PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907328

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907328

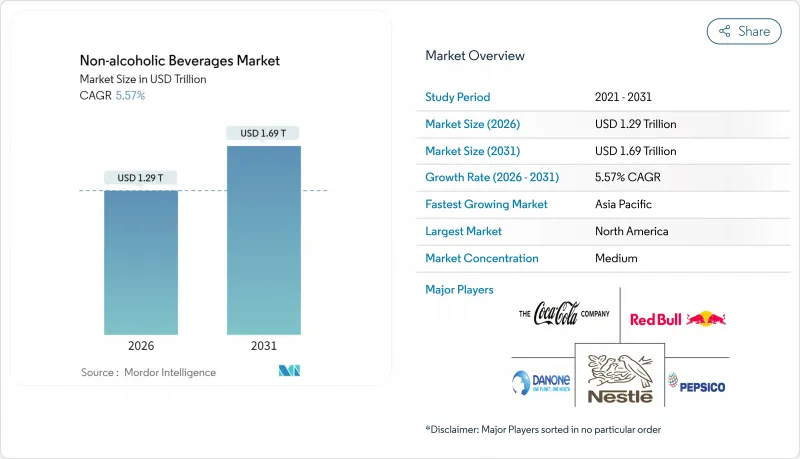

Non-alcoholic Beverages - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The non-alcoholic beverages market is expected to grow from USD 1.22 trillion in 2025 to USD 1.29 trillion in 2026 and is forecast to reach USD 1.69 trillion by 2031 at 5.57% CAGR over 2026-2031.

This growth trajectory is driven by a combination of increasing consumer health consciousness, regulatory approvals favoring natural ingredients, and rapid product innovation across nine distinct beverage categories. Energy drinks and plant-based alternatives are emerging as the fastest-growing segments, as consumers increasingly prioritize beverages offering functional health benefits. Simultaneously, traditional carbonated beverages are expanding their market presence through the introduction of premium, smaller-packaged products designed to cater to evolving consumer preferences. Regulatory developments are further accelerating market growth. The competitive landscape remains intense, with established global players striving to maintain their market dominance while contending with agile, innovative disruptors. This dynamic environment is also characterized by ongoing consolidation activities aimed at strengthening market positions. From a geographical perspective, North America continues to hold the largest market share, driven by mature consumer markets and high disposable incomes.

Global Non-alcoholic Beverages Market Trends and Insights

Surge in demand for functional and fortified beverages

Functional beverages, which were once considered a niche category, have now transitioned into the mainstream market, driven by growing consumer demand for products that offer health benefits such as enhanced immunity, improved cognitive function, and better gut health. Consumers are increasingly willing to pay premium prices for these value-added offerings. The Asia-Pacific region is leading this shift, with Thailand's implementation of a sugar-tax framework encouraging consumers to opt for low-sugar, nutrient-dense alternatives. In response, brands are innovating by incorporating ingredients like electrolytes, probiotics, and adaptogens into product categories such as waters and teas. Additionally, the recent FDA guidance on plant-based milk labeling has provided clarity on nutrient disclosure requirements, reducing the risks associated with product innovation in this segment. Furthermore, the consumers identify reduced-sugar options as a key factor influencing their purchasing decisions, indicating that this trend is poised for sustained growth rather than being a short-term phenomenon.

Product innovation in terms of flavor and ingredients

The flavor innovation landscape is intensifying. The FDA's 2024 ban on brominated vegetable oil has necessitated product reformulations, while the anticipated 2025 approval of butterfly-pea and galdieria blues is expected to unlock new opportunities for natural formulations with enhanced visual appeal. European companies are leveraging botanical, spice, and hybrid fruit profiles to establish premium positioning. Emerging flavor combinations (e.g., exotic fruits, herbs, spices) are tailored to meet specific consumer preferences or moods, offering a sense of personalization. In mature markets such as carbonated soft drinks and iced teas, innovation in flavors and ingredients is critical for differentiation. Regular flavor launches and seasonal editions help maintain portfolio relevance and encourage repeat purchases. For instance, in February 2025, Keurig Dr Pepper introduced bold new flavors across its U.S. cold beverages portfolio, including Dr Pepper Blackberry as a permanent addition, combining the brand's signature 23 flavors with a blackberry twist.

Health concerns over excessive use of sugar and other chemical ingredients

As regulatory pressures escalate through taxation and marketing restrictions, businesses face formulation challenges in aligning consumer taste preferences with health-focused product positioning. The WHO's analysis of sugar-sweetened beverage taxation in Saudi Arabia and the UAE highlights the effectiveness of such measures. For instance, a 50% excise tax could reduce childhood overweight prevalence in Saudi Arabia from 38.2% to 34.4% and in the United Arab Emirates from 37.0% to 34.6% by 2030 . Regulatory scrutiny now includes preservatives and additives, with the FDA updating post-market review processes, impacting beverage formulations. Consumer awareness, driven by social media, increases reputational risks for brands linked to controversial ingredients. While these measures mainly affect developed markets, emerging economies are adopting similar policies due to urbanization and rising non-communicable diseases. Companies are reformulating products with natural sweeteners and functional ingredients, though these alternatives often raise costs and alter taste, affecting consumer acceptance.

Other drivers and restraints analyzed in the detailed report include:

- Strong influence of social media and celebrity endorsement

- Growing fitness culture and sports participation rate

- High production costs for premium non-alcoholic beverages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, carbonated soft drinks commanded a dominant 33.10% share of the non-alcoholic beverage market. Yet, as consumers gravitate towards low-sugar, functional alternatives, this segment grapples with challenges. In response, brands are reformulating and innovating, pivoting towards healthier options. Energy drinks, sharing a consumer base with carbonated beverages, thrive on bold flavors, functional claims, and a premium market stance. Juices, however, are waning in popularity, sidelined by rising sugar concerns and a shift towards whole fruits. Bottled water stands resilient, buoyed by premiumization trends and the emergence of functional variants like alkaline and electrolyte-infused options.

Plant-based milk is on a growth trajectory, projected to expand at a robust CAGR of 5.95% through 2031. This surge is fueled by rising lactose intolerance, heightened sustainability awareness, and improvements in flavor and nutrition. Anticipated by June 2025, the FDA's draft guidance on plant-based milk alternatives promises regulatory clarity, potentially amplifying market confidence and spurring innovation. Beyond milk, dairy alternatives like oat- and almond-based beverages are gaining traction. Ready-to-drink (RTD) tea and coffee are seizing the spotlight, driven by younger consumers' cravings for convenience and caffeine, marking a departure from traditional hot drinks.

In 2025, PET and glass bottles together commanded a dominant 71.55% share of the beverage packaging market, driven by strong consumer preference for product visibility, shelf appeal, and recyclability. PET remains popular for its cost-effectiveness and light weight, while glass holds ground in premium and health-positioned beverages due to its inert properties and perception of purity. Aluminum cans continue to register steady growth, especially in the energy drink and carbonated beverage segments, where durability, branding potential, and infinite recyclability align with both manufacturer and consumer priorities. Regulatory shifts, such as Singapore's Beverage Container Return Scheme mandating producer responsibility by 2026, highlight growing policy support for packaging with robust recycling ecosystems.

Tetra pak is emerging as the fastest-growing format, projected to grow at a CAGR of 5.74%, buoyed by its sustainability credentials and ability to facilitate ambient storage. This reduces cold chain dependence, cutting logistics costs and environmental impactckey advantages for both manufacturers and retailers. The brand's Factory Sustainable Solutions initiative furthers its value proposition by helping beverage producers meet energy and water efficiency goals. Other formats like pouches and specialty containers cater to niche applications where portability or barrier protection is critical; however, their broader market adoption is limited by low consumer familiarity and fragmented recycling infrastructure.

The Non-Alcoholic Beverages Market Report is Segmented Into Product Type (Energy Drinks, Sports Drinks, Juices, and More), Packaging Type (PET/Glass Bottles, Cans, Tetra Pack, Others), Category (Conventional, Free-From), Distribution Channel (On-Trade, Off-Trade), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Liters).

Geography Analysis

In 2025, North America accounted for a 26.20% share of the non-alcoholic beverages market. This performance is driven by high per-capita expenditure and the rapid adoption of Free-From, functional, and plant-based product lines. E-commerce penetration has reached double digits, with omnichannel retailers integrating curbside pickup and app-based loyalty programs. This strategy supports premium pricing resilience despite inflationary pressures. A well-established cold-chain infrastructure underpins the growth of RTD coffee and dairy alternatives, while localized canning investments enhance supply chain efficiency by reducing lead times.

Asia-Pacific, projected to grow at a CAGR of 7.02%, is emerging as the primary growth driver for the non-alcoholic beverages market. Increasing urbanization and rising disposable incomes are shifting consumer preferences from boiled water and home-brewed tea to branded RTDs. Government initiatives, such as sugar taxes and nutrition-label mandates, are accelerating the transition to reduced-sugar carbonates and fortified waters. While China and India dominate in terms of volume, Japan and South Korea are developing high-value segments, including amino-acid sports drinks and functional lattes. Thailand's excise reforms highlight the role of fiscal policies in shaping category dynamics.

Europe combines regulatory leadership with a mature market landscape. The Union of European Beverage Associations is targeting a 10% reduction in sugar content by 2025, prompting brands to adopt alternatives such as stevia and monk-fruit sweeteners. Sustainability initiatives are gaining traction, with Scandinavian supermarkets piloting refill stations that could potentially expand across the continent. South America exhibits varied market dynamics. Inflation-driven price sensitivity sustains demand for carbonated multi-packs, while urban millennials are increasingly exploring energy drinks that offer mood and focus benefits.

- The Coca-Cola Company

- PepsiCo Inc.

- Nestle S.A.

- Danone S.A.

- Keurig Dr Pepper Inc.

- Monster Beverage Corp.

- Red Bull GmbH

- Parle Agro Pvt. Ltd.

- AriZona Beverages USA

- Carlsberg Group

- Suntory Holdings Ltd.

- National Beverage Corp.

- Asahi Group Holdings

- Heineken N.V.

- Lyre's Spirit Co.

- Hint Inc.

- Talking Rain Beverage Co.

- Celsius Holdings Inc.

- Oatly Group AB

- Ocean Spray Cranberries Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in demand for functional and fortified beverages

- 4.2.2 Product innovation in terms of flavor and ingredients

- 4.2.3 Strong influence of social media and celebrity endorsement

- 4.2.4 Growing fitness culture and sports participation rate

- 4.2.5 Rising health consciousness among consumers boosts demand.

- 4.2.6 Expansion of e-commerce platforms enhances product accessibility.

- 4.3 Market Restraints

- 4.3.1 Health concerns over excessive use of sugar and other chemical ingredients

- 4.3.2 Growing prominence of healthy and safe options

- 4.3.3 High production costs for premium non-alcoholic beverages

- 4.3.4 Limited shelf life of certain non-alcoholic products

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE/VOLUME)

- 5.1 By Product Type

- 5.1.1 Energy Drinks

- 5.1.2 Sports Drinks

- 5.1.3 Juices

- 5.1.4 Bottled Water

- 5.1.5 Carbonated Soft Drinks

- 5.1.6 RTD Tea and Coffee

- 5.1.7 Dairy Alternative Drinks

- 5.1.8 Dairy Based Beverages

- 5.1.9 Other Product Types

- 5.2 By Packaging Type

- 5.2.1 PET/Glass Bottles

- 5.2.2 Cans

- 5.2.3 Tetra Pack

- 5.2.4 Others

- 5.3 By Category

- 5.3.1 Conventional

- 5.3.2 Free-From

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Supermarkets/Hypermarkets

- 5.4.2.2 Convenience/Grocery Stores

- 5.4.2.3 Online Retail Stores

- 5.4.2.4 Others Distribution Channel

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Spain

- 5.5.2.5 Netherlands

- 5.5.2.6 Italy

- 5.5.2.7 Sweden

- 5.5.2.8 Norway

- 5.5.2.9 Russia

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Vietnam

- 5.5.3.7 Indonesia

- 5.5.3.8 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 The Coca-Cola Company

- 6.4.2 PepsiCo Inc.

- 6.4.3 Nestle S.A.

- 6.4.4 Danone S.A.

- 6.4.5 Keurig Dr Pepper Inc.

- 6.4.6 Monster Beverage Corp.

- 6.4.7 Red Bull GmbH

- 6.4.8 Parle Agro Pvt. Ltd.

- 6.4.9 AriZona Beverages USA

- 6.4.10 Carlsberg Group

- 6.4.11 Suntory Holdings Ltd.

- 6.4.12 National Beverage Corp.

- 6.4.13 Asahi Group Holdings

- 6.4.14 Heineken N.V.

- 6.4.15 Lyre's Spirit Co.

- 6.4.16 Hint Inc.

- 6.4.17 Talking Rain Beverage Co.

- 6.4.18 Celsius Holdings Inc.

- 6.4.19 Oatly Group AB

- 6.4.20 Ocean Spray Cranberries Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK