PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844719

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844719

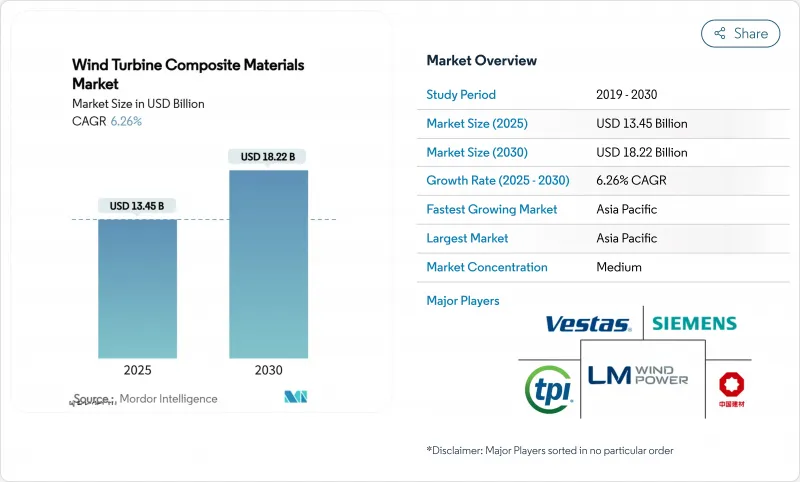

Wind Turbine Composite Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Wind Turbine Composite Materials Market size is estimated at USD 13.45 billion in 2025, and is expected to reach USD 18.22 billion by 2030, at a CAGR of 6.26% during the forecast period (2025-2030).

Widespread adoption of blades longer than 100 m, supported by lighter glass-, carbon- and hybrid-fiber architectures, is raising material content per turbine and pushing suppliers to expand capacity in Asia Pacific and Europe. Policy incentives such as the United Kingdom's Contracts for Difference (CfD) budget and China's 117 GW of new 2024 installations assure multi-year order visibility and accelerate automation and vertical integration strategies across the wind turbine composites market.

Global Wind Turbine Composite Materials Market Trends and Insights

Increasing Onshore and Offshore Turbine Capacities Drive Demand for Advanced Composites

Global turbine ratings now routinely exceed 15 MW offshore, pushing blade lengths past 115 m and multiplying structural loads that only advanced composites can withstand. Vestas' 115.5 m-long blades on the V236-15 MW platform and Siemens Gamesa's confidential 21.5 MW prototype exemplify the scale-up that magnifies composite volume per rotor while simultaneously mandating lighter carbon-reinforced spar caps for stiffness and fatigue resistance. The United Kingdom alone aims to raise offshore capacity to as much as 50 GW by 2030, a target that cements long-term pull for high-performance laminate systems able to deliver a 25-year design life in corrosive marine environments.

Government Decarbonization Policies Accelerate Composite Material Adoption

Supportive frameworks, such as the United Kingdom's USD 1.2 billion CfD round dedicated to offshore wind and China's record 117 GW of 2024 wind installations, lock in multi-gigawatt auction pipelines and de-risk investments in new composite plants. Clean-industry bonus mechanisms that reward low-carbon supply chains are encouraging local blade production and greener resin chemistries. The European Green Deal's binding 2030 renewables targets, along with Germany's 80% clean-power ambition, consolidate demand visibility across the wind turbine composites market and motivate capacity expansions from Vestas, LM Wind Power, and Chinese glass-fiber majors. Carbon pricing and renewable energy certificates further boost project economics, ensuring sustained pull for lightweight, durable, and recyclable composites.

Carbon Fiber Price Volatility Constrains Premium Applications

Surging demand for 100 m-plus blades is expected to triple carbon consumption by 2027, yet capacity expansions lag, creating price spikes that discourage wider uptake in cost-sensitive turbines. China's market, which absorbed 69,000 t of carbon fiber in 2023, saw sharp swings as export restrictions and geopolitical frictions disrupted supply chains. OEMs, therefore, pursue hybrid glass-carbon architectures and localized sourcing to hedge volatility. Until additional lines lift global output toward the 450,000 tons predicted for 2030, the wind turbine composites market must navigate erratic input costs.

Other drivers and restraints analyzed in the detailed report include:

- Polyurethane Infusion Resins Transform Manufacturing Economics

- Bio-based Thermoplastic Systems Enable Circular-Economy Transition

- Regulatory Emission Limits Drive Manufacturing-Process Transformation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Glass fiber retained a dominant 71.66% share of the wind turbine composites market in 2024, underpinned by favorable cost and robust supply chains. Carbon, however, is growing at 7.11% CAGR as OEMs chase mass reductions that let longer rotors survive higher tip speeds without excess loads. LM Wind Power's hybrid carbon/glass spar caps on its 88.4 m blade validated weight cuts without cost blowouts.

Incremental uptake also stems from textile-based carbon fibers that are 40% cheaper than aerospace grades, unlocking mid-tier turbine segments. Natural-fiber blends offer sustainable niches, with palm or flax hybrids matching key mechanical metrics while lowering embodied energy. Over the forecast horizon, hybridization strategies will remain pivotal as the wind turbine composites market balances stiffness, fatigue life and affordability.

Epoxy systems held 34.88% revenue share in 2024, thanks to well-characterized performance, yet polyester/vinyl-ester and polyurethane blends are tracking the fastest 7.45% CAGR. Proven 10-25% cycle-time savings and improved wet-out make polyurethane infusion the prime candidate for stretching annual output without large capex.

Demand for bio-based chemistries that curb life-cycle emissions by 30-40% will steer formulation research and development, broadening the wind turbine composites market size for greener resins, particularly in Europe, where carbon-footprint disclosures already feature in tenders. Baxxodur curing agents and additive packages that cut exotherm peaks further enhance epoxy competitiveness, ensuring multiple resin classes co-exist through 2030.

The Wind Turbine Composite Materials Report is Segmented by Fiber Type (Glass Fiber, Carbon Fiber, Natural/Hybrid Fibers), Resin Type (Epoxy, Polyester/Vinyl-Ester, Polyurethane, Thermoplastic Resins), Technology (Vacuum Infusion, Prepreg, and More), Application (Wind Blades, Nacelles and Nose Cones, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific, at 46.44% of 2024 revenue, remains the anchor region for the wind turbine composites market and posts a leading 6.99% CAGR. China's record 117 GW of 2024 additions, supported by local-content rules favoring China Jushi and CPIC, underpin an unrivaled supply-chain footprint that exports both raw fabrics and finished blades worldwide.

Europe follows with mature technology adoption and rigorous sustainability regulations. The United Kingdom's ambition to reach up to 50 GW of offshore wind by 2030, Germany's 80% clean-power target, and France's circular-economy mandates push European makers toward recyclable thermoplastics and closed molding.

North America couples federal tax credits with state procurement to expand onshore fleets in the Great Plains and repower coastal wind zones. The U.S. Department of Energy forecasts composite demand tripling by 2027, propelling investments from TPI Composites and GE Vernova that localize spar-cap and root-insert production.

- AVIC Huiteng Windpower

- BASF

- China Jushi Co., Ltd.

- Covestro AG

- Exel Composites

- Gurit Holding AG

- Hexcel Corporation

- INCA Renewtech

- Lianyungang Zhongfu Lianzhong Composite Material Group Co., Ltd

- LM WIND POWER

- Molded Fiber Glass Companies

- Owens Corning

- Reliance Industries Limited

- SGL Carbon

- Siemens AG

- Sinoma Science & Technology Co.,Ltd.

- Teijin Limited

- TORAY INDUSTRIES, INC.

- TPI Composites

- Vestas

- Zhongfu Lianzhong Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Increasing Onshore and Offshore Turbine Capacities Drive the Need for Lighter, Longer Blades.

- 4.1.2 Government Decarbonization Goals and CFD Auctions are Speeding Up Wind Energy Development.

- 4.1.3 Cost-Saving Polyurethane Infusion Resins Shorten Cycle Time

- 4.1.4 Bio-Based/Recyclable Thermoplastic Systems Unlock ESG Finance

- 4.1.5 Composites Compatible with Smart Fabrics Facilitate Digital Twinning of Blades.

- 4.2 Market Restraints

- 4.2.1 Carbon-Fiber Price and Supply Volatility

- 4.2.2 Upcoming BPA and Styrene Emission Limits for Composites

- 4.2.3 Skilled-Labour Deficit in Advanced Infusion for Emerging Hubs

- 4.3 Value Chain Analysis

- 4.4 Porter's Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Fiber Type

- 5.1.1 Glass Fiber

- 5.1.2 Carbon Fiber

- 5.1.3 Natural/Hybrid Fibers

- 5.2 By Resin Type

- 5.2.1 Epoxy

- 5.2.2 Polyester/Vinyl-Ester

- 5.2.3 Polyurethane

- 5.2.4 Thermoplastic Resins

- 5.3 By Technology

- 5.3.1 Vacuum Infusion

- 5.3.2 Prepreg

- 5.3.3 Hand Lay-up

- 5.3.4 Filament Winding / Pultrusion

- 5.4 By Application

- 5.4.1 Wind Blades

- 5.4.2 Nacelles and Nose Cones

- 5.4.3 Hubs, Covers and Ancillary Parts

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 AVIC Huiteng Windpower

- 6.3.2 BASF

- 6.3.3 China Jushi Co., Ltd.

- 6.3.4 Covestro AG

- 6.3.5 Exel Composites

- 6.3.6 Gurit Holding AG

- 6.3.7 Hexcel Corporation

- 6.3.8 INCA Renewtech

- 6.3.9 Lianyungang Zhongfu Lianzhong Composite Material Group Co., Ltd

- 6.3.10 LM WIND POWER

- 6.3.11 Molded Fiber Glass Companies

- 6.3.12 Owens Corning

- 6.3.13 Reliance Industries Limited

- 6.3.14 SGL Carbon

- 6.3.15 Siemens AG

- 6.3.16 Sinoma Science & Technology Co.,Ltd.

- 6.3.17 Teijin Limited

- 6.3.18 TORAY INDUSTRIES, INC.

- 6.3.19 TPI Composites

- 6.3.20 Vestas

- 6.3.21 Zhongfu Lianzhong Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Government net-zero targets are accelerating global wind power installations.