PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844661

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844661

Bio-alcohols - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

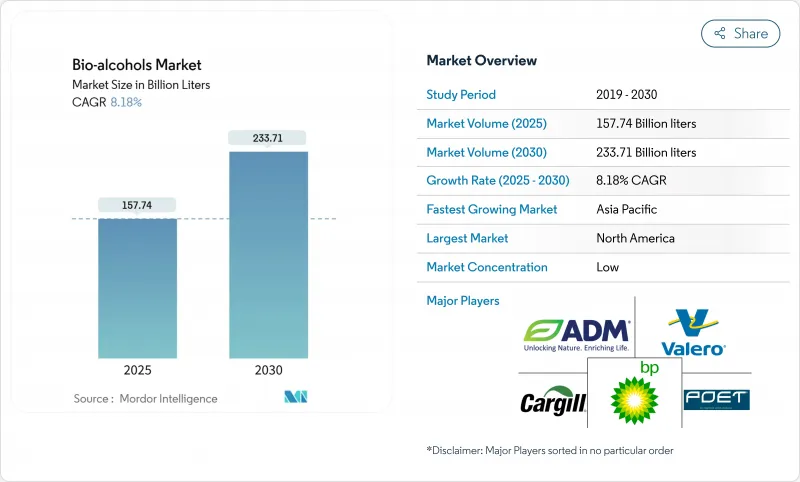

The Bio-alcohols Market size is estimated at 157.74 billion liters in 2025, and is expected to reach 233.71 billion liters by 2030, at a CAGR of 8.18% during the forecast period (2025-2030).

This growth reflects tightening renewable-fuel rules, quick progress in alcohol-to-jet certification, and the arrival of commercial carbon-capture-to-alcohol systems that give refiners fresh revenue while cutting emissions. Demand is also being reshaped by sustainable marine-fuel corridors, premium chemical uses in consumer goods, and stronger investor appetite for low-carbon supply chains. Established North American producers keep scale advantages, yet Asia-Pacific is adding capacity faster thanks to policy tailwinds and cost-optimized technologies. Feedstock innovation, especially with algae and industrial off-gases, is helping moderate margin risks linked to crop price swings, while strategic offtake deals with airlines and shippers give investors cash-flow clarity.

Global Bio-alcohols Market Trends and Insights

Mandated Ethanol-Blend Targets

Blend mandates guarantee demand, reduce investor risk, and speed plant expansions. India's goal of 30% blending by 2030, having already reached 20%, shows the upside that ambitious policy can unlock. The EU's ReFuelEU Aviation rule starts with 2% SAF in 2025 and rises to 70% by 2050, offering a clear runway for alcohol-to-jet projects. Brazil's E27 program remains a template for high blend ratios once logistics barriers ease. Because mandates shield volumes from commodity swings, producers can line up long-term feedstock contracts and lower financing costs.

Rapid Airline SAF Certification of Alcohol-to-Jet Pathways

Aviation's net-zero push has sharply accelerated testing of alcohol-to-jet routes. LanzaJet's Freedom Pines Fuels site in Georgia already makes 9 million gallons a year and gives financiers confidence that large plants will run reliably. Axens' Jetanol projects now top 1 billion gallons per year of planned capacity, underlining the technology's bankability. SAF often sells at two to three times the price of conventional jet fuel, so bio-ethanol producers enjoy wider margins when they pivot toward aviation customers. Long-term airline offtake deals, such as Southwest's agreement with USA BioEnergy, further derisk project cash flows.

Insufficient Pipeline Compatibility for High-Blend Alcohols

Most petroleum pipelines cannot handle high alcohol blends due to corrosion and water uptake, forcing reliance on truck or rail. The extra logistics cost erodes delivered-price competitiveness, especially in regions far from blending terminals. Upgrading lines needs cooperation between many owners and warrants high capital that some markets cannot justify yet.

Other drivers and restraints analyzed in the detailed report include:

- Integration of CO2-to-Alcohol CCU Plants at Refineries

- Bio-Alcohol as Low-Carbon Chemical Feedstock in CPG

- Stagnant Global Light-Vehicle Production Post-2027

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bio-ethanol kept a 68.05% 2024 Bio-alcohol market share, underpinned by mature plants, standardized specs, and supportive mandates. Its conversion cost edge and global supply chain reinforce leadership. The Bio-alcohol market size for bio-ethanol is expected to expand steadily in line with nationwide blend limits that increase absolute volume even as gasoline peaks. Yet bio-butanol's superior energy density and drop-in compatibility are propelling its 9.40% CAGR and a rising slice of premium chemical demand.

Alcohol-to-jet breakthroughs provide a higher-value outlet for ethanol. LanzaJet's early operating data confirm that low-cost agricultural ethanol can be upgraded into SAF that sells at a 2-3X price multiple. Meanwhile, bio-methanol is carving room in marine fuels and plastics, and bio-BDO caters to pharmaceutical and engineered-material niches. Collectively, specialty alcohols diversify the Bio-alcohol market and lessen sensitivity to road-fuel swings.

The Bio-Alcohol Market Report is Segmented by Product Type (Bio-Methanol, Bio-Ethanol, Bio-Butanol, Bio-BDO, and More), Feedstock (Starch-Based Crops, Sugar-Based Crops, Lignocellulosic Biomass, and More), Application (Transportation, Construction, Electronics, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Liters).

Geography Analysis

North America's 39.44% 2024 share mirrors its dense corn-to-ethanol corridor, ample rail logistics, and the Renewable Fuel Standard that keeps baseline volumes. Canada's 2025 Clean Fuel Regulation widens demand for low-carbon blends beyond the United States. Mexico's new mill investments knit the continent into a self-reinforcing supply chain. Summit Next Gen's USD 1.6 billion Texas ethanol-to-SAF complex, eligible for JETI subsidies, underlines how local grants align with federal tax credits to lure mega-projects.

Asia-Pacific is the growth engine, tracking a 9.55% CAGR on the back of India's fast-tracked 30% blend agenda and record rice-feedstock pull. China adds momentum by funding CO2-to-alcohol pilots that dovetail with its 2060 neutrality plan, while Japan and South Korea channel green-fuel incentives at refineries and airports. ASEAN markets, including the Philippines, are lifting blending rules too, keeping regional demand broad-based. This policy updraft attracts joint ventures that stitch together local feedstock with imported technology, accelerating capacity rollout.

Europe moves with stringent carbon-pricing and SAF mandates that jump-start premium niches. The ReFuelEU rulebook gives investors clarity on future SAF ramp-ups, while Germany and the UK run national subsidies to ensure domestic production. Feedstock flexibility, including sugar beet and waste biomass, helps buffer supply shocks. South America continues leveraging cheap sugarcane and advanced second-generation mills that process bagasse, supporting steady export flows to deficit regions. The Middle East and Africa, though smaller, are piloting projects as part of diversification strategies.

- Abengoa

- ADM

- BASF SE

- BP p.l.c.

- Cargill Incorporated

- CropEnergies AG

- Gevo

- Green Plains Inc.

- INEOS

- Mascoma LLC

- POET LLC

- Raizen

- SEKISUI CHEMICAL CO., LTD.

- Valero Energy Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandated ethanol-blend targets

- 4.2.2 Rapid airline SAF certification of Alcohol-to-Jet pathways

- 4.2.3 Integration of CO2 to alcohol CCU plants at refineries

- 4.2.4 Bio-alcohol use as low-carbon chemical feedstock in CPG

- 4.2.5 Emerging methanol-powered shipping corridors

- 4.3 Market Restraints

- 4.3.1 Feedstock price volatility

- 4.3.2 Insufficient pipeline compatibility for high-blend alcohols

- 4.3.3 Stagnant global light-vehicle production post-2027

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Bio-Methanol

- 5.1.2 Bio-Ethanol

- 5.1.3 Bio-Butanol

- 5.1.4 Bio-BDO

- 5.1.5 Other Bio-Alcohols

- 5.2 By Feedstock

- 5.2.1 Starch-based Crops

- 5.2.2 Sugar-based Crops

- 5.2.3 Lignocellulosic Biomass

- 5.2.4 Algal Biomass

- 5.2.5 Industrial Off-gases and MSW

- 5.3 By Application

- 5.3.1 Transportation

- 5.3.2 Construction

- 5.3.3 Electronics

- 5.3.4 Pharmaceuticals

- 5.3.5 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Abengoa

- 6.4.2 ADM

- 6.4.3 BASF SE

- 6.4.4 BP p.l.c.

- 6.4.5 Cargill Incorporated

- 6.4.6 CropEnergies AG

- 6.4.7 Gevo

- 6.4.8 Green Plains Inc.

- 6.4.9 INEOS

- 6.4.10 Mascoma LLC

- 6.4.11 POET LLC

- 6.4.12 Raizen

- 6.4.13 SEKISUI CHEMICAL CO., LTD.

- 6.4.14 Valero Energy Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment