PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844715

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844715

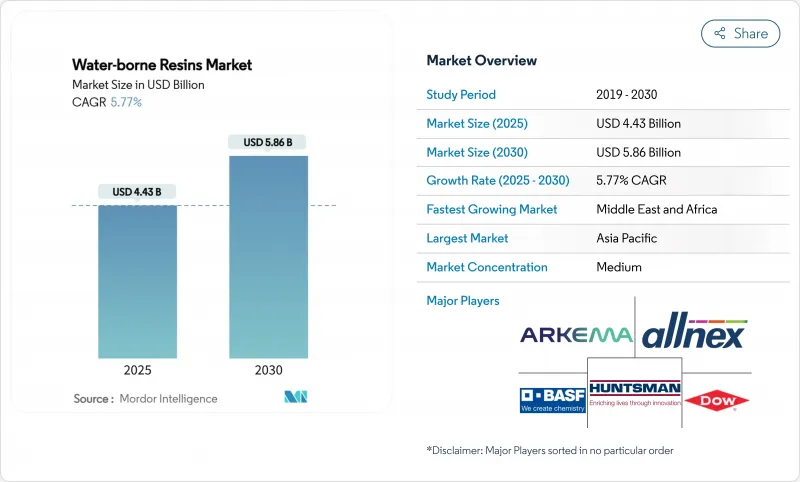

Water-borne Resins - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Waterborne Resins Market size is estimated at USD 4.43 billion in 2025, and is expected to reach USD 5.86 billion by 2030, at a CAGR of 5.77% during the forecast period (2025-2030).

This performance underscores the sector's pivot toward low-emission chemistries in response to tightening volatile organic compound rules, rising renewable-energy investment, and progress in bio-based feedstocks. Increasing adoption of water-dilutable binders in automotive refinish, infrastructure coatings, and electronic encapsulation reinforces demand, while capacity additions in Asia Pacific and North America sustain supply resilience. Product innovation around bio-circular raw materials, nano-reinforced films, and rapid-cure additives sustains competitive differentiation, yet raw-material cost swings and technical gaps in heavy-duty anticorrosion systems temper growth momentum. Companies are mitigating these risks by expanding renewable-power sourcing, backward-integrating critical intermediates, and forming downstream application alliances, positioning the waterborne epoxy resin market for broad-based, regulation-led expansion.

Global Water-borne Resins Market Trends and Insights

VOC-Based Emission Limits Favour Waterborne Systems

Regulators are imposing stricter VOC ceilings, pushing formulators to water-dilutable chemistries that satisfy compliance while retaining film integrity. The US EPA's revised aerosol-coating rule extended the transition deadline to January 2027, giving manufacturers time to optimise waterborne packages. Similar momentum is evident in California's South Coast Air Quality Management District, where Rule 1151 mandates waterborne automotive refinish systems by 2033. European regulators follow parallel paths by lowering allowable solvent thresholds in industrial maintenance paints, stimulating demand for zero-solvent epoxy dispersions. Producers increasingly leverage renewable electricity and high-solid feedstocks to cut total carbon footprints and satisfy corporate net-zero pledges, creating a virtuous cycle that accelerates uptake across the waterborne epoxy resin market.

Construction Boom Raising Demand for Low-Odor Interior Coatings

Rapid urbanisation coupled with worker-safety mandates fuels interest in low-smell, low-toxic coatings for commercial buildings, hospitals, and residential towers. National infrastructure plans across India, Indonesia, and GCC states prioritise green building certifications that reward low-emission materials. Contractors select waterborne epoxy primers and self-levelling flooring compounds because they reduce ventilation requirements and accelerate job-site turnaround. Building-material suppliers now bundle epoxies with antimicrobial additives to satisfy post-pandemic hygiene criteria and secure specification in healthcare projects, deepening penetration of the waterborne epoxy resin market.

Performance Gap vs. Solvent-Borne in Heavy-Duty Anti-Corrosion

Waterborne epoxies still trail solvent-borne rivals in barrier properties demanded by ships and offshore platforms. Moisture presence during film formation can create micro-porosity that lowers impedance values. Comparative studies show solvent-borne coatings maintain resistance above 10^9 Ω after extended salt-spray exposure, whereas waterborne equivalents plateau nearer 10^8 Ω, necessitating thicker builds or frequent maintenance. International Marine's low-VOC product lines have mitigated part of this gap, yet applicators remain cautious on life-cycle cost, constraining uptake in the waterborne epoxy resin market.

Other drivers and restraints analyzed in the detailed report include:

- Electronics Encapsulation Shift to Halogen-Free Chemistries

- EU Circular-Economy Incentives for Bio-Based Waterborne Epoxy

- Price Volatility and Nano-Silica Solvent-Free PU Top-Coats

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bisphenol-A resins dominated 2024 with 47.55% share of the waterborne epoxy resin market. Their established supply chains, predictable cure behaviour, and wide formulation latitude underpin leadership. Yet market sentiment is shifting. Bio-based chemistries built from lignin, tall-oil fatty acids, and sugar derivatives are growing at a 6.88% CAGR as regulators incentivise circular raw materials and brand owners seek low-carbon footprints. The European Green Deal channels funding toward demonstration plants that scale bio-epoxy dispersion output for coatings and electronics, driving diversification within the waterborne epoxy resin industry.

Bisphenol-F variants provide lower viscosity and better electrical insulation, serving high-layer-count printed circuit boards. Novolac epoxies fulfil heat-resistance mandates in aerospace composites. Researchers have produced bisphenol-free diepoxide monomers capable of 0.4 W m-1 K-1 thermal conductivity, easing heat-management challenges in electric-vehicle battery packs. This breadth of options secures innovation momentum across the waterborne epoxy resin market, even as fossil-based incumbents guard volume share.

Amine-based hardeners held 38.34% of 2024 demand in the waterborne epoxy resin market. They cure at ambient temperature, offer broad substrate adhesion, and tolerate variable humidity, making them the default for flooring, primers, and electronic encapsulation. Producers have decreased residual free amine content to enhance worker safety and reduce odour. Phenolic adducts, although comprising a smaller slice, will log a 6.10% CAGR through 2030 thanks to high chemical and thermal resistance valued in tank linings and high-speed rail infrastructure.

Anhydride chemistries remain niche, targeting high-temperature composites. Hybrid bio-amine hardeners using amino acids such as tryptophan have demonstrated comparable tensile performance while cutting carbon footprints by 45%, aligning with customer decarbonisation roadmaps. Evonik's VESTAMIN IPD eCO employs biomass-balanced ammonia to slash cradle-to-gate emissions by 65%. These advances broaden the toolkit available to formulators across the waterborne epoxy resin market.

The Waterborne Epoxy Resin Market Report is Segmented by Resin Type (Bisphenol-A Based, Bisphenol-F Based, and More), Curing-Agent Chemistry (Amine-Based, Anhydride, and More), Application (Paints & Coatings, Adhesives & Sealants, and More), End-Use Industry (Building & Construction, Aerospace, and More), Distribution Channel (Direct Sales, Distributors, and More), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia Pacific held 47.33% of global 2024 sales value, anchored by robust manufacturing bases in China, India, and Southeast Asia. China remains the largest producer and consumer despite preliminary 354.99% dumping margins imposed on exports to the United States. Local infrastructure upgrades, semiconductor fab expansion, and electric-vehicle output sustain domestic offtake. India's Smart Cities Mission and national expressway plan unlock multi-year flooring and waterproofing demand, propelling the regional waterborne epoxy resin market. Multinational suppliers continue to localise capacity; Evonik will bring a specialty amine plant online in Nanjing by 2026 to serve regional formulators.

North America is a significant consumer of coatings. Progressive VOC legislation and decarbonisation programmes encourage rapid conversion to water-dilutable coatings. California's Rule 1151 revisions prescribe waterborne refinishing by 2033, setting a nationwide compliance benchmark. Wind-farm repowering and US-Mexico-Canada trade stability support long-term demand visibility. BASF's shift to 100% renewable electricity in key North American sites, removing over 11,000 t CO2 per year, demonstrates supplier commitment to sustainable operations.

Europe occupies a technology leadership role. The region shapes global standards through Green Deal regulations and carbon-border-adjustment mechanisms that favour low-footprint chemistries. Mass-balance-certified resins, waste-derived bio-feedstocks, and closed-loop collection of construction debris gain traction. Offshore wind capacity additions in the North Sea require erosion-resistant, fast-cure repair epoxies, lifting regional demand.

The Middle East and Africa, though smaller, will expand at a 6.66% CAGR. National diversification agendas in Saudi Arabia and the United Arab Emirates prioritise downstream chemical production and high-performance building materials, stimulating offtake. Government investment in desalination plants and petrochemical complexes necessitates corrosion-resistant waterborne coatings, bolstering the regional waterborne epoxy resin market.

- Aditya Birla Chemicals

- Allnex Netherlands B.V.

- Arkema

- BASF SE

- Dow

- Eastman Chemical Company

- Evonik Industries AG

- Hexion Inc.

- Huntsman International LLC

- Kukdo Chemical

- Momentive

- Nan Ya Plastics

- Olin Corporation

- Solvay

- Tnemec

- Westlake Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 VOC-based emission limits favour waterborne systems

- 4.2.2 Construction boom raising demand for low-odor interior coatings

- 4.2.3 Electronics encapsulation shift to halogen-free chemistries

- 4.2.4 Offshore wind blade repair kits adopting waterborne epoxy

- 4.2.5 EU circular-economy incentives for bio-based waterborne epoxy

- 4.3 Market Restraints

- 4.3.1 Performance gap vs. solvent-borne in heavy-duty anti-corrosion

- 4.3.2 Price volatility

- 4.3.3 Nano-silica solvent-free PU top-coats cannibalising epoxy share

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Bisphenol-A Based

- 5.1.2 Bisphenol-F Based

- 5.1.3 Novolac

- 5.1.4 Bio-based

- 5.1.5 Others

- 5.2 By Curing-Agent Chemistry

- 5.2.1 Amine-Based

- 5.2.2 Anhydride

- 5.2.3 Phenolic

- 5.2.4 Others

- 5.3 By Application

- 5.3.1 Paints and Coatings

- 5.3.2 Adhesives and Sealants

- 5.3.3 Composites

- 5.3.4 Inks

- 5.3.5 Electrical and Electronics Encapsulation

- 5.3.6 Others

- 5.4 By End-Use Industry

- 5.4.1 Building and Construction

- 5.4.2 Automotive and Transportation

- 5.4.3 Industrial Machinery

- 5.4.4 Aerospace

- 5.4.5 Marine

- 5.4.6 Consumer Goods

- 5.4.7 Energy and Wind Turbines

- 5.5 By Distribution Channel

- 5.5.1 Direct Sales

- 5.5.2 Distributors

- 5.5.3 Online Platforms

- 5.6 By Geography

- 5.6.1 Asia-Pacific

- 5.6.1.1 China

- 5.6.1.2 India

- 5.6.1.3 Japan

- 5.6.1.4 South Korea

- 5.6.1.5 ASEAN

- 5.6.1.6 Rest of Asia-Pacific

- 5.6.2 North America

- 5.6.2.1 United States

- 5.6.2.2 Canada

- 5.6.2.3 Mexico

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Aditya Birla Chemicals

- 6.4.2 Allnex Netherlands B.V.

- 6.4.3 Arkema

- 6.4.4 BASF SE

- 6.4.5 Dow

- 6.4.6 Eastman Chemical Company

- 6.4.7 Evonik Industries AG

- 6.4.8 Hexion Inc.

- 6.4.9 Huntsman International LLC

- 6.4.10 Kukdo Chemical

- 6.4.11 Momentive

- 6.4.12 Nan Ya Plastics

- 6.4.13 Olin Corporation

- 6.4.14 Solvay

- 6.4.15 Tnemec

- 6.4.16 Westlake Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Growing Demand for Eco-Friendly Coatings