PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844686

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844686

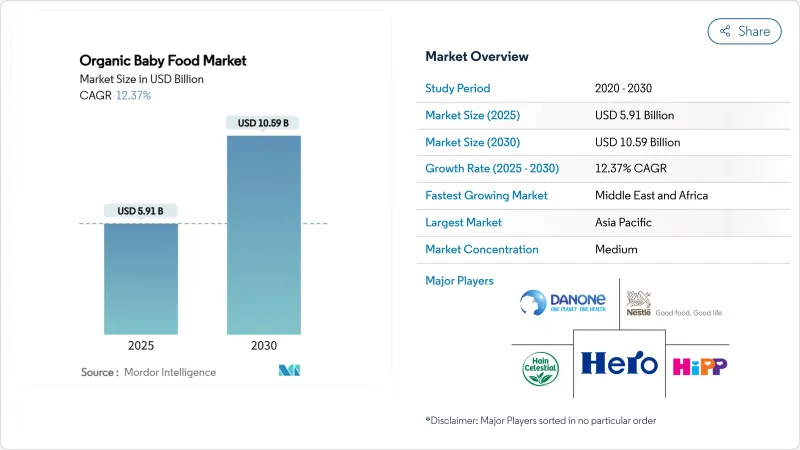

Organic Baby Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The organic baby food market size is estimated to be USD 5.91 billion in 2025 and is projected to reach USD 10.59 billion by 2030, reflecting a robust 12.37% CAGR during the forecast period.

The organic baby food market growth stems from increased demand for clean labels, organic certification standards, and premium products. Higher household incomes drive increased spending on infant nutrition, supporting market expansion. Enhanced organic certification processes improve consumer trust and customer retention. Besides, market research shows that supply chain transparency and online health information expand market reach beyond urban areas. Product distribution in tier-two cities is critical for market share retention. E-commerce growth and ingredient developments through 2030 reduce market entry barriers while intensifying competition. Also, companies utilizing direct organic ingredient procurement maintain competitive margins, particularly as supply constraints increase. Moreover, cold-chain infrastructure development in emerging markets creates opportunities for refrigerated products. These command higher prices despite shorter shelf life, meeting consumer willingness to pay for premium offerings.

Global Organic Baby Food Market Trends and Insights

Increased Awareness about Ingredient Composition and Health Benefits

The increasing awareness among parents regarding the composition of ingredients in baby food and their associated health benefits is driving the demand for organic baby food. Parents are becoming more conscious of the potential risks posed by synthetic additives, preservatives, and pesticides commonly found in conventional baby food products. For instance, the preference for organic baby food, which is free from harmful chemicals and artificial ingredients, has grown significantly as it aligns with the desire to provide a healthier start for infants. Additionally, the rising prevalence of food allergies and sensitivities among babies has further encouraged parents to opt for organic alternatives, which are perceived as safer and more nutritious. For example, brands like Earth's Best and Happy Baby have gained popularity by offering organic baby food options that cater to these health-conscious demands. This trend is expected to continue driving the organic baby food market during the forecast period.

Growing Number of Working Women Driving the Market Growth

The increasing number of working women is significantly driving the growth of the organic baby food market. According to data from the U.S. Bureau of Labor Statistics, as of 2025, the employment-population ratio for women aged 20 and over was 54.8% . This trend has led to a rising demand for convenient, healthy, and organic food options for infants, as working mothers prioritize nutrition and quality for their children. The International Labour Organization (ILO) also highlights a global rise in female labor force participation, particularly in emerging economies, where dual-income households are becoming more common. This demographic shift has amplified the need for organic baby food products that cater to the health-conscious preferences of working parents. Furthermore, the growing awareness of the harmful effects of synthetic additives and pesticides in conventional baby food has reinforced the demand for organic alternatives. Moreover, governments worldwide are also supporting this trend by implementing stricter regulations on baby food safety and promoting organic farming practices.

Scarcity-Driven Cost Escalation for Certified Organic Ingredients

The organic baby food market faces operational constraints due to the increasing costs of certified organic ingredients. The limited supply of these ingredients stems from insufficient organic farming land allocation and certification requirements. Organic farming operations, which exclude synthetic fertilizers, pesticides, and GMOs, generate lower production volumes compared to conventional farming methods. The transition of conventional farmland to organic-certified operations requires substantial capital investment and implementation time, further constraining ingredient supply. Besides, market demand for organic products continues to increase due to consumer awareness of health and environmental benefits, while ingredient supply remains insufficient, creating market inefficiencies that increase procurement costs. Also, regulatory compliance requirements for organic certification generate additional operational expenses for producers. These cost increases impact product pricing strategies, limiting market penetration, particularly in price-sensitive segments. Manufacturers must address the operational challenge of maintaining competitive price points while meeting organic certification standards.

Other drivers and restraints analyzed in the detailed report include:

- Rising Birth Rates Propelling the Market Growth

- Premiumisation Trend Toward Infant Formulations

- Shorter Shelf-Life of Refrigerated Cold-Pressed Pouches

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, milk formula holds a dominant 43.78% market share, establishing itself as the leading category within the organic baby food market. This significant share underscores its widespread acceptance among consumers, driven by its nutritional benefits and suitability for infants. The demand for milk formula continues to be fueled by increasing awareness of organic products and the growing preference for high-quality, safe, and healthy food options for babies. Its position as a staple in the organic baby food market highlights its critical role in meeting the dietary needs of infants globally. Additionally, the availability of various formulations catering to specific nutritional requirements has further strengthened its market presence.

Conversely, dried baby food is experiencing a remarkable growth trajectory, with a projected CAGR of 13.30% through 2030. This growth reflects a shift in consumer behavior towards convenience-oriented products, as dried baby food offers ease of preparation and longer shelf life. Parents are increasingly opting for these products due to their practicality and ability to retain nutritional value. The rising demand for on-the-go feeding solutions and the growing adoption of organic dried baby food further contribute to this category's expansion, signaling a transformation in consumption patterns within the organic baby food market. Furthermore, innovations in flavor profiles and packaging are enhancing the appeal of dried baby food among modern consumers.

The 6-12 months age group dominates the organic baby food market with a 43.26% share in 2024, representing a critical period when infants transition from exclusive milk feeding to solid foods. This segment's leadership stems from parents' heightened nutritional vigilance during this developmental phase, with organic options perceived as safer first foods. The introduction of diverse flavors and textures during this window is crucial for developing healthy eating habits, driving demand for varied organic purees and soft foods. Companies like Lil' Gourmets are capitalizing on this opportunity by offering globally-inspired flavor profiles that expand infants' palate development during this formative period.

The 12-24 months segment is projected to grow fastest at a 10.95% CAGR (2025-2030), reflecting the increasing recognition of this period's importance in establishing long-term eating patterns. Products for this age group are evolving beyond simple purees to include more complex textures and nutrient-dense formulations supporting cognitive and physical development. Across all age segments, the trend toward functional ingredients addressing specific developmental needs is gaining momentum, with brands increasingly positioning their offerings around milestone-specific nutritional benefits supported by scientific research.

The Organic Baby Food Market Report is Segmented by Product Type (Milk Formula, Prepared Baby Food, and More), Age Group (0-6 Months, 6-12 Months, and More), Packaging Type (Pouches, Jars/Bottles, and More), Distribution Channel (Supermarkets/Hypermarkets, Online Retailers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, Asia-Pacific commanded a significant market share, holding 35.41% of the total. The region's dominance is driven by a growing population, increasing urbanization, and rising disposable incomes, which collectively boost the demand for organic baby food. According to a UN-Habitat report, Asia comprises 54% of the global urban population, totaling more than 2.2 billion people. The region's urban population is projected to grow by 1.2 billion by 2050, representing a 50% increase from current levels . Countries like China and India are key contributors, with a heightened focus on infant nutrition and a shift toward organic and natural food products. China, being one of the largest markets, benefits from a strong e-commerce presence and a growing preference for premium organic baby food brands. In India, government initiatives such as subsidies for organic farming and awareness campaigns about the benefits of organic food are driving the market growth. The region also benefits from a rising number of working mothers, which has led to a higher demand for convenient and nutritious baby food options.

Middle East and Africa stand out as the regions with the highest growth rate, boasting an impressive 11.52% CAGR projected through 2030. The growth in this region is fueled by an increasing awareness of the benefits of organic baby food, coupled with a rising middle-class population and improving economic conditions. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa are witnessing a surge in demand due to growing health consciousness among parents and the expansion of retail channels offering organic products. The region is also seeing increased investments in organic farming and supply chain infrastructure, which are expected to address challenges such as limited local production and higher prices compared to conventional baby food.

North America and Europe, with their well-established organic infrastructure and supportive regulatory frameworks, continue to thrive through innovation and premiumization. Owing to high disposable incomes and a pronounced health consciousness, these regions can adopt premium pricing strategies for organic baby food products. While declining birth rates pose demographic challenges, these markets offset them with heightened per-child spending and prolonged organic feeding trends. Furthermore, with regulatory bodies like the FDA setting action levels for heavy metals and the EU enforcing organic standards, compliant organic producers gain a competitive edge, creating hurdles for conventional alternatives.

- Nestle S.A.

- Danone S.A.

- Abbott Laboratories

- The Hain Celestial Group Inc.

- Hero Group

- HiPP GmbH & Co. KG

- Neptune Wellness Solutions, Inc.

- Little Spoon Inc.

- Serenity Kids

- Baby Gourmet Foods Inc.

- Tiny Organics, Inc.

- Sun-Maid Growers of California

- Once Upon a Farm, LLC

- Else Nutrition Holdings Inc.

- Bubs Australia Ltd.

- Impressive Foods, LLC

- Cerebelly, Inc.

- Holle baby food AG

- Perrigo Company PLC

- White Leaf Provisions, LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Awareness about Ingredient Composition and Health Benefits

- 4.2.2 Growing Number of Working Women Driving the Market Growth

- 4.2.3 Rapid Penetration of D2C Organic Puree Subscription Models

- 4.2.4 Rising Birth Rates Propelling the Market Growth

- 4.2.5 Premiumisation Trend Toward Infant Formulations

- 4.2.6 Advertisements and Endorsements Promoting Demand

- 4.3 Market Restraints

- 4.3.1 Scarcity-Driven Cost Escalation for Certified Organic Ingredients

- 4.3.2 Shorter Shelf-life of Refrigerated Cold-Pressed Pouches

- 4.3.3 Complex Multi-Logo Certification Compliance for Exporters

- 4.3.4 Price-Sensitivity in Underdeveloped Regions Limiting Premium Adoption

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porters Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Milk Formula

- 5.1.1.1 Infant Formula

- 5.1.1.2 Follow-up Milk Formula

- 5.1.1.3 Grow-up Milk Formula

- 5.1.1.4 Specialty Formula

- 5.1.2 Prepared Baby Food

- 5.1.3 Dried Baby Food

- 5.1.1 Milk Formula

- 5.2 By Age Group

- 5.2.1 0-6 Months

- 5.2.2 6-12 Months

- 5.2.3 12-24 Months

- 5.2.4 More than 24 Months

- 5.3 By Packaging Type

- 5.3.1 Pouches

- 5.3.2 Jars/Bottles

- 5.3.3 Tetra-Pak/Cartons

- 5.3.4 Others (snap-pots, stick-packs)

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Pharmacies and Drugstores

- 5.4.3 Specialty Stores

- 5.4.4 Online Retailers

- 5.4.5 Others Distribution Channels

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Sweden

- 5.5.2.7 Netherlands

- 5.5.2.8 Poland

- 5.5.2.9 Belgium

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Indonesia

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Peru

- 5.5.4.5 Columbia

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Egypt

- 5.5.5.7 Morocco

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Nestle S.A.

- 6.4.2 Danone S.A.

- 6.4.3 Abbott Laboratories

- 6.4.4 The Hain Celestial Group Inc.

- 6.4.5 Hero Group

- 6.4.6 HiPP GmbH & Co. KG

- 6.4.7 Neptune Wellness Solutions, Inc.

- 6.4.8 Little Spoon Inc.

- 6.4.9 Serenity Kids

- 6.4.10 Baby Gourmet Foods Inc.

- 6.4.11 Tiny Organics, Inc.

- 6.4.12 Sun-Maid Growers of California

- 6.4.13 Once Upon a Farm, LLC

- 6.4.14 Else Nutrition Holdings Inc.

- 6.4.15 Bubs Australia Ltd.

- 6.4.16 Impressive Foods, LLC

- 6.4.17 Cerebelly, Inc.

- 6.4.18 Holle baby food AG

- 6.4.19 Perrigo Company PLC

- 6.4.20 White Leaf Provisions, LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK