/851 Targets Driving Diversion from Landfill

- 4.2.2 Upcoming EU Carbon Border Adjustment Mechanism Boosting Demand for Waste-Derived Energy Credits

- 4.2.3 Rapid Decommissioning of Coal Power Plants in Germany Creating Baseload Demand for WtE Electricity

- 4.2.4 District-Heating Expansion in Nordics & CEE Favouring CHP WtE Plants

- 4.2.5 Rising Gate Fees for Landfill Operations in the UK & France Enhancing WtE Economics

- 4.2.6 EU Innovation-Fund Grants for Carbon-Capture-Ready WtE Facilities

- 4.3 Market Restraints

- 4.3.1 Escalating Public Opposition & Litigation Against Incineration in Urban Hubs (Amsterdam, Madrid)

- 4.3.2 Declining Wholesale Power Prices from Surging Wind & Solar Undermining WtE Revenue

- 4.3.3 Permitting Delays Under the EU Industrial Emissions Directive Increasing Project Lead-Times

- 4.3.4 Competition from Advanced (Chemical) Recycling Stealing Plastic Feedstock Streams

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porters Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Physical (Refuse-Derived Fuel, Mechanical Biological Treatment)

- 5.1.2 Thermal (Incineration/Combustion, Gasification, Pyrolysis and Plasma-Arc)

- 5.1.3 Biological (Anaerobic Digestion, Fermentation)

- 5.2 By Waste Type

- 5.2.1 Municipal Solid Waste (MSW)

- 5.2.2 Industrial Waste

- 5.2.3 Agricultural and Agro-industrial Residues

- 5.2.4 Sewage Sludge

- 5.2.5 Others (Commercial, Construction, Hazardous)

- 5.3 By Energy Output

- 5.3.1 Electricity

- 5.3.2 Heat

- 5.3.3 Combined Heat and Power (CHP)

- 5.3.4 Transportation Fuels (Bio-SNG, Bio-LNG, Ethanol)

- 5.4 By End-user

- 5.4.1 Utilities and Independent Power Producers (IPPs)

- 5.4.2 Industrial Captive Plants

- 5.4.3 District Heating Operators

- 5.4.4 Transport Fuel Distributors

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Nordic Countries (Denmark, Sweden, Finland, Norway)

- 5.5.7 Poland

- 5.5.8 Turkey

- 5.5.9 Russia

- 5.5.10 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Veolia Environnement SA

- 6.4.2 SUEZ SA

- 6.4.3 Hitachi Zosen Inova AG

- 6.4.4 Mitsubishi Heavy Industries Environmental & Chemical Engineering Co.

- 6.4.5 Martin GmbH

- 6.4.6 A2A SpA

- 6.4.7 STEAG Energy Services GmbH

- 6.4.8 Wheelabrator Technologies

- 6.4.9 EEW Energy from Waste GmbH

- 6.4.10 Indaver NV

- 6.4.11 AVR Afvalverwerking BV

- 6.4.12 Viridor Ltd.

- 6.4.13 FCC Environment Ltd.

- 6.4.14 Zabalgarbi S.A.

- 6.4.15 Tiru S.A. (Paprec Group)

- 6.4.16 Cory Group

- 6.4.17 Geminor AS

- 6.4.18 Remondis SE & Co. KG

- 6.4.19 Babcock & Wilcox Volund A/S

- 6.4.20 Keppel Seghers Belgium NV

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment