PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844711

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844711

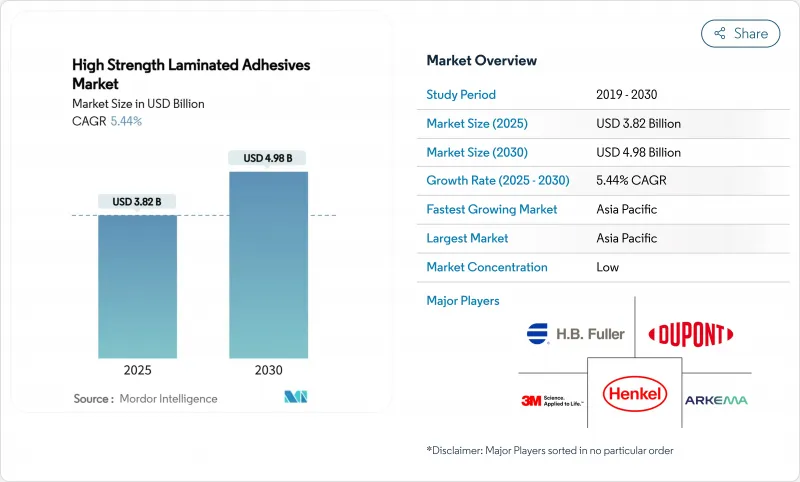

High Strength Laminated Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The High Strength Laminated Adhesives Market size is estimated at USD 3.82 billion in 2025, and is expected to reach USD 4.98 billion by 2030, at a CAGR of 5.44% during the forecast period (2025-2030).

Robust flexible-packaging demand, accelerating automotive lightweighting and rapid electronics miniaturization keep the market firmly on a growth track despite tighter environmental rules. Producers are racing to introduce low-VOC chemistries, develop bio-based feedstocks and localize production in Asia-Pacific to capture rising downstream output. Strategic divestments, such as Dow's sale of its flexible-packaging laminating adhesives line, illustrate an industry streamlining around high-value niches while raw-material volatility pressures margins. Technology migration toward UV-curable and water-borne systems is gathering pace, yet solvent-based products still dominate critical high-performance laminations, highlighting a market in transition. Consolidation among tier-one players is tempered by a long tail of regional specialists that anchor supply close to converters and car plants.

Global High Strength Laminated Adhesives Market Trends and Insights

Escalating Demand for Flexible and Lightweight Packaging

Flexible packaging volumes keep rising as brand owners pursue down-gauging and consumer convenience. The sector is projected to hit USD 341.6 billion by 2028, lifting multilayer laminate output that relies on high-performance bonding systems . Mono-material pouches and recyclable barrier films mandated under the European Green Deal require adhesives compatible with closed-loop recycling, opening premium niches for product formulators. E-commerce adds urgency, with Packsize and Henkel reporting a 32% greenhouse-gas cut across 340 million shipper boxes when using Eco-Pax bio-based hot-melt solutions. Suppliers able to certify food-contact safety, low migration and de-inking debonding gain a pricing edge in the laminating adhesives market.

Automotive Lightweighting Replacing Mechanical Fasteners

Modern vehicles average more than 400 linear feet of adhesive versus 30 feet two decades ago, underscoring the structural shift from rivets and welds to bonding lines . Mixed-material bodies in white, battery-pack encapsulation and noise-damping laminates all raise the technical bar for shear strength and thermal-cycling durability. Mexico's auto sector, contributing 6% to national GDP, is on track for 13% production growth, amplifying localized demand in North American supply corridors. Thermoplastic polyurethane formulations gain share as OEMs prioritize dismantlability and end-of-life recycling.

Raw-Material Price Volatility

Raw material price volatility continues to pressure laminating adhesives manufacturers, with BASF implementing price increases of USD 0.08-0.10 per pound for key polyurethane precursors including 1,4-Butanediol and N-Methylpyrrolidone effective April 2025. Seventy-nine percent of composites fabricators cite resin shortages, exposing formulators to unpredictable lead times. Petroleum dependency keeps polyurethane inputs tethered to crude swings, while bio-based feedstocks face limited scale. Suppliers respond with quarterly pricing clauses and dual-sourcing strategies, yet the uncertainty still trims margin expansion in the laminating adhesives market.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push Toward Low-Volatile Organic Compound (VOC) and Solvent-Free Chemistries

- Electronics Miniaturization in Global Manufacturing Hubs

- Stringent Solvent-Emission Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyurethane (PU) claimed 43.18% of global revenue in 2024, underscoring its versatility in high-flexibility pouch laminations and resilient automotive interior skins. The segment is projected to grow at a 6.41% CAGR through 2030, keeping its lead in the laminating adhesives market as converters favor robust adhesion across heterogeneous substrates. Regulatory pressure on diisocyanates accelerates migration to non-isocyanate polyurethane (PU) and bio-based polyol routes that curb hazard labeling without sacrificing bond strength.

Bio-content gains momentum with lignin-, soy-, and castor-derived precursors enabling partially renewable polyurethane chains. Research demonstrates successful Non-Isocyanate Polyurethane (NIPU) syntheses that retain hydrolysis resistance equal to incumbent grades. Acrylic systems pick up share in ultraviolet (UV)-curable electronics laminations where optical clarity and rapid line speed are paramount. Epoxies continue to serve niche aerospace and wind-blade fabrics demanding extreme chemical stability, yet their relative market slice stays modest. Overall, innovation in polyurethane keeps the laminating adhesives market moving toward lower-carbon yet high-performance solutions.

The High Strength Laminating Adhesives Market Report is Segmented by Resin Type (Polyurethane, Acrylic, Epoxy, Other Resin Types), Technology (Water-Borne, Solvent-Based, Hot-Melt, UV-Curable), Application (Packaging, Automotive, Industrial, Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 44.18% of global demand in 2024 and is anticipated to expand at a 6.04% CAGR through 2030, fueled by chemical cluster investment and rising per-capita packaged-goods consumption. Regional heavyweights, including China's converters and India's new Loctite plant, localize supply, shorten lead times and cut currency risk for multinationals.

North America remains a high-value arena where automotive lightweighting and food-contact safety standards steer innovation. Lubrizol's USD 20 million acrylic-emulsion expansion in North Carolina illustrates continued capacity reinforcement for specialty grades.

Europe's stringent emission rules catalyze technology pivots and extend producer-responsibility schemes that prioritize recycle-ready laminations, pushing regional formulators into low-monomer polyurethane and water-borne recipes. Latin America and the Middle East present emergent demand nodes linked to industrialization projects and consumer spending catch-up, albeit from lower bases. The geography split shows that proximity to downstream packagers and automakers remains decisive for success in the laminating adhesives market.

- 3M

- Arkema

- artience Co., Ltd.

- Avery Dennison Corporation

- BASF

- Daubert Chemical Company

- DIC Corporation

- DuPont

- Franklin International

- H.B. Fuller Company

- Henkel AG and Co. KGaA

- Huntsman Corporation llc

- Jowat SE

- SAPICI S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Demand for Flexible and Lightweight Packaging

- 4.2.2 Automotive Lightweighting Replacing Mechanical Fasteners

- 4.2.3 Regulatory Push Toward Low-VOC (Volatile Organic Compound) and Solvent-Free Chemistries

- 4.2.4 Electronics Miniaturization in Global Manufacturing Hubs

- 4.2.5 Ultraviolet (UV)-Curable Lines for On-Demand Short-Run Packaging

- 4.3 Market Restraints

- 4.3.1 Raw-Material Price Volatility

- 4.3.2 Stringent Solvent-Emission Regulations

- 4.3.3 Supply Bottlenecks in Bio-Based Polyurethane Feedstocks

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Polyurethane

- 5.1.2 Acrylic

- 5.1.3 Epoxy

- 5.1.4 Other Resin Types (Vinyl Acetate, etc.)

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-based

- 5.2.3 Hot-melt

- 5.2.4 UV-curable

- 5.3 By Application

- 5.3.1 Packaging

- 5.3.2 Automotive

- 5.3.3 Industrial

- 5.3.4 Other Applications (Electronics and Electrical, Construction, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 artience Co., Ltd.

- 6.4.4 Avery Dennison Corporation

- 6.4.5 BASF

- 6.4.6 Daubert Chemical Company

- 6.4.7 DIC Corporation

- 6.4.8 DuPont

- 6.4.9 Franklin International

- 6.4.10 H.B. Fuller Company

- 6.4.11 Henkel AG and Co. KGaA

- 6.4.12 Huntsman Corporation llc

- 6.4.13 Jowat SE

- 6.4.14 SAPICI S.p.A.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Introduction of Nano-Adhesives