PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846145

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846145

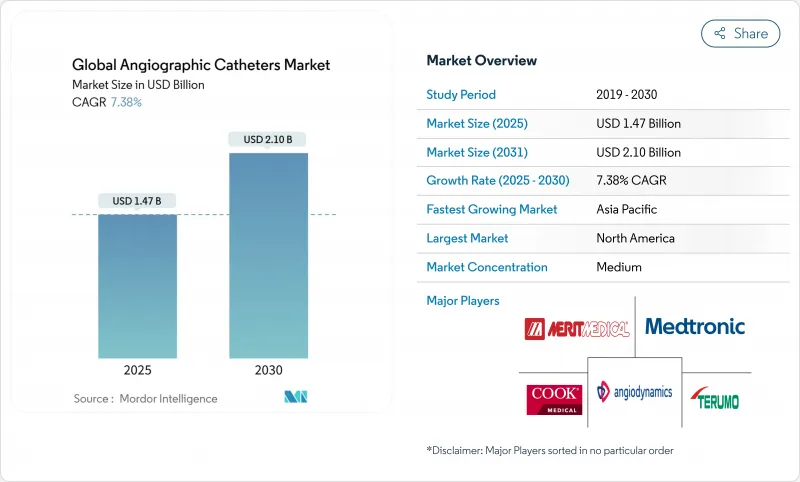

Global Angiographic Catheters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The angiographic catheter market was valued at USD 1.47 billion in 2025 and is forecast to reach USD 2.10 billion by 2030, advancing at a 7.38% CAGR.

This growth reflects rising cardiovascular disease (CVD) prevalence, rapid device innovation, and the continued migration of percutaneous procedures to outpatient settings. An aging population with complex comorbidities drives steady procedural volume, while reimbursement reforms encourage hospitals and ambulatory sites to adopt minimally invasive solutions that shorten stays and lower overall costs. Material science breakthroughs-particularly Nylon & Pebax blends-improve torque control and kink resistance, enabling complex interventions through smaller access points. Strategic acquisitions such as Boston Scientific's purchase of Silk Road Medical and Teleflex's buyout of BIOTRONIK's vascular unit signal that scale and technological breadth remain decisive competitive levers. Conversely, expanding use of intravascular imaging is beginning to reduce purely angiography-guided runs, creating a long-term usage headwind for basic catheters.

Global Angiographic Catheters Market Trends and Insights

Rising Incidence Of Cardiovascular Diseases

Ischemic heart disease remained the leading cause of CVD deaths in 2024, claiming 20.5 million lives and shifting therapeutic focus toward earlier diagnosis and less-invasive care . Emerging economies experience the steepest climb as dietary and lifestyle risk factors converge with urbanization. Procedural volumes therefore rise in tandem, especially where governments invest in catheterization capacity. Private-equity groups viewed this demand as durable, acquiring 41 cardiology practices comprising 342 sites between 2021 and 2023 to build regional networks that capture steady referral streams. These trends collectively sustain healthy growth in the angiographic catheter market.

Growing Geriatric Population Prone To CVD

Older adults present higher rates of multivessel stenosis, calcified lesions, and frailty, each necessitating specialized catheter platforms that balance pushability with vessel safety. Vascular stiffening complicates device navigation, prompting manufacturers to refine shaft stiffness gradients and tip flexibility. Minimally invasive access translates to shorter recovery times-an outcome prized by physicians managing elderly patients with multiple comorbidities. Global cardiac surgery benchmarking suggests an unmet need of 61.6 catheter-based or surgical cardiac procedures per 100,000 population in low- and middle-income countries, implying vast room for catheter expansion as life expectancy rises .

High Cost Of Angiographic Procedures

Device prices, facility fees, and post-acute care combine to make angiography among the costliest routine hospital procedures, a reality magnified in cash-pay and publicly funded systems. The USD 156 billion U.S. device market demonstrates that navigating complex reimbursement channels remains resource-intensive for manufacturers . Cost-effectiveness studies increasingly favor pharmacologic or preventive options for borderline lesions, potentially dampening catheter usage when payers tighten thresholds. Utilization-management programs that mandate prior authorization now span most U.S. insurers, adding administrative lag that can defer non-urgent cases.

Other drivers and restraints analyzed in the detailed report include:

- Demand For Minimally-Invasive Procedures

- Expansion Of Ambulatory Cath-Labs In EMS

- Intravascular Imaging Reducing Stand-Alone Angiography Usage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The coronary segment accounted for 49.91% of the angiographic catheter market share in 2024 and remains the bedrock of vendor revenue. Despite mature protocols, ongoing material and coating enhancements keep demand steady, with the angiographic catheter market size for coronary work projected to rise in parallel with stable 7%-plus CAGR. Neurovascular catheters, by contrast, show an 8.14% CAGR as mechanical thrombectomy becomes front-line for large-vessel stroke. Ultra-trackable distal access catheters and aspiration platforms such as SOFIA Flow 88 optimize clot retrieval success rates, pushing neurovascular penetration higher.

Endovascular and peripheral interventions form a sizable mid-tier, where devices like intravascular lithotripsy catheters treat heavily calcified lesions. The "Others" category-renal denervation, structural heart, and hybrid platforms-remains small yet lucrative. Medtronic's Symplicity Spyral won transitional pass-through status in 2025, unlocking incremental reimbursement and placing hypertension therapy firmly within the angiographic catheter market.

Hospitals retained 65.34% of 2024 revenue, largely because they manage complex and emergent cases requiring surgical back-up or ICU care. The angiographic catheter market size attributable to hospitals should still climb but at a slower rate than ASCs. Outpatient centers enjoy lean staffing models and dedicated rooms, translating to shorter turnaround and improved patient throughput. Growth momentum is further reinforced by private-equity consolidation of cardiology groups that establish in-house ASCs to capture downstream device margins.

Specialty clinics and office-based labs occupy a niche for diagnostic angiography and simple interventions, relying on shared staff with nearby hospitals. Their appeal lies in lower facility fees and community proximity, though capital requirements limit expansion pace. Mobile cath-lab units and hybrid ORs round out the landscape, offering flexible solutions for underserved regions or combined surgical-interventional cases.

The Angiographic Catheter Market Report is Segmented by Application (Coronary, Endovascular/Peripheral, and More), End-User (Hospitals, Ambulatory Surgical Centrs and More), Material (Polyurethane, Polyvinyl Chloride, and More), Coating Type (Hydrophilic, Non-Coated), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 42.71% revenue in 2024, underpinned by broad insurance coverage, national clinical guidelines, and high procedural density. Transitional pass-through payments for break-through devices shorten payback cycles, incentivizing hospitals to upgrade inventories. The U.S. alone holds 40% of global device sales and exerts outsized influence on material and coating standards. Consolidation among cardiology practices has accelerated, bringing ASC development to both urban and underserved rural counties, thereby preserving volume growth in the angiographic catheter market.

Asia-Pacific logs the highest CAGR at 8.95%. China streamlined device reviews, approving 12,213 new registrations in 2023, including 61 classified as innovative, which sharply cuts time-to-market. Government push under Healthy China 2030 and rising CVD incidence create dual demand and policy tailwinds. Japan and South Korea contribute through export-oriented manufacturing, while India's 2025 marketing code elevates ethical promotion standards, giving multinational brands clearer compliance guidance.

Europe offers steady but slower gains. The Medical Device Regulation unifies market entry, and Germany's updated OPS coding ensures reimbursement alignment for novel procedures. France's 2025 add-on payment policy widens access to specialty catheters once superiority is proven. Post-Brexit, the UK maintains a distinct yet harmonized pathway that still recognizes much of the Continental clinical evidence file, limiting duplicative trials.

The Middle East & Africa and South America collectively present high-single-digit growth potential but face structural hurdles. In North Africa, ischemic heart disease ranks among leading DALY drivers, yet public funding gaps and brain drain hinder cath-lab expansion. Opportunities lie in public-private partnerships and regional manufacturing of base-grade catheters. In Latin America, Brazil spearheads adoption through hybrid cardiac centers in tertiary hospitals, while Argentina and Colombia steadily update reimbursement lists, albeit with currency volatility risks.

- Boston Scientific

- Cardinal Health

- Terumo

- Medtronic

- Merit Medical Systems

- AngioDynamics

- Cook Group

- Oscor

- B. Braun

- Abbott Laboratories

- Asahi Intecc Co., Ltd.

- Teleflex

- Lepu Medical

- Tokai Medical Products

- Nipro

- Lepu Medical

- Penumbra

- iVascular S.L.U.

- Acandis

- Medinol Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence Of Cardiovascular Diseases

- 4.2.2 Growing Geriatric Population Prone To CVD

- 4.2.3 Demand For Minimally-Invasive Procedures

- 4.2.4 Expansion Of Ambulatory Cath-Labs In EMS

- 4.2.5 Ai-Enabled 3-D Road-Mapping Integration

- 4.2.6 Ultra-Low-Profile Polymer Blends For Radial Access

- 4.3 Market Restraints

- 4.3.1 High Cost Of Angiographic Procedures

- 4.3.2 Catheter-Related Complications & Recalls

- 4.3.3 Reimbursement Uncertainties In Emerging Markets

- 4.3.4 Intravascular Imaging Reducing Stand-Alone Angiography Usage

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Application

- 5.1.1 Coronary

- 5.1.2 Endovascular / Peripheral

- 5.1.3 Neurovascular

- 5.1.4 Others

- 5.2 By End-user

- 5.2.1 Hospitals

- 5.2.2 Ambulatory Surgical Centres

- 5.2.3 Specialty Clinics

- 5.2.4 Others

- 5.3 By Material

- 5.3.1 Polyurethane

- 5.3.2 Polyvinyl Chloride

- 5.3.3 Nylon & Pebax Blends

- 5.3.4 Others

- 5.4 By Coating Type

- 5.4.1 Hydrophilic

- 5.4.2 Non-coated

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.3.1 Boston Scientific Corporation

- 6.3.2 Cordis (Cardinal Health)

- 6.3.3 Terumo Corporation

- 6.3.4 Medtronic plc

- 6.3.5 Merit Medical Systems, Inc.

- 6.3.6 AngioDynamics, Inc.

- 6.3.7 Cook Medical

- 6.3.8 Oscor Inc.

- 6.3.9 B. Braun Melsungen AG

- 6.3.10 Abbott Laboratories

- 6.3.11 Asahi Intecc Co., Ltd.

- 6.3.12 Teleflex Incorporated

- 6.3.13 Lepu Medical Technology

- 6.3.14 Tokai Medical Products

- 6.3.15 Nipro Corporation

- 6.3.16 Lepu Medical Technology

- 6.3.17 Penumbra, Inc.

- 6.3.18 iVascular S.L.U.

- 6.3.19 Acandis GmbH

- 6.3.20 Medinol Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment