PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844644

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844644

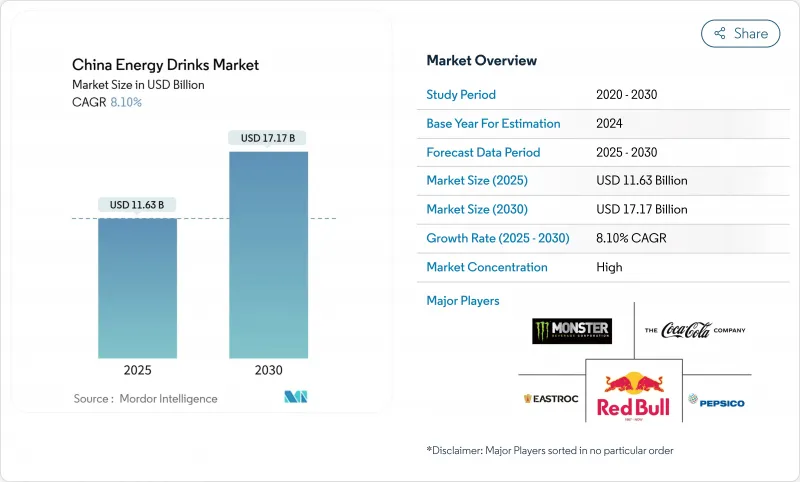

China Energy Drink - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The China energy drinks market, valued at USD 11.63 billion in 2025, is projected to grow significantly, reaching USD 17.17 billion by 2030. This growth represents a CAGR of 8.10% during the forecast period.

The market's expansion is driven by increasing consumer demand for functional beverages that provide instant energy and enhanced performance. Factors such as rising disposable incomes, urbanization, and a growing health-conscious population are further fueling the adoption of energy drinks across the country. Additionally, the introduction of innovative flavors and packaging by key players is expected to attract a broader consumer base, contributing to the market's robust growth trajectory. The growing prevalence of hectic lifestyles, particularly among the younger demographic and working professionals, has amplified the demand for convenient energy-boosting solutions, positioning energy drinks as a preferred choice. Furthermore, the increasing penetration of e-commerce platforms has enhanced product accessibility, enabling manufacturers to reach a wider audience. The market is also witnessing a shift toward sugar-free and natural ingredient-based energy drinks, aligning with the evolving preferences of health-conscious consumers. Key players in the market are actively investing in marketing campaigns and endorsements by celebrities and influencers to strengthen brand visibility and consumer engagement.

China Energy Drink Market Trends and Insights

Product Innovation in Terms of Flavor and Ingredients

In the China energy drink market, product innovation in terms of flavor and ingredients serves as a significant market driver. Manufacturers are increasingly focusing on introducing unique and localized flavors to cater to the diverse taste preferences of Chinese consumers. For instance, flavors inspired by traditional Chinese ingredients, such as goji berries, ginseng, and chrysanthemum, are gaining popularity. Additionally, there is a growing emphasis on incorporating functional ingredients, such as vitamins, minerals, amino acids, and natural extracts, to align with the rising demand for health-conscious and performance-enhancing beverages. These functional ingredients not only provide energy but also offer additional health benefits, such as improved focus, hydration, and recovery, which resonate well with the evolving consumer preferences. Furthermore, the trend of clean-label products is influencing the market, with consumers increasingly seeking beverages free from artificial additives, preservatives, and excessive sugar content. This has prompted manufacturers to explore natural sweeteners, such as stevia and monk fruit, as well as organic and plant-based ingredients to enhance the appeal of their products.

Strong Demand From Fitness-Conscious Consumers

The growing awareness of health and fitness among consumers in China is significantly driving the demand for energy drinks. With an increasing number of individuals adopting active lifestyles and prioritizing physical well-being, energy drinks have become a popular choice to support their fitness goals. These beverages are often marketed as products that enhance energy levels, improve performance, and aid in recovery, making them highly appealing to fitness-conscious consumers. Additionally, the rise in gym memberships, participation in sports, and other physical activities has further fueled the consumption of energy drinks in the country. The increasing prevalence of fitness trends, such as yoga, aerobics, and high-intensity interval training (HIIT), has also contributed to the growing demand for energy drinks, as these beverages are perceived to provide the necessary stamina and hydration required for such activities. Furthermore, the influence of social media and fitness influencers has played a crucial role in promoting energy drinks as an essential part of a healthy and active lifestyle.

Health Concers Over Chemical Ingredients

Health concerns regarding the chemical ingredients used in energy drinks are acting as a significant restraint in the China energy drink market. Consumers are increasingly becoming aware of the potential adverse effects associated with the consumption of synthetic additives, artificial sweeteners, and high caffeine content commonly found in energy drinks. This growing awareness is leading to a shift in consumer preferences toward healthier and more natural alternatives. Additionally, regulatory bodies are imposing stricter guidelines and monitoring the use of chemical ingredients in energy drinks, further impacting the market. Manufacturers are facing challenges in reformulating their products to meet these evolving consumer demands and regulatory standards, which is hindering the market's growth potential. Furthermore, the increasing prevalence of health issues such as obesity, diabetes, and cardiovascular diseases, which are often linked to the excessive consumption of energy drinks, is amplifying these concerns.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Urbanization Driving the Market Growth

- Increasing Youth Population

- Rising Awareness Against Sugar

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In the China energy drink market, traditional energy drinks dominate with a substantial 92.45% market share in 2024. This dominance highlights the segment's robust distribution infrastructure and the strong consumer preference for conventional energy drink formats. These drinks benefit from widespread availability across various retail channels, including supermarkets, convenience stores, and online platforms, ensuring easy access for consumers. Their established brand presence, coupled with extensive marketing campaigns, has solidified their position as a go-to energy solution for a diverse consumer base. Traditional energy drinks cater to a wide demographic, including athletes, students, and working professionals, who rely on these beverages for a quick and reliable energy boost.

Conversely, the shots segment is emerging as the fastest-growing category in the market, with an impressive 8.45% CAGR projected through 2030. This growth is driven by increasing consumer demand for compact and concentrated energy solutions that offer convenience and precise dosing. Energy shots are particularly appealing to urban consumers with fast-paced lifestyles, as they provide the same energy benefits as traditional drinks but in smaller, portable volumes. These products are often marketed as premium offerings, with innovative formulations that include natural ingredients, added nutrients, or functional benefits, such as improved focus or endurance. The willingness of consumers to pay higher per-unit prices for these attributes reflects a growing trend toward functional and on-the-go energy products in China.

In 2024, cans dominate the China energy drink market, holding a significant 77.35% market share. This dominance is attributed to their superior shelf stability, which ensures longer product life and consistent quality. Additionally, cans offer excellent brand visibility, making them a preferred choice for manufacturers aiming to capture consumer attention on retail shelves. Global brands like Red Bull and Monster have played a pivotal role in associating cans with premium energy drink experiences, further solidifying their position in the market. The lightweight and recyclable nature of cans also contribute to their widespread adoption, aligning with the growing focus on convenience and environmental considerations.

Conversely, PET and glass bottles are emerging as the fastest-growing segment in the China energy drink market, with a robust CAGR of 8.63% projected through 2030. This growth is primarily driven by increasing consumer awareness of sustainability and the environmental impact of packaging materials. PET and glass bottles are perceived as more eco-friendly options, particularly when paired with advancements in recycling technologies. Furthermore, their resealable design supports multiple consumption occasions, catering to the evolving lifestyles of consumers who prefer on-the-go and portion-controlled drinking. These factors, combined with the rising demand for premium and customizable packaging, are propelling the adoption of PET and glass bottles in the market.

The China Energy Drink Market Report is Segmented by Product Type (Drinks, Shots, and Mixers), Packaging Type (PET/Glass Bottles, Cans, and Other Packaging Types), Ingredient (Conventional and Natural/Organic), and Distribution Channel (On-Trade and Off-Trade). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Red Bull GmbH

- PepsiCo, Inc.

- The Coca-Cola Company

- Monster Beverage Corporation

- Eastroc Beverage Co., Ltd.

- Hangzhou Wahaha Group Co., Ltd.

- Dali Foods Group Co., Ltd.

- Jinmailang Beverage Co., Ltd.

- Taisho Pharmaceutical Holdings Co., Ltd.

- Hangzhou Brillante Industrial Enterprise Co., Ltd.

- Otsuka Pharmaceutical Co., Ltd.

- Carabao Group PCL

- Nongfu Spring Co., Ltd.

- Uni-President China Holdings Ltd.

- Alien Energy (Yuanqi Forest)

- HeiKa 6-Hour Energy

- War Horse

- Celsius Beijing

- Jianlibao Group Co., Ltd.

- Celsius

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Product Innovation in Terms of Flavor and Ingredients

- 4.2.2 Rising Influence of Endorsements and Social Media Marketing

- 4.2.3 Strong Demand From Fitness-Conscious Consumers

- 4.2.4 Growing Demand For On-The-Go Healthy Beverages

- 4.2.5 Rapid Urbanization Driving the Market Growth

- 4.2.6 Increasing Youth Population

- 4.3 Market Restraints

- 4.3.1 Health Concers Over Chemical Ingredients

- 4.3.2 Consumer Inclination Towards Fresh Juice Products

- 4.3.3 Intense Market Competition

- 4.3.4 Risin Awareness Against Sugar

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Drinks

- 5.1.2 Shots

- 5.1.3 Mixers

- 5.2 By Packaging Type

- 5.2.1 PET/Glass Bottles

- 5.2.2 Cans

- 5.2.3 Other Packaging Types

- 5.3 By Ingredient

- 5.3.1 Conventional

- 5.3.2 Natural/Organic

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Convenience Stores/Grocery Stores

- 5.4.2.2 Supermarkets/Hypermarkets

- 5.4.2.3 Online Retail Stores

- 5.4.2.4 Others Distribution Channel

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Red Bull GmbH

- 6.4.2 PepsiCo, Inc.

- 6.4.3 The Coca-Cola Company

- 6.4.4 Monster Beverage Corporation

- 6.4.5 Eastroc Beverage Co., Ltd.

- 6.4.6 Hangzhou Wahaha Group Co., Ltd.

- 6.4.7 Dali Foods Group Co., Ltd.

- 6.4.8 Jinmailang Beverage Co., Ltd.

- 6.4.9 Taisho Pharmaceutical Holdings Co., Ltd.

- 6.4.10 Hangzhou Brillante Industrial Enterprise Co., Ltd.

- 6.4.11 Otsuka Pharmaceutical Co., Ltd.

- 6.4.12 Carabao Group PCL

- 6.4.13 Nongfu Spring Co., Ltd.

- 6.4.14 Uni-President China Holdings Ltd.

- 6.4.15 Alien Energy (Yuanqi Forest)

- 6.4.16 HeiKa 6-Hour Energy

- 6.4.17 War Horse

- 6.4.18 Celsius Beijing

- 6.4.19 Jianlibao Group Co., Ltd.

- 6.4.20 Celsius

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK