PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844649

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844649

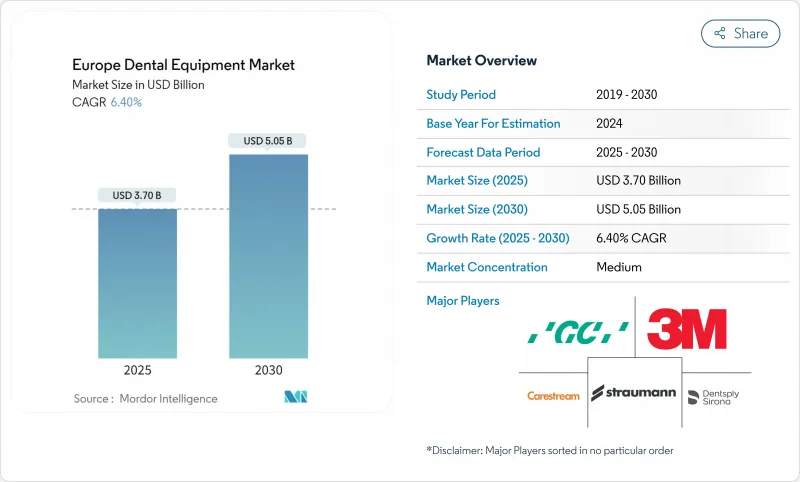

Europe Dental Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe Dental Equipment Market size is estimated at USD 3.70 billion in 2025, and is expected to reach USD 5.05 billion by 2030, at a CAGR of 6.4% during the forecast period (2025-2030).

Demand is propelled by the convergence of chairside digital workflows with AI-powered diagnostics, which shortens treatment cycles and improves clinical accuracy. Strong uptake of3D printing for customized prosthetics, coupled with growing preference for biomimetic and zirconia materials, is reshaping restorative procedures. Country-level dynamics also matter: Germany's engineering base anchors equipment manufacturing, while the UnitedKingdom's private-practice boom is accelerating premium device investment. Meanwhile, the new Medical Devices Regulation (MDR) is tightening quality standards and lengthening approval timelines, nudging clinics toward trusted multinational suppliers and well-documented devices health.

Europe Dental Equipment Market Trends and Insights

Increasing Incidence of Dental Diseases

The Europe dental equipment market is heavily influenced by a rising disease burden that now affects more than half of the region's adults who.int. Dental caries alone afflict 33.6% of residents, while 25.2% experience significant tooth loss, generating steady demand for restorative devices and imaging systems. Severe periodontitis cases are projected to escalate through 2050, prompting practices to adopt advanced periodontal probes and portable diagnostic units. Refugee cohorts amplify unmet need: 84% of Ukrainian children examined in Italy showed caries, underscoring the requirement for mobile X-ray and preventive technologies . Collectively, these epidemiological pressures are set to lift unit shipments across consumables, scalers, and CAD/CAM-enabled prosthetics.

Innovation in Dental Products

Biomimetic glass ionomer cements and nanofilled composite resins are improving longevity of restorations, lowering retreatment rates, and reducing chair time materials-journal.com. Natural polymers such as chitosan and collagen now underpin guided tissue regeneration membranes, boosting clinical adoption of compatible delivery equipment materials-journal.com. Equipment vendors are integrating dedicated dispensers and curing lights optimized for these new chemistries. Zirconium dioxide implants act as optical waveguides that allow photodynamic biofilm inactivation, cutting bacterial counts by as much as 85% and opening opportunities for laser-ready implant handpieces microorganisms-journal.com. As R&D pipelines widen, suppliers that bundle consumables with application devices stand to capture recurring revenue streams across the Europe dental equipment market.

Lack of Proper Reimbursement of Dental Care

Fragmented national coverage models hinder uniform technology rollouts. France reimburses only 60% of basic consultations, dampening appetite for premium imaging upgrades among smaller practices. Denmark requires adults to pay 60% of fees, while Sweden's tiered subsidy introduces copay uncertainty, blunting early adoption of high-cost lasers nhwstat.org. UK clinics, grappling with constrained NHS budgets, face reduced capital reserves, as evidenced by practices in Sheffield struggling to service recent expansion loans. As a result, leasing and pay-per-use models are gaining ground within the Europe dental equipment market.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand for Cosmetic Dentistry

- Technological Advancements in Dental Solutions

- High Cost of Surgeries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Europe dental equipment market size data show dental consumables captured 58.50% revenue share in 2024 on the back of recurring purchase cycles and procedural indispensability. Natural biomaterials such as alginate, cellulose, and hydroxyapatite are winning clinician favor for their biocompatibility, pushing suppliers to introduce pre-dosed cartridges that simplify chairside handling materials. The Europe dental equipment industry is simultaneously witnessing a leap in smart dispensers that track usage and automate reordering, reducing stockouts.

General and diagnostics equipment, although smaller by revenue, is posting the fastest 8.07% CAGR through 2030 as AI-ready intraoral scanners and CBCT units become routine for treatment planning. Lasers represent the most dynamic subcategory because Er:YAG systems now enable flapless extractions, while diode-laser periodontal adjuncts deliver measurable reductions in probing depth. Suppliers focused on bundling consumables with diagnostics-such as infection-control kits packaged with imaging sensors-stand to deepen wallet share in the Europe dental equipment market.

The Europe Dental Equipment Market Report Segments the Industry Into by Product (General and Diagnostics Equipment, Dental Consumables and More), by Treatment (Orthodontic, Endodontic, Peridontic, Prosthodontic), by End User (Dental Hospitals, Dental Clinics, and More), and Geography (Germany, United Kingdom, France, Italy, Spain, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Dentsply Sirona

- Envista Holdings (KaVo Kerr)

- Planmeca

- Straumann Group

- Align Technology

- 3M Oral Care

- Ivoclar Vivadent

- GC Corporation

- Vatech Co., Ltd.

- Acteon Group

- Carestream Dental

- A-dec

- Midmark

- Coltene Holding

- Ultradent Products

- DentalEZ Group

- Nobel Biocare Services

- Anthogyr

- VOCO

- Osstem Implant Co.

- Eurodent Srl

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Incidence of Dental Diseases

- 4.2.2 Innovation in Dental Products

- 4.2.3 Increasing Demand for Cosmetic Dentistry

- 4.2.4 Technological Advancements in Dental Solutions

- 4.2.5 Government-sponsored oral-health screening programs expanding imaging fleet in Nordics

- 4.2.6 Orthodontic tourism inflow to Spain & Hungary boosting demand for digital intra-oral scanners

- 4.3 Market Restraints

- 4.3.1 Lack of Proper Reimbursement of Dental Care

- 4.3.2 High Cost of Surgeries

- 4.3.3 Shortage of trained CAD/CAM technicians in CEE slows lab automation uptake

- 4.3.4 Price compression in entry-level handpieces due to Asian OEM influx

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 General and Diagnostics Equipment

- 5.1.1.1 Dental Laser

- 5.1.1.1.1 Soft Tissue Lasers

- 5.1.1.1.2 Hard Tissue Lasers

- 5.1.1.2 Radiology Equipment

- 5.1.1.2.1 Extra Oral Radiology Equipment

- 5.1.1.2.2 Intra-oral Radiology Equipment

- 5.1.1.3 Dental Chair and Equipment

- 5.1.1.4 Other General and Diagnostic equipment

- 5.1.2 Dental Consumables

- 5.1.2.1 Dental Biomaterial

- 5.1.2.2 Dental Implants

- 5.1.2.3 Crowns and Bridges

- 5.1.2.4 Other Dental Consumables

- 5.1.3 Other Dental Devices

- 5.1.1 General and Diagnostics Equipment

- 5.2 By Treatment

- 5.2.1 Orthodontic

- 5.2.2 Endodontic

- 5.2.3 Peridontic

- 5.2.4 Prosthodontic

- 5.3 By End User

- 5.3.1 Dental Hospitals

- 5.3.2 Dental Clinics

- 5.3.3 Academic & Research Institutes

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Dentsply Sirona

- 6.3.2 Envista Holdings (KaVo Kerr)

- 6.3.3 Planmeca Oy

- 6.3.4 Straumann Group

- 6.3.5 Align Technology, Inc.

- 6.3.6 3M Oral Care

- 6.3.7 Ivoclar Vivadent

- 6.3.8 GC Corporation

- 6.3.9 Vatech Co., Ltd.

- 6.3.10 Acteon Group

- 6.3.11 Carestream Dental LLC

- 6.3.12 A-dec Inc.

- 6.3.13 Midmark Corporation

- 6.3.14 Coltene Holding AG

- 6.3.15 Ultradent Products Inc.

- 6.3.16 DentalEZ Group

- 6.3.17 Nobel Biocare Services AG

- 6.3.18 Anthogyr SAS

- 6.3.19 VOCO GmbH

- 6.3.20 Osstem Implant Co.

- 6.3.21 Eurodent Srl

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment