PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844637

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844637

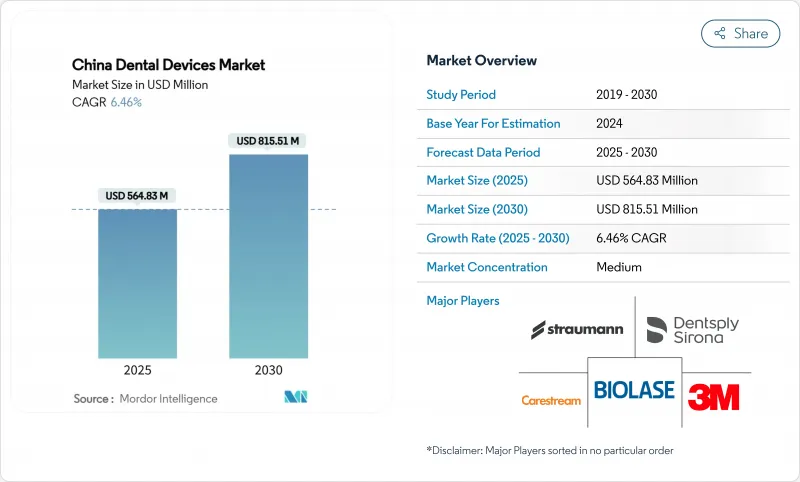

China Dental Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The China dental devices market size stands at USD564.83 million in 2024 and is projected to reach USD815.51 million by 2030, expanding at a 6.46% CAGR during 2025-2030 .

Robust policy support, a fast-growing middle-class, and the rising penetration of digital workflows are steering the sector toward higher-value procedures. Volume-based procurement of implants, the Healthy China 2030 preventive targets, and the burgeoning power of dental service organizations (DSOs) are reshaping pricing, patient access, and procurement norms. Domestic manufacturers are capitalising on these shifts to gain share in tier-2 and tier-3 cities, while global brands defend premium niches through technology leadership. Advanced imaging and chairside CAD/CAM equipment are diffusing rapidly across urban hubs, and clear-aligner therapy is becoming a default orthodontic choice for millennial patients driven by social-media aesthetics.

China Dental Devices Market Trends and Insights

Growing Adoption of Digital Dentistry Workflows in Tier-1 Chinese Cities

Clinics in Beijing, Shanghai, Guangzhou, and Shenzhen are leapfrogging from analogue impressions to fully digital intraoral scanning and CAD/CAM fabrication, cutting treatment-planning time by 60% and lifting case-acceptance rates by 32%. The cloud integration of chairside devices lets practitioners co-design restorations with labs in real time, compressing turnaround from days to hours. Competitive intensity is shifting toward software ecosystems, tilting advantage to vendors able to bundle scanners, mills, and AI design modules as a single subscription. Early technology adopters in these cities influence referral patterns nationwide, accelerating the diffusion of digital tools into tier-2 markets and undergirding long-run demand across the China dental devices market.

Expanding Coverage of Implantology in China's National Medical Insurance Pilot

The first national tender for dental implants reduced average hospital prices by 55%, targeting 2.25 million sets and saving patients an estimated CNY4 billion annually. Implants-once confined to self-pay elites-are now affordable to a broader middle-income cohort, enlarging the addressable pool by 30% through 2030. Hospitals able to guarantee tender volumes benefit from central subsidies, while manufacturers with scalable local capacity win share. As provincial pilots converge into a permanent reimbursement schedule, the China dental devices market experiences a structural shift: value items rise sharply in unit volume, premium systems defend niche positioning through differentiated surface technologies.

Price Pressures from Group Purchasing Organizations on High-end Equipment

Following the implant tender, hospital consortia are extending pooled procurement to CBCT and chairside milling units, compressing average selling prices by up to 35%. Makers respond with tiered portfolios, stripping non-essential features to hit target price points. The policy favours domestic producers with leaner cost structures, eroding premium share for multinationals and moderating overall revenue expansion within the China dental devices market.

Other drivers and restraints analyzed in the detailed report include:

- Aging Population Driving Prosthodontic & Implant Demand in Coastal Provinces

- Cosmetic Consciousness Among Millennials Boosting Demand for Clear Aligners

- Shortage of Trained Oral Radiologists Limiting Imaging Adoption in Lower-Tier Cities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dental consumables commanded 46.51% revenue in 2024, anchored by high-volume implants, crowns, and biomaterials. The national implant tender slashed patient out-of-pocket costs, widening penetration of screw-retained crowns across county hospitals. Consumables are projected to expand at a 3.23% CAGR, sustaining the largest slice of the China dental devices market size through 2030. Diagnostic equipment, though smaller in value, is set for the fastest proportional climb as AI tools elevate chair productivity and enable preventive interventions aligned with Healthy China 2030 targets. AI-guided caries-detection software demonstrated 93.40% accuracy in Chinese clinics, illustrating readiness for widescale rollout.

Cloud-connected intraoral scanners shorten impression workflows and dovetail with chairside mills, encouraging upsell of hybrid ceramic blocks. Therapeutic equipment, notably CAD/CAM systems, finds early traction in high-footfall practices where same-day dentistry boosts patient satisfaction. 'Other devices', including air-polishers and surgical motors, grow steadily as the installed base of private clinics rises above 120,000 nationwide. The interplay among these segments strengthens ecosystem stickiness, reinforcing multi-line revenue flows within the China dental devices market.

The China Dental Devices Market Report is Segmented by Product (Diagnostics Equipment, Therapeutic Equipment, Dental Consumables, Other Dental Devices), Treatment (Orthodontic, Endodontic, Peridontic, Prosthodontic), End User (Dental Hospitals, Dental Clinics, Academic & Research Institutes). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Mindray

- Foshan ANLE Dental Equipment Co., Ltd. (Sinol)

- Ningbo Runyes Medical Instrument Co., Ltd.

- Shanghai Fosun Pharmaceutical Co., Ltd. (Sail Dental)

- Guangdong Huge Dental Material Co., Ltd.

- Align Technology

- Straumann Group

- Dentsply Sirona

- Medit Corporation

- Envista

- GC Corporation

- Ivoclar Vivadent

- Kulzer GmbH (Mitsui Chemicals)

- Planmeca

- Carestream Dental

- Vatech Co., Ltd.

- Shenzhen Upcera Dental Technology Co., Ltd.

- Shandong Huge Dental Material Corporation

- Shanghai Luk Company Ltd

- Runyes Medical Instrument Development Co

- Hangzhou Insert Dental Equipment Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Adoption of Digital Dentistry Workflows in Tier-1 Chinese Cities

- 4.2.2 Expanding Coverage of Implantology in China's National Medical Insurance Pilot

- 4.2.3 Rise of Dental Service Organizations (DSOs) Accelerating Bulk Equipment Procurement

- 4.2.4 Aging Population Driving Prosthodontic & Implant Demand in Coastal Provinces

- 4.2.5 Cosmetic Consciousness Among Millennials Boosting Demand for Clear Aligners

- 4.2.6 Government's "Healthy China 2030" Targets Supporting Preventive Equipment Investments

- 4.3 Market Restraints

- 4.3.1 Price Pressures from Group Purchasing Organizations on High-end Equipment

- 4.3.2 Shortage of Trained Oral Radiologists Limiting Imaging Adoption in Lower-Tier Cities

- 4.3.3 Persistent Import Dependency for High-precision CAD/CAM Materials

- 4.3.4 Regulatory Delays in NMPA Approval for Novel Class III Dental Implants

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (China Dental Devices Market, Value)

- 5.1 By Product

- 5.1.1 Diagnostics Equipment

- 5.1.1.1 Dental Laser

- 5.1.1.1.1 Soft Tissue Lasers

- 5.1.1.1.2 Hard Tissue Lasers

- 5.1.1.2 Radiology Equipment

- 5.1.1.2.1 Extra Oral Radiology Equipment

- 5.1.1.2.2 Intra-oral Radiology Equipment

- 5.1.1.3 Dental Chair and Equipment

- 5.1.2 Therapeutic Equipment

- 5.1.2.1 Dental Hand Pieces

- 5.1.2.2 Electrosurgical Systems

- 5.1.2.3 CAD/CAM Systems

- 5.1.2.4 Milling Equipment

- 5.1.2.5 Casting Machine

- 5.1.2.6 Other Therapeutic Equipments

- 5.1.3 Dental Consumables

- 5.1.3.1 Dental Biomaterial

- 5.1.3.2 Dental Implants

- 5.1.3.3 Crowns and Bridges

- 5.1.3.4 Other Dental Consumables

- 5.1.4 Other Dental Devices

- 5.1.1 Diagnostics Equipment

- 5.2 By Treatment

- 5.2.1 Orthodontic

- 5.2.2 Endodontic

- 5.2.3 Peridontic

- 5.2.4 Prosthodontic

- 5.3 By End User

- 5.3.1 Dental Hospitals

- 5.3.2 Dental Clinics

- 5.3.3 Academic & Research Institutes

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- 6.3.2 Foshan ANLE Dental Equipment Co., Ltd. (Sinol)

- 6.3.3 Ningbo Runyes Medical Instrument Co., Ltd.

- 6.3.4 Shanghai Fosun Pharmaceutical Co., Ltd. (Sail Dental)

- 6.3.5 Guangdong Huge Dental Material Co., Ltd.

- 6.3.6 Align Technology, Inc.

- 6.3.7 Straumann Holding AG

- 6.3.8 Dentsply Sirona Inc.

- 6.3.9 Medit Corporation

- 6.3.10 Envista Holdings Corporation

- 6.3.11 GC Corporation

- 6.3.12 Ivoclar Vivadent AG

- 6.3.12.1 Ivoclar Vivadent AG

- 6.3.13 Kulzer GmbH (Mitsui Chemicals)

- 6.3.14 Planmeca Oy

- 6.3.15 Carestream Dental LLC

- 6.3.16 Vatech Co., Ltd.

- 6.3.17 Shenzhen Upcera Dental Technology Co., Ltd.

- 6.3.18 Shandong Huge Dental Material Corporation

- 6.3.19 Shanghai Luk Company Ltd

- 6.3.20 Runyes Medical Instrument Development Co

- 6.3.21 Hangzhou Insert Dental Equipment Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

- 7.1.1 Integration of Chair-side AI for Early Caries Detection in Community Clinics

- 7.1.2 Locally Manufactured Zirconia Blocks for Cost-effective CAD/CAM Restorations

- 7.1.3 Expansion of Mobile Dental Vans in Rural Western Provinces

- 7.1.4 Subscription-based Equipment-as-a-Service Models for DSOs