PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844690

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844690

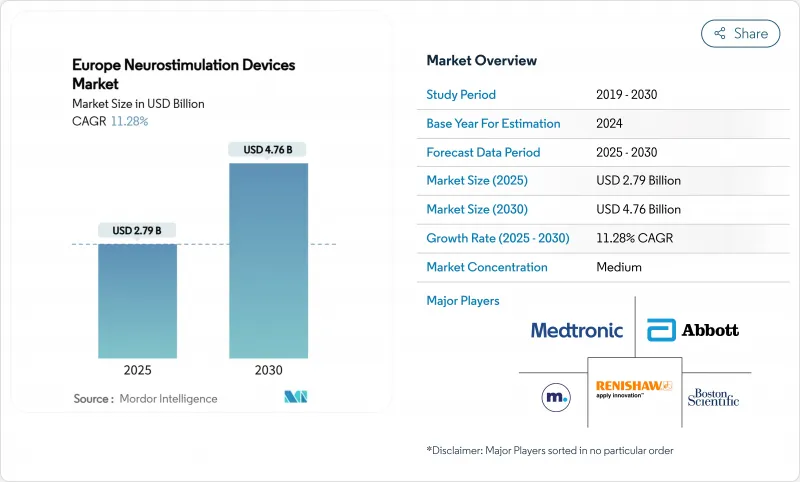

Europe Neurostimulation Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe Neurostimulation Devices market size stands at USD 2.79 billion in 2025 and is forecast to reach USD 4.76 billion by 2030, translating into an 11.28% CAGR.

Demographic aging, a rising neurological disease burden, and steady regulatory support nurture a demand up-curve for sophisticated neuromodulation options. Continuous engineering advances-especially AI-enabled closed-loop systems-sharpen therapeutic precision and widen the addressable patient pool. At the same time, non-invasive alternatives win mindshare by lowering surgical risk, shortening recovery, and increasing adoption in outpatient and home settings. Intensifying vendor consolidation, led by Globus Medical's acquisition of Nevro, signals a strategic race to command platform breadth and data science capabilities. However, Europe-specific supply-chain checks on rare-earth elements and extended EU-MDR review cycles add cost and scheduling friction that firms must navigate to preserve growth momentum.

Europe Neurostimulation Devices Market Trends and Insights

Ageing Population & Neurological Disease Burden

Europe's demographic shift raises the prevalence of Parkinson's, epilepsy, and chronic pain, with neurological disorders now affecting 19% of European adults . Direct Parkinson's care costs reached EUR 25,649 per patient over a three-month period in Sweden, underscoring fiscal pressure on state systems. Projections pointing to a 112% hike in Parkinson's incidence by 2050 intensify the need for scalable, economically sustainable interventions . Neurostimulation devices-because they are reusable, adjustable, and often opioid-sparing-fit payer imperatives to tame lifetime treatment spend while sustaining quality of life. As longevity extends, device replacement and upgrade cycles generate recurring revenue streams that underpin the Europe Neurostimulation Devices market's resilient expansion path.

Escalating Demand for Minimally-Invasive Pain Therapies

Closed-loop spinal cord stimulation (SCS) has trimmed mean pain scores from 8.2 to 2.6 in real-world European cohorts and delivered 92% patient satisfaction, strengthening clinical confidence . Reversibility and programmability differentiate SCS from ablative procedures, aligning it with evidence-based opioid substitution policies now embedded in Western Europe's pain guidelines. ECAP-controlled systems provide objective neuro-feedback, allowing physicians to titrate energy in precise, reproducible increments. These attributes position neuromodulation as the default escalation step when pharmacologic regimens plateau, driving steady unit demand and ancillary revenue from software upgrades.

Adverse Events & Explant Risks

Explant procedures carry surgical risk and average USD 39,106 in hospital reimbursement, prompting stricter patient selection and real-time performance monitoring mandates. Negative outcomes erode referring-physician confidence, slowing conversion rates despite mounting evidence of long-term efficacy. Regulators have responded by tightening post-market surveillance, obliging manufacturers to finance larger registries and faster-cycle root-cause investigations. Sustained progress in lead durability, infection control, and predictive maintenance algorithms is pivotal to neutralize this drag on the Europe Neurostimulation Devices market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Product Upgrades

- Home-Based TENS/TMS Adoption via E-commerce

- Lengthy EU-MDR Approval Timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Internal neuromodulation commanded 71.77% of Europe Neurostimulation Devices market share in 2024, reflecting three decades of clinical routine and reimbursement familiarity. Yet external modalities trailblazed an 11.98% CAGR through 2030, propelled by next-generation rTMS platforms that deliver 10,000 pulses in under four minutes, trim session counts, and present minimal contraindications. The Europe Neurostimulation Devices market size for external modalities is expected to nearly double, helped by cloud-linked TMS headsets that document outcomes in payers' preferred data formats. Rotating-coil multi-locus systems, now piloted in Germany, permit instantaneous cortical focus changes, improving efficacy for comorbid depression and insomnia.

Internal platforms are hardly static. Closed-loop SCS leveraging ECAP feedback maintains durable pain relief at 12 months, anchoring replacement cycles that underpin manufacturer annuity revenue. Adaptive DBS expands beyond Parkinson's into severe addiction use-cases under the Brain-PACER study in Cambridge, projecting new adoption curves once early clinical endpoints read out. Meanwhile, sacral and gastric stimulators continue serving niche bowel-motility disorders, reinforcing the technology's multi-organ versatility.

The Europe Neurostimulation Devices Market Report is Segmented by Technology (Internal Neuromodulation [Spinal Cord Stimulation (SCS) and More] and External Neuromodulation), Application (Pain Management, Parkinson's Disease, Epilepsy, and More), End-User (Hospitals, and More), and Geography (Germany, United Kingdom, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Medtronic

- Boston Scientific

- Abbott Laboratories

- Nevro

- LivaNova plc

- NeuroSigma

- Neuronetics

- The Magstim Company Ltd.

- Renishaw plc

- Salvia BioElectronics

- ElectroCore

- Soterix Medical

- Nurotron Biotechnology

- BIOTRONIK

- Otivio AS

- Aleva Neurotherapeutics

- MicroTransponder Inc.

- Pixium Vision

- G-Tec Medical Engineering

- Synergia Medical SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing population & neurological disease burden

- 4.2.2 Escalating demand for minimally-invasive pain therapies

- 4.2.3 Rapid product upgrades

- 4.2.4 Home-based TENS/TMS adoption via e-commerce

- 4.2.5 EU-MDR driven replacement cycle of legacy implants

- 4.2.6 Opioid-reduction programs boosting neuromodulation uptake

- 4.3 Market Restraints

- 4.3.1 Adverse events & explant risks

- 4.3.2 Lengthy EU-MDR approval timelines

- 4.3.3 High device cost & patchy reimbursement

- 4.3.4 Supply-chain pinch in implant-grade rare-earth materials

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Technology

- 5.1.1 Internal Neuromodulation

- 5.1.1.1 Spinal Cord Stimulation (SCS)

- 5.1.1.2 Deep Brain Stimulation (DBS)

- 5.1.1.3 Vagus Nerve Stimulation (VNS)

- 5.1.1.4 Sacral Nerve Stimulation (SNS)

- 5.1.1.5 Gastric Electrical Stimulation (GES)

- 5.1.2 External Neuromodulation

- 5.1.2.1 Transcutaneous Electrical Nerve Stimulation (TENS)

- 5.1.2.2 Transcranial Magnetic Stimulation (TMS)

- 5.1.2.3 Respiratory Electrical Stimulation (RES)

- 5.1.1 Internal Neuromodulation

- 5.2 By Application

- 5.2.1 Pain Management

- 5.2.2 Parkinson's Disease

- 5.2.3 Epilepsy

- 5.2.4 Depression

- 5.2.5 Dystonia

- 5.2.6 Others

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centres

- 5.3.3 Specialty Clinics

- 5.3.4 Home-care Settings

- 5.3.5 Others

- 5.4 By Geography

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Medtronic plc

- 6.4.2 Boston Scientific Corporation

- 6.4.3 Abbott Laboratories

- 6.4.4 Nevro Corporation

- 6.4.5 LivaNova plc

- 6.4.6 NeuroSigma Inc.

- 6.4.7 Neuronetics Inc.

- 6.4.8 The Magstim Company Ltd.

- 6.4.9 Renishaw plc

- 6.4.10 Salvia BioElectronics

- 6.4.11 ElectroCore Inc.

- 6.4.12 Soterix Medical

- 6.4.13 Nurotron Biotechnology

- 6.4.14 Biotronik SE & Co. KG

- 6.4.15 Otivio AS

- 6.4.16 Aleva Neurotherapeutics

- 6.4.17 MicroTransponder Inc.

- 6.4.18 Pixium Vision

- 6.4.19 G-Tec Medical Engineering

- 6.4.20 Synergia Medical SA

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment